President Donald Trump recently signed into law the historic COVID-19 stimulus package worth around $2 trillion. It sets aside $250 billion for direct payments to individuals and families to help them deal with the economic impact of the coronavirus pandemic.

Though there were some proposals for a bill that would simply send money to all Americans, the package ultimately includes means testing. The full check of $1,200 would be sent to individuals with an adjusted gross income (AGI) of up to $75,000 and a reduced benefit would be sent to individuals earning up to $99,000, at which point it phases out completely. For married couples without children, the full benefit of $2,400 would go to couples earning a combined amount of less than $150,000, and a reduced benefit would phase out completely at a combined income of $198,000. For those with children, there is also an additional $500 payment per child to help American families weather the recession and save money. Use our coronavirus stimulus check calculator to determine how much money you can expect to receive.

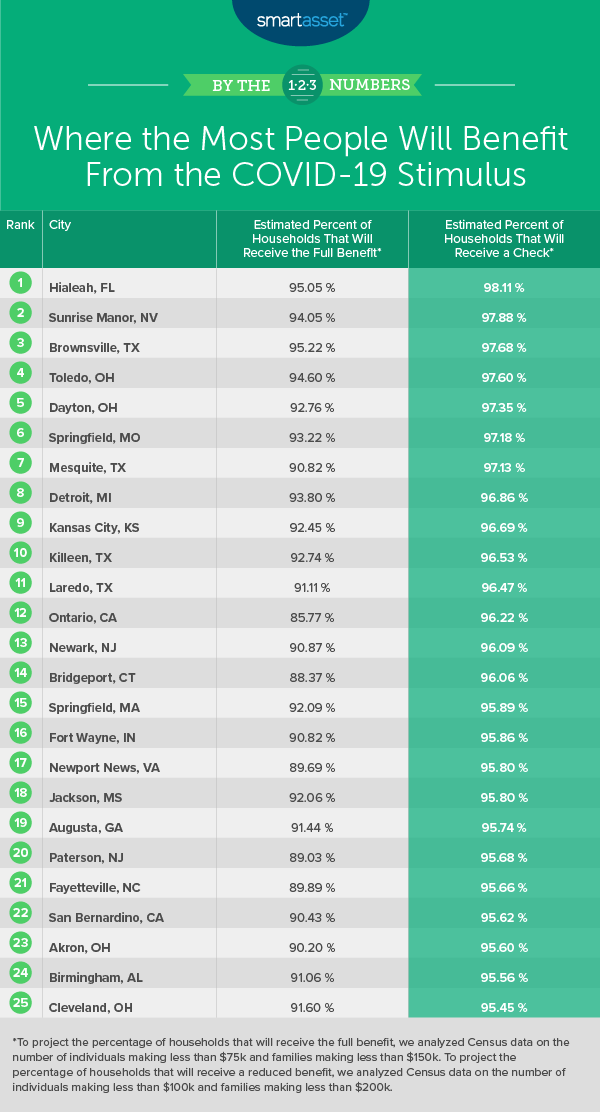

To find the cities where the most and fewest people will be receiving some sort of stimulus check, SmartAsset analyzed income data from the Census Bureau. It is important to note that given the constraints of Census data, we were unable to account for the differences between heads of household and married couples, which are considered differently under the stimulus bill. For further details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- Nearly 9 in 10 Americans may receive some kind of benefit from a COVID-19 stimulus package. Nationally, 80.48% of households would receive the full benefit amount, and 89.02% of households would receive some kind of benefit, even if reduced.

- Across the 200 largest U.S. cities, benefits will reach the most people in the Midwest and South. Of the top 10 cities where the highest percentage of households will receive a COVID-19 stimulus benefit, five are in the Midwest: Toledo, Ohio; Dayton, Ohio; Springfield, Missouri; Detroit, Michigan and Kansas City, Kansas. The average median family household income across these five cities is less than $47,000. Four other cities in our top 10 are in the South: Hialeah, Florida; Brownsville, Texas; Mesquite, Texas and Killeen, Texas. The average median family household income across these four cities is approximately $50,000.

- Across the 200 largest U.S. cities, benefits will reach fewer households on the coasts. Of the bottom 10 cities in our study, nine are on the coasts. Four of these cities are in California’s Bay Area – Sunnyvale, San Francisco, Fremont and San Jose, with an average median family household income of almost $145,000. Three other cities in our bottom 10 are in and around the nation’s capital – Arlington, Virginia; Alexandria, Virginia and Washington, D.C., with an average median family household income of almost $133,000.

Cities Where the Highest Percentage of People Would Benefit From the COVID-19 Stimulus

1. Hialeah, FL

In Hialeah, Florida, we estimate that 98.11% of all households – which total 72,672 – would get a check of some sort. We estimate a little more than 95% of households would receive the full check of either $1,200 or $2,400, depending on whether the household is an individual or a married couple. The median individual income in the city is $18,089, while the median income for a family is $41,867.

2. Sunrise Manor, NV

Sunrise Manor, Nevada, located east of Las Vegas, has nearly 62,000 households in total. Around 94.05% of those households would receive the full benefit from this stimulus, and 97.88% would get some sort of check. The median income for an individual is $24,397, and the median income for a family is $48,475.

