The American prison system is massive. So massive that its estimated turnover of $74 billion eclipses the GDP of 133 nations. What is perhaps most unsettling about this fun fact is that it is the American taxpayer who foots the bill and is increasingly padding the pockets of publicly traded corporations like Corrections Corporation of America and GEO Group. Combined both companies generated over $2.53 billion in revenue in 2012, and represent more than half of the private prison business. So what exactly makes the business of incarcerating Americans so lucrative?

The American Prison System

Most of it has to do with the way the American legal system works and how it has changed over the last 40 years. In the 1970’s, lawmakers were dealing with a nationwide rash of drug-use and crime. By declaring a nation-wide war on drugs in 1971, President Richard Nixon set a precedent for hard-line policies towards drug-related crime.

New York governor Nelson Rockefeller followed suit declaring “For drug pushing, life sentence, no parole, no probation.” His policies once put into action promised 15 years to life in prison for drug users and dealers. His policies catalyzed the growth of a colossal corrections system that currently houses an estimated 2.2 million inmates.

The runaway growth of US corrections did not come overnight, and did not come from the government alone. Since the 1970’s federal and state correction agencies have consistently struggled to meet the increased demands brought on by the US Department of Justice and strict drug laws.

In 1982, three Texas businessmen, Tom Beasley, John Ferguson, and Don Hutto saw an opportunity in the shortcomings of the Texas corrections system’s inability to deal with this influx of incarcerations. They devised and executed a plan to secure the first government contract to design, build, and operate a corrections facility from the Immigration and Naturalization Service and the Texas Department of Justice.

Contract in hand, the trio was given 90 days to open a detention center for undocumented aliens. As their January 28 deadline neared, Hutto, Ferguson, and Beasley had no facility, no staff and their experiment seemed doomed to fail.

On New Year’s Eve, 1983, Beasley decided to get crafty, “Well, we’ll just go to Houston and find a place,” he reportedly told Ferguson. Incredulous, Ferguson replied, “Tom, you’re crazy. There’s no possible way. This is New Year’s Day. There is no possible way we can find a place today.” Beasley simply responded, “We have to.”

The three men immediately got on a plane and began their search. After a litany of rejections they came upon the Olympic Motel at 1am on New Year’s Day and immediately began negotiations that lasted for three days.

After hiring the motel owner’s family and promising to return the motel to its original condition, the group was in business. They then converted all of the motel rooms to secure cells, procured secure transportation and opened shop on January 28, 1983 when 87 inmates were brought in. Hutto, Ferguson and Beasley formed Corrections Corporation of America, the largest prison private prison network in the United States.

With the precedent it set with the first private detention center, CCA changed the face of US corrections for good. The private sector came to be seen as a quick-fix to the problem of overcrowded, understaffed public prisons. Today, privatized prisons make up over 10% of the corrections market—turning over $7.4 billion per year.

The American Prison Business

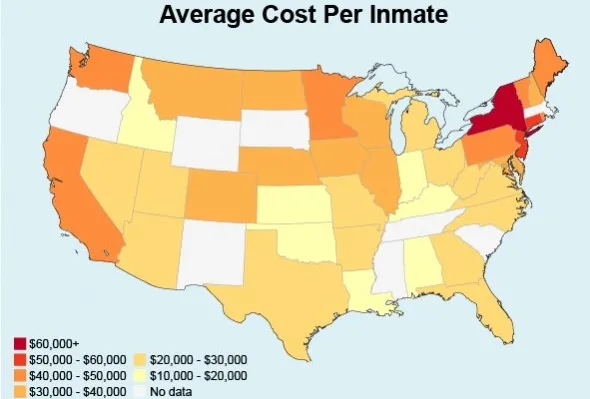

The average cost of incarcerating an American prisoner varies from state to state. Some states, like Indiana have managed to keep prices low at around $14,000 per inmate. While states like New York pay around $60,000 to keep its citizens behind bars. The costs of running the American prison system is expensive and has become increasingly so despite public opposition.

