A clear and defined marketing strategy can help financial advisors attract their ideal clients, establish their brand’s credibility and reputation, and increase conversions. In fact, advisors with a defined marketing plan generate 168% more leads per month from their websites than advisors who lack one, according to a Broadridge survey 1 of over 400 advisors. The same study found that advisors with strategic marketing plans onboard 50% more clients each year and are more confident in their business growth.

Are you looking to expand the marketing of your financial advisor practice? Try SmartAsset AMP, a holistic client prospecting and marketing automation platform.

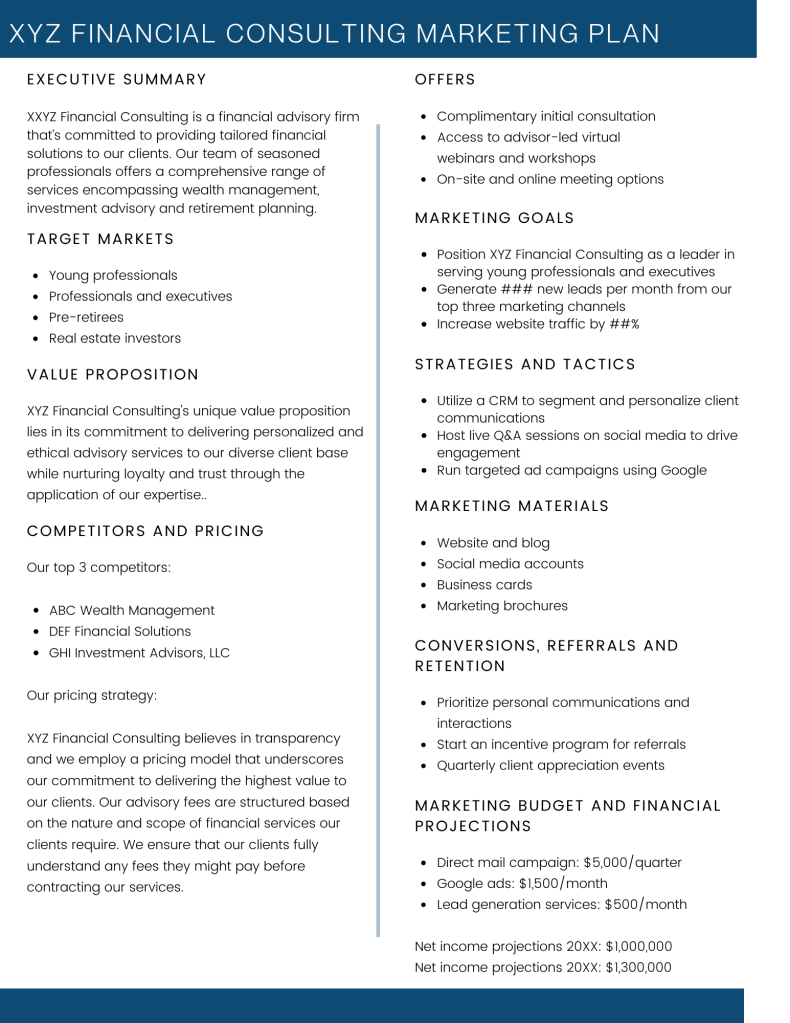

What to Include in a Financial Advisor Marketing Plan

An effective financial advisor marketing plan starts with a clear understanding of who the firm is trying to reach. Defining an ideal client profile helps focus messaging, channels and content on the people most likely to benefit from the advisor’s services. This clarity prevents wasted effort and makes marketing feel more intentional.

The plan should also clearly articulate the advisor’s value proposition. This explains what differentiates the firm, how it helps clients and why someone should choose it over alternatives. Strong value propositions focus on client outcomes and experiences rather than credentials alone. Additionally, at a minimum, a financial advisor marketing plan should include these sections:

- Executive summary

- Target market

- Value proposition

- Marketing goals

- Marketing strategy and tactics

- Marketing materials

- Conversion, referrals and retention

- Marketing budget and financial projections

- Competitors and pricing

- Offers

Let’s take a closer look at how each one works.

