In a survey of economists conducted by the University of Chicago’s Booth School of Business at the beginning of March 2020, more than half of participants expected COVID-19 to cause a major recession. Since then, increasing numbers of economists and policy makers have predicted that coronavirus will lead to a recession, defined as a fall in GDP in two successive quarters. In fact, one of the most dire estimates came out on Friday, March 20, with Goldman Sachs predicting that the U.S. GDP will shrink by 24% in the second quarter of 2020. That decline would be two and half times larger than any previous quarterly decline, critically affecting everyday Americans’ ability to manage expenses and save for their futures.

Though a COVID-19 recession is likely to affect all Americans, despite the government’s coronavirus stimulus package, it may strain some communities more than others. In this study, we looked at workers, states and cities that are likely to be most affected by a forthcoming recession. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- Leisure and hospitality workers may be hit the hardest. Of industries that are most at risk during a COVID-19 recession, leisure and hospitality industries (i.e. arts, entertainment & recreation and accommodation & food services) have seen the largest immediate impacts as a result of store closures and restrictions on large gatherings of people. Leisure and hospitality industries are also expected to face continued headwinds, and as they employ the most workers of vulnerable industries, potential layoffs will affect the most people.

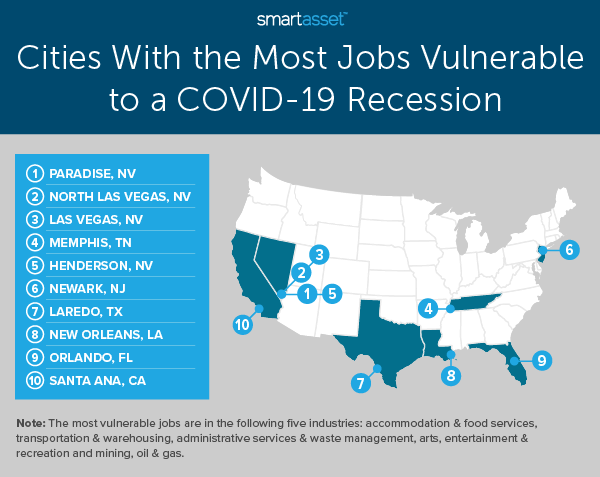

- Nevada cities rank poorly, as does the state overall. Of the 10 cities we identified where workers in vulnerable industries make up the largest percentage of the workforce, four are in Nevada. All within an approximate 20-mile radius of one another, they include Paradise, North Las Vegas, Las Vegas and Henderson. In these cities, the five industries most vulnerable to a COVID-19 recession comprise more than 30% of the total workforce. Nevada, overall, has the most vulnerable workforce to a COVID-19 recession of all 50 states.

- In the 100 largest U.S. cities alone, more than 1.42 million jobs could be lost due to a coronavirus recession. We found that there were 7.10 million workers in at-risk industries, identified below, across the 100 largest cities in the U.S. Using an estimate from Moody’s Analytics economist Mark Zandi, who predicted that 20% of those workers may face unemployment, we found that more than 1.42 million individuals could lose their jobs. Unemployment benefits are administered by individual states, but if you are looking for more general information, careeronestop.org is a good place to start. SmartAsset also has a guide on applying for unemployment benefits here.

Most Vulnerable Industries

While healthcare workers are at the greatest risk of contracting coronavirus, workers in other industries may be more at-risk of losing their jobs or having their paycheck impacted. According our research, workers in the following five Census-designated industries are the most at risk in terms of job security during a COVID-19 recession:

- Mining, oil & gas

- Transportation & warehousing

- Administrative services & waste management

- Arts, entertainment & recreation

- Accommodation & food services

The mining, oil & gas and transportation & warehousing industries rely heavily on global supply chains, which have been disrupted due to the rapid spread of coronavirus. According to one source, the mining, oil & gas industry is expected to be the hardest-hit sector in the U.S. economy. Highly dependent on global commodity prices, the industry has already seen significant declines. Similarly, the transportation & warehousing industry is expected to see declines in demand from commercial and consumer markets.

