In an effort to help curb the economic effects of the coronavirus pandemic, President Donald Trump signed a coronavirus stimulus package called the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act is the biggest rescue package in U.S. history with a staggering price tag of $2 trillion. The legislation seeks to provide emergency financial assistance to people and businesses as the coronavirus crisis continues to have major effects on the job market and economy across the U.S. On April 24, President Trump signed into law another relief bill that provides an additional $484 billion in funding to a number of small business programs and healthcare provisions in the original CARES Act.

It’s important to have a financial plan in place during turbulent times. Find a financial advisor today.

Overview of the Coronavirus Stimulus Package

The federal government’s CARES Act involves multiple policy changes, new relief programs and more. The most important among these include pushing back the federal income tax deadline, sending stimulus checks (Economic Impact Payments) to most Americans and expanding unemployment benefits. Programs created or enhanced through the CARES Act for the benefit of small businesses include the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL) program, the latter of which includes cash advances.

A quarter of the money in the original stimulus package – $500 billion – went to bailing out corporations, while $349 billion was for for small business loans and about $150 billion was for public health. An estimated $300 billion has been sent or is being sent to taxpayers in the form of stimulus checks.

Directly below, take a look through the various provisions in the CARES Act that offer relatively immediate relief to individuals and small businesses. The sections directly below are a breakdown of the most important programs, and after that, you’ll find overviews of other offerings that are specifically meant for either individuals or small businesses.

In addition to the CARES Act, many states around the country have taken it upon themselves to create relief programs and benefits for their residents and companies. For example, Pennsylvania small business owners have access to a small business loan program, while Washington state has some tax relief provisions for businesses. Check out our full state-by-state guide.

