It can at times feel daunting to buy a home. In many cities, home prices are rising and pushing Americans increasingly further from their homeownership dreams. The difficulty of buying a home starts long before you decide to become a homeowner, though. Closing costs and down payments mean people may need to spend years saving for a home before they can sign the deed. For people trying to thread the needle between a smart homeownership decision, a secure retirement and ample general savings, it’s important to develop a holistic financial plan. Below, we explore the relationship between time, savings and upfront costs of homeownership to understand the scope of the difficulty young Americans face in buying a home.

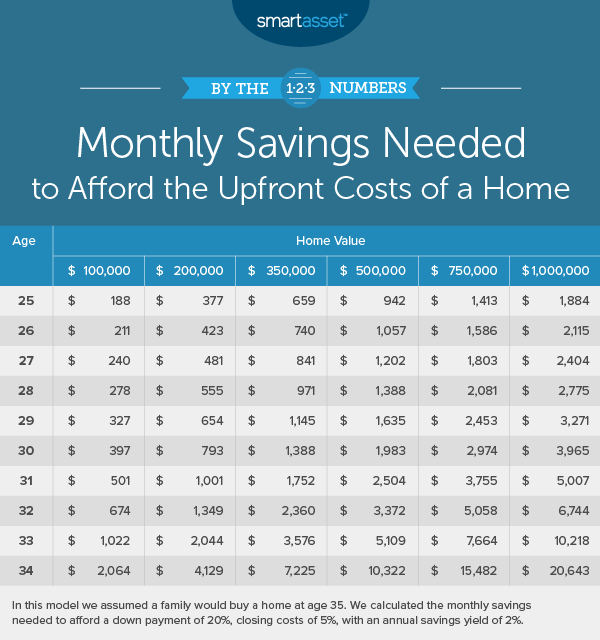

In order to find out how much millennials need to save to buy a home, we looked at data on 60 different home buying situations. Specifically, we estimated the monthly savings needed for millennials between the ages of 25 to 34 to afford the down payment and closing costs on a home worth between $100,000 and $1,000,000. We assumed a 20% down payment and closing costs equal to 5% of the home value.

We also assumed your money would not just be sitting under a mattress while you were saving it. In our calculations, we assumed an annual percentage yield of 2% on your savings. Banks like Ally and Synchrony both offer annual percentage yields (APYs) well above our 2% threshold.

Key Findings

- The average home may be within reach – Are you a young person able to find an extra $400 per month in your budget? If so, you may be able to afford the average American home. The Census Bureau estimates the average home in America is worth $217,600. To be able to afford a home worth $200,000, you only need to save $377 per month over ten years or $423 per month over nine years.

- Planning is key – One fact that jumps out from this analysis is the importance of planning. Even if you want to buy a modest $100,000 home by 35, your necessary savings drops dramatically based on when you start saving. If you wait until you are 30 to start saving instead of 25, your savings rate needs to double to hit your target.

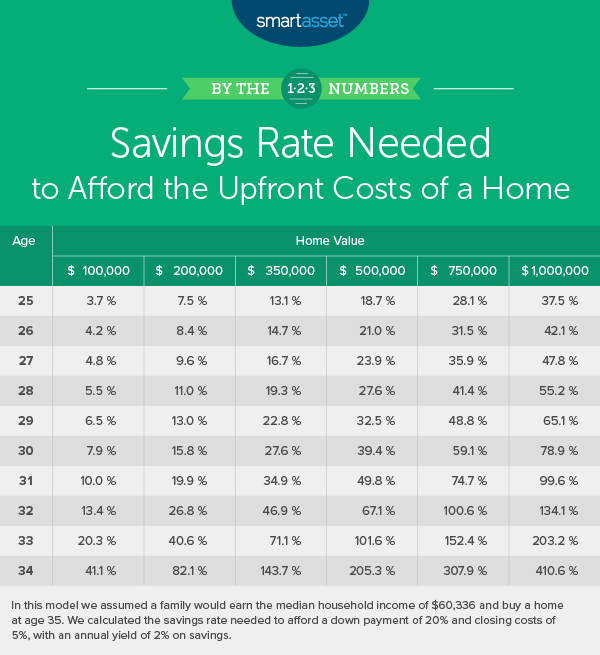

- The average American family will probably never own a million-dollar home – Even with the best intentions, a carefully laid-out plan and a budget cut to the bone, the average American household almost certainly can’t afford the down payment and closing costs on a home worth $1 million. Starting at age 25, a family earning the median household income would need to dedicate over 37% of income to save for a million-dollar home. Someone at age 34, who had his or her dream home in mind, would need to “save” or borrow the equivalent of 411% of income to afford a million-dollar home the next year.

- How much can you afford to save? – Data from the Federal Reserve shows that the average American saves only 6% of his or her disposable income. Assuming he or she earns the median household income, 6% would be roughly $300 per month, enough to buy a $100,000 home by 35 if he or she started saving at 28. But a savings rate of 6% would not be enough to buy a $350,000 home or even a $200,000 home. Step up your savings game to 10% and a $100,000 home is within reach after just four years of saving. A savings rate of 10% also means you can buy a $200,000 home after eight years of saving. To unlock a $350,000 home or a $500,000 home, you’d need a 10-year savings rate of 13.1% or 18.7%, respectively.

- How better investments can help – In our model, we assumed a return on savings of 2%, and in that model, it was nearly impossible to save for a million-dollar home. But what if, instead of saving the money somewhere secure like a high-yield savings account, you decided to take some risks on the stock market. In that case, if the average American household saved $1,000 per month (roughly 20% of his or her income) and had constant returns of 13.4% over 10 years, he or she would have $250,000 saved up, enough for the down payment and closing costs on a home worth $1 million. If you are thinking consistent returns of 13.4% sounds unlikely, you may be surprised to hear there are 36 periods where the 10-year average annual returns on investments on the S&P 500 (including dividends) surpassed 13.4%. But in investing timing is everything, and no one is guaranteed 13.4%. Someone who invested in the S&P 500 in 1999 would have seen an average annual return of 0.65% after 10 years largely thanks to 2008 when the financial crisis took off. But had you invested in the S&P 500 from 2009 to 2018, your annual return on investments would be 13.5%. Keep in mind, though, that even if the stock market puts you in position for a down payment on a nice home, you may still not be able to afford the long-term mortgage and property tax payments.

Tips for saving for a home

- Don’t go overboard – Even if you can afford a down payment, you may not want to take the plunge and buy the home. Our mortgage calculator can help you figure out just how much home you can afford by taking into account local property taxes, homeowners insurance, your income and your expected mortgage costs.

- Ask an advisor – A home may not be the best way to invest your money. As illustrated above, the stock market may offer better returns. In order to make sure you are putting your savings and investments in all the right places, why not spend some time with a financial advisor? An expert of this sort can take care of your investments as well as the taxes that come with them. If you are not sure where to find a financial advisor, check out SmartAsset’s financial advisor matching tool. It will match you with up to three local financial advisors who fit your investing needs.

Questions about the study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/mapodile