When Joe Anderson founded Pure Financial Advisors, his goal wasn’t just to offer great financial advice to clients. He also wanted to build an in-house sales and marketing team capable of converting leads into new clients at scale.

Today, Pure Financial Advisors uses a 20-point checklist for establishing and nurturing relationships with new leads. From the initial emails and phone calls to prospective clients to a pair of complimentary consultations with a financial advisor, Anderson’s firm has a defined step-by-step process for marketing and selling its services.

The San Diego-based firm even has a nine-person business development team that reviews and adjusts this system on a weekly basis, allowing his advisors to focus on what they do best: providing great financial advice.

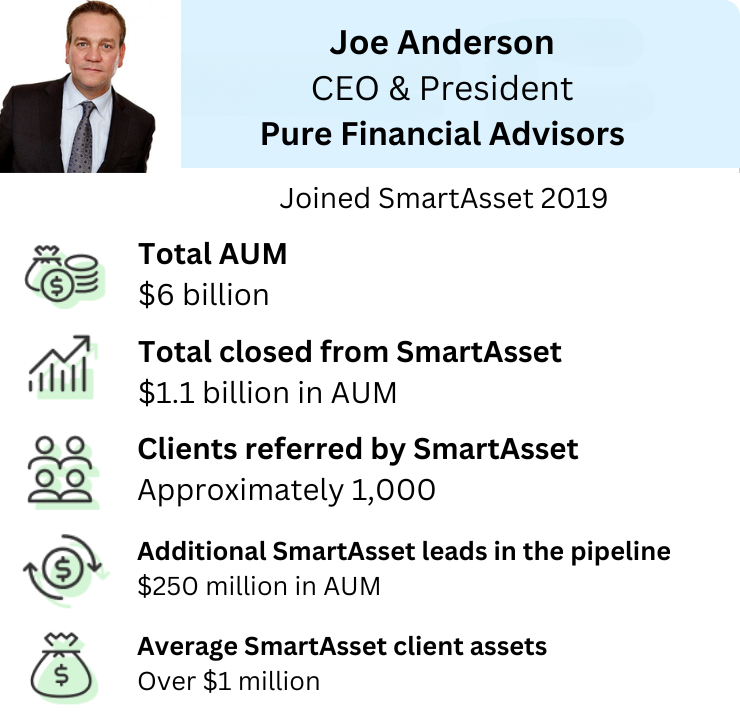

The proof is in the pudding. Pure Financial Advisors has added over $1 billion in new assets through SmartAsset referrals alone: about a sixth of its total assets under management (AUM). Anderson recently sat down with SmartAsset founder and CEO Michael Carvin to discuss his firm’s approach to marketing and business development.

“I think generating the lead is one thing, but converting it to a long-term client is something different,” Anderson said. “You need to have people in different chairs throughout the journey.”

Interview Transcript

Michael Carvin

Hi, I’m Michael Carvin, and I’m the CEO and founder of SmartAsset. Welcome to our Advisor Success Series. I’m pleased to be joined by Joe Anderson, the CEO and president of Pure Financial. Joe, welcome to the program here. Glad to have you. I want to hear a little bit about you and your firm.

Joe Anderson

Michael, thank you so much for having me. This is a real pleasure. Pure Financial Advisors president and CEO. We started the firm in 2007. We’re a West Coast-based wealth management firm that specializes in deep financial planning, investment management, but I think with a real core of client education. We started the firm in 2007 and we brought in our first client in 2008.

Today, we manage roughly $6 billion. And I have to say a lot of thanks to you, Michael. A little bit more than a billion dollars of that $6 billion is from SmartAsset. I’m super excited to talk about the journey in regards to marketing and business development activities, and everything in between. Because really the goal of Pure Financial Advisors when we started the firm was twofold. One is that we really wanted to build a strong back office. We wanted to support the Certified Financial PlannersTM, so we wanted to have robust tax and financial planning services, [an] investment management team that’s really dealing with the portfolios, a strong back office in regards to operations and compliance. But I think what makes us a little bit unique is that we also wanted to build a very strong front office.

