As the coronavirus pandemic intensifies, Americans are facing not only a public health crisis but an economic one as well.

As the coronavirus pandemic intensifies, Americans are facing not only a public health crisis but an economic one as well.

To help you navigate this uncertain period and protect your financial well-being, SmartAsset has gathered a list of resources to help you answer the difficult money questions you may have. We’re updating this page daily, so check back often for answers to your questions.

Table of Contents

Coronavirus Stimulus Package and Stimulus Checks

As the coronavirus pandemic wreaks havoc on the global economy, the White House, Federal Reserve and other governmental bodies are regularly announcing new policies and programs to help families and businesses weather the crisis. In fact, on March 27, 2020, President Donald Trump signed into law a new raft of emergency measures as part of a stimulus package called the Coronavirus Aid, Relief and Economic Security (CARES) Act.

Coronavirus Stimulus Package: What You Need to Know

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security (CARES) Act, with a whopping $2 trillion price tag to help… read more

Coronavirus Stimulus Checks: How Much You’ll Get, and When You’ll Get It

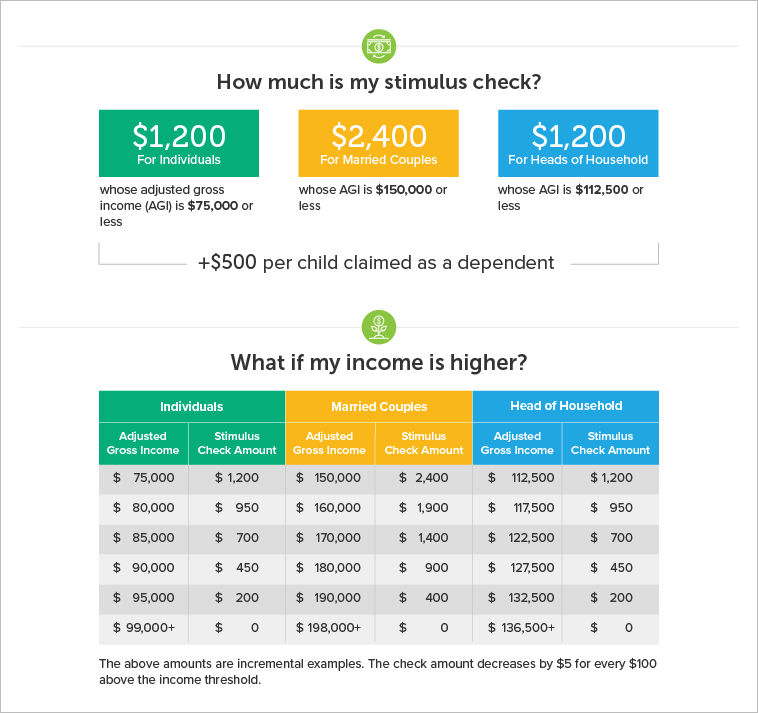

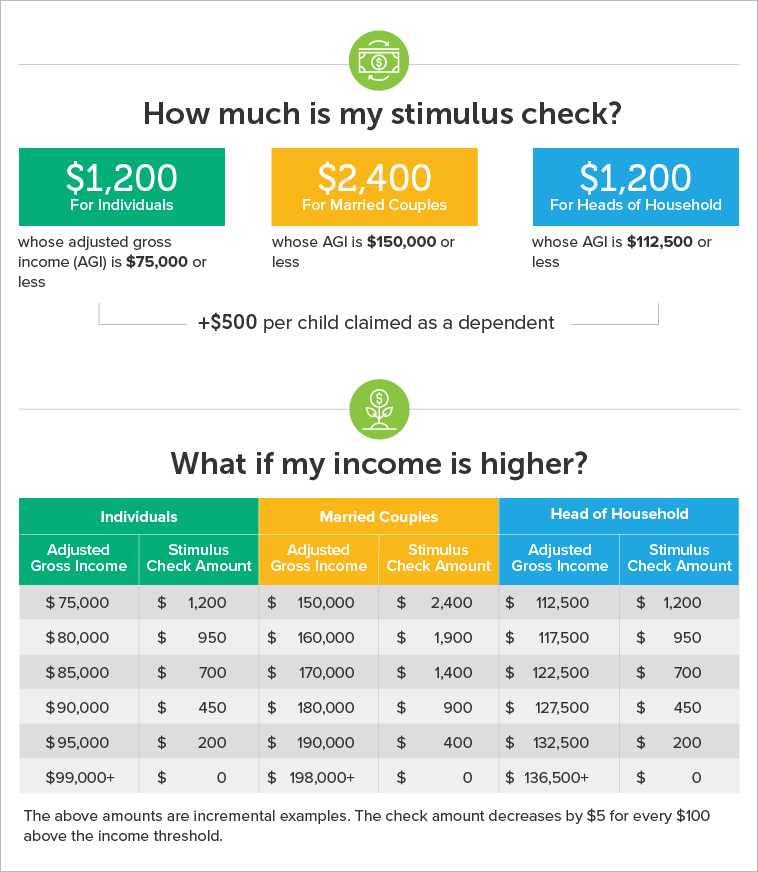

For direct stimulus payments, individuals will receive a maximum of $1,200 and married couples will receive a maximum of $2,400. Families will receive an additional $500 per child… read more

Coronavirus Stimulus Check Calculator: How Much Will I Get?

Amid economic distress fueled by the coronavirus crisis, President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which provides stimulus checks… read more

Trouble Getting Your Stimulus Check? Here Are Your Options

Since last month’s passage of the Coronavirus Aid, Relief and Economic Security (CARES) Act — a $2 trillion package designed to help individuals and small businesses – most… read more

How to Spend Your Coronavirus Stimulus Check

The global coronavirus pandemic has had a devastating impact on the American economy. With many Americans laid off and struggling to pay for essentials… read more

