Posts by Alex Silady

What’s the Ideal Debt-to-Income Ratio for Mortgages?

Mortgage lenders use the debt-to-income ratio to evaluate the creditworthiness of borrowers. It represents the percentage of your monthly gross income that goes to monthly debt payments, including your mortgage, student loans, car payments and minimum credit card payments. The debt-to-income ratio… read more…

How to Make Extra Mortgage Payments

By consistently paying your mortgage bill on time, you’re showing your lender that you’re a responsible borrower. That may be obvious, but what’s often overlooked is the art of making extra mortgage payments. Paying more than you’re required to can… read more…

Why You Need a Support Network for Your Small Business

As a small business proprietor, you probably enjoy moving to the beat of your own drum. But doing everything on your own might not get you very far. Some of the most successful business owners have strong support systems. Regardless of… read more…

Top 5 Tips for New Investors

Investing can be intimidating, especially when you’re doing it for the very first time. It’s easy to get confused and overwhelmed when trying to understand financial terminology and many new investors worry about making a false move. If you’re nervous… read more…

The Top Ten Most Dangerous Cities in the Country

A feeling of safety where we live and work is an essential part of quality of life. After all, it’s hard to enjoy our situation when we’re constantly worrying whether we’ll come to harm. So where is safety hardest to find – which of America’s major cities is most dangerous? SmartAsset wanted to find out.… read more…

Which States Put the Most People in Prison?

The United States has the highest percentage of its population in prison in the world, ahead even of countries like China and North Korea that are notorious for locking away political dissenters. All in all, close to 1.6 million people… read more…

The Top Ten Most Educated Cities in America

According to the Bureau of Labor Statistics, individuals with bachelor’s degrees alone make twice as much and are half as likely to be unemployed on average as those with only a high school education. SmartAsset wanted to find out which United States cities truly have the best educated populations. Find out now: How Much House… read more…

The Top Ten Community Colleges in the Country

A college education is increasingly important in order to get and keep a job in the current information-oriented world. However, even as it becomes more and more of a necessity, college costs are rising, making it luxury-priced. Many people turn to community college in their local areas in order to get a higher education at… read more…

The Top Ten Mutual Funds Today

Not everyone has the time or qualifications to pick individual stocks and bonds to invest their hard-earned money in. That’s why mutual funds exist, so that many investors can pool their money in order for trained fund managers to purchase… read more…

Top Ten Best American Cities to Work in Tech

The tech industry is booming across the country. From big cities to small ones, successful startups are taking root, and job prospects for tech workers are rising precipitously and show no signs of stopping. Lots of people want to get in on the tech boom, and SmartAsset wanted to find out what cities are truly… read more…

Top 10 Banks in America By Assets Held

The consolidation of banks in the U.S. has been a trend over the past 40 years. In fact, in 1985, there were 14,427 banks that were insured by the Federal Deposit Insurance Corporation (FDIC). However, in 2022, there were only… read more…

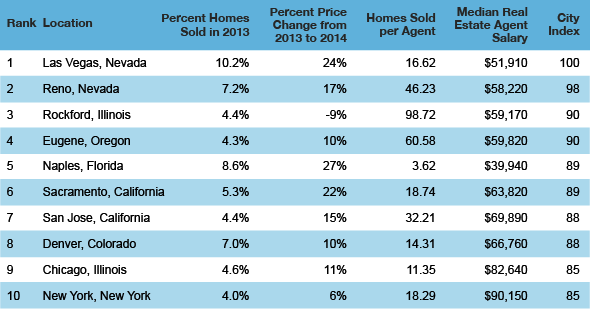

Top 10 Best Cities to Be a Real Estate Agent

Across the country, real estate markets are much healthier than they were a few short years ago, when a housing bubble precipitated a much larger economic crisis. But some places have recovered better than others have, and continue to grow… read more…

10 Best and Worst Cities for Healthcare Access for Your Money

There are many reasons to choose a city to live in, but most of them revolve around our basic needs: employment, cultural stimulation and education. But sooner or later, we all need healthcare, whether it’s a routine doctor’s visit or… read more…

3 Ways the Chocolate Industry is Changing

Once upon a time, chocolate was unheard of across most of the world. From the 1800s BCE to the 16th century CE or so, it was exclusively consumed by a small group of people – Aztec nobles in what is… read more…

The Reality (and Cost) of Running a Renaissance Fair

As the last traces of the long and brutal winter disappear across the country and the weekends start to get warmer and sunnier, people of a certain mindset – let’s call them history nerds – start to get the idea… read more…

Property Tax: Who is Getting the Best Bang for Their Buck?

SmartAsset wanted to know who in the country is getting the best deal for their property taxes. To find that out we answered 3 questions: how good are the schools, how safe is the area and how much are the property taxes. Methodology The United States is divided into 3,144 counties (or county equivalents in… read more…

5 Reasons to Hoard Salt Packets in Your Desk

When you get delivery or takeout from your favorite restaurant on the job, chances are you’ll get, along with your plastic cutlery, a handful of tiny paper packets of salt. If food needs it, we typically use one or two… read more…

The Economics of Flowers: A Mother’s Day Must?

They’re as much of a holiday obligation as a card, a fancy dinner, or a phone call, de rigeur for certain people in our lives, as well as the go-to gesture for congratulations or apologies. And they constitute an industry… read more…

The Rise of the Software Engineer

A computer is only as good as the information that’s fed into it. That’s one of the truisms of programming that has held for as long as computers have existed, and ever since Charles Babbage and Ada Byron Lovelace designed the first “difference engine” in 1822, there has been a need for professionals to program… read more…

The Economics of ASMR

Ilse Blansert rearranges her stick-straight brown hair so that it’s out of her face and puts on a couple dabs of makeup to even out her pale complexion. Satisfied after checking her appearance in her webcam’s display, she gingerly attaches her microphones to her blouse lapels, careful not to let her fingertips touch the sensitive… read more…

The Economics of Competitive Video Gaming

Thousands of fans attending in person, as well as millions more watching at home, strike up a cheer as the teams make their entrances for the playoff match. There’s been a bitter rivalry between the two sides for years that… read more…

Four People Who Single-handedly Caused Economic Crises

Wall Street bigwig Bernie Madoff became infamous several years ago when a fraudulent securities operation he was running collapsed and cost his investors, including hospitals and charities, $17.3 billion. While Madoff’s crime may have been the largest-ever scam of its… read more…

America’s Urban Jungles Breed Diverse Real Estate Climates

A well-known real estate truism is that housing prices in America’s biggest cities are much higher than the national average. New Yorkers, for example, often complain that thousands of dollars a month in rent only gets them a tiny one-bedroom apartment, especially in Manhattan, and one might assume that’s the case for every major metropolitan… read more…