Before signing on with a broker or investment advisor, consider looking them up using the Financial Industry Regulatory Authority’s (FINRA) BrokerCheck. FINRA is authorized by Congress to oversee brokers and broker-dealers. The FINRA BrokerCheck database provides various information about individual brokers and brokerage firms, including registrations, employment history and any criminal matters, regulatory actions and civil judiciary proceedings complaints. BrokerCheck is a useful tool for gathering basic info about a firm or advisor that you’re considering working with.

SmartAsset’s free tool can pair you with up to three financial advisors who serve your area today.

What Is FINRA BrokerCheck?

FINRA BrokerCheck was developed to help investors steer clear of brokers who have a checkered past. It reveals the status of their registration (brokers must be registered with FINRA to conduct securities transactions in the U.S.) or if they’ve been outright banned from FINRA. It also provides their licenses and other qualifications, as well as a detailed report of any disclosures on their record.

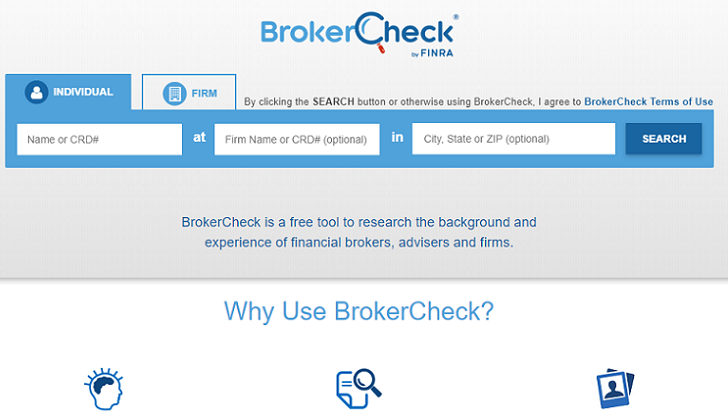

To find the individual or firm you’re looking for, simply search for their name or the name of their firm. Alternatively, you can enter their Central Registration Depository (CRD) number, which the broker or advisor will provide if you ask for it.

Most information on FINRA BrokerCheck comes from the CRD, which holds information about registered and licensed brokers, including disciplinary histories. For SEC information about brokers who are also registered as investment advisors, the site links to the SEC’s Investment Adviser Registration Depository (IARD).

To access FINRA BrokerCheck, you can visit the FINRA website and enter the name or CRD number of the broker or firm you want to research. You can also access FINRA BrokerCheck through a link on the SEC’s website or through other third-party websites.

Information About Brokers on BrokerCheck

FINRA BrokerCheck offers a wealth of information on brokers and brokerages that are currently registered with FINRA or who have been within the previous 10 years. You can find the following information on brokers through BrokerCheck:

- Report Summary: This involves a brief overview of the broker’s current job functions and credentials.

- Qualifications and Licenses: This section will tell you about the broker’s various registrations and licenses. It also contains a list of any qualification exams they’ve passed. In order to be licensed to trade most securities, a broker must pass the Series 7 exam.

- Registration and Employment History: This section covers the broker’s employment history over the last 10 years. It may include jobs outside the securities industry, but rarely. It also provides a listing of registered securities firms which the broker is or has been registered with.

- Disclosures: This part contains information about whether the broker underwent disciplinary action, customer disputes or criminal offenses. If present, some of these disclosures may involve matters that are pending action or have yet to be resolved. It also contains the broker’s most recently submitted comments on these matters, if applicable.

Accessing information on BrokerCheck is straightforward and user-friendly. Simply visit the BrokerCheck website and enter the name of the broker or firm you wish to research. The platform will then display a comprehensive report that includes the information above. This transparency helps consumers evaluate the trustworthiness and expertise of financial advisors, ultimately guiding them toward more secure investment decisions.