Coronavirus Relief Programs by State

Though the Coronavirus Aid, Relief and Economic Security (CARES) Act provides a bevy of recovery measures on the federal level, including stimulus checks for… read more

How Is the US Going to Pay for All This Stimulus Spending?

At time of writing the United States owed $19.3 trillion in public debt. It owed another $5.9 trillion in debt held by its own agencies. Together, these figures come to… read more

Individual Coronavirus Benefits and Relief Measures

Direct stimulus payments will help some individuals face the challenges the coronavirus has presented in the economy. But people are also in dire need of help when it comes to unemployment, housing payments and student loan debt. There are measures in place to provide relief to individuals on these fronts.

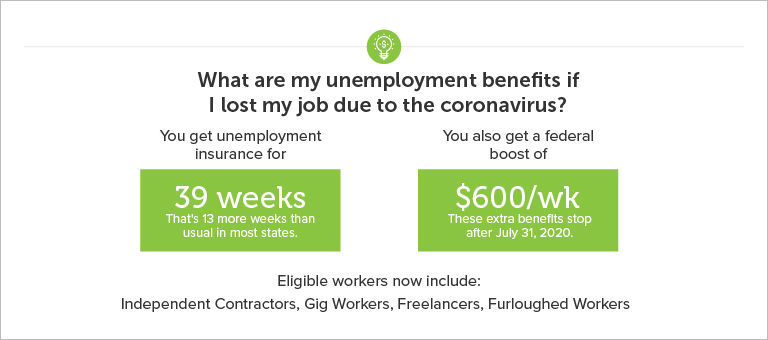

Enhanced Unemployment Benefits for Coronavirus

Workers who lose their jobs because of coronavirus can receive unemployment for up to 39 weeks – 13 weeks more than usual in most states. The government is providing an extra $600… read more

Pandemic Unemployment Assistance (PUA) Program

The Coronavirus Aid, Relief and Economic Security (CARES) Act introduced several stimulus programs to provide financial assistance to Americans struggling under the effects… read more

Guide for Those Who Lost Their Job to Coronavirus

Losing your job is never easy, but it can be particularly anxiety-inducing in the middle of a pandemic. There are steps, though, workers can take to mitigate their challenges… read more

Paid Sick Leave for Coronavirus: A Guide to What’s Available

The Families First Coronavirus Response Act (FFCRA) mandates that employers must provide paid sick or family leave benefits to employees affected by COVID-19 who work… read more

Coronavirus Relief for Rent and Mortgage Payments

If you’re financially affected by the coronavirus, you may be able to suspend your mortgage or rent payments for 180 days . You may also qualify for foreclosure and eviction protection… read more

Mortgage Forbearance vs. Mortgage Forgiveness: What’s the Difference?