According to a 2012 Vera Institute of Justice study, the number of those incarcerated has increased by over 700% over the last four decades. The cost to the taxpayer? $39 billion.

Where is all of this money going? The Vera institute study contends that many corrections-related costs, such as employee benefits and taxes, pension contributions, retiree health care contributions, legal judgments and claims are deemed central administrative costs.

Moreover, many states fund inmate services—such as hospital care in 8 states, and education and training in 12 states—outside of their corrections departments. It’s a nice accounting trick but this amounts to a $5.4 billion gap between the reported corrections budgets of the 40 states examined by the study—$33.5 billion—and the actual cost to taxpayer of $39 billion.

The ideology behind this peculiar industry is that private companies, forced to compete with state government prices and one another for contracts, can provide correctional services more efficiently than the government itself can. Moreover, these private companies offer a correctional solution that prevents the government from having to sink capital into the brick-and-mortar of new prisons and other long term costs such as pensions, salaries, and health-care for new prison staff.

Private prisons like CCA not only provide states and the federal government with lower “per-diem” costs, but they also provide a means for them to balance their budgets by buying off and refurbishing state-owned prisons.

The Largest Corrections Corporation in America

CCA operates the fifth largest prison system, public or private, in the system in the US. Under its control include 51 owned-and-operated facilities in 16 states and contracted management of 18 more state-owned facilities in 7 states. This network allows CCA to maintain a 44% stake in the $7.4 billion private corrections market for a market cap of $3.53 billion. All of this equates to a massively profitable operation for CCA who recorded $1.64 billion in revenue, $883.1 million of which came from state governments in 2012.

Studies mostly agree that privatized prisons save money on the balance sheet—with short run savings averaging about 19.25% and long run savings averaging about 28.82%. In fact, many states have statutes that require a certain percentage of savings—Florida 7%, Texas 10%, Kentucky 10%, Mississippi 10% –in contracts with private corrections providers. On paper, private corrections facilities are almost always more efficient than public ones. CCA reports savings of 68-74% vs. various government agencies for 1000 new beds added. Astonishingly, CCA was able to generate these savings while also recording a 29.6% operating margin of $17.53 per man, per day in 2012. Are private prisons really that much more efficient or are we missing something?

Let’s break this down further. In 2012 CCA received $59.14 in revenue per compensated man-day from the government. Of this $59.14, CCA committed $41.61 to operating expenses per man-day. This effectively means CCA commits $41.61 to each prisoner each day. According to CCA’s SEC filings 65% of these operating expenses, or $27.05 goes to employee salaries and benefits. This leaves $14.56 per man-day for the combined costs of food, medical care, and contracted drug rehabilitation and education programs.

Considering that this is the area private prisons choose to cut costs, it is little wonder they come with hidden costs unaccounted for by their reported savings. For instance, a study on recidivism performed in Oklahoma between 1997 and 2008 showed that prisoners released from private prisons had almost a 4% higher rate of recidivism (returning to prison). This means, that for every 1000 prisoners released, private prisons have the additional annual cost to the Oklahoma taxpayer of $554,010 (based on average annual cost per inmate). If you extrapolate this recidivism gap to a state like New Jersey that spends more per prisoner, the hidden cost of releasing 1000 inmates jumps to $1,645,950.

Private Problems Become Public Issues

In recent years, private prisons have also come under fire for failing to successfully fulfill their contracts. In 2010 alone, US private prisons were the subject of four major scandals. An Arizona prison operated by the Management and Training Corporation allowed three inmates—two convicted of murder and one convicted of attempted murder—to escape. Before being captured the escapees murdered a couple in New Mexico. The family filed a multimillion dollar lawsuit against MTC and the state of Arizona.

In 2010, a nationally released video showed an inmate at the Idaho Correctional Center thrown to the ground, beaten, and kicked. ICC guards made no attempt to intervene, and were later charged with “routinely failing to protect inmates” and deliberately exposing inmates to “prison gangs and violent culture.” In Kentucky, a sex scandal involving female prisoners and guards forced a CCA prison to relocate several hundred women 377 miles away to a state-run prison. Also in 2010, the GEO group was forced to reach a $2.9 million settlement to provide up to $400 to inmates at six facilities for illegal and unnecessary strip searches.