Client Acquisition Simplified: For RIAs

- Ideal for RIAs looking to scale.

- Validated referrals to help build your pipeline efficiently.

- Save time + optimize your close rate with high-touch, pre-built campaigns.

CFP®, CEO

Joe Anderson

Pure Financial Advisors

We have seen a remarkable return on investment and comparatively low client acquisition costs even as we’ve multiplied our spend over the years.

Pure Financial Advisors reports $1B in new AUM from SmartAsset investor referrals.

Executive Summary

An effective financial advisor marketing plan provides a clear roadmap for attracting, engaging and converting the right clients. It aligns business goals with targeted messaging, consistent branding and a realistic mix of marketing channels. By focusing on a defined ideal client and a compelling value proposition, the plan ensures marketing efforts are intentional rather than reactive.

The executive summary should briefly outline the firm’s objectives, target audience and core strategies. It highlights how marketing activities support growth goals, whether through increasing visibility, generating leads or strengthening client relationships. This snapshot gives advisors a high-level view of where the firm is headed and how marketing supports that direction.

Ultimately, a strong executive summary sets expectations and creates alignment. It serves as a reference point for decision-making and helps keep marketing efforts focused as the business evolves.

Outsource Your RIA Marketing

Automate your marketing with a proven system. Automated outreach, nurture campaigns and more.

Target Market

Your target market represents who you hope to connect with through your marketing efforts. For instance, you may choose to segment potential clients based on age, geography, net worth or another characteristic.

Your marketing plan should include a detailed description of each segment and how you selected them. Create a buyer persona for each group to help plan marketing strategies and tactics. This will guide you in reaching your target audience.

Value Proposition

Who are you and what makes your company different? Those are the questions you should aim to answer in this section of your marketing plan.

If you’re not able to clearly define what makes your firm valuable to your ideal client, you’re going to have a much harder time convincing them to choose your services over a competitor’s. It’s worth investing some time in drilling down on what makes your business unique.

Completing a market analysis can help you do that.

Marketing Goals

Your marketing plan should define what your goals are. And there’s a simple rule of thumb for setting goals as a financial advisor: Make them SMART.

SMART goals are:

- Specific

- Measurable

- Achievable

- Relevant

- Time-bound

Setting a goal of generating $1 million in revenue in a year meets the criteria because it’s specific, you can measure your progress, it’s relevant to your business growth and you’re giving yourself a deadline. The achievable element comes in when you develop tactics for implementing your marketing strategies.

Marketing Strategy and Tactics

Your marketing strategy is the overall plan for promoting your business. Tactics are the specific actions you will take to make that plan happen. These steps may include:

- Building out website and blog content

- Growing your social media following

- Launching a direct mail marketing campaign

- Marketing to your email list

- Offering yourself as an expert source for news articles or podcasts relevant to your niche

- Taking on speaking engagements

- Attending conventions, trade shows, conferences and other networking events

- Hosting an online seminar

- Marketing locally through community events or print advertising

In addition to outlining your strategies and tactics, you can also detail how much attention each one will get.

But implementing various marketing strategies and tactics can be time consuming, with 85% of advisors reporting that it’s challenging to find the time to devote to marketing, the same Broadridge survey found. SmartAsset Advisor Marketing Platform (AMP) can help you automate your marketing efforts and save time. For example, the platform’s Outreach Automation Tool can help advisors send automated, personalized text messages and emails to leads.

“In terms of using OAT (the Outreach Automation Tool) that’s been really helpful.” said T.J. Tamura, an AMP participant and financial advisor at Capitol Planning Group in Sacramento, California. “I’m fairly consistent with calling people very soon after I get connected. But that being said, I always have an automatic text go out. I always have an automated email go out that I have customized.”

Marketing Materials

Your marketing materials represent the tangible and intangible things you’ll use to promote your advisory business. These can include:

- Business cards

- Brochures or flyers

- Print newsletters (if you’re engaging in direct mail marketing)

- Email newsletters

- A website or blog

- Written social media content

- Video content

- White papers or case studies

If you’re testing any outside-the-box strategies with marketing materials, you could mention them here. For example, say you’re doing some A/B testing with business cards. You have one that’s a traditional business card and a second one that includes a QR code that takes you to your firm’s website when scanned.

