Elderly people have been hardest hit by the coronavirus pandemic, with the greatest risk of complications and death occurring among older people. If you’re an elderly person on Medicare, you might be wondering what medical costs related to coronavirus are covered by the programs. In this article we’ll break down which costs are covered by Medicare, and what other services are provided and covered during this time.

Elderly people have been hardest hit by the coronavirus pandemic, with the greatest risk of complications and death occurring among older people. If you’re an elderly person on Medicare, you might be wondering what medical costs related to coronavirus are covered by the programs. In this article we’ll break down which costs are covered by Medicare, and what other services are provided and covered during this time.

What COVID-19 Expenses Medicare Covers

Medicare Part B now covers the lab tests for COVID-19. You will not have to pay any out-of-pocket expenses if your doctor states that you need a test. This is applicable to those who were tested on or after Feb. 4. Medicare beneficiaries can be tested for the coronavirus without a written order from a physician. Further, testing is available for Medicare beneficiaries who cannot leave their homes.

Medicare Part A will cover all medically necessary hospitalization expenses due to the virus. This can include those who were diagnosed with COVID-19 but may have been released from the hospital following an inpatient stay. If you now need to stay in the hospital under quarantine, your costs should be covered.

As of this writing, there is no vaccine for COVID-19. If one becomes available to the public, the Medicare Prescription Drug Plan Part D will cover the expense. However, if you don’t have a Medicare Advantage Plan or the Medicare Prescription Drug Plan Part D, you may have to pay for the vaccine if it becomes available. If you have a Health Savings Account (HSA), you could use those funds to pay for the cost.

It’s important to note that if you have a Medicare Advantage Plan, you have access to the same benefits. It’s up to you to verify your coverage and costs during this time.

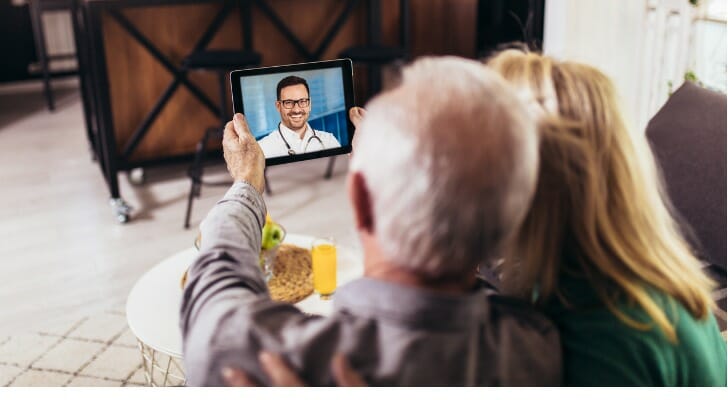

Medicare is Expanding Telehealth & Related Services

Temporarily, Medicare is expanding its telehealth and related services coverage to respond to the current public health emergency. To make interacting with healthcare providers easier and more accessible, the telehealth services are expanding access to a larger variety of places such as your home. It will also include using communication tools such as your smartphone. You’ll now be able to communicate with a wide range of healthcare providers including nurse practitioners, doctors, clinical pyschologists, occupational therapists and as speech language pathologists.

Temporarily, Medicare is expanding its telehealth and related services coverage to respond to the current public health emergency. To make interacting with healthcare providers easier and more accessible, the telehealth services are expanding access to a larger variety of places such as your home. It will also include using communication tools such as your smartphone. You’ll now be able to communicate with a wide range of healthcare providers including nurse practitioners, doctors, clinical pyschologists, occupational therapists and as speech language pathologists.

Through this expansion, you will be able to receive a certain set of services. These services include scheduled doctors’ visits, evaluation and management visits, mental health counseling, and preventative visits. Retirees on Original Medicare, you won’t have to pay a copay.

During this time, you can communicate with your doctors or other practitioners. Medicare pays for virtual check-ins or other communications within the previous seven days that doesn’t lead to a medical visit within the next 24 hours or the soonest appointment available to avoid having to go into the office for a full visit. You can also communicate with your doctors using an online patient portal without having to visit their office. With both virtual check-ins and online communication, you will have to initiate these communications.

For those who live in rural areas, you can complete a full telehealth visit with your doctor. However, the law requires patients to visit a designated telehealth site to conduct the visit. Using these teleservices can help keep you safe and prevent the risk of exposure to COVID-19.

Other Ways Medicare is Helping Patients

Medicare is helping individuals, some of whom may be struggling to pay their medical bills, in a few other ways as well. Medicare’s primary responsibility is enforcing health and safety requirements for healthcare providers. Therefore, Medicare is taking action to help healthcare providers and guide individuals through their healthcare plans. To help alleviate the pressure caused by an increased number of patients, hospitals are providing their services in alternate facilities and including these services as part of Medicare coverage.

Additionally, Medicare is creating new codes so providers can bill Medicare for services related to COVID-19. They are guiding nursing homes and skilled care facilities through the necessary actions so that everyone with the disease is being treated to the furthest extent of the facility’s ability. This will help to prevent further cases and avoid abuse or neglect as well as unfair billing in nursing homes and hospitals.

Other Financial Considerations

If you claim Medicare but are still in the workforce, the COVID-19 pandemic poses a difficult choice: Going to work and running the risk of contracting the illness, or staying home and potentially losing income. Some companies are allowing employees to work remotely, but for some industries or jobs, that’s not possible. And many companies are cutting back on hours or making layoffs. All told, there’s significant risk of lost income during the pandemic even if actual medical costs don’t turn out to be a significant factor for you.

If you’re lucky enough to still be employed, you may want to start padding your emergency funds as the pandemic continues. To do this, you may want to cut back on some of your spending. For some, this may already be happening as a result of cutting back on commuting, restaurants and other expenses. Take this as the opportunity that it is, and keep this money safe in the bank so you can access it when you need it. Even in a bull market it’s not recommended that you keep your emergency funds in the stock market, and given the current volatility it’s especially important to keep your emergency fund away from the market.

It’s important to note that your emergency fund should have enough to pay for three to six months of expenses even when you’re not self-isolating. If you don’t currently have an emergency fund, try stashing away some cash to at least build up enough to fund one month’s expenses.

The Bottom Line

As a general rule, all medical expenses should be covered by Medicare. But there are costs and economic risks related to the pandemic that go beyond medical expenses. Building an emergency fund and cutting costs are two of the best ways to ensure you have extra cash to prepare for whatever comes next.

Tips for Managing Your Money

- A financial advisor can help you build a financial plan that accounts for medical expenses and other unpredictable needs. To find a financial advisor who fits your needs, use SmartAsset’s free matching tool. If you’re ready to find a financial advisor near you, get started now.

- The best place to put your emergency fund is in a high-yield savings account that has no minimum balance requirement. Or if you are inclined to do a little research, consider these 10 safe investments.

Photo credit: ©iStock.com/Moyo Studio, ©iStock.com/Jovanmandic, ©iStock.com/designer491