The administrative services & waste management industry includes service workers who are involved in personnel administration, clerical activities and cleaning activities along with individuals who collect, treat and dispose of waste materials. Administrative service workers, such as office clerks and security guards, work face-to-face with others and cannot perform their jobs because of the necessary proximity to people. Waste management has also slowed. According to Politico, there has been significantly less commercial waste to be collected in the second half of March in New York City as a result of restaurant and bar closures. In the Department of Labor’s unemployment report for the week ending on March 14, 2020, five of the 11 states with an increase of more than 1,000 in initial jobless claims cited layoffs in the administrative services & waste management industry as a key contributor.

Companies within leisure and hospitality industries – arts, entertainment & recreation and accommodation & food services – have seen the largest number of initial layoffs due to coronavirus. The closing of shows, concerts and sports games along with sweeping closures of restaurants and bars throughout the U.S. have impacted staffing and payroll. Though both small and large companies have announced one-time changes to paid sick leave policies and the Families First Coronavirus Response Act includes short-term paid sick leave benefits and longer-term paid family leave for some workers, employment in those industries is largely supported by consumer spending. As the pocketbooks of many Americans tighten, many economists expect there to be more layoffs.

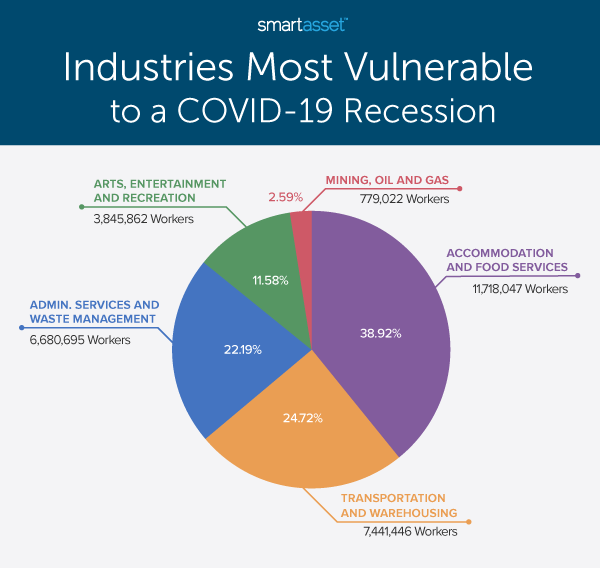

The five industries most likely to be affected vary in size. According to 2018 Census Bureau estimates, there are about 11.72 million accommodation & food service workers in the U.S. compared to fewer than 800,000 mining, oil & gas workers. The chart below shows the breakdown of vulnerable industries, according to total numbers employed nationally in 2018.

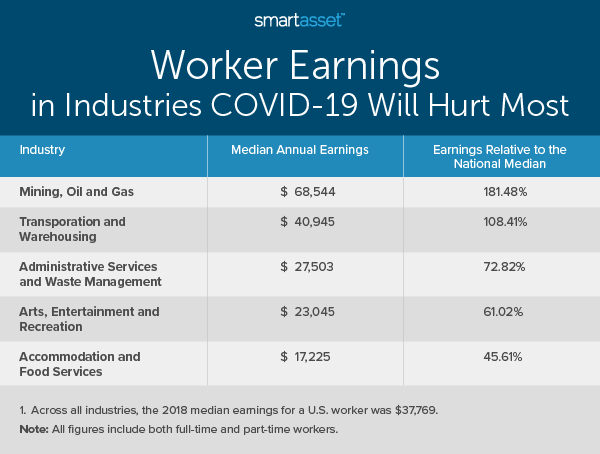

As noted by the New York Times and Brookings Institution, low-wage earners within industries may be even more affected by a downturn, as they will have less in savings to cover fixed monthly expenses such as mortgage or rent payments. In three of the five industries, median earnings are lower than the national average, as seen below.