3. Brownsville, TX

Brownsville, Texas has a total of 51,334 households. Of those households, we estimate that 97.68% would receive a check through this stimulus package, while 95.22% would receive the full benefit. In Brownsville, the median individual income is $20,045, while the median family income is $40,498.

4. Toledo, OH

Toledo, Ohio has nearly 117,000 total households. The median income for an individual is $24,485, while the median income for a family household is $45,419. In Toledo, we estimate 94.60% of people would get the full benefit from the stimulus package, while 97.60% would get some sort of benefit.

5. Dayton, OH

Another Ohio city, Dayton, rounds out our top five. The median individual income in Dayton is $21,835, while the median family income is $46,729. There are approximately 60,000 households in the city, and we estimate 92.76% of them would receive the full benefit of this package, with 97.35% receiving a check at all.

Cities Where the Lowest Percentage of People Would Benefit From the COVID-19 Stimulus

1. Sunnyvale, CA

The median income for a family household in Sunnyvale, California is $164,833, and the median income for an individual is $106,960. There are 56,537 households in this Silicon Valley city. We estimate the full benefit of this stimulus would go to only 40.85% of households, while 54.27% would get some sort of check.

2. Arlington, VA

Arlington, Virginia, a suburb of Washington, D.C., has 109,940 households. We estimate the full benefit of the stimulus package would go to 42.13% of them, while 57.14% of households would get a check for any amount. Arlington has a median income of $96,802 for individuals and $154,608 for families.

3. San Francisco, CA

San Francisco, California is the largest city in the bottom five of our study, with 362,827 households. Of those households, we estimate 59.55% would get a check from this stimulus, while 49.73% would get the full benefit. The median income in the city is $88,771 for individuals and $131,253 for families.

4. Fremont, CA

In Fremont, California, another Bay Area locale, we estimate 48.22% of households would receive the full stimulus benefit and 63.64% would get any kind of check. The median income for the city’s 78,243 households is $66,740 for individuals and $156,224 for families.

5. Alexandria, VA

The final city in the bottom five across all 200 cities in our study is Alexandria, Virginia, another suburb of Washington, D.C. Alexandria has 71,740 households, with median incomes of $84,312 for individuals and $125,680 for families. We estimate the full stimulus check would go to 49.57% of households, while 65.92% would get some level of stimulus check.

Data and Methodology

To find the cities where the most and fewest people can expect checks from the COVID-19 stimulus package, SmartAsset looked at the income of people living in the 200 largest U.S. cities. We estimated:

- The percentage of households that will receive the full benefit. This is the number of individual (i.e. non-family) households making less than $75,000 and families making less than $150,000 divided by the total number of households citywide. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- The percentage of households that will receive a check. This includes both households that will receive the full benefit and households that will receive a reduced benefit. To calculate the percentage, we divided the number of individual (i.e. non-family) households making less than $100,000 and families making less than $200,000 by the total number of households citywide. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

Cities were ranked according to the second metric: the percentage of households that will receive a check. Cities where the most people can expect checks from the stimulus have the highest percentage of households that will receive a check. Cities where the fewest people can expect checks from the stimulus have the lowest percentage of households that will receive a check.

Notably, due to Census Bureau data constraints, our study does not perfectly align with the text of the bill and has several limitations, listed below:

- The category of families, as defined above, includes married couples (with or without children) and heads of household. Under the stimulus bill, married couples and heads of households (typically single parents with children) are treated differently. Married couples are eligible for a $2,400 check if they earn up to $150,000 a year and a reduced benefit if they earn up to $198,000 annually. People who file as heads of household are eligible for a $1,200 check if they earn up to $112,500 a year and a reduced benefit if they earn up to $136,500 annually. Since Census Bureau income distributions delineate only between family (i.e. married couples and heads of household) and non-family households (i.e. individuals), our analysis did not account for the stimulus bill’s differentiation between married couples and heads of household.

- Upper income limits for households that will receive a reduced benefit deviate slightly from the bill. The adjusted gross income needed to receive any kind of check for individuals is $99,000 and for married couples is $198,000, according to the signed bill. However, because of Census-reported income brackets, our calculations include individuals making up to $100,000 and families making up to $200,000.

- We did not account for Americans who did not file a federal tax return in 2019 or 2018 using a Social Security number or receive Social Security payments. To receive the coronavirus stimulus direct cash payments, Americans must have filed federal tax returns in recent years using a Social Security number or have received Social Security payments. Taxpayers using an Individual Taxpayer Identification Number (ITIN) will not receive a check, unless one spouse served in the military in 2019. Since the Census Bureau aims to count all Americans, some individuals or families who we predicted, based on Census data, would receive a check may actually not. Low-income households nationally who do not fall into either category could number in the millions.

Tips on Managing Your Money in a Recession

- You don’t have to weather this alone. Looking for help navigating the economic downturn that’s come as a result of the COVID-19 pandemic? Consider finding a financial advisor. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Reassess your budget if possible. Use SmartAsset’s budget calculator to see how your coming payment could fit into your spending plan.

- How will this affect my taxes? Get a sense of what your taxes could look like next year with SmartAsset’s income tax calculator.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/fizkes