I’ve been in this business since the late 1990s, and I see a lot of really good advisors come and go, but I think a lot of good advisors leave because they don’t necessarily know how to market, or they don’t know a sales process, or they can’t convert a client or even get a client in front of them. We wanted to build a very strong, robust front office as well. From a marketing perspective, we wanted to handle all of the “biz dev” and marketing activities for the firm and basically have preset appointments for advisors so they could do what they do best, which is really give great advice to those end clients.

Michael Carvin

What a success, Joe – a billion dollars raised through SmartAsset. Clearly, you guys are doing something right and we really appreciate you taking the time to talk through some of those processes that are working for you. I think these are lessons that can work whether you’re using SmartAsset or sourcing leads from elsewhere. It’s just about building good processes to have that initial meeting and take them through to close. So maybe you start by just telling us a little more about what the ideal client looks like for Pure Financial.

Joe Anderson

The mission and vision of Pure Financial Advisors was to give robust, comprehensive financial planning to the mass affluent. We started the firm like I said, in 2007 as a fee-only registered investment advisor. And I think back in 2007 and 2008, the firms that were RIAs really catered to the high net worth or ultra-high net worth, which is fantastic.

But for us, we felt that we could give more comprehensive financial planning advice at scale to the mass affluent, because we feel that, unfortunately, a lot of those individuals need every last dollar to make sure that they can accomplish their goals. So that’s what we specialize in. Our ideal client is someone that is transitioning into retirement, that is looking for help to create retirement income, preserve their capital, pass it on to the next generation. I think similar goals to a lot of other advisors. But what our main focus is is to give that a comprehensive strategy at scale.

Michael Carvin

That makes a lot of sense. In terms of finding that client, I think you work across a number of different marketing channels. Maybe you can share the different channels that you currently operate in, and where have you seen success and where have you seen challenges?

Joe Anderson

Because of how I got into the business, it was … this business is hard, right? I got in right out of college. You know, I’m 20-some-odd years old, and they’re like, “Okay, well, you’re a financial advisor now, so go find clients.” You get your list of 100 names, and you’re calling your friends and family. My dad was my first client; he gave me 10,000 bucks that I put in new opportunities that blew up a couple of years later. You kind of get accustomed to see every lead as gold because the business is hard. You got to generate the lead, and then you got to set the lead.

So you’re calling all these people to try to set appointments. And then from there, they got to show up. And it’s like, “Okay, great. They showed up, now what?” You got to bring them through a sales process, and hopefully, you can motivate the client to take action and actually hire you to be their advisor long term.

In the beginning, I’ve done everything and anything. From the list of friends and family to setting up fish bowls in restaurants to have them put cards in, and I’ll buy them lunch or dinner, and then present my services to them; to doing focus groups, dinner workshops – you name it. Sitting in lunchrooms at the schools, kindergarten rooms, trying to sell 403(b)s, just to see if I could build and grow a business. So over the years, I’ve tried to create a little bit better strategy.

If you think about constructing an overall portfolio for your investment clients, we did the same with our marketing strategy. You have stocks, bonds, cash, alternatives. We have four similar silos if you look at a marketing portfolio. For instance, client education is really key for us, so we have a client education silo. We do workshops. We do adult education long-form that we actually charge clients to go to. We do a lot of webinars, white papers, blogs – you name it. We try to throw the content out there to educate the client. We feel that an educated client is a much better client.

The second silo that we have is our media channel. We started the firm on AM radio – the AM radio Saturday morning talk show. We still have that. That morphed into a TV show, then that morphed into a podcast. And so we do a lot of education in regards to white papers, special offers in regards to that channel.

Recently, because of COVID, you can’t necessarily really go out and teach the public, and that’s where we built out our digital platform or silo, if you will. That’s when we partner up with great firms like you, Mike – SmartAsset – or we’re driving leads to our website just from a digital channel.