States Most Likely to Be Affected

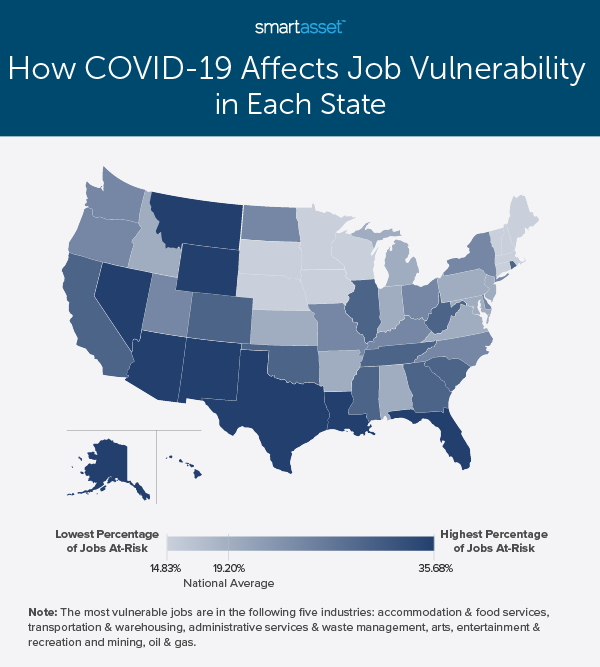

State responses to coronavirus and differences in policies may mitigate or exacerbate how much residents are affected health-wise and economically. But the degree to which state economies rely on the five most vulnerable industries will also influence economic outcomes. Using Census Bureau data, we determined which state economies depend the most on at-risk industries. The heat map below highlights those most and least likely to be affected by a COVID-19 recession.

More than one in four jobs in Nevada, Hawaii and Wyoming are at risk. With both Nevada’s and Hawaii’s economies relying heavily on tourism, there are high numbers of arts, entertainment & recreation workers along with accommodation & food service workers compared to the numbers in other industries in those states. Specifically, in 2018, more than 23% of Nevada’s workforce and almost 17% of Hawaii’s workforce were involved in the leisure and hospitality industries.

Wyoming ranks as the third state most likely to be affected a COVID-19 recession, as it has the highest percentage of mining, oil & gas workers in its workforce of all 50 states. In 2018, almost 21,300 individuals of the total roughly 287,400 Wyoming workers were a part of the mining, oil & gas industry, or 7.39%. By contrast, only about 0.50% of the national workforce is involved in the industry.

South Dakota, Iowa and Minnesota rank as the states least likely to be affected by a COVID-19 recession. Only about one in seven jobs in South Dakota falls into the five industries we identified as most vulnerable and all vulnerable industries are smaller in the state as compared to national averages. In both Iowa and Minnesota as well, less than 16% of the workforce is part of at-risk industries.

