President Joe Biden proposed doubling capital gains taxes for investors making over $1 million to fund his $1.8 trillion American Families Plan. This could compel some high-income investors to sell off assets before the tax hike takes effect. Others will look into alternative strategies to lower their taxes. Whether you’re thinking about selling off investments or holding them, a financial advisor can help you optimize your tax strategy.

Understanding Capital Gains and the Biden Tax Plan

Biden proposed raising the top capital gains tax from 20% to 39.6% before a joint session of Congress on April 28. This will affect long-term and short-term capital gains, since both would be taxed as ordinary income in the highest bracket.

“We’re going to get rid of the loopholes that allow Americans who make more than $1 million a year pay a lower rate on their capital gains than working Americans pay on their work,” he said.

Currently, the 20% tax paid for long-term capital gains over $459,750 is lower than the ordinary income tax rate that many Americans pay. For reference, the table below breaks down the tax rates and income brackets for tax year 2022. This is what Americans would pay on short-term capital gains, with the top rate jumping to 39.6%.

2022 Federal Ordinary Income Tax Rates for Short-Term Capital Gains

| Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

| 10% | $0 – $10,275 | $0 – $20,550 | $0 – $10,275 | $0 – $14,650 |

| 12% | $10,276 – $41,775 | $20,551 – $83,550 | $10,276 – $41,775 | $14,651 – $55,901 |

| 22% | $41,776 – $89,075 | $83,551 – $178,150 | $41,776 – $89,075 | $55,901 – $89,050 |

| 24% | $89,076 – $170,050 | $178,151 – $340,100 | $89,076 – $170,050 | $89,051 – $170,050 |

| 32% | $170,051 – $215,950 | $340,101 – $431,900 | $170,051 – $215,950 | $170,051 – $215,950 |

| 35% | $215,951 – $539,900 | $431,901 – $647,850 | $215,951 – $323,295 | $215,951 – $539,900 |

| 37% | $539,901+ | $647,851+ | $323,296+ | $539,901+ |

The president specified that the capital gains increase would only apply to three-tenths of 1% of all Americans. So while some investors may panic in response and think about selling off their holdings to avoid paying a 19.6% tax hike, it will only affect a very small portion of the country. However, if it does affect you, there are other alternatives to lower capital gains taxes.

It’s worth noting that a recent study from the University of Pennsylvania’s Wharton Business School says that raising the top rate to 39.6% will decrease tax revenue between 2022 and 2031 by $33 billion. However, the study also states “if stepped-up basis were eliminated – as proposed in President Biden’s campaign plan – then raising the top rate to 39.6 percent would instead raise $113 billion over 2022-2031.”

How Will Biden’s Tax Reform Affect Capital Gains?

The IRS applies the capital gains tax to the profits that are made from selling investments. These profits can come from short-term and long-term gains, and the agency taxes them differently.

Short-term capital gains come from investments that were sold after being held for less than one year. Whereas long-term capital gains come from investments that were sold after being held for longer than one year.

The IRS taxes short-term capital gains like ordinary income. This means that high-income single investors making over $539,901 in tax year 2022 have to pay the top income tax bracket rate of 37%. It’s important to note that Biden is also proposing a tax hike that will raise the top income tax bracket from 37% to 39.6%.

Biden’s tax plan would impact long-term capital gains significantly by nearly doubling the rate for high-income investors. Currently, individuals pay a 20% tax rate for long-term gains made over $459,750. The table below breaks down current long-term capital gains tax rates and income brackets for tax year 2022:

2022 Federal Tax Rates for Long-Term Capital Gains

| Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

| 0% | $0 – $41,675 | $0 – $83,350 | $0 – $41,675 | $0 – $55,800 |

| 15% | $41,676 – $459,750 | $83,351 – $517,200 | $41,676 – $258,600 | $55,801 – $488,500 |

| 20% | $459,751+ | $517,201+ | $258,601+ | $488,501+ |

The proposed increase would tax long-term gains over $1 million as ordinary income, which means that these high-income investors would have to pay a top rate of 39.6%.

You should note that the tax rates and income thresholds above do not apply to collectible assets like coins, gold and silver, antiques and art. Long-term capital gains on these are usually taxed at a maximum rate of 28%, while short-term gains are still taxed as ordinary income. Tax rate exceptions also apply to small business stock and property.

