President Joe Biden officially unveiled the American Families Plan before a joint-session of Congress on April 28. This is the second part of his Build Back Better initiative, which aims to boost the U.S. economy by investing trillions of dollars in infrastructure, jobs, education, healthcare and other programs for millions of Americans. The American Families Plan would be funded through a number of tax hikes, including raising capital gains taxes on high-income investors. In this article we’ll break down the key components of the American Families Plan, and explain how it could benefit your family or impact your taxes.

A financial advisor can help investors navigate changes to the tax code. Find a financial advisor today.

What Is the American Families Plan?

Biden’s $1.8 trillion American Families Plan will specifically focus on supporting millions of American families by investing in childcare, universal prekindergarten and paid family and medical leave; education programs that include free community college and make college education affordable for low- and middle-income students; and tax cuts for families with children and American workers.

This follows Biden’s $2.3 trillion infrastructure and jobs plan – the American Jobs Plan – which was presented on March 31 as the first part of a Build Back Better economic recovery package. The eight-year initiative is what Biden calls the largest “jobs investment since World War Two,” and it would spend roughly 1% of the annual GDP to rebuild infrastructure for transportation, manufacturing, tech research and development and job training programs.

While the American Jobs Plan would be funded by increasing corporate taxes, the American Families Plan will require the government to raise the top individual income rate for taxpayers making over $400,000, double the capital gains taxes for millionaire investors, eliminate Medicare tax loopholes for the wealthy and invest in IRS enforcement against high-income taxpayers and corporations that are evading taxes.

Key Components of the American Families Plan

Biden’s Build Back Better plans are long-term strategies that aim to “ease the financial burdens of working families.” With that objective, the President is proposing a “once-in-a-generation investment in America” through both infrastructure spending and provisions aimed at supporting families.

The White House breaks down the $1.8 trillion American Families Plan into three main parts:

- Add at least four years of free public education through quality universal prekindergarten and free community college; close equity gaps by training teachers and making college more affordable for low- and middle-income students.

- Provide direct support to children and low- and middle-income families by increasing access to quality child care; create a national paid family and medical leave program; and provide nutritional assistance and health programs aimed at reducing childhood hunger.

- Extend tax cuts for low- and middle-income families with children and American workers through the child tax credit, the earned income tax credit, and the child and dependent care tax credit. The President also wants to expand health insurance tax credits in the American Rescue Plan.

This table below breaks down 10 programs and credits in Biden’s American Families Plan. Key components are largely based on the White House fact sheet that was presented on April 28:

Breakdown of the American Families Plan

| Expand the Earned Income Tax Credit | Biden’s $1.9 trillion American Rescue Plan temporarily expanded the earned income tax credit, which helps low-wage workers reach a living wage. This credit ranges from $538 to $6,660 for tax year 2020, depending on filing status, number of children and earned income. The White House says that the President will call on Congress to make this expansion permanent. During his 2020 campaign, Biden had also supported eliminating the 65-year-old age cap for older workers. |

| Increase Access to Paid Family and Medical Leave | Only 20% of private sector employees had paid family leave in 2020. Biden will invest $225 billion to guarantee 12 weeks of paid parental, family, and personal illness/safe leave within 10 years, and ensure workers get three days of bereavement leave each year. The White House says the program will “provide workers up to $4,000 a month, with a minimum of two-thirds of average weekly wages replaced, rising to 80 percent for the lowest wage workers.” |

| Free Prekindergarten | Biden wants to close the achievement gap and increase labor participation for parents by providing “high-quality universal pre-kindergarten for all three- and four -year-olds.” The White House says that the President will partner up with states “to offer free, high-quality, accessible, and inclusive preschool to all three-and four-year-olds,” which will benefit 5 million children and save average families roughly $13,000. This is part of a $200 billion investment in education that prioritizes high-need areas. |

| Tuition-Free Community College and Training | The White House says that the American Families Plan will include $109 billion to “ensure that first-time students and workers wanting to reskill can enroll in a community college to earn a degree or credential for free.” This benefit will be available to all Americans and DREAMers, and qualifying students can use it up to four years. With the collaboration of all states, territories and Tribes, roughly “5.5 million students would pay $0 in tuition and fees.” Biden is also calling on Congress to fund a $39 billion program that provides two years of subsidized tuition for four-year HBCU, TCU, or MSI students in families earning less than $125,000; and another $5 billion to expand existing institutional aid grants to those schools. |

| Increase Pell Grant Awards | Biden wants to double the maximum Pell Grant award to approximately $1,400 (the maximum award for the 2021-2022 school year is $6,495). The White House says that almost seven million students depend on Pell Grants to help pay for college, but the value of these grants has fallen from covering nearly 80% of the cost of a four-year college degree to under 30%. |