And then finally, it’s referrals – referrals, CUIs and things like that. If you look at our portfolio, we run hundreds of different campaigns, and we feel that marketing is like “2 + 2” should equal six. Because let’s say I purchase a lead from SmartAsset and then from there, in our drip campaign we might throw in, “Here, listen to the podcast” or we might give them a white paper. Or they go to a class and then they come in, download something on our website. We’re constantly trying to touch these people, so the more robust portfolio we have, I think the stronger the close ratio is that we have motivating the client to take action.

Michael Carvin

It makes a lot of sense. And again, a billion dollars in organic growth through SmartAsset, you have to have a machine to make that work. Maybe we can just dive into the details. How did you set up your partnership with us? Why do you think it’s been so successful?

Joe Anderson

Yeah, I think generating the lead is one thing, but converting it to a long-term client is something different. You need to have people in different chairs throughout the journey. With purchasing a lead or getting a lead or referral from SmartAsset, what that does is that goes into a wholly separate department. It’s our biz dev/inside sales team. We have a team of around nine people. What their job is to make the phone calls, the text messages, the emails, the follow-ups, the nurturing and everything else in between to make sure that we can capture that overall prospect into our sales funnel, if you will.

I found out a long time ago I didn’t necessarily want advisors making those types of calls. They’re going to call them once or they’re going to call them three times and they’re going to say, “Joe, this lead is no good.” But if I have a separate team that I’m paying specifically to motivate that client to have an appointment with our certified financial planner, you’re going to receive a lot better results.

Because you have to have a sequence, you have to have a set system. So, every single lead that goes through into our system or process, we have a 20-point checklist. They’re going to receive a text message and a phone call, then the next day an email, and so on. So it’s going to walk them all the way through, and then we’re going to drip on them and hit them again. It just goes back to when I started in the business, that every lead was gold. If you treat every lead as gold, you’re going to see a lot better conversion, and that’s the culture that we have.

“Because you have to have a sequence, you have to have a set system. So, every single lead that goes through into our system or process, we have a 20-point checklist. They’re going to receive a text message and a phone call, then the next day an email, and so on. So it’s going to walk them all the way through, and then we’re going to drip on them and hit them again. It just goes back to when I started in the business, that every lead was gold.”

We’re a high-growth firm. We want to continue to grow. Growth is great for the firm, but I think a lot of our advisors have the mantra that we want to help the client. We want to give fiduciary CFP® advice to the mass affluent. Let’s see as many people as we possibly can to help those people. And if you have that type of culture, it’s a lot easier, too, because you have to see a ton of meetings to grow at scale.

Michael Carvin

I’ll just say that you’re not just high growth, you’re high retention, which is also adding to the growth, which means you’re serving a great product to our referrals and to your clients. We really appreciate you taking care of the consumers that we refer over to you.

Maybe, if you don’t mind, would you go through just the metrics? You talked about having a dedicated business development team, getting the consumer on the phone, and getting that first meeting, and then getting the second or third meeting. Can you tell us more about the sequence that you’d like to take a prospect through, and what are the conversion metrics you’re trying to get to?

Joe Anderson

Great question. Our advisors are responsible for bringing a prospect through three processes. Upfront, a lead is generated from whatever source. That lead drives through our business development team, who are going to call and nurture that lead and set that appointment, and hopefully, they show up.

Then, the advisor’s job is to bring them through three processes. The first one is an assessment. It’s free. It’s two meetings. What I found, too, is that if you get a referral from a really good client, your closing ratio is 70-80%. But if you get a lead from someone that calls a radio show or a TV show or SmartAsset, your closing ratios are going to be a little bit different because they don’t know you. So you have to show value very quickly. And you have to show that you’re competent, that you care, in a very quick manner.

So we have a two-meeting process, but that first meeting is really the nuts and bolts of it. We want to get as much information from the client as possible, but it’s hard information. I want to know what they’re doing with their money; how much money they have; what is their real estate look like; IRAs, Roth IRAs, non-qualified accounts. What are their strategies? And then we can ask really good questions. “Have you thought of this? Have you thought of that?”