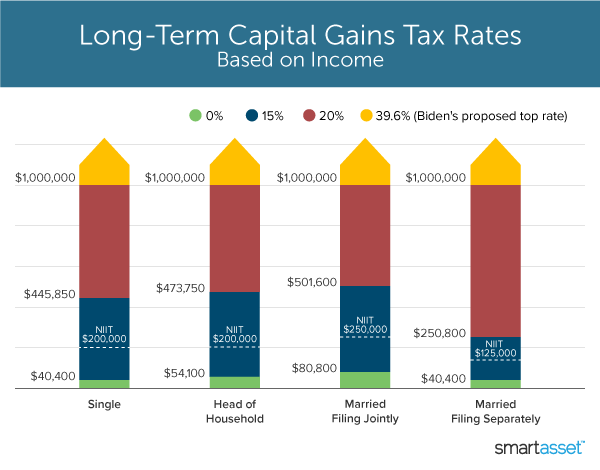

The IRS charges high-income investors an additional 3.8% net investment income tax (NIIT), which could raise Biden’s proposed tax to 43.4% for those with long-term capital gains over $1 million. And depending on where you pay state taxes, your capital gains may also be taxed at the same rate as regular income taxes as well.

The table below breaks down long-term capital gains tax rates and income brackets for tax year 2022. It also includes income thresholds for Biden’s top rate proposal and the 3.8% NIIT:

As you can see above, individual taxpayers and heads of household will have to pay the additional 3.8% tax on income over $200,000. Joint filers pay the surcharge on capital gains over $250,000, while married taxpayers filing separately pay it on income over $125,000.

Under Biden’s proposal, all taxpayers making more than $1 million in long-term capital gains would have to pay the 39.6% rate, in addition to the 3.8% NIIT.

To figure out how much you owe in capital gains taxes, use SmartAsset’s free capital gains tax calculator.

How Can High-Income Investors Lower Capital Gains?

While there are many reasons to sell off an investment, experts agree that holding onto it long-term generally makes the most financial sense. For those who are looking to minimize capital gains taxes, here are four strategies for investors:

- Time your sales: Investors have flexibility on when to sell their investments, and therefore can determine how much tax they will have to pay in a specific tax year. High-income investors may want to sell off their assets slowly over time to keep their long-term capital gains beneath the $1 million threshold.

- Harvest your losses: If your capital losses are greater than your capital gains, the IRS currently allows you to claim up to $3,000 ($1,500 if you’re married filing separately) to lower ordinary income. Investors can also carry the loss forward to other tax years, pairing them with gains in their portfolios, until they are fully claimed.

- Invest in your retirement: Contributions to IRAs and 401(k)s are a tax-free or tax-deferred alternative that is exempt from paying capital gains taxes. This means that when your retirement account sells investments you won’t have to pay a capital gains tax like you do with other investment portfolios. However, when you take out money from those retirement accounts, you will be taxed at your ordinary income tax rate.

- Trim your income: If you’re investing outside of a retirement account, you may want to wait until retirement to sell. Investors with a lower retirement income could minimize their capital gains tax. And because the capital gains rate depends on your taxable income, you may want to max out other tax-advantaged contributions to health savings accounts (HSAs) as long as you are younger than 65 or 529 plans. Note that you could also reduce your taxable income by itemizing deductions as long as they add up to more than the standard deduction. These could include charitable donations, business expenses, mortgage points and interest, and medical and dental expenses.

Under the current rules, heirs can take advantage of a tax-provision known as stepped-up basis to reduce capital gains taxes. Biden said he wants to close this loophole, which allows heirs to pay minimal taxes on inherited wealth. The Wharton study says that the new proposed tax rate without the stepped-up basis “would raise $113 billion over 10 years.”

Bottom Line

President Joe Biden proposed doubling capital gains taxes for investors making over $1 million to fund his American Families Plan. While some high-income investors may consider selling assets to avoid paying a 39.6% rate, the current tax code allows for different strategies to minimize capital gains taxes. Biden’s plan will change as it moves through Congress, and both chambers will have to approve it via vote before the president can sign it into law.

Tips for Tax Planning

- A financial advisor can help you create a financial plan and optimize your tax strategy. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- SmartAsset’s free income tax calculator can help you figure out how much you will owe in taxes.

Photo credits: ©iStock.com/Drazen_, ©iStock.com/mediaphotos, ©iStock.com/PamelaJoeMcFarlane