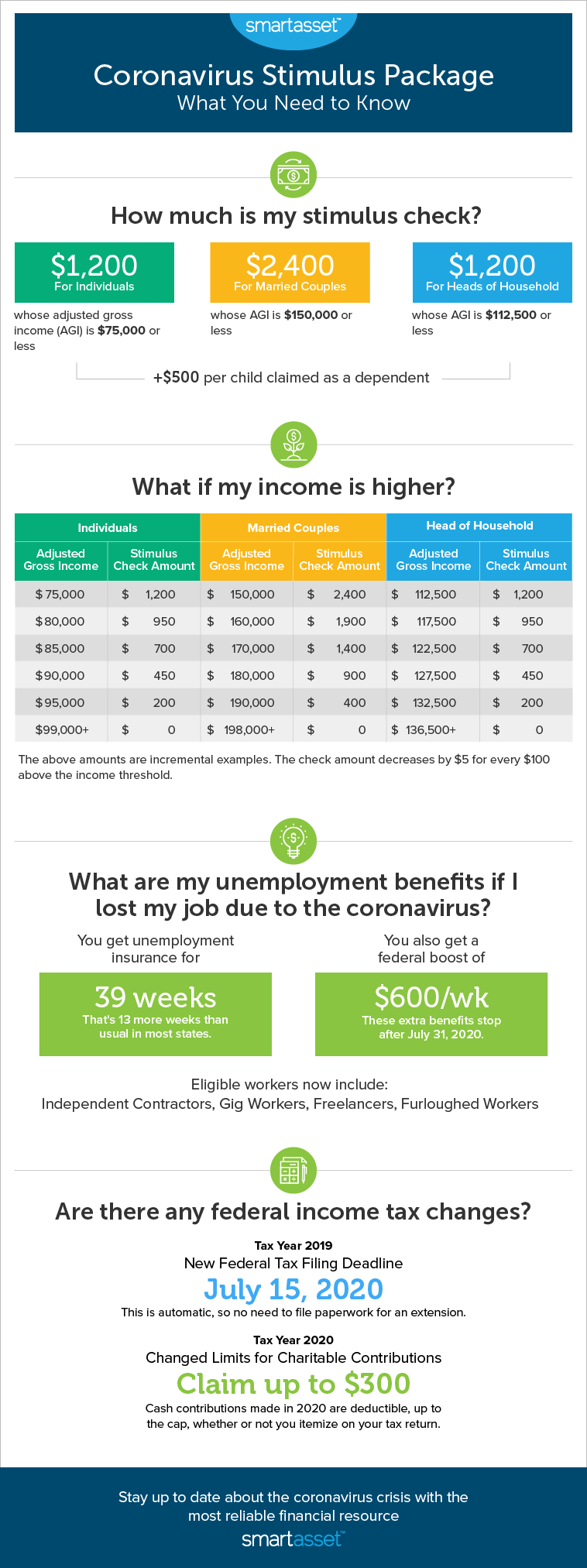

Stimulus Checks

To relieve the financial pressures many Americans are undergoing, the federal government is sending $1,200 in stimulus check payments to most people, or $2,400 to married couples. In fact, about 159 million stimulus checks have been paid out thus far, which is equal to a total of almost $267 billion. To be eligible for a full-size stimulus check, you’ll need an individual adjusted gross income (AGI) of $75,000 or less, or $112,500 for heads of household and $150,000 for joint filers.

Single filers who earn up to $99,000 and joint filers who earn up to $198,000 receive reduced amounts. In other words, every $100 in income above the threshold reduces your check by $5. Also, families with eligible children below age 17 will receive $500 per child.

To determine your AGI, the government will use your 2018 tax return if you have yet to file your 2019 return. Anyone who’s required to file, but has yet to do so for tax years 2018 and 2019, will need to file a 2019 tax return to receive a check. Retirees who receive Social Security benefits will automatically get a stimulus check. People who receive the Earned Income Tax Credit (EITC) are also eligible for a check.

Use our stimulus check calculator to see how much you’ll receive:

Here’s a breakdown of the stimulus check payment structure based on filing status and income level:

Stimulus Check Amounts for Single Filers

| AGI | Payment |

| $75,000 | $1,200 |

| $80,000 | $950 |

| $85,000 | $700 |

| $90,000 | $450 |

| $95,000 | $200 |

| $99,000 | $0 |

Stimulus Check Amounts for Joint Filers

| AGI | Payment |

| $150,000 | $2,400 |

| $160,000 | $1,900 |

| $170,000 | $1,400 |

| $180,000 | $900 |

| $190,000 | $400 |

| $198,000 | $0 |

Stimulus Check Amounts for Heads of Household + 1 Child

| AGI | Payment |

| $112,500 | $1,700 |

| $117,500 | $1,450 |

| $122,500 | $1,200 |

| $127,500 | $950 |

| $132,500 | $700 |

| $142,500 | $200 |

| $146,500 | $0 |

The money that you receive via your stimulus check is not taxable, meaning it doesn’t count towards your 2020 taxable income. In addition, the check is not an advance on your 2020 tax refund, as they are mutually exclusive from one another. Stimulus checks are also not a loan, so you do not need to pay the money back to the federal government.

From April 11 to April 15, the IRS sent out electronic stimulus check payments to the vast majority of people who have their bank account on file with the IRS. For those that do not have their direct deposit information on file with the IRS, physical checks began mailing out on April 24. About five million physical checks are going out on a weekly basis, with those who have lower AGIs receiving payment before those with higher AGIs. You can also receive your check via a prepaid debit card called “The Economic Impact Payment Card.”

The IRS has a free online tool called “Get My Payment” that lets you to track the status of your stimulus check. At one point, you could also update your bank account information thorough the app so you could receive your money faster. However, the deadline for most people to complete this by was May 13, which has since passed. According to the Treasury Department, some glitches that existed within the Get My Payment tool have been fixed.

If you have your bank account on file with the IRS and you receive Social Security retirement benefits, Social Security survivor benefits, Social Security disability benefits, Supplemental Security Income (SSI), Railroad Retirement benefits or VA benefits, your stimulus check should have arrived by the end of April. Americans that are not required to file a tax return for 2018 or 2019 can use the new online tool created by the IRS to submit their information for a stimulus check.

Within 15 days of your check’s disbursement, you should have received notification in the mail. This will state your check’s method of payment and amount, as well as a phone number to use if you did not get your payment. If you have yet to get your stimulus check, review our guide that details what your options are.

