As the economy remains shut down due to the coronavirus pandemic, export businesses have taken a significant hit. With transport links reduced and consumers staying home, global demand for U.S. exports has plunged, and American businesses that rely on shipping their products overseas have seen sales tumble.

One of the government’s tools in mitigating the pandemic’s effects is an existing organization: The U.S. Export-Import Bank (EXIM), the nation’s official export credit agency. It has created four programs to help qualifying businesses through this crisis. All of them attempt to promote liquidity among U.S. exporters, giving them the resources they need to stay afloat while the economy recovers.

EXIM Procedural Relief

Overall, the Export-Import Bank has currently instituted procedural relief aimed at making operations a little bit easier for export businesses. These measures include extended application deadlines for various programs, certain application waivers and a streamlined processing time. All are designed to make it easier for businesses to reach out to the Export-Import Bank and take advantage of existing programs.

Substantively, the bank runs four programs to help eligible exporters.

The Bridge Financing Program

This program is designed to respond to a slowdown in lending worldwide. As the coronavirus quarantine creates uncertainty and economic instability, private markets have slowed down traditional financing. This makes it harder for foreign companies to buy products from U.S. exporters.

In response, the Bridge Financing Program will help foreign borrowers secure loans to buy products from U.S. exporters for a period of at least one year. Borrowers can receive either a direct loan from the Export-Import Bank or a guarantee against private lending. The loans will be extended for each transaction that the foreign borrower wants to make, meaning that they can take out a loan for each purchase from a U.S. exporter.

This financing program is intended to bridge the current liquidity issues. Its terms are designed to move borrowers back onto the private market over time, while providing foreign companies with the capital they need to buy from U.S. businesses today.

The Pre-Export Payment Program

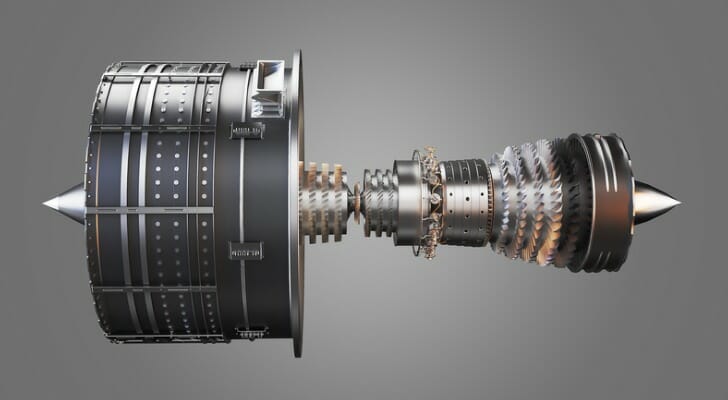

Another source of problems can arise in pre-export and pre-delivery payments. These occur when an exporter, often a manufacturer, requires a certain amount of payments before the final product ships out of the country. This allows the business to cover some of its costs and supplies during production. Pre-export payments are a particularly common feature with large-scale manufactured products such as engines, airplanes and other heavy equipment.

Another source of problems can arise in pre-export and pre-delivery payments. These occur when an exporter, often a manufacturer, requires a certain amount of payments before the final product ships out of the country. This allows the business to cover some of its costs and supplies during production. Pre-export payments are a particularly common feature with large-scale manufactured products such as engines, airplanes and other heavy equipment.

To help support this sector, the Export-Import Bank has an existing program called the Pre-Export Payment Program. Ordinarily this program is restricted to exports that already involve a degree of Export-Import Bank financing. However, given the reduced liquidity in commercial markets, the bank has expanded this program.

For the next year, foreign buyers and U.S. businesses can apply for loans through the Export-Import Bank to help cover pre-export and pre-delivery payments. These can be either direct loans through the bank or loan guarantees through private lenders. In all cases, however, they are available regardless of whether the borrower has a current or past relationship with the Export-Import Bank.

The goal is to help ensure that U.S. exporters receive their payments on a regular basis, and to make sure that existing deals don’t fall through because of sudden liquidity problems.

The Supply Chain Financing Guarantee Program

The Export-Import Bank created its supply chain financing program in 2010, but notes that exporters have “seldom used” it. In the wake of the coronavirus quarantine and the resulting financial issues, the bank has expanded this program to help prop up the supplier companies that exporters depend on.

EXIM’s supply chain financing program works much like similar programs in the commercial markets. An exporter can approach the bank for financing. If approved, the Export-Import Bank will buy the relevant materials held by the exporter’s supplier. The exporter will receive those materials and then pay the Export-Import Bank back according to the terms of the financing agreement.

This program allows suppliers to receive immediate payments, helping to ensure the liquidity and viability of that market, while at the same time helping exporters which might otherwise struggle to pay suppliers before they receive payment from their own customers. While the nature of this program hasn’t changed, the Export-Import Bank has chosen to expand it significantly for the coronavirus crisis, removing several restrictions it has traditionally put in place for qualifying firms.

The Working Capital Guarantee Program

The Working Capital Guarantee Program (WCGP) has existed for several decades. It was built to solve a single problem for small and mid-sized businesses: Creating an export business model is expensive.

While a firm might have good products and the potential to sell them overseas, building the infrastructure and client relationships to do so can cost a lot of money. The WCGP helps firms to cover that gap. Using the goods for export themselves as the basis for the loan, this program provides a guarantee for 90% of the financing extended by private lenders. Businesses use that money to build and maintain their export business, helping to boost the presence of U.S. products around the world.

In light of the liquidity problems that businesses have faced during the coronavirus crisis, the Export-Import Bank has temporarily expanded its WCGP. It has expanded the amount available to borrow by changing the basis for these loans from “export inventory” to “all potentially exportable inventory,” meaning that a business can get financing based on any products it theoretically could sell overseas as opposed to just the products actively slated for export.

The bank has also adjusted its fee structure to allow for more flexible lending, and may modify its terms to guarantee 100% of loans. Between these changes, EXIM hopes to help get operating capital moving much more quickly and easily to small and mid-sized exporters.

The Bottom Line

The Export-Import Bank provides liquidity to companies that sell American products abroad. In the wake of the credit problems created by the coronavirus pandemic, it has stepped up several of its programs to help businesses stay afloat through the crisis.

Tips for Benefiting from Export Businesses

- Many financial advisors specialize in working with business owners. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors who will help you achieve your financial goals, get started now.

- Understanding trade deficits can help you make wise decisions about your investment portfolio. Learn about trade deficits here.

Photo credit: ©iStock.com/Tryaging, ©iStock.com/Denes Farkas, ©iStock.com/blackred