Including that in your marketing plan could give you a useful metric to track to see which one ends up generating more leads. You can then use what you learn to adjust your plan going forward.

Conversion, Referrals and Retention

The bulk of your marketing plan may detail how you plan to attract prospects, but you also need to consider how you’re going to convert them and retain them once they become clients.

For example, if you have a website and are using email marketing, what incentive do you offer to get people to sign up for your list? While you’re not required to offer anything, having an attractive lead magnet, such as access to a free online wealth planning workshop or an e-book, can give prospects a compelling reason to hand over their email address.

If you hope to gain referrals, consider what reasons your clients would have to tell their friends, family members or coworkers about you. Aside from that, think about how you plan to ask for those referrals, whether that be on your website, through email marketing, direct mail marketing or social media.

You may decide to incentivize referrals by offering a discount on services. Or you may establish a loyalty program and hold client appreciation events as a reward for sticking with your services. All of that belongs in your marketing plan.

But your work doesn’t end after receiving a referral. It takes time, effort and persistence to convert a lead into a client. Robert Gilliland, founder and managing director of Concenture Wealth Management in Houston, says the timeline for closing a new client may more than a matter of weeks.

“If we can get a lead from SmartAsset and turn them into a client in less than 120 days, then that was relatively efficient,” said Gilliland, whose firm participates in SmartAsset AMP. He added that only around 45% of new clients close in less than 90 days. A majority of prospects take closer to 120 days to become clients.

Marketing Budget and Financial Projections

Last but not least, your marketing plan should cover how much you plan to spend to promote your business, where that money is going and what you expect to get in return. For reference, the Broadridge survey found that the median marketing spend for advisors is $6,250 per year.

Creating a visual, such as a pie chart, can make it easier to see exactly where the money in your marketing budget goes. You can then compare the percentages you’re spending on email marketing, digital marketing, social media, etc. to the revenue each one generates for you.

If you notice that you’re spending a lot on a specific marketing channel but getting little back on your investment, you can adjust your budget accordingly to redirect those funds elsewhere. For example, you may find that you derive more value from investing in a lead generation tool like SmartAsset AMP versus ads on local television.

Your marketing plan should also include some of the same information you’d put in your business plan. For example, you’d want to attach a balance sheet, cash flow statement and income statement and update them each time you update your marketing plan.

Competitors and Pricing

The financial services landscape is vast, and your marketing plan should consider what your competitors bring to the table. Ask yourself who your top three to five competitors are, then look at their value proposition.

How does it compare with yours? How are they conveying it through their branding and marketing materials? What’s their position in the overall market and how are they perceived?

Once you’ve answered those questions go back to your marketing plan and consider how you want potential clients to view your business. Considering the problems they have and how you are uniquely equipped to solve them can help shape your marketing approach.

While you’re checking out the competition, remember to consider pricing as well. How do you price your services relative to your competitors? And how does your pricing model benefit your clients? The goal here is to pinpoint exactly what it is that makes you different.

Offers

Prospective clients are looking for solutions and your marketing plan should convey what you have to offer. That includes the types of services you provide as well as any products you offer.

Again, it’s helpful to pick out what’s unique about your business. For example, do you offer interactive tools to help clients manage their accounts? Exclusive discounts for bundling services? Incentives for referrals?

Prospective clients may want to know about these benefits, so make sure to highlight them in your marketing plan.

Why Financial Advisors Need a Marketing Plan

Your marketing plan is a detailed framework for how you plan to promote and scale your advisory business. Financial advisor marketing plans are usually written with both broad and specific goals in mind.

For example, your big goal may be to scale your firm to $1 million a year in revenue. That’s supported by several smaller goals, such as:

- Generating five new leads per week

- Attracting 5,000 visitors to your financial advisor website per month

- Increasing engagement on social media by 10% each month

Writing out a financial advisor marketing plan allows you to define, and then refine, what you want to achieve in your business. Once you have some clear goals in sight, you can break each one down into specific actionable steps to market your firm.