Many people are wondering whether a second stimulus check may be on the way. As of May 21, a new $3 trillion relief bill proposed by House Speaker Nancy Pelosi, which includes a second round of stimulus checks, has passed in the House of Representatives. The bill is called the Health and Economic Recovery Omnibus Emergency Solutions Act, or the HEROES Act.

The HEROES Act stipulates that households would receive another $1,200 stimulus check per family member, with a total household cap of $6,000. Individuals with an income of $75,000 or less would receive the full amount, and married couples would get up to $2,400 if their income is no more than $150,000. Anyone over those caps would receive a reduced check.

This bill must also pass in the Senate before it has any chance of being signed into law by President Trump. Republicans have also laid out plans for their own stimulus package, which includes a limit on the total size of the bill, as well as a condition that it will be the final coronavirus-related stimulus package. However, nothing is expected to pass until late July at the earliest.

There have been a plethora of other stimulus proposals over the last few weeks and months. These include $2,000 monthly payments for a year or for the length of the pandemic plus three months. There have also been ideas of a temporary travel tax credit, a payroll tax cut for workers and more.

Unemployment Insurance Program

The law provides unemployment insurance to more people and for longer. Workers who lose their jobs to coronavirus can receive unemployment for 39 weeks, which is 13 weeks longer than usual in most states. Also, the government has expanded the types of workers who are eligible for unemployment to include independent contractors, gig workers, freelancers and people who have been furloughed. Additionally, the federal government is adding $600 in extra weekly benefits until July 31, 2020.

The proposed HEROES Act that’s known for including a second set of stimulus checks would also push extra unemployment benefits further if it passes in its current form. In fact, the bill specifies that the additional $600 in weekly unemployment benefits would be extended from July 31, 2020 to January 2021.

Paycheck Protection Program (PPP)

In mid-April, the Paycheck Protection Program (PPP) ran out of loan funds to offer to small businesses. However, on April 24, President Trump signed into law an additional coronavirus relief bill that included another $310 billion for the PPP. As of June 30, about $139 billion of the program’s $659 billion in total funding is still up for grabs.

The PPP provides loans to small businesses of 2.5 times their average monthly payroll costs (excluding salary compensation in excess of $100,000), up to $10 million. The goal of the Paycheck Protection Program (PPP) is to incentivize businesses with 500 or fewer employees to continue employing people. In turn, businesses that maintain their full-time workforce and payroll will be forgiven the part of their loan that amounts to eight weeks of their payroll costs (excluding salary compensation in excess of $100,000 salaries) plus rent on a leasing agreement, mortgage interest and utilities.

Interest on the part of the loan that is not forgiven is fixed at 1.00%, the loan will be due in five years and payments are deferred for six months (though interest will accrue during the deferral period).

Due to changes to the PPP program, borrowers now have 24 weeks to use their loan funds. In addition, up to 40% of the money can be used to cover non-payroll costs, like rent and utilities. In addition, businesses now have until Dec. 31, 2020 to rehire employees up to their pre-pandemic numbers.

What’s more, sole proprietors, independent contractors and self-employed individuals are eligible for these loans. To receive a PPP loan, you do not need to have been denied credit elsewhere. You also do not need to sign a personal guarantee or put up collateral.

To apply, you’ll need to contact an existing SBA 7(a) lender or any federally insured depository institution, federally insured credit union or Farm Credit System institution that is participating. Check out our comprehensive overviews of PPP loan lenders and requirements and the PPP application.

The application deadline for the PPP is June 30, 2020, though some banks have already stopped accepting applications. Here are your options if your business misses out on a PPP loan.

Economic Injury Disaster Loans (EIDLs)

Up until mid-April, the Economic Injury Disaster Loan (EIDL) Program was on hold. But as part of the additional coronavirus relief bill that President Trump signed into law on April 24, the EIDL program received another $60 billion in funding. As of July 3, around $135 billion has been approved through the EIDL program, in addition to all $20 billion in EIDL cash advance grants.

When the EIDL program shut down, many small businesses still had applications processing. Because of the backlog this created, the EIDL Program has been reopened on a limited basis to only agricultural businesses. As of May 5, Texas, Colorado and South Dakota began accepting EIDL applications for non-agricultural businesses in counties that have been affected by adverse weather, drought and flooding, respectively.