From there we say, “Hey, let me clean some of this up. And let’s have another meeting. Let me show you the ideas and strategies that we have for you that you should be thinking about.” So the goal for the advisor is really to really educate the client on everything that they should be doing. It’s not like, “Hire me because Pure Financial Advisors is really great. We have a $6 billion firm” or things like that. It’s like, “Michael, have you thought about this tax implication of your retirement account? Or “you sold ‘XYZ’ stock,” or “you have a highly concentrated position, have you thought about ‘this’ or have you thought about ‘that?’”

It’s just giving the client more information they can be thinking about that they can either implement on their own or they can hire an advisor. If they hire us, that’s fantastic. Or they can go back to their existing advisor or they can hire another advisor. Our goal for that first assessment meeting is to really give high touch, high value really quickly, to show that, we’re more competent. We should be more competent than them or else they shouldn’t hire the advisor. Our goal is, “Hey have you thought about these different things?”

That’s the first step of the process. They hire us for planning so we charge financial planning fees upfront because we’re truly a financial planning firm first, and then we manage their client assets afterwards. Then we’ll bring them through a financial planning process. This could be one to three meetings where we’re going to take a really deep dive and give them written recommendations. We’ll give them the roadmap, we’ll give them the blueprint. Here’s everything that you need to do, how you got to do it and why you should be doing it. The assessment is more or less high level, “Have you thought of these things?” And then the second process is more getting really into the weeds to give them all the nuts and bolts for them to implement on their own or to implement with us.

A lot of times they’re like, “This is great, I understand what I should be doing. Now, let’s go ahead and implement. It sounds like we’re on the same page.” And then we go ahead and implement the process. And then the job for the advisor ongoing is to retain that relationship and service the client ongoing.

Those are the three steps that we use to onboard a client. Our sales process is a little bit longer than most, I think, because we’re not in there in that first meeting trying to pitch investment management or a product or services in that meeting. We try to get as much information as we possibly can and give them value in the different areas of financial planning: their cash flow needs, retirement income needs, taxes, investments, estate planning, risk management. We want to go through a laundry list of ideas. And then from there, they’re like, “Wow, this is a lot more information than I thought” and then we can bring them through.

Michael Carvin

That makes a lot of sense. Maybe you can talk a little bit about if you got 100 leads, how many of you are getting to that first or second meeting? And then once you get in front of them, how many are you expecting to close?

Joe Anderson

So we’re setting 20% of leads, roughly. We have eight different offices now. We’re in Southern California, we’re in Seattle, Portland, Denver and Chicago. If we have leads in those metro areas where we have physical advisors, we’re setting 20% of the lead.

From there, around 65% of leads are going to show up, and then from there, we’re going to close roughly 25% of those people long term. So you can revert it back, it’s about 3.5% of the lead is becoming a long-term client if you want to run the numbers that way. If you want to look at cost per AUM – if I spend a million dollars with SmartAsset, I know what the ratio is over the years is that I’ll bring in $100 million of assets. So we’re spending about $10,000 for cost per acquisition per million dollars. And I’ll do that all day long, because the long-term value of the client is a lot more than that. But it’s an investment upfront, right? So short term, you’re going broke, but long term, you’re going to be very profitable.

“If you want to look at cost per AUM – if I spend a million dollars with SmartAsset, I know what the ratio is over the years is that I’ll bring in $100 million of assets.”

Michael Carvin

Yes, absolutely. So a million dollars invested, $100 million in AUM. Can you tell us a little about what your fee structure is like, and what does that work out to you in terms of a dollar invested to a dollar in revenue?

Joe Anderson

Our fee structure is 1%, roughly. We’re probably a little bit lower on the spectrum for higher net worth clients. We’re probably a little bit higher on the spectrum for lower-tier clients, just because of the robust planning that we do. On average, our clients have a million dollars with us. On average, and our fee is around 1% – maybe a little bit more than that, 1.1, call it. So if I have a million-dollar client, call it $10,000 of revenue, and so I’m paying $10,000 to get that million dollars of AUM. It’s a little bit skewed, but I’m just trying to keep it simple.

Michael Carvin

I think you said you spent $1 million to raise $100 million in new assets. What does that equate to in terms of the billion that you’ve raised so far with SmartAsset?