| Create a College Retention and Completion Grant Program | The White House says that only “three out of five students finish any type of degree or certificate program within six years.” Biden proposes a $62 billion grant program that serves low income students in community colleges “to invest in completion and retention activities.” These will include wraparound services that range from child care and mental health services to faculty and peer mentoring, and emergency basic needs grants. |

| Education and Preparation Programs for Teachers | Biden calls on Congress to invest $9 billion in American teachers. The White House says the plan doubles scholarships for future teachers earning degrees from $4,000 to $8,000 per year, invests $2.8 billion in Grow Your Own programs and year-long, paid teacher residency programs; targets $400 million for teacher preparation at HBCUs, TCUs, and MSIs; and $900 million for special education teacher development. The plan also invests $1.6 billion to help over 100,000 educators earn in-demand credentials for special education, bilingual education, and certifications that improve teacher performance; as well as $2 billion for educator leadership programs that support new teacher mentorship and teacher diversity. |

| Expand and Make Nutrition Programs Permanent for Children | The President will invest $45 billion in overall health and nutrition programs to reduce food insecurity among children. These include: $25 billion to make the Summer EBT program permanent and available to 29 million children getting free and reduced-price meals; $17 billion to expand free meals for children in high poverty districts, which will provide free meals to an additional 9.3 million children; and $1 billion to support schools that are expanding healthy food offerings. Individuals who were convicted of drug-related felonies will now also qualify for these benefits. |

| Expand Child Care and Make the Tax Credit Permanently Refundable | Biden will invest $225 billion to fully cover child care costs for most children in “hard-pressed working families.” Under this plan, families earning 1.5 times their state median income will pay a maximum of 7% of their income. Child care providers will also get funding to develop early childhood care and education programs for culturally and linguistically diverse classes and children with disabilities. The plan also aims to raise the minimum wage for child care workers from $12.24 in 2020 to $15 per hour. Note that the President wants to make the expanded child tax credit in the American Rescue Plan permanent (which aims to benefit almost 66 million children) and calls on Congress to also make the child and dependent care tax credit permanent (which benefits over 6 million families). |

| Extend Affordable Care Act Premiums Tax Credits | The American Families Plan will invest $200 billion to make lower health insurance premiums permanent. The White House says that this will help nine million people save money on health insurance and four million uninsured people will get coverage. |

Note that during his 2020 presidential campaign, Biden supported three other family-specific credits. One of these was an elderly care credit that targets working families caring for elders with physical and cognitive needs, and it would have increased tax benefits for older taxpayers with long-term care insurance. The President also proposed making a first-homebuyers tax credit “permanent and advanceable” to help qualifying families get up to $15,000 to buy their first home, and equalizing benefits across the income scale for retirement so that working families could get tax benefits for retirement savings.

How Will Tax Rates Change?

Biden describes his Build Back Better plans as “fiscally responsible,” because they rely on tax revenue to pay for spending programs and credits. While the American Jobs Plan will be funded by corporate tax increases, the American Families Plan will be paid for by higher individual taxes on the wealthy.

This progressive tax reform will be a major shift from the 2017 Trump tax plan, which cut the corporate tax by almost half, and it will also prioritize tax credits over tax deductions to target benefits for working class families.

The president is expected to raise taxes on individuals earning more than $400,000, nearly double the capital gains tax on investors making over $1 million and close a $1 trillion tax gap by ramping up IRS enforcement against wealthy Americans and corporations evading taxes. Altogether, the White House says these tax reforms could raise $700 billion over 10 years.

This table below breaks down four ways that individual taxes will help to fund programs and credits in the American Families Plan. Key components are largely based on the White House fact sheet:

Biden Tax Plan: Breakdown for Individual Taxpayers

| Raise Top Individual Income Rate to 39.6% | The Biden administration will increase the top individual federal income tax bracket from 37% to 39.6% for incomes above $400,000. This was the 2017 rate for incomes above $418,400, before the Trump Tax Plan was approved. |

| Raise Capital Gains Taxes for the Wealthiest | Taxpayers with gains over $1 million will have to pay a higher tax rate of 39.6% on investments. This is almost double the current capital gains tax rate which is levied at 20% for individual taxpayers with income over $445,850. Biden’s tax plan will make these investors pay the same rate for investments as they do on wages, and close the stepped-up basis loophole that allows heirs to reduce capital gains taxes. |

| Eliminate Medicare Tax Loopholes | The White House says high-income workers and investors generally pay 3.8% Medicare tax on earnings. However, loopholes allow them to avoid them. Biden wants to “apply the taxes consistently to those making over $400,000, ensuring that all high-income Americans pay the same Medicare taxes.” |

| Invest in IRS Enforcement | IRS Commissioner Charles P. Rettig told the Senate Committee on Finance in April that the U.S. is losing roughly $1 trillion in unpaid taxes annually. Biden wants to increase funding to enforce the tax law and prevent high-income Americans and corporations from evading taxes. The White House says that the top 1% of individual taxpayers failed to report 20% of their income and did not pay $175 billion owed in taxes. |