Incidents such as these occur frequently and the money doled out by private prisons, and the government in lawsuits, retributions, and relocation are is not reflected in the per-diem costs cited by private companies to highlight savings. When one considers the $156,800,000 net income of a company like CCA, it becomes easy to understand why such incidents occur. Operators of private prisons are given a sum in government contract. It is their duty to then carry out the terms and provide the conditions specified in the contract.

As it turns out the best way to turn a profit from this sum is to strive for the absolute minimum requirements that these contracts allow. By slashing costs related to crucial aspects of operating facilities such as training and hiring of personnel and maintaining safe facilities companies like CCA turn a greater profit for their shareholders and create more enticing cost-reduction statistics to draw in more government contracts.

Furthermore, the statistics used to measure the success of all prisons in cutting costs—usually total taxpayer cost per inmate—are generally considered to be unreliable in assessing real cost. These same statistics are often used to validate private contracting of corrections operations. In today’s fiscally anxious political climate, government officials and private prison employees are hyper-aware of the impact of these statistics on measuring success of budget slashing strategies. They are often incentivized to bring down these numbers and employ several strategies that skew cost statistics to make them more palatable to the taxpayer.

The Vera Institute study identifies several factors that tend to these alter cost-per-prisoner numbers. The first is overcrowding of prisons. By overcrowding prisons and allowing the inmate population to exceed the capacity of a facility, the price-per-inmate figure of that facility is driven downward at the cost of safety, reliability, and increased recidivism. States and private prisons with greater incarceration of low-level offenders will also report lower per-prisoner costs though their total cost to the tax payer is actually greater.

Low-level offenders can be placed in minimum and medium security prisons which require fewer staff, and generally have much lower incarceration costs. Therefore, by incarcerating a greater number of persons who commit less-serious offenses, corrections systems can present themselves as more efficient despite the increase in total cost they create. Finally, state corrections systems often reimburse local jails to house state-sentenced offenders. These costs are often set by statute and not updated in accordance with rising costs.

The Cost of Corrections to the American Taxpayer

So what does all of this mean for American citizens. Let’s take a look at Joe Taxpayer from Arizona to see what it costs to run and maintain American prisons. Joe is a pretty average guy, a single man making a living in Scottsdale. The state of Arizona allocates just over 10% of its budget to corrections each year in the name of public safety. Joe, who works as a middle school principal, brings home $75,000 a year and pays $2,309 annually in state taxes.

Some simple math reveals that Joe pays $230.90 every year towards the incarceration, monitoring and rehabilitation of prisoners. Now, 13% (and growing) of Arizona’s prisoners are housed and managed by private corrections facilities. If Arizona is spending equally on private and public prisoners Joe is giving $30 every year to private corporations to house prisoners.

If we account for the savings offered by Arizona prisons, reconciling the -1.0% of medium security prisons and 8.0% savings to 7.0% for the sake of simplicity, Joe forks over a final sum somewhere around $28 for the services of private prisons every year out of his state taxes alone. Joe Taxpayer is not pleased.

The business of prisons is deeply intertwined with a number of issues ranging from accounting shady accounting practices, to recidivism and other hidden social costs. However it is difficult to discern whether private prisons are a better use of taxpayer dollars especially if they serve government interests ahead of civil liberties and transparency.

What is abundantly clear is that prisons system is a lucrative business for those uniquely positioned to service the growing needs of the federal and state judicial systems.

Financial Tips

- If you have questions beyond the economics of the prison system, a financial advisor can help. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Are you keeping a close eye on your personal finances? Consider using SmartAsset’s budget calculator to help you get things in order.

Sources: CCA, Vera Institute of Justice, The Nation, AFSC, CJR, University of Chicago Crime Lab, Barclays Capital, NPR, AFSC

Photo Credit: CCA.com, The New York Times, KQED.org