Posts by Chris Thompson

Frequently Asked Questions (FAQs) About the January 2025 New Rule of the Telephone Consumer Protection Act (TCPA)

What You Should Know About the New Rule The FCC is updating rules about how businesses get consent for telemarketing calls and texts. SmartAsset is proactively ensuring our clients understand and will comply with the updated rule. What Are the New FCC Consent Rules, and When Do They Take Effect? The new FCC consent rules,… read more…

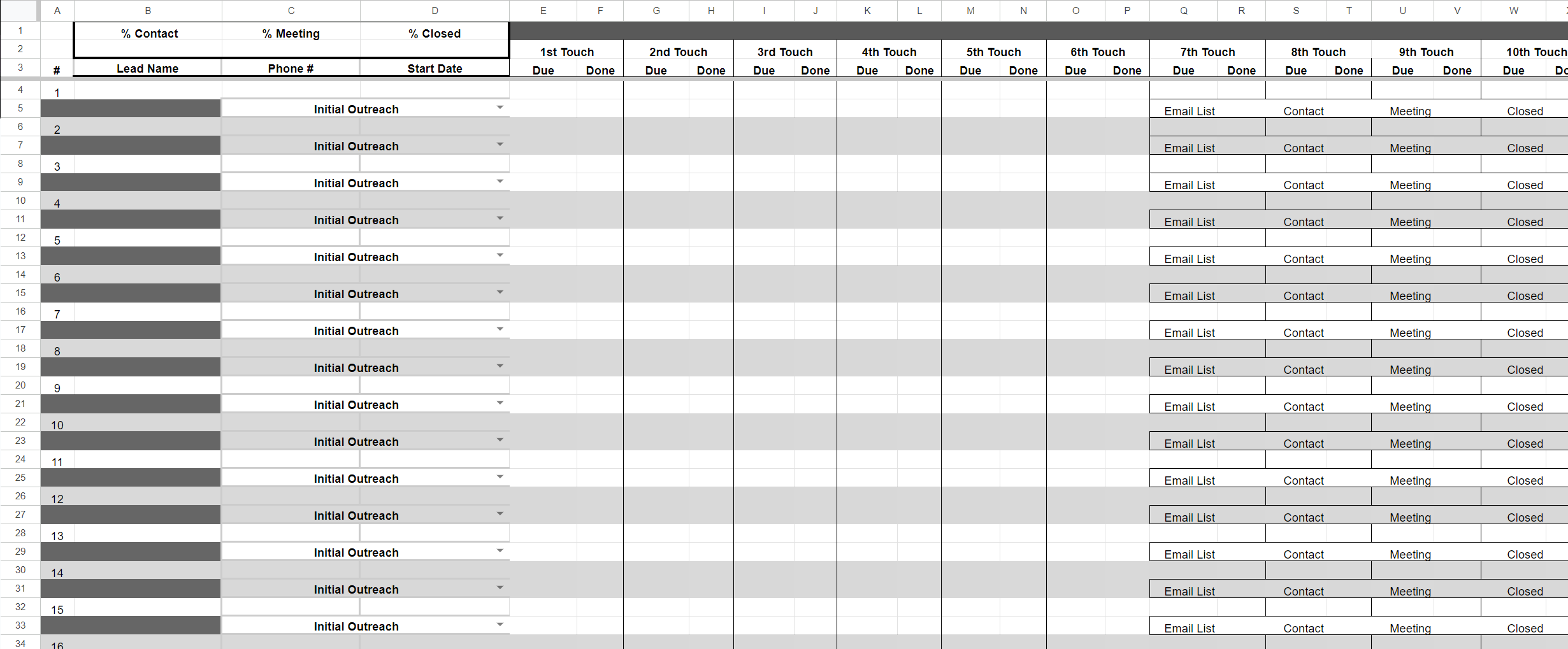

SmartAsset AMP Outreach Workbook

Download the file here:

