The coronavirus pandemic has drastically impacted the budgets of not only individuals, but also states. State revenues have declined due to delays in income tax collections along with decreases in revenue brought in from sales tax. Meanwhile, state expenses are rising as unemployment claims have spiked. Because of these changes and the growing mismatch between revenues and expenses, many states have revised their 2020 fiscal projections to reflect potential budget shortfalls. Though some states may receive aid from the federal government to cover deficits, many may still need to dip into reserve accounts, commonly referred to as rainy day funds.

The coronavirus pandemic has drastically impacted the budgets of not only individuals, but also states. State revenues have declined due to delays in income tax collections along with decreases in revenue brought in from sales tax. Meanwhile, state expenses are rising as unemployment claims have spiked. Because of these changes and the growing mismatch between revenues and expenses, many states have revised their 2020 fiscal projections to reflect potential budget shortfalls. Though some states may receive aid from the federal government to cover deficits, many may still need to dip into reserve accounts, commonly referred to as rainy day funds.

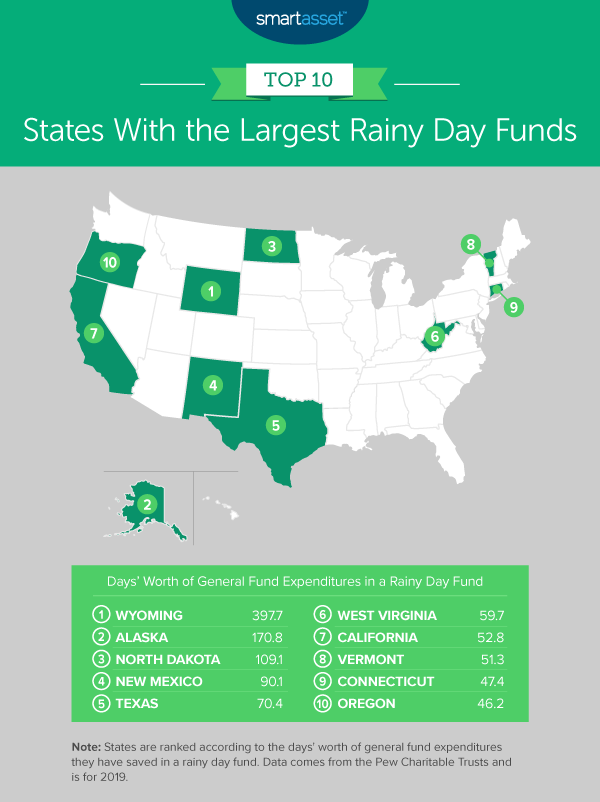

In this study, SmartAsset uncovered the states with the largest rainy day funds. Specifically, we ranked all 50 states based on the number of days’ worth of general fund expenditures saved in their rainy day funds in 2019. We also looked at rainy day funds as a percentage of each state’s general fund expenditures. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- Western states have the largest rainy day funds. Five of the 10 states with the largest 2019 rainy day funds relative to general fund expenditures are located in the West. They are Wyoming, Alaska, New Mexico, California and Oregon. In 2019, all five of these states had more than 45 days’ worth of general fund expenditures saved in a rainy day fund.

- The average state has less than one month’s worth of expenses saved. Data from the Pew Charitable Trusts shows that across all 50 states, the median rainy day fund is 7.7% of state general fund expenditures. This means that the median number of days’ worth of general fund expenditures saved in a rainy day fund is 27.9.

- Some states may be able to access rainy day funds more easily than others. State withdrawal limits and restrictions vary. A 2017 paper from the Pew Charitable Trusts shows that the conditions for withdrawal from a rainy day fund span four categories: volatility (either revenue or economic), forecast error, budget gap or no conditions. Six states have more than one of the four categories as withdrawal conditions, 11 have only volatility as a reason, 11 require only a forecast error, 16 require only a budget gap and six have no set conditions.

1. Wyoming

In 2019, Wyoming had close to $1.70 billion saved in a rainy day fund, according to data collected by the Pew Charitable Trusts. This amount exceeded general fund expenditures in 2019. In fact, last year, Wyoming’s rainy day fund could cover close to 400 days’ worth of general fund expenditures, the longest period of time for any state.

While Wyoming has the largest rainy day fund of any state, it is one of six states – along with Kentucky, Maryland, Nebraska, North Carolina and Ohio – that does not have specific conditions for withdrawing money from the fund. As noted by the Pew Charitable Trusts, with no set conditions to use the money, Wyoming has grappled with the question of when to use the money and how bad conditions need to be before tapping into its large balance.

2. Alaska

The price of oil recently fell below $0, creating significant revenue headwinds for Alaska, whose economy heavily depends on the petroleum sector. In the state’s most recent forecast from the Department of Revenue, analysts predict a $527 million shortfall in general fund revenues for the 2020 fiscal year from previous projections. Luckily, Alaska has a large rainy day fund – totaling close to $2.30 billion in 2019 – that may help cover expenses. Data from the Pew Charitable Trusts shows that Alaska’s rainy day fund could cover about 171 days’ worth of general fund expenditures. Moreover, Alaska is one of the eight states that can use rainy day funds if there is revenue volatility.