Joe Anderson

The ratio is fairly simple with us: if I spent a million dollars, I know that I will bring in $100 million of assets. It’s actually a little bit more than that just from a compliance perspective. I want to keep the math super simple. So if I spend 2 million, it’s 200 million. So to get a billion is it 10? It’s less than that but you get the gist.

Michael Carvin

And can you tell us a little about what the client is like that you’re getting from SmartAsset? Does it feel different than other channels? What’s the average investable assets? Of that billion dollars, how many clients is that?

Joe Anderson

That’s about 1,000 clients so we’re right at about a million-dollar average. I think we get really good clients from SmartAsset, and of course, with any channel, you get really bad clients. But on average, they’re really good clients.

I guess my advice for everyone that is using this system is that you have to think on your feet. Because a lot of times, these clients don’t know what questions to ask. “Hey, I’m going to sit down with an advisor.” That person is going to be a little bit nervous. They’re going to shoot out, “What are your fees? What’s your performance?” or “Hey, I need an estate plan” or “Mortgage rates are really high.” They’re just throwing things out there. So the advisor has to be really good to say, “Oh, you’re thinking about mortgage rates. Are you looking to refinance? Tell me a little bit more. Can you tell me a little bit more about your real estate?”

Then you can kind of roll into different things and you can add value to their overall client situation. And I think we’ve done a really good job of doing that, versus “I need an estate plan” – “well, I don’t do estate planning, so you should go to an estate planning attorney.”

And then there are some clients that are like, “You know what, I need a Certified Financial PlannerTM that’s a fiduciary and I want to hire you right now.” But you have to go through it, it’s all statistics. You’re going to get really good, you’re going to get really bad, but on average, our closing rates are really good with these particular clients with this particular lead source, because I think we have a systemized process, and you have to think on your feet. You’ve got to, you know, bob and weave a little bit.

Michael Carvin

And I know you’re in a number of marketing channels. Are you using the same system – the same process across all channels – including SmartAsset?

Joe Anderson

Yes. Because here’s why: I have 40 advisors and I need to understand the ratios. Let’s say if I have a first meeting, and that first meeting doesn’t convert to a second meeting for whatever reason – they cancel, they fall out, they don’t want to come back to get really good free information. So then I know that I have to work with that advisor to say, ‘Well, what are their skill sets to make sure that they can hold that second meeting.” Then from the second meeting to a planning client; then planning client to AUM client; AUM client to retention.

So I want to follow that same process just so: a) the client is going to feel the same experience no matter what office or no matter what advisor they go to. Of course the advisor is going to put their own personality and their spin on it, and they’re going to have their own autonomy to give the great advice that they’re really good at doing. But from a process and system standpoint, they have so much support behind them. So we have a full planning team of certified financial planners. We have a tax team of JDs and CPAs. We have an investment management team and so on. It’s like an assembly line that this client or prospect is going through, so the other team members know when they have to step in.

The process is the same, but of course, the personalities are going to be a little bit different. But from a training perspective, we need that because if I’m hiring advisors, these are not referrals that they’re gonna close at 70%. So there has to be a little bit better skillset to be able to convert them.

Michael Carvin

Joe, what advice would you give to an advisor who’s just getting started? You know, a solo practitioner [who] wants to build their business but doesn’t have all these capabilities. How do they go and get started?

Joe Anderson

You’ve got to start somewhere. A couple of things: the best professional golfers, they have a very short memory. Because they have bad shots, and then it’s like, “I gotta hit another good shot.” So you’re going to get a ton of rejection. That’s just part of the game. And just enjoy it and make it a game. You have to have a short memory, and you have to have a lot of passion for this business. And I think a lot of people that get into this business do have that passion to help people. If you have the passion, if you have a short memory, I think you’re going to be alright.

However, you have to start somewhere. So, if you start with a $1,000 budget a month or $500 budget a month, I think that is way better than zero. If you get a goose egg your first month, don’t worry about it, continue to do this because the numbers will play out. And then you start getting some traction, and then you can invest more in your business.