When you’re struggling to make mortgage payments, you may be wondering what options you have. Mortgage forbearance programs can help… read more

A Guide to Coronavirus Student Loan Relief

Federal student loans payments are suspended up until September 30, 2020, under the CARES Act. No interest will accrue during this time period. There are other avenues for relief… read more

Tax-Free Student Loan Repayment Benefits

The Coronavirus Aid, Relief and Economic Security (CARES) Act offers a slew of benefits for Americans, including benefits related to student loan repayment… read more

2020 Tax Deadline Extension

The federal government has extended the federal income tax filing deadline from the typical April 15 due date to July 15, 2020. This move also has implications for your retirement… read more

How the CARES Act Helps Retirees

In an effort to quell some of the financial fallout created by the coronavirus pandemic, the federal government passed a $2 trillion stimulus package known as the Coronavirus Aid… read more

What the CARES Act Means for Retirement Accounts

Saving for retirement can be challenging even at the best of times. But it can become even more difficult when a crisis hits. With the coronavirus pandemic… read more

How the CARES Act Helps Self-Employed People

Ordinarily, only salaried employees who lose their jobs through no fault of their own are eligible to collect unemployment insurance. But the $2 trillion Coronavirus Aid, Relief, and… read more

Coronavirus Financial Relief: The CARES Act and Beyond

More than 1 million people in the U.S. have COVID-19, the disease caused by the novel coronavirus, and by the end of April nearly 60,000 Americans had died of the illness… read more

How the CARES Act Helps Investors

The Coronavirus Aid, Relief and Economic Security (CARES) Act introduces a number of provisions to help Americans who may be impacted financially… read more

Banks Helping Customers Affected by Coronavirus

Many financial institutions are going the extra mile to institute more lenient policies for their clients during the coronavirus economic downturn. Does your bank make the list?… read more

Small Business Coronavirus Relief Measures

The coronavirus pandemic has dealt a gut punch to small businesses, especially those that rely on a healthy trickle of foot traffic. But there are a number of grant and loan programs that small business owners can explore to protect themselves and their employees.

Coronavirus Relief for Businesses

The $2 trillion coronavirus stimulus package includes $349 billion in small business loans. The Small Business Administration and state programs have fonts of relief at the ready… read more

Economic Injury Disaster Loans (EIDLs)

The Small Business Administration’s (SBA) Economic Injury Disaster Loan (EIDL) Program can provide as much as $2 million of financial support to small businesses… read more

How to Access the SBA’s Emergency EIDL Grant

The Coronavirus Aid, Relief, and Economic Security (CARES) Act includes several provisions that offer relief for small businesses that have been affected by the economic stress created by… read more

Paycheck Protection Program (PPP) Loans

With stay-at-home orders in place across the U.S., revenues for the nation’s 30 million small businesses have dried up, and many businesses have had to lay off employees… read more

PPP Calculator: How Much Can Your Business Get?

The COVID-19 pandemic has caused serious problems for the economy, and small businesses in particular are taking it on the chin… read more

PPP Loans: Lender List and Requirements

Exactly one week after the signing of the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Paycheck Protection Program (PPP), a lifeline for small businesses… read more

The New Small Business Stimulus: PPP Funding and More

Small business owners who missed out on the first round of PPP loans and EIDL grants will have another shot. Congress has approved what’s officially called the Paycheck Protection… read more

Do You Have to Reapply for a PPP Loan?

If you applied for a Paycheck Protection Program (PPP) loan in the first round but didn’t get one, do you need to put in a second application now… read more

What to Do If You Missed Out on a PPP Loan

When the Paycheck Protection Program (PPP) loan fund set up by the CARES Act ran through its initial $349 billion in funding on April 16 countless small business owners… read more

Guide to the Business Tax Provisions in the CARES Act

The federal government has launched a wide-ranging set of initiatives to help individuals and businesses dealing with the coronavirus pandemic… read more

Payroll Tax Delay for Coronavirus-Impacted Businesses

As the COVID-19 outbreak continues to keep Americans home and businesses closed, the Coronavirus Aid, Relief, and Economic Security (CARES) Act… read more

Coronavirus Small Business Relief: SBA Loans

As the COVID-19 pandemic continues to grow, many small businesses may find relief in SBA 7(a) loans, which are available for up to $5 million… read more

SBA Relief Programs: Which is Best For Your Business?

The Small Business Administration (SBA) has a number of programs available for small business owners suffering during the coronavirus pandemic… read more

SBA Debt Relief Program

Small businesses dealing with the economic fallout of the coronavirus pandemic can qualify for several federal small business relief programs… read more

What Is the Federal Reserve Main Street Lending Program?

