Millennials are much more likely to move than their generational counterparts. IRS data shows than less than 30% of taxpayers are younger than age of 35, but from 2017 to 2018, more than half of tax returns marking a change of address across state lines belonged to filers under 35. In other words, less than 3% of all taxpayers moved to a different state between 2017 and 2018 while more than 5% of millennial taxpayers (i.e. those under the age of 35) did so.

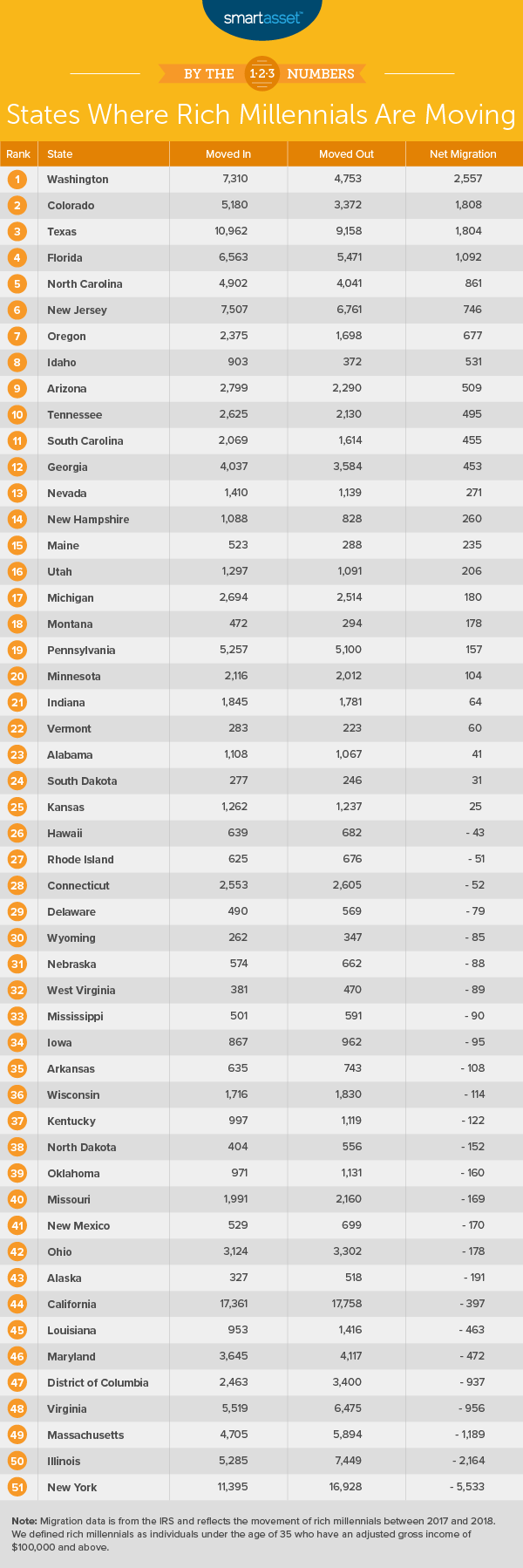

In this study, SmartAsset looked specifically at the movement of rich millennials, defined as individuals younger than age 35 with adjusted gross incomes (AGIs) of at least $100,000. We considered the inflow and outflow of rich millennials from each state between 2017 and 2018 to determine the states where rich millennials are moving the most. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s second annual study on the states where rich millennials are moving. Check out the 2019 rankings here.

Key Findings

- Rich millennials are not moving more than other millennials. As previously noted, more than 5% of all millennial taxpayers moved to a different state between 2017 and 2018. The rate at which rich millennials moved mirrors that figure, with 5.45% of taxpayers younger than 35 and earning more than $100,000 changing residences across state lines between those two years.

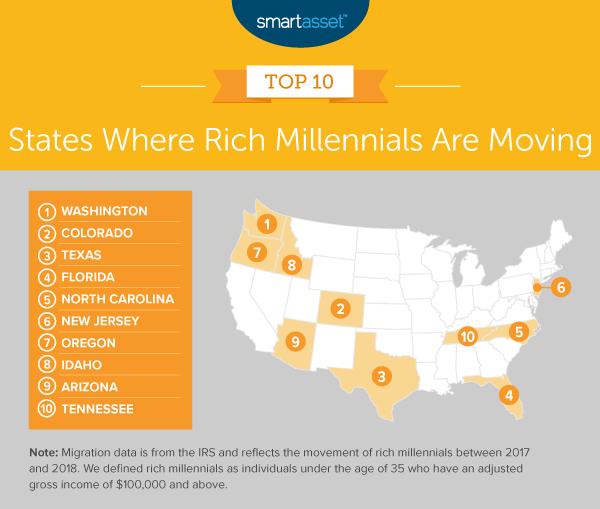

- Western and Southern states are popular. Half of the top 10 states where rich millennials are moving are in the West, according to Census regional divisions. They include Washington, Colorado, Oregon, Idaho and Arizona. There was a net migration of more than 500 rich millennials to all five states between 2017 and 2018. Furthermore, four other states in the top 10 are in the South: Texas, Florida, North Carolina and Tennessee.