EIDLs involve less red tape than the PPP program, which is good news for small businesses amid the coronavirus crisis. The SBA will approve EIDLs based on the applicant’s credit score, while loans of up to $200,000 do not require a personal guarantee. To qualify, you must have been in business by Jan. 31, 2020. Terms for EIDLs are 30 years and 3.75% interest, or 2.75% for nonprofits. Payment is deferred for one year from the date of the loan.

EIDLs are available for up to $2 million for businesses with fewer than 500 employees, nonprofits, sole proprietors, independent contractors, tribal businesses and more. However, reports have also shown that following the new relief bill, the loan cap has been unofficially reduced to $150,000.

Additionally, the EIDL program provided cash advance grants of up $10,000 upon completion of a loan application. However, as of July 11, the entire $20 billion allocated for these grants has been paid out, which means they are no longer available. If this money was used to cover paid leave, payroll or increased costs due to coronavirus, it was completely forgiven.

More Stimulus Package Benefits for Individuals

In addition to direct stimulus check payments and the other programs listed above, the CARES Act offers Americans a number of other important benefits. These cover student loan payments and interest, retirement accounts, paid sick leave and more. Read on to learn about what else is available for you.

Federal Income Tax Filing Extension

The deadline for filing tax returns for 2019 has been officially pushed back three months from April 15 to July 15. The extension also applies to tax payments owed for 2019 and estimated tax payments for 2020. People who use the extension will not incur late fees, and they do not need to file extra paperwork, as the extension is automatic.

Rent and Mortgage Payment Relief

Homeowners who have federally backed mortgages (Fannie Mae, Freddie Mac, FHA, VA, HUD or USDA loans) and are experiencing financial hardship due to the coronavirus pandemic may request forbearance for up to 180 days. Treasury Secretary Steven Mnuchin clarified that you must have lost your job to qualify for federally backed mortgage forbearance.

During this period, borrowers will not incur fees, penalties or interest due to not making their mortgage payments. To receive the deferral, you do not have to prove the condition of your finances; you only have to attest to it. But you do have to contact your loan servicer to have your payments postponed. You may request an additional 180 days of mortgage relief if needed.

That said, if your mortgage is held by a private lender, you should still contact it to see if it is providing mortgage relief. Many banks, including Fifth Third Bank, Marcus (Goldman Sachs) and TD Bank, have either suspended payments or are offering special terms. Also, check to see if your governor has made any mortgage-related declarations. Many states are also calling a moratorium on evictions and foreclosures.

Paid Sick Leave

Generally, employees who work for public or private companies with fewer than 500 workers are entitled to up to two weeks of paid leave if they can’t work due to COVID-19. It can be the employee who is sick or someone in their family who needs care.

Under the new law, employers are required to pay the employee’s regular rate, up to $511 per day, for 10 days if the employee is sick or under quarantine, or no more than $200 per day for 10 days if the employee has to stay home to care for a family member. If your company has more than 500 employees, it likely has a paid sick leave policy.

Student Loan Relief

To help borrowers during the financial crisis, the CARES Act authorizes the Secretary of Education to suspend payments for federal student loans until Sep. 30, 2020. During this period, no interest will accrue on any federal student loans.

The Department of Education has now informed borrowers that the collection of their payments was temporarily suspended and interest is being waived. If you choose to continue making payments, though, they will be applied entirely against the principal. Also, students with work-study grants who are not able to do their jobs because their campus is closed may still be paid in full (though schools may choose to pay less).

In addition to authorizing student loan forbearance, the legislation allows institutions of higher education to turn unused work-study funds into supplemental grants. Also, students who drop out because of COVID-19 will not have to pay back federal grants. What’s more, payments for capital financing are deferred for historically black colleges and universities (HBCUs) for an initial 180 days.

Penalty-Free IRA and 401(k) Early Withdrawals

People who have been diagnosed with COVID-19 or whose spouses have been diagnosed, or anyone who has been adversely impacted financially by the coronavirus or disease, can withdraw up to $100,000 from their tax-advantaged retirement accounts, like a 401(k) or IRA, penalty-free. Normally, early withdrawals come with a 10% surtax, on top of normal income taxes.

