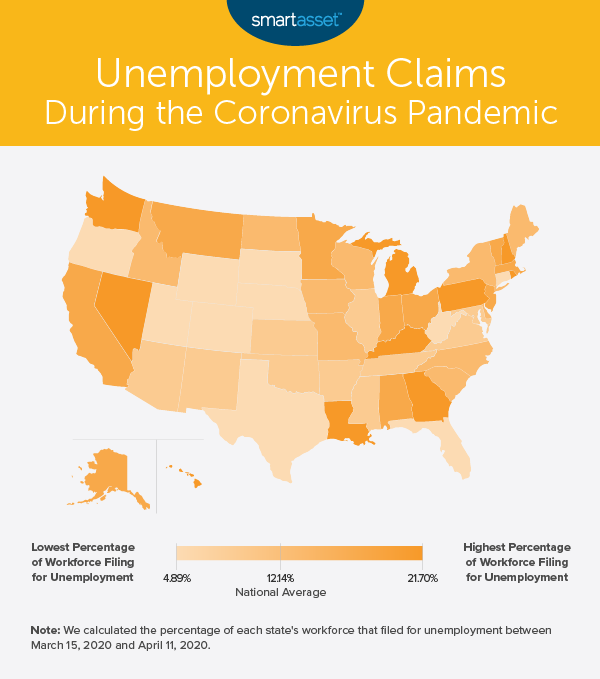

Since mid-March as the coronavirus pandemic has intensified, there have been four straight record weeks for jobless claims filed in the U.S. – a fact that increases economic uncertainty and makes it difficult for Americans to save adequately. For the week ending March 21, 2020, 3.31 million Americans filed for unemployment, followed by 6.87 million and 6.62 million the two subsequent weeks. Last Thursday, the Department of Labor reported that another 5.25 million individuals filed for unemployment for the week ending April 11, 2020, bringing the four-week moving average to 5.51 million claims per week. In total, more than 22 million Americans filed for unemployment between mid-March and mid-April, though state and local labor forces have been affected to varying degrees.

In this study, we uncovered the states with the most initial unemployment claims for the period between March 15, 2020 and April 11, 2020. We compared the total number of initial jobless claims for those four weeks to the state’s labor force, calculating the percentage of the workforce that filed for unemployment. For more information on our data and how we put it together, check out our Data and Methodology section below.

