The Coronavirus Aid, Relief and Economic Security (CARES) Act introduces a number of provisions to help Americans who may be impacted financially by the COVID-19 pandemic. The $2 trillion stimulus package offers relief to individuals and small businesses in an effort to support the economy and markets. As an investor, there are several things to know about the CARES Act and what it may mean for your financial plan.

You May Be Eligible for a Stimulus Payment

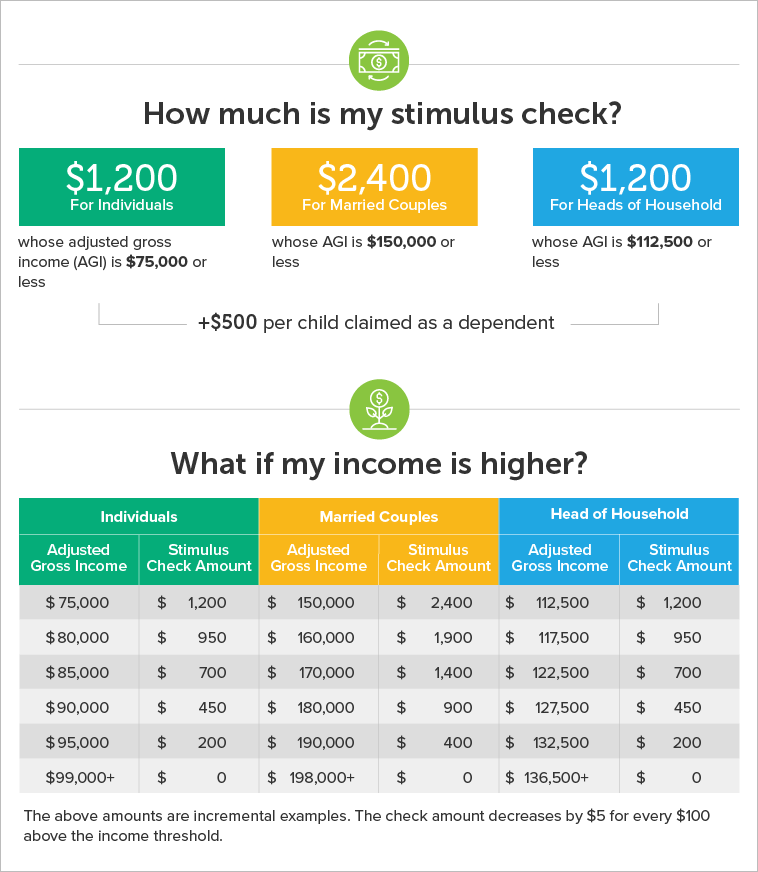

One of the most talked-about aspects of the CARES Act is the decision to send stimulus check payments directly to Americans. Single filers and those filing head of household are eligible to receive $1,200; married couples filing jointly can receive up to $2,400.

Whether you get a stimulus check depends on your income. The full check amount is available to single filers making less than $75,000, heads of household earning less than $112,500 and married couples filing jointly earning less than $150,000. Phaseout limits apply to stimulus payments, as follows:

If you receive a stimulus check and you don’t need it to immediately pay bills, you may choose to save or invest it instead. Putting the money into a low-cost exchange-traded fund, for example, is something you might consider. If you’ve got a larger amount saved and want to have it professionally managed, you could find a financial advisor. Or you may decide to deposit it into a safe deposit account such as a money market fund or CD.

There’s More Time to Fund Your IRA

If you haven’t made your full traditional or Roth IRA contribution for 2019 yet, there’s still time. You now have until July 15, 2020, to make contributions to your IRA for the previous year. That’s an advantage if you were hoping to claim a deduction for traditional IRA contributions for the 2019 tax year.

Remember, the annual contribution limit for 2019 is $6,000 unless you’re 50 or older. In that case, you can invest an additional $1,000 into your IRA. Adding more money to your IRA while the market is down may be an opportunity to purchase mutual funds or other investments at a discount.

On the flip side, investors who are retired also get a break thanks to the CARES Act. For 2020, required minimum distributions are temporarily suspended. This applies traditional, Roth, SEP and SIMPLE individual retirement accounts, 401(k), 403(b) and 457(b) plans. Beginning in 2020, RMDs kick in for people age 72 or older, but you don’t have to take them for this year. That could allow your portfolio time to recover if stock market volatility resulted in losses.