- Rich millennials are leaving New York State. Between 2017 and 2018, fewer than 11,400 rich millennials moved to New York State, while close to 17,000 of them left. As a result, New York saw the lowest net migration in our study. A net figure of roughly 5,500 rich millennials left the state between 2017 and 2018.

1. Washington

Between 2017 and 2018, Washington State was the most popular destination for wealthy millennials. More than 7,300 millennials making at least $100,000 moved to the state, while fewer than 4,800 left. In total, there was a net inflow of roughly 2,600 wealthy millennials – the highest of any state and the District of Columbia.

2. Colorado

Colorado follows behind Washington State with a net migration of 1,808 rich millennials between 2017 and 2018. About 73% of those millennials earned between $100,000 and $200,000 annually, while the remaining 27% made upwards of $200,000.

3. Texas

Texas is a hotspot for millennials in general, and many rich millennials in particular have moved to the state in recent years. IRS migration data shows that between 2017 and 2018 there was a net migration to the Lone Star state of about 1,800 individuals younger than 35 and with incomes of $100,000 or more.

4. Florida

One of nine states with no income tax on wages, Florida ranks as the fourth-most-popular state where rich millennials are moving. About 6,600 high-earning millennials recently moved to Florida while fewer than 5,500 moved out. As a result, there was a net migration of close to 1,100.

5. North Carolina

Between 2017 and 2018, there was a net migration to North Carolina of close to 900 taxpayers under the age of 35 and earning more than $100,000. Specifically, about 700 of those individuals earned between $100,000 and $200,000, while the remaining 202 earned upwards of $200,000.

For advice on how to manage your money to achieve your financial goals, see our top spending tips for millennials.

6. New Jersey

New Jersey is the only East Coast state that makes it into our top 10. Between 2017 and 2018, there was a net migration of 746 millennials earning at least $100,000 to the state. In fact, close to 500, or roughly two-thirds, of those individuals earned upwards of $200,000; that’s the second-highest gross net migration of millennials in that income bracket in our study.

7. Oregon

Oregon is the third of five Western states in our top 10. From 2017 to 2018, a net of more than 30 wealthy taxpayers under the age of 26 moved to the state. Additionally, a net of close to 650 wealthy taxpayers between the ages of 26 and 34 moved there. In total, there was a net migration of 677 rich millennials to Oregon between 2017 and 2018.

8. Idaho

Idaho takes the eighth spot on our list, with a net inflow of 531 wealthy millennials from 2017 to 2018. IRS data shows that more than 900 wealthy millennials moved to the state between the two years, while fewer than 400 left.

If you recently moved to Idaho and are looking for help in managing your finances, check out our list of the top financial advisors in the state here.

9. Arizona

A net of more than 500 high-earning millennials moved to Arizona between 2017 and 2018. About 71% of those individuals earned between $100,000 and $200,000 annually, while the remaining roughly 29% earned upwards of $200,000. Those millennials looking to buy a home in their new state of residence will need to budget and save accordingly.

10. Tennessee

Tennessee rounds out our list of the top 10 states where rich millennials are moving. Between 2017 and 2018, there was a net migration of almost 500 rich millennials to the state. The majority (97.78%) of those rich millennials were between the ages of 26 and 34.

Data and Methodology

To find the states where rich millennials are moving, we looked at data on all 50 states and the District of Columbia. We defined rich millennials as individuals younger than the age of 35 with adjusted gross incomes of $100,000 or more. Using that definition, we looked at two metrics:

- Inflow of rich millennials. The number of rich millennials who moved into the state.

- Outflow of rich millennials. The number of rich millennials who moved out of the state.

Data for both metrics comes from the latest available IRS migration data from 2017 to 2018. IRS data is based on year-to-year address changes reported on individual income tax returns filed with the agency. To note, in last year’s study we analyzed 2015-2016 IRS migration data since 2016-2017 data was not available at the point of publication.

We determined each state’s net migration of rich millennials (i.e. the inflow of rich millennials minus the outflow of rich millennials) and ranked states accordingly. States with the highest net inflow of rich millennials ranked highest.

Tips for Rich Millennials to Maximize Their Investments

- Invest early. Rich millennials can maximize their earnings by being proactive and strategic. By planning and saving early, they can take advantage of compound interest. Take a look at our investment calculator to see how your investment can grow over time.

- You don’t have to go at it alone. Investing is complicated; investors must consider their overall asset allocation in the context of their investment time horizons and financial goals. A financial advisor can help you make smarter financial decisions and be in better control of your money. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/onurdongel