Self, formerly known as Self Lender, is a financial services company that offers two different products aimed at helping customers with bad or little credit. Its premier offering, called the Credit Builder Account, allows you to receive a credit-building loan in the form of a certificate of deposit (CD) that matures once you complete your payments. The company also offers a credit-building credit card. These products are offered along with robust mobile and online account management services.

Do you have financial questions that go beyond your credit score? Speak with a financial advisor today.

Self Overview and History

As of 2019, the company rebranded from Self Lender to Self. Although its products and services didn’t change much following the rebranding, it soon after introduced the Self Visa® Credit Card. This credit-building tool, in conjunction with the Credit Builder Account, is what Self specializes in.

Overview of Self

| Pros | – Four account options and two credit-building tools are available – No upfront cash or income requirements needed for approval |

| Cons | – Somewhat high APRs – Credit score improvement can vary |

| Best For | – Anyone with bad or little to no credit – Those who feel comfortable managing accounts through online/mobile platforms |

Self Credit Builder Account

Self Credit Builder Account: Fees & Rates

| Fee/Rate Type | Amount |

| Non-refundable administrative fee | $9 (one-time charge) |

| Interest Rate/APR | Varies depending on the size of your loan |

| Payment fees | – No fee when paying through a bank account or with a prepaid card – $0.30, plus 2.99% convenience fee when paying with a debit card |

| Late payment fee | A 15-day grace period, then a fee equal to 5% of your monthly payment amount |

| Early withdrawal fee | Depends on your account size, but usually less than $5 |

Self’s Credit Builder Account is its main offering, as its focus is to help customers improve their credit scores through a small installment loan. This loan isn’t provided to you directly by the company; rather, the funds are placed in an FDIC-insured CD account at one of Self’s banking partners. This account is technically yours, but the funds won’t be released until your loan is paid off.

There’s no application needed to become a member of Self, but you will need to apply for a Credit Builder Account. Within this application process, you will specify which of Self’s four account options you want:

- $25 monthly payments over a 24-month term, resulting in a $520 payout

- $35 monthly payments over a 24-month term, resulting in a $724 payout

- $48 monthly payments over a 24-month term, resulting in a $992 payout

- $150 monthly payments over a 24-month term, resulting in a $3,076 payout

If you receive approval for a Credit Builder Account, you’ll immediately be charged a one-time $9 administrative fee. Simultaneously, Self’s banking partner will place the loan funds in your CD account. Starting the following month, your payments will begin, with each being equal for the loan’s entire length. If you’re late on a payment, there’s a 15-day grace period, followed by a late fee equal to 5% of your payment amount.

As you make payments, Self will report them to TransUnion, Experian and Equifax, which are the three main credit bureaus. The moment you make your last payment, the bank through which your CD is held will unlock your account. After 10 to 14 days, the full loan amount will then be disbursed to you, minus any applicable fees and interest. The funds can be sent to you either by check or via an ACH money transfer.

The Credit Builder Account is available through Self’s online and mobile platforms to residents of all 50 states. To apply, you must be at least 18 years old and be a U.S. citizen or permanent resident with a physical address in the U.S. You’ll also need to have a Social Security number, a valid email address, a phone number and either a bank account, debit card or prepaid card. Note that payments are fee-free when you use a bank account or prepaid card, but a convenience fee of $0.30 plus 2.99% will be tacked on to debit card payments.

Self Visa® Credit Card

The Self Visa® Credit Card offers another way for Self members to improve their credit score. To be eligible for this card, you’ll need to:

- Currently have an open Credit Builder Account

- Make three on-time monthly payments to your Credit Builder Account

- Have at least $100 in your Credit Builder Account

- Have your account in good standing

This is a secured credit card, which means it’s backed by some form of collateral that protects the card issuer in case of default. To provide this backing, you’ll need to decide how much of your Credit Builder Account’s $100 or higher balance will act as collateral. In addition, this amount will also become your card’s credit limit.

During the application process, Self will not run a credit check on you. That’s because you will already own a Credit Builder Account, which means the company already knows your credit situation. Once you receive your card by mail and activate it, you’re free to use it as you please. Because Self’s card is a Visa, it’s accepted virtually everywhere.

How Much Can Self Raise Your Credit Score?