Information About Brokerage Firms on BrokerCheck

While you’ll surely want to learn about the broker you may work with, the firm itself matters, too. Learning about the firm may give you some insight into the kinds of overarching practices your advisor or broker engages in. Much of the firm information found on BrokerCheck may overlap with what’s available for a broker, but things are typically more general. Here’s what you’ll find:

- Report Summary: From this section, you’ll learn about the firm’s services and history. It shows where the firm is licensed to operate and its addresses. You can also access the link to the firm’s SEC profile if it’s an investment advisor in addition to a brokerage.

- Firm Profile: This part contains a detailed breakdown of the firm’s structure. It includes the firm’s founding date, and the names and titles of its largest shareholders and leaders.

- Firm History: This section tracks the firm’s moves from its establishment to the present. It details any mergers, acquisitions, name changes and similar actions.

- Firm Operations: This part describes the services the firm offers, along with any licenses and registrations it holds.

BrokerCheck plays a crucial role in ensuring regulatory compliance within the financial industry. By maintaining a public record of brokers’ professional conduct, FINRA encourages adherence to ethical standards and deters misconduct. This accountability mechanism not only benefits consumers but also enhances the overall integrity of the financial sector.

Information Available on Investment Advisors and Firms

The FINRA BrokerCheck database doesn’t contain detailed information about investment advisors and firms, but it directs you to the Investment Advisor Public Disclosure (IAPD) database that’s administered by the SEC. Here you can look up a firm or individual by name or CRD number.

For most advisors and firms, you’ll find a Form ADV and one or more informational brochures. Every advisor registered with the SEC must file and update the Form ADV on an annual basis, at least. This document includes information like business practices, types of clients served, disciplinary disclosures and much more. Brochures provide more intricate details, such as:

- Advisory Business: This part explains the types of services the advisor or firm provides to its clients. It also goes over who owns the firm and how long it has been in business.

- Fees and Compensation: This section provides a detailed breakdown of the fees the firm or the individual charges for each kind of service rendered. Keep an eye out here for any conflicts of interest that may be involved with said fees.

- Other Financial Industry Activities and Affiliations: This provides crucial, but often overlooked, research material for a potential client. It details whether its business practices with other firms may affect the fees it would charge you and whether these collaborations may pose a potential conflict of interest. For example, a firm or individual working for the firm may receive commissions from other firms for recommending its products.

Brokers and firms should be motivated to maintain clean records, knowing that their professional history is accessible to potential clients and regulatory bodies alike.

Other Resources for Researching Brokerages

Depending on what other information you’re looking for, there are a few other databases that you can use during your research process. For example, the FINRA Disciplinary Actions Online database offers further insights into the legal issues and disclosures that a broker, brokerage or advisor may have been involved in. This database only records disciplinary actions from 2005 and on.

Another resource is FINRA’s Arbitration Awards database. It can provide some insights into disputes the brokerage or broker has had with clients that have been resolved through arbitration or mediation. To locate case reports through this database, you’ll need to know a relevant case number, keyword or name and the type of case it is.

If you’re looking to research a firm or advisor with a specific skill set, then you might be in luck with other types of resources. Some of those include:

- Certified Public Accountants: You can research or verify your license through the AICPA.

- Mortgage Brokers: You can verify their license and see any potential background information related to that license through the NMLS research center.

- Commodities and Futures Brokers: The National Futures Association (NFA) provides a basic check of these brokers.

Bottom Line

FINRA BrokerCheck is a valuable tool for investors who want to research the background and credentials of brokers and brokerage firms before investing. By reviewing employment history, licenses, disclosures and disciplinary events, investors can make more informed decisions and spot potential red flags early. While BrokerCheck doesn’t replace due diligence or professional advice, it adds an important layer of transparency.

Tips for Finding a Financial Advisor

- A financial advisor can provide you with valuable insight and guidance as you manage your portfolio. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- You’ll likely want to talk to at least three advisors before signing on with one. This will give you enough information to compare and contrast their fees, services and different investment strategies. Check out SmartAsset’s list of questions to ask financial advisors as you plan your interviews.

Photo credit: ©finra.org, ©iStock.com/PeopleImages, ©iStock.com/marchmeena29