But if you’re not investing in your business, your business will die. Like I said, it took us a while to get to see “the black,” if you will, because we were so committed on the front end to make sure – we felt that there were a lot of really good prospects and clients that needed help – but we wanted to make sure that we did that as a firm to help our advisors. Because advisors are really good advisors, not necessarily great marketers. And if they’re really good marketers and rainmakers, they probably don’t need services like this anyway, right? They’re in the country club, and they’re closing the $20 million deals. But I think for the average advisor like myself, this is a goldmine.

If I open up an office in Chicago, it takes me a while to get an AM radio show on, and I’m probably not going to do that because AM’s dead. Let’s face it, the podcast is really driving a lot more than I ever thought. Then you get the TV show, then we’re gonna do classes and things like that. Some of that stuff takes a little bit of time to get robust and up and running. But if I go to Chicago, if I want to start leads, and I want to get them tomorrow, I’m going to call Luke [from SmartAsset], I’m going to call Michael [from SmartAsset], and say, “Hey, I need leads tomorrow.” Boom, they’re in my inbox, and I’m off and running.

So as a quick start, this is perfect because instead of going to the rotary meeting, are you kidding me? That is awful. “Hey, are you doing?” Networking and this and that. Some people love that; I hated it.

I’m here in San Diego, we had the Farmers Insurance (professional golf tournament) and a mortgage broker invited me to go to the 18th box. I sat there for like 15 minutes, and I had to get out because it was just a network. “Oh, hey, can I get your…” I’m like, no, that’s not for me. I’d much rather call Michael, get a thousand leads in my mailbox and then hit the phones, and I’m off and running.

Michael Carvin

Great advice. And I guess similarly, if you had an advisor who had good lead flow but just wasn’t seeing that conversion, what would you tell them? How would you help them troubleshoot their process?

Joe Anderson

Yeah, I would want to examine the process first. How are you doing this? Are you doing it similar every single time? Because what I find is that no one has a clear sales process. It’s like, “Alright, well here, I’m going to meet this person, and I’m gonna see how they react, and then I might take a fact-find, I might not, or I might just take a deep dive into their goals. Or maybe it’s a ‘get to know you’ meeting, right? What are your feelings about money?” I never really liked that part of the business. I wanted to show the hard facts of saying, “Hey, if you do X, Y, and Z, you can save X, Y, and Z in taxes.” Or “Hey, you have so much money in a retirement account, have you thought about required distributions or what tax bracket that’s going to be. Or if you die prematurely, what’s that going to do to the heirs?” And then that sparks them up vs. “What does money mean to you?” Nothing against that, but I wanted to get the hard facts.

If you have a process that you can follow, how is that lead coming through your process? If it’s similar every single time, you’ll know where to tweak. “Hey, this person is going here,” or “I’m losing it there, so I need to get a little bit better in this aspect of my process.” But if you don’t have a well-defined sales process, it’s going to be really challenging to tweak it.

So the first step is, do I have one? And then second, is to track and monitor. Right, we’re tracking “talk-tos,” how many dials it takes to talk to someone. And then from there, how many emails does it take for a response? And then from there, how many talk-tos are we getting to set an appointment and what is that percentage? And then from the percentage [of leads] that we’re talking to, how many of them are actually showing up, setting an appointment versus not? We’re tracking everything within the process, and if you can track that, then you can improve. Like, “Okay, well here, our ratios are a little bit down here so we have to put a little bit of energy in this aspect of our process.” I guess that was super longwinded. I’m sorry, I got a little excited, Michael. But they need a written process, that way they can kind of figure it out.

Michael Carvin

Fair to say even at your scale you’re continuing to tweak your process, and improve and optimize your process?

Joe Anderson

Every single day. We have a three-hour biz dev meeting weekly. We’re looking at the ratios and the numbers. Sequences is another: “What emails are you sending out? What text message are you sending out? Okay, these are getting stale. Let’s switch this up.” A/B test constantly. But you have to have a starting point, and then you can A/B test to see what is doing well and what’s not.