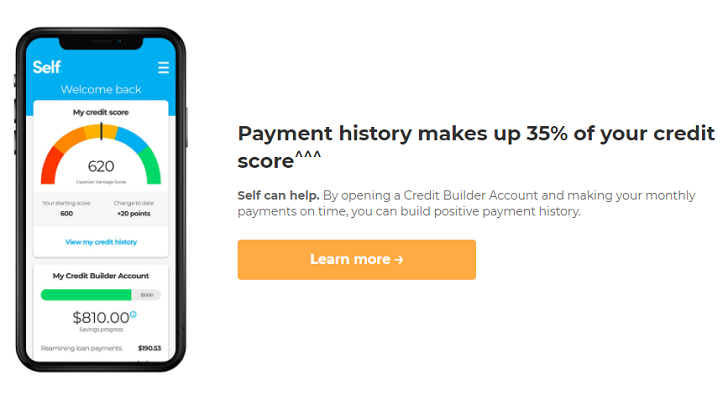

As Self lists throughout its website, most credit scoring agencies use your payment history to account for 35% of your credit score. This fact is at the heart of why the company’s two products – the Credit Builder Account and the Self Visa® Credit Card – have the opportunity to be so beneficial for you.

For starters, Self will not do a hard credit pull when opening your account, which is good for those with low credit. Then, once your account is open and you’re making payments, Self will report your payment history to the three major credit bureaus (Experian, Equifax and TransUnion).

It should take about one to two months for your Credit Builder Account to show up on your credit report. Also, don’t be alarmed if you don’t see “Self” on your credit report, as sometimes the company is listed as a “secured installment loan” from one of the bank’s partners.

All of this should have a strong effect on your credit score, but significant changes could take up to three months to materialize. But because everyone has a different credit situation, results through Self can vary. More specifically, if you make late payments to Self or manage your outside accounts poorly, the overall benefits of its products could be completely negated.

In addition, for those looking to pay off their Self accounts early, the cumulative effect of on-time payments could be drastically weakened. Credit bureaus want to see people sustain payments over long periods, and cutting your account’s term short could limit your potential upside.

Customer Experience

When you open an account with Self, be prepared to manage your account solely through the company’s online and mobile platforms. Both online and mobile accounts have the same features, so you have the convenience to choose whichever works best for you.

The Self mobile app is available for both Apple and Android users. Features include the ability to check your Credit Builder Account’s balance and savings progress, open a Self Visa® Credit Card, set up automatic monthly payments and more.

Current and former Self customers are very happy with these mobile apps. The iOS app averages a 4.9-star rating (out of 5) from more than 40,000 user reviews on the Apple app store. The Android version of the app gets a 4.8-star rating out of 5 from nearly 20,000 Google Play store reviews.

In terms of customer service, Self offers live chat, email and phone support. You can find the company’s phone number, email address and live chat link through your online or mobile account.

What to Watch Out For

Self is a fully legitimate credit-building company that has helped many people with low or little to no credit. However, that doesn’t mean that its offerings don’t come with some downsides.

While utilizing the credit-building services of a brand like Self will almost assuredly improve your credit score and history, the actual effect it has will vary from person to person. This is somewhat expected, though, as not all people have the same circumstances surrounding their credit.

For all the benefits that Self offers, its loan interest rates can be a little high. Although this may not come as a huge surprise given that customers of Self typically have bad credit, these APRs can still have a somewhat strong effect.

How Self Compares to Secured Credit Cards

In addition to credit-building loans, secured credit cards can help you build or repair your credit score. These cards are called “secured” because your credit limit is typically backed by a deposit you make with the credit card company before your card is issued. This is done to protect the credit card issuer if you default on your account.

Self’s Credit Builder Account compares quite favorably to secured cards, though. Self does not ask you to deposit before your account is activated, while secured card issuers do. The Self Visa® Credit Card also doesn’t call for a deposit, as you can simply use the value you’ve accrued in your Credit Builder Account as backing. These perks could be hugely beneficial for someone with a low credit score, as they may not have the capital to back a secured card.

When it comes to interest rates, Self’s APRs tend to be lower than most secured credit cards. In most cases, the purchase APRs associated with secured cards are 20% or higher, whereas Self’s current APRs are closer to 15%. This shouldn’t come as a massive surprise, though, as card issuers are simply trying to protect themselves from a riskier situation.

Bottom Line

All in all, Self provides those with a weak credit past a great opportunity to improve their credit score and habits. The ability to open a credit-building account without any upfront cash is an extremely attractive benefit as well. While Self’s APRs can get a little steep, managing your account correctly and avoiding extra fees will mean you get to recoup most of your money when your CD account is paid off.

Tips for Managing Your Finances

- If you’re struggling to improve your credit score but still have some money to invest or save for retirement, a financial advisor could be helpful. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you don’t have enough money to work with a financial advisor, consider a financial planner or a robo-advisor. If you’re more interested in building a retirement savings or estate plan, saving money for your child’s college education or minimizing your taxes, a financial planner is your best bet. But if you want to start investing, a robo-advisor can automatically manage your money for you through a portfolio of investments.

Photo credits: Self.inc