When you have a clear marketing plan, it becomes easier to:

- Direct your energy toward actions that are designed to produce results and eliminate time- and money-wasters

- Clarify your brand messaging and what it is you do as an advisor, as well as who you serve

- Target your efforts toward those channels where your ideal clients spend the most time

- Evaluate the competition to see what they’re doing right (or wrong) to attract clients

- Track key metrics to identify the actions that are working and ones that are falling short of your expectations

While trial-and-error methods can yield some valuable lessons, a proper marketing plan can help you avoid potentially costly mistakes as you work on scaling your business.

Strategies Advisors Can Include in a Plan to Nurture Leads

Nurturing leads is key for financial advisors who want to grow their business. Here are five common strategies that a marketing plan could include to help you convert leads into long-term clients:

- Social media targeting and personalization: Customizing social media content for specific demographic groups is a common strategy to engage potential clients. Financial advisors can use platforms like LinkedIn to connect with professionals and Facebook to target retirees, delivering targeted content for each group’s unique needs and preferences.

- Content marketing with a focus on SEO: Creating content that answers common financial questions could help you establish financial advisors as industry leaders. Optimizing content for search engines improves site visibility and attracts more traffic.

- Interactive tools and mobile apps: Offering clients interactive tools and mobile applications to help with financial planning can significantly enhance client engagement. Tools like investment calculators or budgeting apps offer practical help, making financial planning accessible and personalized.

- Email marketing automation: Using automated email marketing tools allows advisors to send personalized, relevant information to different segments of their audience. Whether it’s a newsletter, a follow-up email, or educational content, automated systems can help you reach all your leads is strategic and timely ways.

- Video marketing and webinars: Videos and webinars allow advisors to share their expertise and offer advice in an engaging format. These resources can help demystify complex financial topics and showcase the advisor’s knowledge and approachability.

Bottom Line

A well-crafted financial advisor marketing plan brings structure and clarity to growth efforts. By defining the ideal client, value proposition, channels and metrics upfront, advisors can focus their time and resources more effectively. With a clear plan in place, marketing becomes a repeatable, measurable process that supports sustainable long-term growth.

Tips for Growing Your Advisory Business

- SmartAsset AMP (Advisor Marketing Platform) is a holistic marketing service financial advisors can use for client lead generation and automated marketing, helping improve follow-ups and save time. Sign up for a free demo to explore how SmartAsset AMP can help you expand your practice’s marketing operation. Get started today.

- Developing a marketing plan yourself can save money if you’re not paying an agency’s fees. However, if you’re unsure of what to include or want a second set of eyes to look over your plan you may consider scheduling a one-time meeting with a marketing consultant.

Testimonials appearing on this site are actually received via text, audio, or video submission. The testimonials are provided by financial advisors that have ongoing business relationships with SmartAsset. They are individual experiences, reflecting the real-life experiences of those who have used our products and/or services. The testimonials are not 100% representative of all of those who will use our products and/or services, and we make no admissions of such. The testimonials displayed (text, audio, and/or video) are given verbatim except for correction of grammatical or typing errors. In some cases, the testimonial has been shortened in length where it has not been possible to display the whole testimonial, and where we considered, acting reasonably, that some parts of the testimonial were not relevant to our site, products, or services. SmartAsset may extend free products, discounts, promotional support, or other indirect or direct financial incentives to these sources. These incentives may or may not influence the nature of the testimonial. In this case, compensation was provided.

Photo credit: ©iStock/Dragos Condrea, ©Rebecca Lake, ©iStock/master1305

Article Sources

All articles are reviewed and updated by SmartAsset’s fact-checkers for accuracy. Visit our Editorial Policy for more details on our overall journalistic standards.

- Broadridge Financial Advisor Marketing Trends Report 2024. (2024). Advisorstream.com. https://info.advisorstream.com/financial-advisor-marketing-trends-report-2024