The distribution will be counted as income (you still have to pay taxes) over three years. Also, people who take the distribution will have a three-year window to repay the money if they wish. This provision for penalty-free early withdrawals does not apply to pension plans.

For hands-on help with your retirement savings, talk to a financial advisor today.

Delayed Required Minimum Distributions (RMDs)

With so much volatility in the stock market, retirees who must take required minimum distributions (RMDs) may delay making them for one year. This applies to both 2019 RMDs that were supposed to be taken by April 1, 2020 and RMDs for 2020 itself.

Coronavirus Health Insurance Coverage

The CARES Act has stipulations within it that require private health insurance providers to cover various healthcare costs associated with COVID-19. More specifically, the bill calls for providers to cover all costs surrounding coronavirus testing, inpatient treatment and any future vaccines.

Charitable Contributions

So that people can contribute more to their churches and other charitable organizations, the new law allows you to claim up to $300 in cash contributions as a deduction. This will apply whether or not you itemize on your tax return.

Also, the “50% of AGI” ceiling has been suspended for individuals, while the 10% limitation on corporations has been raised to 25%.

More Stimulus Package Benefits for Businesses

The CARES Act is full of programs built specifically to help out all types of businesses around the country. Although the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDLs) take the headlines, there are plenty of other benefits and program that small, med-sized and large businesses can take advantage of. Check out what’s available below.

Federal Reserve Main Street Lending Program

The Federal Reserve’s Main Street Lending Program is another small business relief effort that’s offered by the Federal Reserve. That makes it distinct from other relief programs, as most of those are run by the SBA. Lenders were able to begin registering for this program on June 15, 2020.

The purpose of this program is to remove some of the risk that banks will encounter when they offer loans to small businesses. More specifically, when a bank gives a loan to a small business under this program, the Federal Reserve will buy 95% of the loan amount, leaving just 5% for the bank to handle.

Loans provided through the Main Street Lending Program abide by four-year terms. Loans can be anywhere from $1 million to $25 million, though these funds cannot be used to pay off existing debts. In turn, the Federal Reserve is prepared to purchase up to $600 billion in loans.

Businesses eligible for the Main Street Lending Program include those with fewer than 15,000 employees or with annual revenues of less than $5 billion. The program is expected to run through Sept. 30, 2020.

Employee Retention Tax Credit

The Employee Retention Tax Credit is a credit that employers can receive for up to 50% of qualified wages paid to employees, including qualified health plan costs. The qualified wage cap is $10,000 per employee for all calendar quarters, meaning the maximum credit is $5,000 per employee.

According to the IRS website, employers eligible for the Employee Retention Tax Credit include those that carry on business during the 2020 calendar year and:

- Fully or partially suspend operation during any calendar quarter in 2020 due to orders from an appropriate governmental authority limiting commerce, travel or group meetings (for commercial, social, religious or other purposes) due to COVID-19

- Experience a significant decline in gross receipts during the calendar quarter

For the latter requirement, the IRS defines a “significant decline in gross receipts” as any instance where an employer’s gross receipts for a 2020 calendar quarter are less than 50% of its gross receipts for the same calendar quarter in 2019.

Tax Benefits for Businesses

One of the more significant tax impacts of the CARES Act is that businesses and self-employed individuals now have the ability to defer their Social Security payroll tax payments. This deferral lasts for two years, meaning they must be paid by the end of that two-year period. In addition, at least 50% of these taxes must be paid by the end of 2021, with the latter half due by the end of 2022.

If your business was due to receive corporate alternative minimum tax (AMT) credits for 2021, you can now claim a refund on them instead. In addition, businesses can write off the costs associated with improving their facilities.

The CARES Act also authorizes an increase to business interest expense deductions for 2019 and 2020. In fact, these deductions are now 50% of a business’ taxable income, which is up from the original 30%.

Do you need help managing the finances of your small business? Speak with a financial advisor today.

Short-Time Compensation Programs

In an effort to curb employers from having to lay off employees during situations like the coronavirus crisis, 27 states have implemented what’s called a short-time compensation (STC) program. Employers use STCs to reduce work hours, and in turn pay, for certain employees, though these employees are simultaneously allowed to collect a portion of their unemployment compensation benefits.