Note that Biden had also initially proposed reducing the current estate tax exemption from $11.7 million to $3.5 million and increasing the maximum estate tax rate from 40% to 45%. This would have rolled back the estate and gift tax rates and exemptions back to 2009 levels. The estate and gift tax increase may have been omitted to win over moderate and bipartisan support in Congress.

While the president’s proposed tax hikes will target high-income tax brokerage accounts that are used to buy and sell securities, tax-deferred retirement accounts like traditional IRAs and 401(k) plans will not be impacted directly. Withdrawals from those retirement accounts are taxed as ordinary income, but taxpayers can manage distributions gradually to avoid being pushed into a higher tax bracket. And some high-income taxpayers may also consider moving their money to Roth IRAs since they could make tax-free withdrawals in retirement.

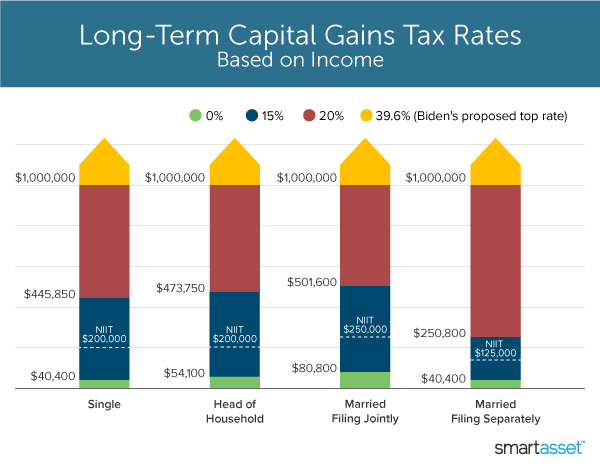

You should also note that the IRS charges an additional 3.8% net investment income tax (NIIT), which was created by the 2010 Health Care and Education Reconciliation Act. Currently, individual taxpayers and heads of household pay the additional 3.8% tax on income over $200,000. Married taxpayers filing jointly pay the surcharge on capital gains over $250,000. And married taxpayers filing separately pay it on income over $125,000.

This could raise Biden’s top capital gains tax rate up to 43.4%.

For reference, the table below breaks down the long-term capital gains tax rates and income brackets for tax year 2021. You can see income thresholds for Biden’s top rate proposal in each bracket and the 3.8% NIIT.

As the table indicates above, all taxpayers earning over $1 million in long-term capital gains will have to pay Biden’s 39.6% top rate, in addition to the 3.8% NIIT.

For a fuller explanation about how capital gains are taxed and common mitigation strategies to avoid paying higher tax rates, read Inside Biden’s Capital Gains Tax Plan.

Bottom Line

Biden presented the American Families Plan before a joint session of Congress on April 28. Democrats may face tough opposition from Republicans due to proposed tax increases and additional spending programs. Senate Republicans have already made a counterproposal to Biden’s infrastructure and jobs plan worth almost one-quarter of the President’s proposed budget. All Build Back Better plans must be presented in both chambers of Congress and approved by vote before they can get signed into law. Democrats may have to rely on the budget reconciliation process to approve the plans with a simple majority, which they have already done with the American Rescue Plan in March 2021.

It’s important to keep up with the latest developments to know what type of aid you could qualify for. You can find other relief programs at the federal government help center and our list of coronavirus relief programs by state.

Tax Planning Tips for Families

- The American Families Plan could have a significant impact on your family’s finances. It could also raise your taxes, with specific changes on investment income. A financial advisor can help you create a financial plan and optimize your tax strategy for your needs and goals. SmartAsset’s free advisor matching tool connects you with financial advisors in your area. If you’re ready to be matched with local advisors, get started now.

- Income taxes can be confusing, especially as your family grows. Use SmartAsset’s free income tax calculator to see exactly what you might owe Uncle Sam this year.

Photo credit: ©iStock.com/vorDa, ©iStock.com/NoSystem images, ©iStock.com/skhoward