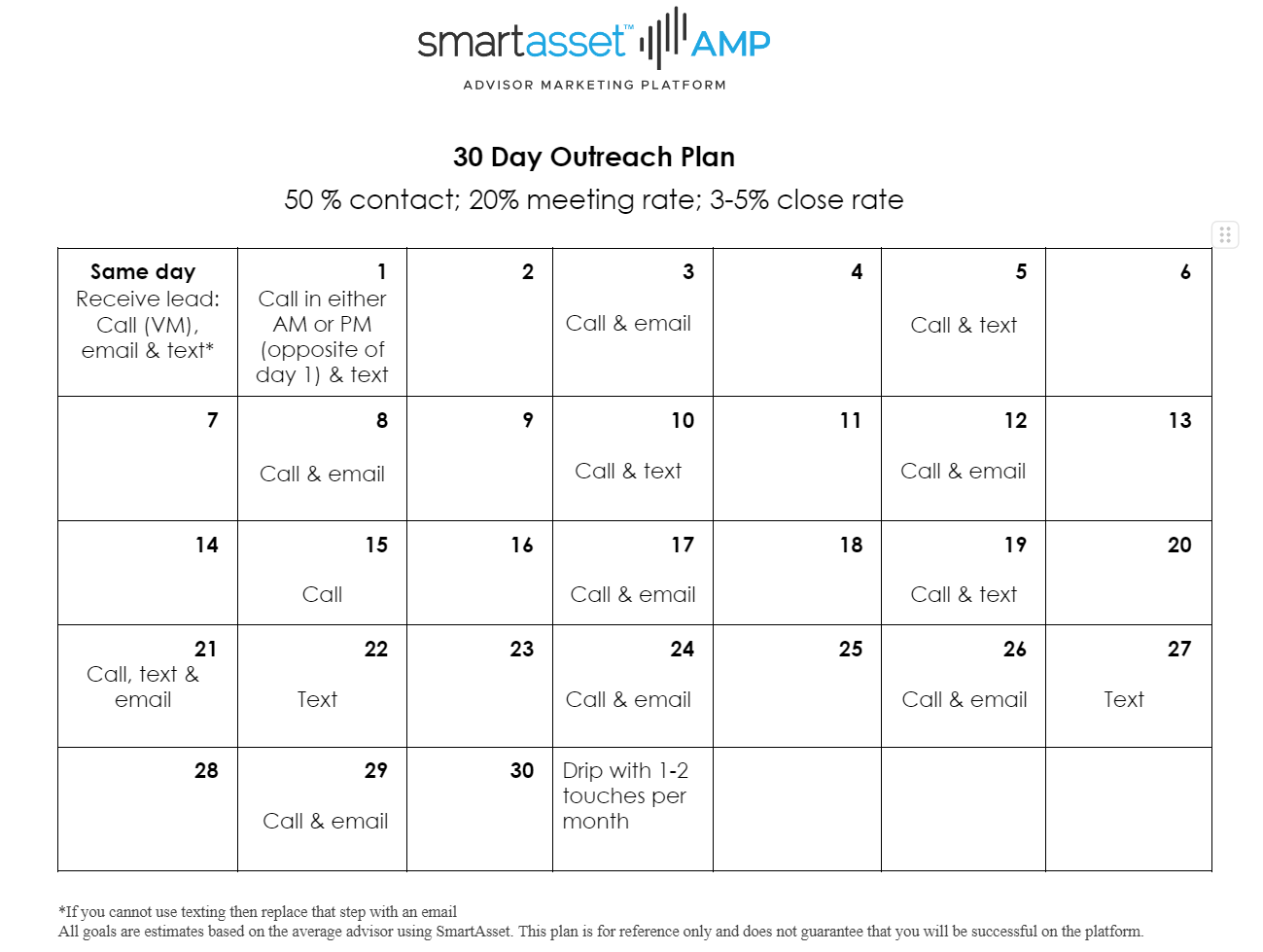

SmartAsset AMP: 30 Day Outreach Plan

Download the file here:

SmartAsset Leads – Standard Advisor Outreach

Use this page to help you follow up with leads from SmartAsset. Touch 1 (Message) Day 1: Schedule an Outreach Hi, this is ______. I’m a Certified Financial Planner and your financial advisor from SmartAsset. I wanted to let you know that I will be giving you a call at __ on __ to go over your… read more…

Handling Indifference for Advisors

This page contains the Common Prospect Resistant Statements and a framework for handling them. A.R.T. Framework Here’s a few things to keep in mind before Use the A.R.T. framework to overcome objections. A.R.T. stands for: Common Prospect Indifferences Acknowledge & Validate: Validate the Prospect’s decision of working with an advisor and open the conversation to.… read more…

Capital Gains Tax: Definition, Rates & Calculation

If you make money from just about any source, you’re likely to find Uncle Sam nearby. It’s true of money you earn from a job, and it’s true of money you earn from investments – whether that’s stocks, real estate… read more…

401(k) Rollovers: The Complete Guide

A 401(k) rollover is the process by which you move the funds in your 401(k) to another retirement account—usually either an IRA or another 401(k). A 401(k) rollover typically happens when you leave your employer, either to retire or to start a new job. There are certain regulations you need to follow when rolling over your assets,… read more…