As the COVID-19 pandemic and accompanying economic crisis continue, people and small businesses are going to be looking for more ways to keep themselves afloat during this…. read more

The SBA Community Advantage Loan Program

One of the most important functions of the Small Business Administration (SBA) is to help entrepreneurs and small businesses raise funds to open or expand a business. To assist with… read more

How Does the SBA 504 Loan Program Work?

The Small Business Administration’s most significant function is to help small businesses secure funding. Often this comes in the form of startup capital for someone looking to create a… read more

How Businesses Can Use the Microloan Program

Coronavirus has hit small businesses hard. While the government has responded with a number of small business-focused relief initiatives, small business owners… read more

Business Interest Deductions Under the CARES Act

The CARES Act has modified the tax code to help business owners hit financially by the COVID-19 pandemic. One key change involves the rules for business interest deductions… read more

CARES Act Loans for Mid-Sized and Big Businesses

One of the federal government’s main economic responses to the coronavirus pandemic is the $2.2 trillion CARES Act, which provides assistance for both small businesses… read more

Guide to the SBA’s Export Assistance Programs

Exporting is important for many small businesses, but the COVID-19 pandemic has made it unusually challenging to reach international markets. The SBA… read more

An Overview of EXIM’s Export Relief Programs

As the economy remains shut down due to the coronavirus pandemic, export businesses have taken a significant hit. With transport links reduced and consumers staying home… read more

Business Interruption Insurance: What You Need to Know

Whether during a natural disaster or pandemic, businesses must sometimes suspend operations. Business interruption insurance can protect owners against financial losses… read more

A Small Business Owner’s Guide to Bankruptcy

If your small business is struggling to pay its debts and your creditors are threatening to take your assets, bankruptcy is an option. Although bankruptcy sounds like the end… read more

What Happens If You Default on a Business Loan?

Taking out a business loan can help you get your startup off the ground or scale an existing business. But you could run into problems… read more

Pivoting Your Business for the Coronavirus Economy

So you’ve got a business that’s impacted by the coronavirus economy. Even with PPP loans and other government resources for small businesses, your revenue is… read more

Facebook’s Small Business Grants: How to Take Advantage

Facebook announced that it plans to provide $100 million in grants to 30,000 small businesses in more than 30 countries… read more

Google Pledges $800 Million to Coronavirus Relief

Google is pledging more than $800 million to support small-to-medium sized businesses (SMBs), health organizations and researchers in the midst of the coronavirus pandemic… read more

Managing Your Money During the Coronavirus Crisis

Personal finance never becomes more personal than when a crisis creates instability in the economy. It is incumbent upon everyone to build up an arsenal of knowledge to be able to make the right money moves during the coronavirus pandemic.

Understanding Monetary and Fiscal Stimulus

When it comes to fixing an economy, the government has two main tools at its disposal: monetary stimulus and fiscal stimulus. This isn’t the limit of what a dedicated government… read more

How to Prepare for a Recession

As a recession materializes amid the coronavirus downturn, Americans must be proactive to make sure they are safeguarding their money and making intelligent decisions… read more

Are We in A Recession?

The coronavirus pandemic is hammering the U.S. economy and Americans’ incomes. In April, private employers slashed 20.2 million jobs… read more

How to Protect Yourself From Coronavirus Scams

Many tragedies bring out scammers looking to take advantage of fear and suffering. The coronavirus pandemic has been no exception… read more

Telehealth Coverage During the Coronavirus Pandemic

Traditionally, if you needed medical care you’d head to your doctor’s office, urgent care clinic or even the emergency room. With the COVID-19 pandemic keeping… read more

Does Medicare Cover Coronavirus (COVID-19) Costs?

Elderly people have been hardest hit by the coronavirus pandemic, with the greatest risk of complications and death occurring among older people… read more

Protecting Your Credit Score During the Coronavirus

As the coronavirus lays waste to the economy and cuts jobs without mercy, Americans may find themselves unable to make payments. That, and other forms of negligence, could be detrimental to their credit scores. Here’s how to keep everything intact… read more

Estate Planning During the Coronavirus Pandemic

The coronavirus pandemic has impacted nearly every aspect of the economy, and the government has responded with measures that focus on U.S. businesses and their employees… read more

Guide to Investing During the Coronavirus Crisis

It’s hard to recall a time when market volatility has been as intense as it has been during the coronavirus pandemic. Between March 1 and March 31, 2020, federal, state and local… read more

Car Insurance Discounts During the Coronavirus Crisis

Several insurance companies have created relief programs to support their car insurance customers during the COVID-19 pandemic… read more