IRA and 401(k) Withdrawal Rules Are Relaxed

Taking an early distribution or a loan from your retirement accounts is not ideal for a number of reasons. Normally, you’d face a 10% early withdrawal penalty for taking money out of an IRA or 401(k) prior to age 59 1/2. That’s in addition to having to pay taxes on your distributions. And the biggest consequence is a long-term one: taking money out of your retirement accounts means your savings don’t have an opportunity to see investment gains, giving you less savings come retirement.

Taking an early distribution or a loan from your retirement accounts is not ideal for a number of reasons. Normally, you’d face a 10% early withdrawal penalty for taking money out of an IRA or 401(k) prior to age 59 1/2. That’s in addition to having to pay taxes on your distributions. And the biggest consequence is a long-term one: taking money out of your retirement accounts means your savings don’t have an opportunity to see investment gains, giving you less savings come retirement.

However, if the coronavirus crisis has put you in a tough spot financially, you now have more options for taking money from retirement accounts without triggering a penalty. You can withdraw up to $100,000 from an IRA without the 10% early withdrawal penalty applying, as long as you’re taking a distribution for a coronavirus-related reason. Taxes would still be due on the distribution but those can be spread out over a period of three years.

The CARES Act also bumps up the amount you can borrow from your 401(k) through a loan. Normally, 401(k) loans are capped at $50,000 but the Act increases the limit to $100,000. You can defer payments on the loan for the first year as well, giving you some breathing room until you get back to your normal work routine.

Help for Real Estate Investors

If you own one or more multifamily rental properties, the CARES Act has some provisions you might be interested in.

First, if you have a federally backed mortgage loan you may be able to take a temporary forbearance on payments. You must be experiencing a financial hardship related to COVID-19 and have an eligible mortgage to qualify. Forbearance periods can last up to 30 days initially and you can request two 30-day extensions, for a total of 90 days in which you don’t have to make payments toward the loan.

During forbearance periods for federal multifamily loans, you can’t evict any of your tenants for non-payment. But many states are already enforcing guidelines to limit or restriction evictions for renters who can’t pay. If your rental property is in danger of foreclosure, you’ll be glad to know that beginning March 18, 2020, and extending for 60 days, loan servicers are prohibited from initiating foreclosure proceedings against multifamily property owners.

Coronavirus Relief and the Stock Market

Despite the market’s volatility since COVID-19 was declared a pandemic, the CARES Act appears to have lifted the equity markets. Since President Trump signed it into law late last month, the S&P 500 index has gained approximately 6 percentage points. However, the market has a ways to go before it regains all of its lost territory. At time of writing, the S&P 500 remained at about 82 percent of its Feb. 19 high.

Despite the market’s volatility since COVID-19 was declared a pandemic, the CARES Act appears to have lifted the equity markets. Since President Trump signed it into law late last month, the S&P 500 index has gained approximately 6 percentage points. However, the market has a ways to go before it regains all of its lost territory. At time of writing, the S&P 500 remained at about 82 percent of its Feb. 19 high.

Congress appears poised to inject hundreds of billions more into the economy through further funding of PPP loans, but it is unclear whether that will extend the market’s recent gains or if major averages have further to slide. More Congressional appropriations to fight the pandemic’s effects could help stabilize some of the industries that have been most affected by the coronavirus crisis, such as hospitality and entertainment.

One of the main obstacles to more stock gains is the global oil market, which sustained a massive price shock because of a policy clash between Saudi Arabia and Russia. Another obstacle is the lack of clarity into just how much damage the overall U.S. economy has suffered from the stay-at-home orders and weaker demand from abroad for U.S. goods and services.

When determining how to manage your portfolio, it’s important to look at all the moving parts and what you’ve invested in. Airline stocks, for example, haven’t fared so well as fewer people travel. Meanwhile, biotech and healthcare stocks are flourishing thanks to increased demand for medical solutions to the pandemic. Considering your overall asset allocation, risk tolerance and where the buying opportunities may lie can help you decide how to invest your money while waiting on the market to turn around.

The Bottom Line

The coronavirus relief package represented a $2 trillion shot in the arm for the economy, resulting in benefits both direct and indirect for investors. It’s also has specific benefits for retirement savers. Still, the long-term effect on the stock market remains unclear.

Tips for Investing

- Consider talking to a financial advisor about the various ways your investments may be affected by the coronavirus crisis. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors who will help you achieve your financial goals, get started now.

- When you’ve suffered investment losses, tax loss harvesting inside a taxable brokerage account can be a powerful tool for limiting your tax liability on gains. Typically, this is something you’ll want to consider as you get closer to the end of the year but you may need to be even more strategic than usual about it this year.

Photo credit: ©iStock.com/South_agency, ©iStock.com/designer491, ©iStock.com/MicroStockHub