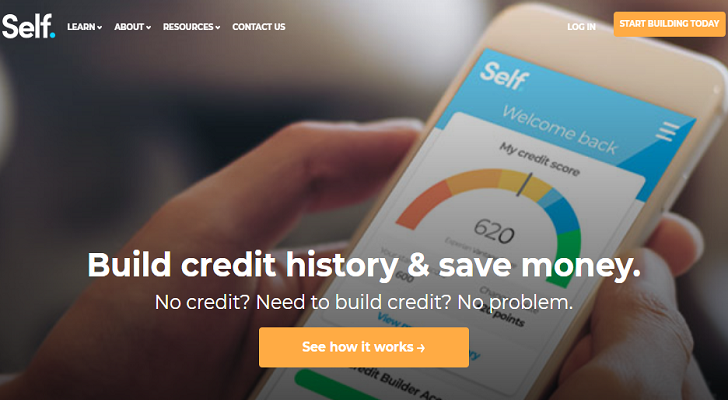

Self Review: Credit-Builder Loans and Cards

Self, formerly known as Self Lender, is a financial services company that offers two different products aimed at helping customers with bad or little credit. Its premier offering, called the Credit Builder Account, allows you to receive a credit-building loan in… read more…

How to Create a Living Trust in Connecticut

As you approach the estate planning process, you have many tools at your disposal. One such tool is a living trust. By creating a living trust, you can protect your assets and property and save your family from having to go through… read more…

How to Create a Living Trust in Utah

If you’re working on your estate plans, you may come across living trusts as a way to protect your assets so you can safely leave them for family and friends. The primary benefit of using a living trust instead of a will is that it can allow you to bypass the probate process. As probate… read more…

How to Create a Living Trust in Virginia

A living trust is an estate planning tool that can simplify the passing on of your assets to your family. Each state tends to have its own rules as to how you can set up your own living trust as a resident.… read more…

Free Investment Classes for Learning How to Invest

As you aspire toward a secure retirement and other financial milestones, investments become an increasingly important financial topic to know about. But those looking to gain knowledge about investing may have issues finding reliable sources. Luckily, the internet is home to many… read more…

A Guide to Dividend Reinvestment Plans

A dividend reinvestment plan, or DRIP, is a vehicle that reinvests the money shareholders get from companies in cash dividends. Many investors favor DRIPs because of their ease, low-to-nonexistent fees and ability to strengthen returns over a long time horizon. By… read more…

How to Invest Your Money

Investing can be an intimidating venture, but learning how to navigate the investment market is a life skill with plenty of upside. You can use the returns you earn from your investment portfolio to achieve a number of goals, such… read more…

How a Passive Investing Strategy Works

Passive investing is an investing strategy that involves buying and holding investments for a long period of time, rather than making frequent trades to try to beat the market. It is a go-to strategy for long-term investors because it capitalizes… read more…

What Is the Net Investment Income Tax?

Investing has the potential to earn you great returns – but where money’s being made, you can surely find Uncle Sam nearby. Accordingly, the net investment income tax (NIIT) will take a 3.8% bite out of a portion of your… read more…

What Are Corporate Bonds & Where Can You Buy Them?

Both public and private corporations issue corporate bonds, which are a type of fixed-income security. Corporations place these investments on the open market to help fund projects and other major financial undertakings. Investors can purchase a corporate bond on either… read more…

How to Buy Walmart Stock

Known for its size, success and seeming ubiquity, Walmart (ticker symbol: WMT) is a discount retailer that has had a tremendous run on Wall Street. Founded by Sam Walton in 1962, the corporation went public in 1970, debuting at $16.50… read more…

How to Buy Samsung Stock

Although widely recognized as solely a technology brand, Samsung is actually more of a conglomerate. The South Korea-based company extends into the financial services, tourism, science and machinery businesses as well. But tech is what Samsung does best, as Forbes… read more…

Annuity vs. IRA

Americans look forward to their golden years, but saving for retirement can be an intimidating undertaking. The long-term nature of this type of financial planning calls for good decision-making, so simplifying it is of the utmost importance. Let’s break down… read more…

How to Buy Berkshire Hathaway Stock

It’s often said that investing in Berkshire Hathaway is like buying into an exchange-traded fund (ETF). Both offer diversification across industry sectors. ETFs are typically passively managed to track a benchmark index, whereas Berkshire Hathaway actively acquires both stocks and businesses. As you explore whether or not investing in Berkshire Hathaway is a good idea… read more…

Beginner’s Guide for How to Buy Mutual Funds

Mutual funds are companies that combine investors’ money in an effort to diversify their assets throughout specific areas of the market. So investing in a mutual fund is more than just buying into the investments a fund makes. You’re actually buying shares of the mutual fund to become a part owner. This typically attracts lots of… read more…

How to Buy Savings Bonds

The most common way to buy savings bonds is to go straight to the US Government, and as of a few years ago, it can only be done online. Though savings bonds may not be as flashy as some other… read more…

How to Buy Nike Stock

Nike stock shares represent a portion of ownership in Nike, one of the most prominent sportswear companies in the world. This means that when you purchase Nike stock, you own a part of the company that makes many Americans’ sneakers. The… read more…

How to Buy Municipal Bonds

Municipal bonds are debt security investments in the daily operations or long-term projects of a state, county, city or other government organization. Government entities themselves issue municipal bonds and they offer interest payments typically on a semi-annual basis. The maturity dates… read more…