Coronavirus Data Studies

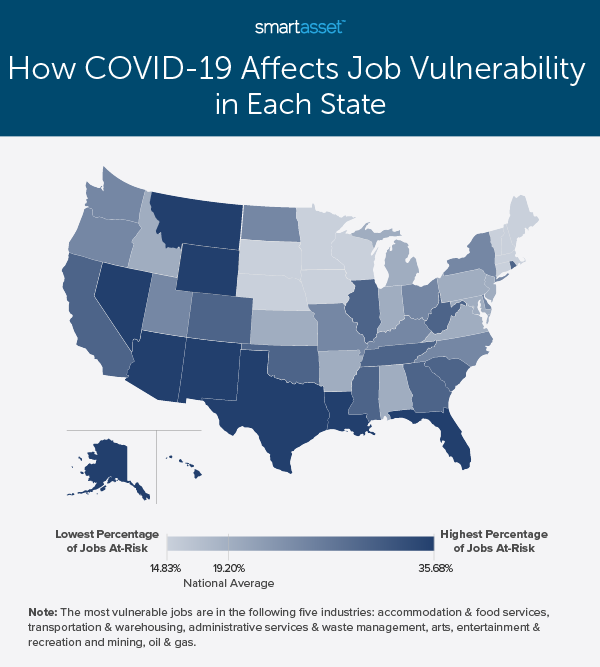

Part of understanding the effects of the coronavirus crisis, and predicting where it might be felt most intensely, hinges on analyzing granular data on unemployment, healthcare access and income. SmartAsset’s data team has painstakingly crunched the numbers to provide visibility into the economic consequences of this public health crisis.

Workers and Places Most Likely to Be Affected by a COVID-19 Recession – 2020 Study

Certain industries and workers in particular parts of the U.S. stand to face more economic challenges than others… read more

Where the Most Would Benefit from COVID-19 Stimulus Checks – 2020 Study

The COVID-19 stimulus package sets aside $250 billion for direct payments to individuals and families, but because of means testing, people in some cities will benefit more than in others… read more

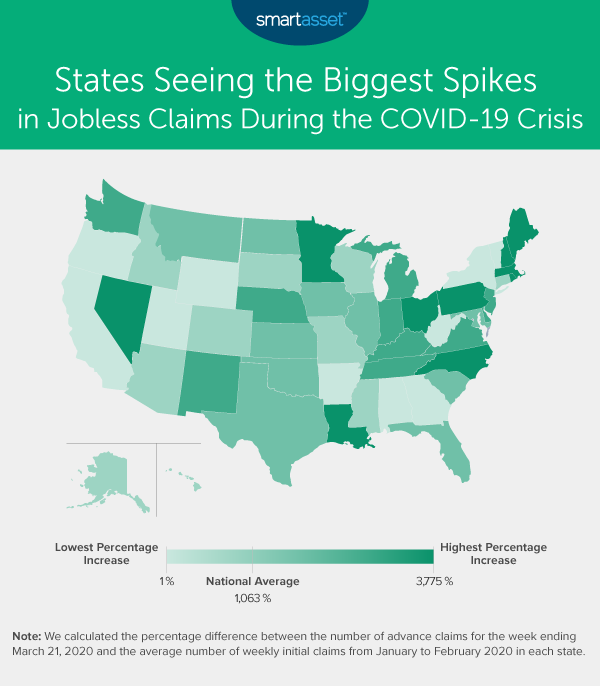

COVID-19 Crisis: States Seeing the Biggest Spikes in Jobless Claims – 2020 Study

Amid the coronavirus crisis, jobless claims have skyrocketed. But certain states have experienced the adverse effects of the pandemic to their employment numbers more than others… read more

Cities Where the Most and Fewest People Can Work From Home – 2020 Study

The shift to remote work during the coronavirus pandemic has been uneven, highlighting the disparity between those who can seamlessly continue business as usual and those unable to… read more

Tips for Surviving the Recession

- As long as you’re receiving a paycheck, continue contributing to your retirement account. It may be tempting to stop, but investing when the market is low will help balance out the past years of investing when the market was high.

- Don’t go it alone. If you’re especially worried about your portfolio, putting its management into a professional’s hands can be a huge relief. To find a fiduciary financial advisor who’s a good fit for your needs and concerns, use SmartAsset’s pro matching tool. It is free, takes five minutes and will recommend up to three advisors vetted by us.

Photo credit: ©iStock.com/Diy13, ©iStock.com/Bill Chizek