Michael Carvin

And we know that when it comes to valuing a firm, organic growth rates are one of the biggest predictors of the value of that firm. How does organic growth impact how you’re thinking about the future of your business?

Joe Anderson

The goal of our firm in the beginning was we had a core group of Certified Financial PlannersTM that came from the commission side of the business that wanted to basically say, “Hey, I don’t ever want to sell another product for the rest of my life, and I only want to focus on helping people with their financial lives.” We kind of nerded out. There was a group, and just like, “I don’t care if they have $50,000 or $50 million, we want to help people.” So that was the goal.

And then the business continued to build. We started from scratch, zero. Zero assets, zero clients. 2008, we billed our first client, and then it was like we had two advisors and then I kept hiring an advisor, and then I would fill them up. Hired another advisor, you fill them up with 100-150 clients, and we kind of did that. And the goal really today is to get an advisor from zero to let’s say 100 clients, $100 million in under three years. Then we want to try to get them to $200 million under five. Some of this is stretch goals, depending on the skill set of the advisor. But that’s always been the mantra – “Help as many people as we possibly can.”

“The goal really today is to get an advisor from zero to let’s say 100 clients, $100 million in under three years. Then we want to try to get them to $200 million under five… But that’s always been the mantra – ‘Help as many people as we possibly can.'”

And then you hit a billion dollars of assets. And then you hit $2 billion of assets and three, and you’re like, “Oh my god, we have a business here.” Of course, as you have capital partners, and you have now 150 employees and you have a lot of stakeholders, of course this is really important to make sure that a) we don’t grow too quickly, because you could blow up your backend. But organic growth, if you look at industry averages, it’s not that great. We’re growing [by] double digits – 15% I think was last year.

Michael Carvin

That’s extremely impressive, Joe. What does the future look like for Pure? Are you thinking about more geographic expansion? Is it growing in your existing geos?

Joe Anderson

I think as long as there are really good Certified Financial PlannersTM out there that want a great career track, and there are individuals out there that need a financial planner, we want to continue to build and grow.

We’re in nine locations today. We started here in San Diego and slowly built this thing out. But yeah, we have big plans. We’re on the West Coast, we want to continue to expand on the West Coast. And then from there, hopefully have a national platform at some point. But we’re having a lot of fun. We’re having a lot of fun helping a lot of people.

I think people try to make this business a little too complicated. I’m a really simple person. I like to keep things super simple. It’s marketing, it’s sales and it’s service. Right? You have to market – you have to get yourself out there. I get it, it’s a professional business, it’s serious business; we’re helping people with their financial lives. But on the flip side, it’s marketing. You got to see people to make sure that you can help them. And then from there, you got to motivate the client to take action. And then finally, you have to take care of that client long term. If I can keep it as simple as possible, I think we could grow this thing to – who knows.

Michael Carvin

Awesome. Joe, thank you. Thank you so much for your partnership. Congratulations on all the success. You’re clearly doing a lot of things extremely, extremely well. And the thing we appreciate is that you’re providing a great experience to our referrals. So thank you very much, Joe.

Joe Anderson

Michael, the pleasure is all mine. And thank you. I remember when you came in my office, and you said, “I think your platform could do very well on this.” And I was like, “SmartAsset? You’re crazy.” And the next thing you know, hey, I think we have a wonderful partnership. I appreciate you and your team. It’s been it’s been a real pleasure.

Testimonials appearing on this site are actually received via text, audio, or video submission. The testimonials are provided by financial advisors that have ongoing business relationships with SmartAsset. They are individual experiences, reflecting the real-life experiences of those who have used our products and/or services. The testimonials are not 100% representative of all of those who will use our products and/or services, and we make no admissions of such. The testimonials displayed (text, audio, and/or video) are given verbatim except for correction of grammatical or typing errors. In some cases, the testimonial has been shortened in length where it has not been possible to display the whole testimonial, and where we considered, acting reasonably, that some parts of the testimonial were not relevant to our site, products, or services. SmartAsset may extend free products, discounts, promotional support, or other indirect or direct financial incentives to these sources. These incentives may or may not influence the nature of the testimonial. In this case, however, no compensation was provided.