Last Thursday, the Department of Labor reported that 3.28 million people filed for unemployment insurance for the week ending March 21, 2020. This was the highest historical number of new claims in a week, almost five times the previous record high. Long-term unemployment, especially during a crisis like the coronavirus pandemic, will make it difficult for many Americans to save money adequately.

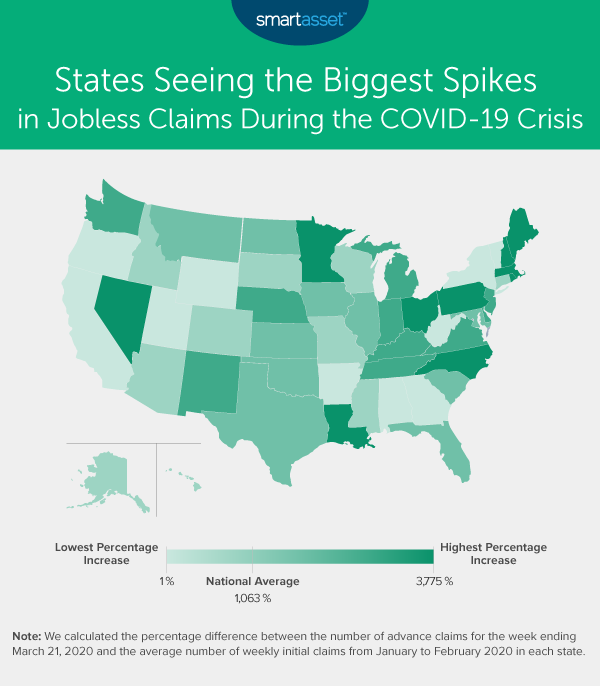

Though the number of jobless claims increased in every state, some states saw bigger increases than others. In this study, we looked at which states saw the biggest spikes in unemployment claims by comparing the average number of initial claims per week in January and February 2020 to the advance number of initial claims for the week ending March 21, 2020. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- Of the 50 states, unemployment claims more than doubled in 48 and more than quadrupled in 45. Georgia and Utah were the only two states where jobless claims did not double between the average number of initial claims filed per week in January and February 2020 and the number of advance claims filed for the week ending March 21. Of the 48 states in which jobless claims did double, they more than quadrupled in 45 of them. The three states for which this was not the case are Alabama, New York and West Virginia.

- Almost 2% of the labor force filed for unemployment for the week ending March 21. Unadjusted, and in the 50 states alone, a total of 2.88 million people filed for unemployment for the week ending March 21. According to 2018 Census Bureau estimates, the labor force is about 165 million people strong in the 50 states. As such, the number of initial claims for that week represents 1.74% of the labor force. By contrast, an average of 0.15% of the labor force filed for unemployment per week in January and February.

The biggest rise in unemployment claims took place in Nevada, the state whose workforce we predicted may be most affected by a COVID-19 recession. In January and February, an average of about 2,400 individuals filed new claims for unemployment per week. That number rose substantially in March. For the week ending March 14, 2020, 6,356 individuals filed new claims for unemployment, followed by more than 93,000 new claims for the week ending March 21, 2020.

Louisiana and New Hampshire follow closely behind Nevada with more than 35 times more new jobless claims in the second-to-last week in March than in January and February. In Louisiana, the number of claims increased by about 70,700, and in New Hampshire, claims increased by almost 21,300.

Pennsylvania has the eighth-highest percentage increase between the average number of initial claims filed per week in January and February and the number of advance claims filed for the week ending March 21. Pennsylvania also saw the largest one-week jump in the gross number of claims filed of any state. For the week ending March 14, a total of about 15,400 jobless claims were filed by Pennsylvania residents. Over the course of a mere week, that number grew by more than 363,400. For the week ending March 21, more than 378,900 individuals filed claims, representing 5.76% of the state’s labor force.

Data and Methodology

All data for this study comes from the Department of Labor. The national figures quoted in the introduction are seasonally adjusted, while the state figures are not. To find the states seeing the biggest spikes in jobless claims during the COVID-19 crisis, we calculated the average initial unemployment claims from the week ending January 4, 2020 through the week ending February 29, 2020. We compared the average number of initial claims in January and February to the number of advance initial claims for the week ending March 21, 2020. We ranked the states from highest to lowest using the metric of the percentage difference between the number of advance claims for the week ending March 21, 2020 and the average number of weekly initial claims from January to February 2020.

Tips for Making It Through a Recession

- Boost your emergency savings. One of the best ways to prepare for the unknown is by having an emergency fund. Though typical financial wisdom suggests you should have savings that can cover three months’ worth of expenses, six months’ may be a better figure to shoot for during a recession. Check out our budget calculator to see how much you spend each month, what sixth months of expenses would look like and how cutting back on discretionary expenses can increase your savings rate.

- If you did lose your job, know if you qualify for unemployment. Many unemployment benefits across states have been expanded as a result of the spread of coronavirus. Our guide on enhanced unemployment benefits for Coronavirus can help you figure out if you may be eligible for receiving a benefit and how much that benefit will be. If you are looking for more general information on the coronavirus and what the government is doing to help, check out our comprehensive guide here.

- Consider talking to a financial advisor about how to ride out a financial downturn. If you are nervous about your retirement account or what to do with money you are making, talking to a financial advisor might not be a bad idea. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in just five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Get your stimulus check. Use our coronavirus stimulus check calculator to see how much money you can expect to receive from the government.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/skynesher