3. North Dakota

Of any state in our top 10, North Dakota saw the biggest growth between its 2018 and 2019 rainy day funds. In 2018, its rainy day fund amounted to about $113.30 million, a figure that covered fewer than 20 days’ worth of general fund expenditures. In 2019, North Dakota’s state budget office reported that it had about $659 million saved in a rainy day fund. As there were about $2.21 billion general fund expenditures in 2019, rainy day funds made up close to 30% of general fund expenditures, meaning that savings would last almost a third of the year (about 109 days).

While North Dakota Legislative Council’s April 2020 report does not indicate an overall budget shortfall from expected forecasts, it does show a 59% and 31% decline in individual and corporate income tax collections, respectively, in March this year compared to original predictions. This decline would qualify as a forecast error, the condition for withdrawal for North Dakota’s rainy day fund.

4. New Mexico

Like North Dakota, New Mexico added to its rainy day fund between 2018 and 2019. In 2018, its rainy day fund totaled almost $527 million, and in 2019, it was worth more than $1.87 billion. With that increase and general fund expenditures remaining relatively stable between the two years, New Mexico’s rainy day fund could cover about 60 more days’ worth of expenses than it could in 2018 (about 31 days in 2018 vs. about 90 days in 2019).

5. Texas

Texas does not collect income taxes, but its average state and local sales tax rate is 8.19%, the 12th-highest in the U.S. More than half of Texas state revenues come from sales tax collections, which have been hit hard by store closures and social distancing measures. Texas’ rainy day funds may be able to aid in budget shortfalls during 2020. In 2019, it had more than 70 days’ worth of general fund expenditures saved in its rainy day fund. Moreover, Texas is able to withdraw money from the fund under two conditions: economic volatility and budget gap.

6. West Virginia

West Virginia is one of 18 states in which a budget gap is a condition for withdrawal for rainy days funds and has the sixth-largest rainy day fund of all 50 states. In 2019, West Virginia had about $753 million saved in a rainy day fund, according to data collected by the Pew Charitable Trusts. With $4.60 billion in general fund expenditures during that same year, West Virginia’s rainy day fund would cover about 60 days’ worth of state spending.

7. California

California had the largest rainy day fund in terms of gross size of any state in 2019. However, as general fund expenditures in California are also high, California ranks seventh on our list of states with the largest rainy day funds relative to general fund expenditures. Its rainy day fund made up approximately 14% of general fund expenditures in 2019 and would be able to cover almost 53 days’ worth of spending. Withdrawals from California’s rainy day fund must happen under the condition of revenue volatility.

8. Vermont

Vermont bolstered its rainy day fund between 2018 and 2019. In 2018, its rainy day fund could cover about one month’s worth of expenses in the case of a budget cap, but in 2019, it could cover more than 50 days’ worth of expenditures. In gross terms, Vermont’s rainy day fund totaled almost $133 million in 2018 and more than $224 million in 2019.

9. Connecticut

In 2019, Connecticut’s rainy day fund could cover about 47 days’ worth of general fund expenditures. The state had more than $2.51 billion saved in its 2019 rainy day fund, and general fund expenditures were less than $20 billion.

10. Oregon

Though Oregon’s rainy day fund was created in 2007, the fourth-most recent of any state – behind only Arkansas, Kansas and Montana – it is the 10th largest in the U.S. In 2019, its rainy day fund made up 12.66% of general fund expenditures, 5% more than the national median across all 50 states. Additionally, Oregon’s rainy day fund could cover about 46 days’ worth of expenditures and is tied to economic volatility. According to the Pew Charitable Trusts, this condition can be used by Oregon’s legislature to justify withdrawal from the rainy day fund if there has been a decline for two or more consecutive quarters in the last 12 months in nonfarm payroll employment – a definition that closely aligns with that of a recession.

Data and Methodology

Data on 2018 and 2019 rainy day funds along with general fund expenditures comes from the Pew Charitable Trusts’ Fiscal 50: State Trends and Analysis. We ranked states with the largest rainy day funds according to the days’ worth of expenses each state had saved in a rainy day fund in 2019. Research on state withdrawal restrictions and limits of rainy day funds also comes from the Pew Charitable Trusts. Its 2017 paper “When to Use Rainy Day Funds” describes the withdrawal policies across states.

Finally, information on revised state revenue projections during COVID-19 comes from the National Conference of State Legislatures. Its page here tracks the revised estimates to state revenues due to the economic consequences of coronavirus.

Tips for Building Up Your Personal Rainy Day Fund

- Commit to a budget. Dedicating yourself to keeping a detailed budget can help you avoid spending more than you are able and avoid future stressful financial situations. By putting away money in a savings account every month you can begin to build up your own rainy day fund and be better prepared to handle unexpected financial situations.

- Get trusted personal finance advice. A financial advisor can help you make smarter financial decisions such as being in better control of your money. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/MarianVejcik