Key Findings

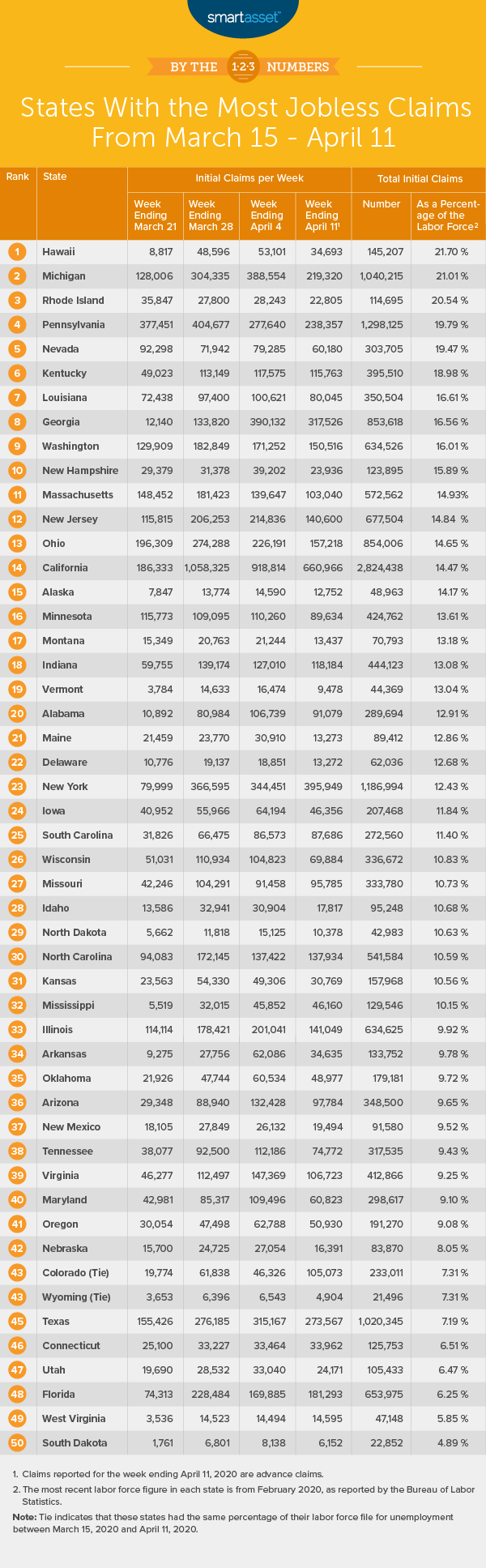

- In three states, more than one in five workers filed for unemployment over the past month. Between March 15, 2020 and April 11, 2020, more than 20% of the labor force filed initial unemployment claims in Hawaii, Michigan and Rhode Island. Of those three states, Michigan has seen the highest gross number of claims, at about 1.04 million.

- California stands out for its high number of new jobless claims. More than 2.82 million Californian residents filed for unemployment between the weeks ending March 21, 2020 and April 11, 2020. This is by far the highest gross number of total claims filed in any state, surpassing Pennsylvania – the state with the next highest gross number – by more than 1.53 million claims.

- Jobless claims seem to have peaked in most states. In 41 of the 50 states, the number of initial jobless claims went down from the week ending April 4, 2020 to the week ending April 11, 2020, mimicking the national trend and potentially indicating a peak in weekly initial jobless claims. The only states where jobless claims were higher for the week ending April 11, 2020 than they were for the previous week are New York, South Carolina, Missouri, North Carolina, Mississippi, Colorado, Connecticut, Florida and West Virginia. Of those, the biggest one-week increase took place in Colorado; claims there spiked by almost 127% from roughly 46,300 to more than 105,000.

Of all 50 states, Hawaii had the highest percentage of its labor force file for unemployment between the weeks ending March 15, 2020 and April 11, 2020. Though the weekly claims number fell by about 35% from the week ending April 4, 2020 to the week ending April 11, 2020, the cumulative number of Hawaiian residents filing over the four weeks was still extremely high compared to its labor force. About 145,200 individuals, or almost 22% of the labor force, filed for unemployment benefits between mid-March and mid-April.

With the fourth-highest gross number of jobless claims over the past month – following only California, Pennsylvania and New York – Michigan ranks as the state with the second-most claims relative to its workforce. More than 200,000 Michigan residents filed for unemployment every week for the past three weeks. In total, for the period spanning from March 15, 2020 through April 11, 2020, more than 1.04 million individuals, or 21.01% of the labor force, filed with Michigan’s state office.

In gross terms, Rhode Island had the 14th-lowest number of residents filing for unemployment benefits between March 15, 2020 and April 11, 2020 of all 50 states. However, this number alone does not reflect the extent to which residents in the state were affected. With a labor force of fewer than 558,500 people, more than one in five residents lost their job over the past month and submitted a claim to receive unemployment benefits.

Data and Methodology

Data for this study comes from the Department of Labor and the Bureau of Labor Statistics (BLS). The national figures quoted in the introduction are seasonally adjusted while state figures are not. To find the states with the most jobless claims, we first calculated the total initial unemployment claims filed for the week ending March 21, 2020 through the week ending April 11, 2020.

It should be noted that the number of initial claims for the week ending April 11, 2020 are advance claims, which are claims reported by the state that pays the unemployment insurance rather than the state in which the claimant lives. There can be adjustments to advance claims for those who live and work in a different state.

We totaled initial claims for those four weeks and compared them to the February 2020 labor force, the most recent data available, as reported by the BLS. States with the most jobless claims during the coronavirus pandemic are those with the highest percentages of their labor forces filing between those weeks. States with the fewest jobless claims during the coronavirus pandemic are those with the lowest percentages of their labor forces filing.

Tips for Making It Through a Recession

- If you did lose your job, find out if you qualify for unemployment. Many unemployment benefits across states have been expanded as a result of the spread of coronavirus. Our guide on the Enhanced Unemployment Benefits for Coronavirus can help you figure out if you may be eligible for receiving a benefit and how much that benefit will be. If you are looking for more general information on the coronavirus and what the government is doing to help, check out our comprehensive guide here.

- Boost your emergency savings. One of the best ways to prepare for the unknown is to build an emergency fund. Though typical financial wisdom suggests you should have savings that can cover three months’ worth of expenses, six months’ may be a better figure to shoot for during a recession.

- Consider talking to a financial advisor about how to ride out a financial downturn. If you are nervous about your retirement account or what to do with money you are making, speaking with a financial advisor might not be a bad idea. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Ekaterina79