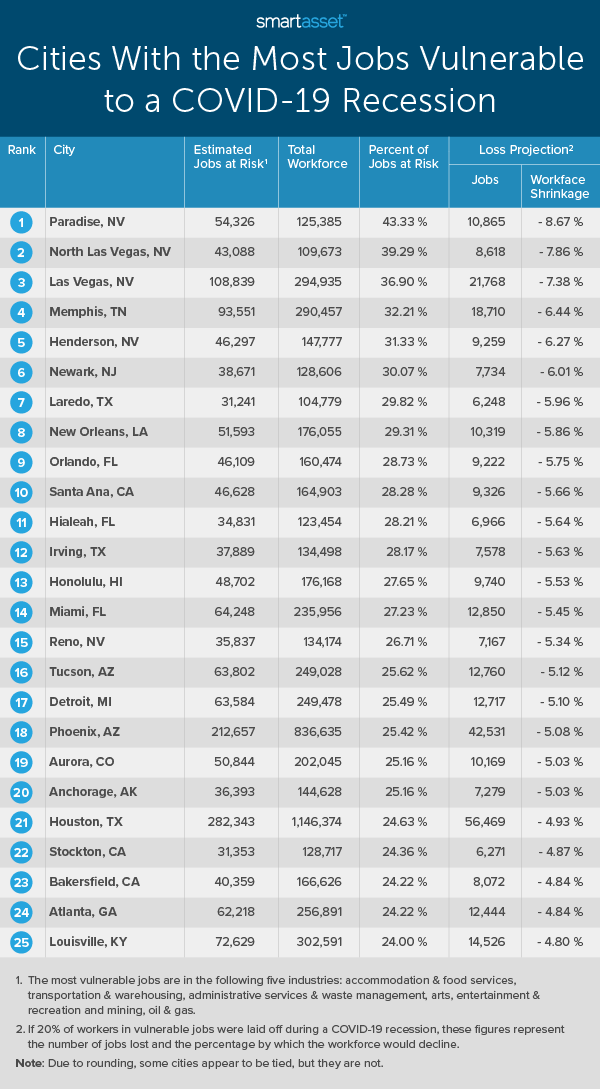

Cities Most Likely to Be Affected

Of the 100 largest cities in the U.S., we identified the 10 cities where workers in vulnerable industries constitute the largest percentage of the workforce. Using the estimate from Moody’s Analytics economist Mark Zandi, who predicted that 20% of those workers could lose their jobs, we additionally found the change in each city’s workforce if that were to occur.

1. Paradise, NV

More than four in 10 workers in Paradise, Nevada work in vulnerable industries. Of the 100 largest cities in the U.S. in 2018, Paradise had the highest percentage of workers in the accommodation & food services industry – at 20.65% – and the third-highest percentage of workers in the arts, entertainment & recreation industry – at 8.58%. If 20% of workers in at-risk industries were to lose their jobs, the Paradise workforce would shrink by more than 8%.

2. North Las Vegas, NV

There are more than 20,500 accommodation & food services workers in North Las Vegas, Nevada along with more than 8,200 transportation & warehousing workers and 7,900 arts, entertainment & recreation workers. Those three industries make up 18.71%, 7.54% and 7.23% of the workforce, respectively. Across all five vulnerable industries, 39.29% of North Las Vegas’ workforce is at an elevated risk for job loss as a result of the coronavirus-spurred economic fallout.

3. Las Vegas, NV

Las Vegas, Nevada has the largest workforce of the 10 cities most likely to be affected. In 2018, the workforce totaled almost 295,000. With 36.90% of workers in vulnerable industries, almost 21,800 jobs could be lost. If that were to happen, the Las Vegas workforce would shrink by 7.38%.

4. Memphis, TN

In Memphis, Tennessee, the economy relies heavily on the transportation & warehousing industry. About 43,200 of the total 290,457 workers, or 14.87%, were employed by transportation & warehousing companies in 2018. In comparison, only 4.75% of Americans nationally work in the transportation & warehousing industry. With 7.04% and 8.63% of its workforce also involved in the administrative services & waste management and accommodation & food services industries, respectively, Memphis may see a significant decrease in its workforce over coming months.

5. Henderson, NV

Henderson is the fourth Nevada city with a large workforce that consists of many vulnerable industries during a COVID recession. Like Paradise, North Las Vegas and Las Vegas, it has many leisure and hospitality workers. In 2018, more than 30,600 residents were a part of the arts, entertainment & recreation or accommodation & food services industries.

6. Newark, NJ

Newark, New Jersey is still feeling the impact of the 2008 housing market recession and may continue to feel economic hardship going forward, as 30.07% of its workforce is a part of at-risk industries. If 20% of the almost 38,700 workers in vulnerable industries were to lose their jobs, the workforce would shrink by about 6%.

7. Laredo, TX

Laredo, Texas has the second-largest mining, oil & gas industry as a percentage of its workforce among the 100 largest U.S. cities, following only Bakersfield, California. In 2018, about three in every 100 workers in Laredo worked for mining, oil & gas companies. Beyond this, the transportation & warehousing industry is large, making up 13.78% of the city’s workforce. Overall, more than 31,200 of the roughly 104,800 workers in the city are employed by vulnerable industries.