The CARES Act is supplementing existing STC programs by fully reimbursing states for what they pay into their specific program. In addition, the Act affords states with STC programs $100 million to strengthen their offering.

States that provide STC programs include Arizona, Arkansas, California, Colorado, Connecticut, Florida, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nebraska, New Hampshire, New Jersey, New York, Ohio, Oregon, Pennsylvania, Rhode Island, Texas, Vermont, Washington. and Wisconsin.

Economic Stabilization Loan Program

The law provides a $500 billion fund for the Treasury Secretary to lend money to distressed corporations, municipalities and states. The caps for funding are $25 billion in loans or loan guarantees to airlines, $4 billion for cargo air carriers and $17 billion for “businesses critical to maintaining national security.” Plus, at least $454 billion is allocated to supporting programs or facilities established by the Federal Reserve for keeping the financial system liquid.

Originally, the GOP proposal did not include Congressional regulation, but now the fund will have an oversight board. Additionally, companies that borrow money from the fund must keep employment at their March 13, 2020 level, may not engage in stock buybacks and cannot increase executive pay that was $425,000 or more in 2019, while their loans are outstanding.

Other Funding Measures in the CARES Act

As you would expect with a $2 trillion spending package, the CARES Act spreads the money to many entities. Allocations include: $9.5 billion to agricultural programs, $55 million to the animal and plant health inspection service, $20 million to the FBI, $100 million to the federal prison system, $33 billion to food safety and inspection, $75 million to the National Science Foundation, $25 million to rural utilities services, $15 million to the United States Marshals Service and more.

State and Local Government Aid

On the front lines of the pandemic, state and local governments are running out of cash. The CARES Act seeks to address budget shortfalls by providing $150 billion in direct aid to them. The Center on Budget and Policy Priorities estimates that each state is receiving at least $1.5 billion in funds, with California receiving approximately $15 billion and Texas more than $11 billion. The legislation allocates another $274 to state and local governments for specific purposes, such as $5 billion for Community Development Block Grants, $13 billion for K-12 schools and $14 billion for higher education.

Hospital and Other Healthcare Provider Assistance

Private hospitals responding to the coronavirus crisis are receiving $100 billion in funding, while community centers that provide healthcare services are receiving $1.32 billion in immediate relief. The CARES Act also affords $20 billion for veteran healthcare; $16 billion to increase the Strategic National Stockpile of ventilators, masks and other equipment; $11 billion for diagnostics, treatments and vaccines; $4.3 billion for the Centers for Disease Control and Prevention (CDC); and $80 million for the Food and Drug Administration (FDA) to fast-track approval of new drugs.

The second round of coronavirus relief provisions that President Trump signed into law on April 24 include $75 billion in grants for hospitals that are seeing an increased flow of patients due to coronavirus. The new law also includes $25 billion for the expansion of coronavirus testing.

Food Banks and Other Food Security Programs

With so many people losing their jobs, the need for food assistance will only grow. To help hungry Americans, The CARES Act authorizes $450 million to go to food banks and other food programs, which is in addition to previous emergency funding. Furthermore, $8.8 billion is going to school meal programs, as well as $15.5 billion to the Supplemental Nutrition Assistance Program.

Tips for Managing Your Money During the Coronavirus Crisis

- The volatility of the current market can be frightening, but you don’t have to go at it alone. A financial advisor can help you create a financial plan or update your existing one to make sure your finances stay in good shape. SmartAsset’s free tool makes finding an advisor easy, as it matches you with personally chosen advisors in your area. Get started now.

- If you can afford to, consider investing your stimulus check money or socking it away in a high-yield savings account. Ideally, you want to find a brokerage account or bank account that has little to no fees or minimums so you can hit the ground running immediately.

- There are plenty of small business-centric programs and provisions available for companies affected by the COVID-19 pandemic. One separate thing you could take advantage of, though, is business interruption insurance.

Photo credits: ©iStock/Kameleon007, ©iStock/Dan Rentea, ©iStock/skynesher