8. New Orleans, LA

The economy of New Orleans, Louisiana is fueled by tourism like in many large cities in Nevada, which rank at the top of this list. As such, many workers in the city are involved in leisure and hospitality industries. Specifically, 4.63% of workers in the city were a part of the arts, entertainment & recreation industry in 2018 and 14.81% were a part of the accommodation & food services industries. A total of more than 29% of workers in the city are a part of vulnerable industries.

9. Orlando, FL

Across the 100 largest cities in the U.S., Orlando, Florida has the sixth-largest arts, entertainment & recreation industry as a percentage of its workforce and the 11th-largest administrative services & waste management industry as a percentage of its workforce. In 2018, there were almost 8,600 arts, entertainment & recreation workers in the city and about 11,000 administrative services & waste management workers. In total, 46,109 workers had jobs in at-risk industries, comprising 28.73% of the workforce.

10. Santa Ana, CA

Of the 100 largest U.S. cities, Santa Ana, California has the largest percentage of its workforce involved in the administrative services & waste management industry. In 2018, almost 17,600 people of the total 164,903 workers – or 10.65% – were a part of that particular industry. In comparison, less than 5% of the national workforce is a part of the administrative services & waste management industry. Across all five vulnerable industries, about 28% of jobs are at risk in Santa Ana, meaning that the workforce could shrink by more than 5% as a result of the negative economic impact caused by the spread of coronavirus.

Data and Methodology

Research for the first part of this study (i.e. Most Vulnerable Industries) comes primarily from three sources. They include a Moody’s Analytics report published by chief economist Mark Zandi, “COVID-19: A Fiscal Stimulus Plan,” IBISWorld’s report “Coronavirus Update: Industry Fast Facts” and the Department of Labor’s March 26, 2020 unemployment report. From there, we identified the five Census-designated industries of the total 20 listed industries that are the most at risk during a recession resulting from coronavirus:

- Mining, oil & gas

- Transportation & warehousing

- Administrative services & waste management

- Arts, entertainment & recreation

- Accommodation & food services

To determine the states and cities most likely to be affected by a COVID-19 recession, we found the percentage of each state’s or city’s workforce that is part of the five vulnerable industries. Data on the number of workers in each industry and total workers in each area comes from the Census Bureau’s 2018 1-year American Community Survey. The city-level view includes the 100 largest U.S. cities. All workers, both full-time and part-time, were included for both parts of the study.

Thus far, coronavirus has affected individuals and families in some places more than others, and our analysis does not account for its localized spread. Additionally, as previously noted, state and city responses may mitigate or exacerbate how much residents are affected by a COVID-19 crisis.

Tips for Making Smart Financial Decisions During a Recession

- Boost your emergency savings. Though the industries listed above are the most at risk during a COVID-19 recession, layoffs may take place across other industries as well. One of the best ways to prepare for the unknown is by having an emergency fund. Though typical financial wisdom suggests you should have savings that can cover three months’ worth of expenses, six months’ worth of expenses may be a better figure to shoot for during a recession.

- Keep your budget top of mind. One of the best ways to save more is through budgeting. Our budget calculator can help with this. Beyond letting you see how much you spend each month and what sixth months of expenses would look like, you can see how cutting back on discretionary expenses can increase your savings rate.

- Consider talking to a financial advisor about how to ride out a financial downturn. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Know your rights. Americans have access to Unemployment Compensation (UC), the Extended Benefit (EB) program, the Families First Act and various other unemployment insurance (UI) provisions. As part of the coronavirus stimulus package for unemployed Americans, workers who lose their jobs because of coronavirus can receive unemployment for four months – that’s 13 weeks more than usual. Also, the government has expanded the types of workers who are eligible to include independent contractors, gig workers, freelancers and people who have been furloughed.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/IVAN ARAGON ALONSO