Finding a roommate to split your rent is a surefire way to save money, which is welcome consolation for the dirty dishes that pile up in your sink. Of course, the real estate market landscape is currently in flux due to the spread of COVID-19, but as people reshuffle their lives and housing arrangements, they may not score the coronavirus deals they expect. Though rental listings website Zumper notes the rental market has seen slowdowns in Google search volumes for apartments and apartment listings due to the increasing number of Americans sheltering in place, prices are still rising. The national average for one-bedroom rent increased 0.2% in March 2020 from the previous month, while the national average for two-bedroom rent increased 0.6% over that period; prices are up year-over-year as well. Since the current state of the world makes economizing of the essence, SmartAsset uncovered where having a roommate can save you the most.

Finding a roommate to split your rent is a surefire way to save money, which is welcome consolation for the dirty dishes that pile up in your sink. Of course, the real estate market landscape is currently in flux due to the spread of COVID-19, but as people reshuffle their lives and housing arrangements, they may not score the coronavirus deals they expect. Though rental listings website Zumper notes the rental market has seen slowdowns in Google search volumes for apartments and apartment listings due to the increasing number of Americans sheltering in place, prices are still rising. The national average for one-bedroom rent increased 0.2% in March 2020 from the previous month, while the national average for two-bedroom rent increased 0.6% over that period; prices are up year-over-year as well. Since the current state of the world makes economizing of the essence, SmartAsset uncovered where having a roommate can save you the most.

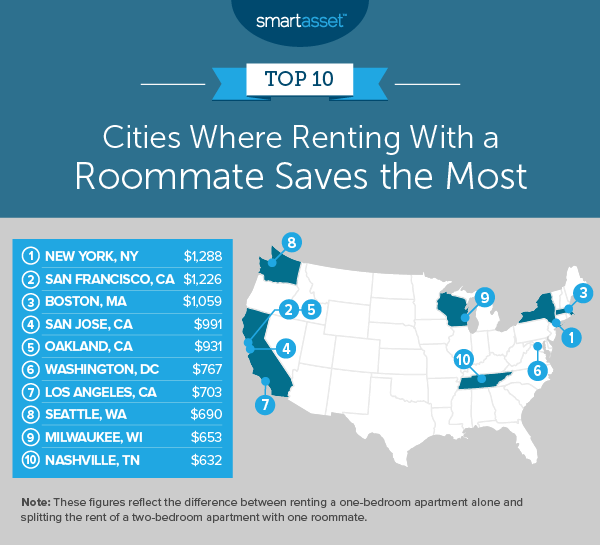

To find what living with a roommate saves you across the country, we examined data on the average rent for a one-bedroom apartment and compared it to the average rent for a two-bedroom apartment for 50 of the largest U.S. cities. We then measured the cost difference between renting a one-bedroom alone and renting a two-bedroom with a roommate. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

In our current times, the coronavirus pandemic is negatively affecting many Americans’ livelihoods and finances. In response to the resulting economic crisis, the government recently passed a stimulus package called the Coronavirus Aid, Relief and Economic Security (CARES) Act that included several provisions directly and indirectly protecting homeowners and renters.

This is SmartAsset’s sixth annual study on how much a roommate saves you. Read the 2019 version here.

Key Findings

- Rare Midwestern contender in the top 10. Milwaukee, Wisconsin is the only Midwestern city in our top 10 cities where renting with a roommate saves the most, and it is one of only two Midwestern cities to crack the top 10 in all six years that we’ve performed this study. The other city was Chicago, Illinois, which ranked ninth in our 2017 edition.

- Average savings of $524. Across the 50 cities for which we considered data, the average amount that a renter can save by splitting a two-bedroom apartment with a roommate is $524. Savings amounts are above average in 22 of these 50 cities and range from $227 in Tucson, Arizona to $1,288 in New York City.

1. New York, NY

Given the high cost of living, New York, New York is where you can save the most by renting with a roommate instead of renting on your own. According to data from Zumper, the average one-bedroom apartment in New York City is $2,973 per month. The average two-bedroom apartment is $3,369, which means splitting a two-bedroom with a roommate would result in a monthly payment of $1,684, ultimately saving you $1,288 per month, or close to $15,500 a year.

2. San Francisco, CA

With the highest average rents in the study for both a one-bedroom apartment as well as a two-bedroom one, San Francisco, California is definitely a place where cutting down on housing expenses can go a long way. Although the average two-bedroom rent ($4,655) in the city is about $1,000 more per month than the average one-bedroom rent ($3,554), splitting a two-bedroom with a roommate can benefit renters’ finances substantially. Average savings amount to $1,226, or $14,715 in a year.

3. Boston, MA

The average two-bedroom rent in Boston, Massachusetts is $2,896, or $34,752 per year. The average one-bedroom rent is $2,507, or $30,079 a year. By splitting rental costs with a roommate, the average renter in the city would only have to pay $1,448 per month, or $17,376 per year. That amounts to the third-highest savings in our study, at $1,059 a month, or roughly $12,700 per year.

4. San Jose, CA

The average San Jose, California renter pays $2,475 per month for an apartment, according to data from Zumper. That means a renter in San Jose is shelling out upwards of $29,000 per year. Renting a two-bedroom apartment with a roommate would be a better decision for the person’s finances, since that way each roommate would only have to pay $1,448 per month, saving $991 per month and $11,889 per year.

5. Oakland, CA

The third and final Bay Area city in our top five, Oakland, California has an average one-bedroom rent of $2,394 a month and an average of $2,928 total ($1,464 each) for two-bedroom rent. Savings for renters in Oakland who choose to have a roommate amount to $931 each month per person, or upwards of $11,000 in a year.

6. Washington, DC

Renting a one-bedroom apartment in Washington, DC would cost the average renter $2,261 per month, or $27,135 per year. By comparison, splitting a two-bedroom apartment would cost each roommate $1,494 each month, or $17,926 each year. This results in monthly savings of $767 and annual savings of $9,209.

7. Los Angeles, CA

The average one-bedroom rent in Los Angeles, California is $2,248 per month, or almost $27,000 per year. Although the average two-bedroom rent is almost $850 more per month – at $3,091 per month and roughly $37,000 per year – it saves to share the costs with a roommate. That way, each renter would pay only $1,545, resulting in savings of $703 in one month, or roughly $8,400 in one year.

8. Seattle, WA

If the average renter in Seattle, Washington chose to live in a one-bedroom apartment in Seattle, the person would have to allocate $1,858 of his or her monthly budget toward rent, making the yearly rental expense $22,300. However, if the person were able to find a roommate and split the rental costs of a two-bedroom apartment, each person would only have to pay $1,169 per month – resulting in savings of $690 per month, which ultimately amounts to $8,277 saved in one year.

9. Milwaukee, WI

The only Midwestern city in our top 10, Milwaukee, Wisconsin has relatively high savings for roommates who split the costs of a two-bedroom apartment instead of separately renting one-bedroom apartments. The average one-bedroom apartment in Milwaukee costs $1,236 per month, or $14,827 in a year. By comparison, the average two-bedroom apartment in the city costs $1,165 per month, or $13,984 in a year. But split down the middle, each roommate in a shared two-bedroom would only need $583 per month to cover rent. This amounts to savings of $653 per month, or upwards of $7,800 in a year.

10. Nashville, TN

Nashville, Tennessee rounds out our top 10. The average one-bedroom apartment in Nashville costs $1,327 per month. By splitting the cost of the average two-bedroom apartment with a roommate, a Nashville resident would instead only need $695 to cover rental expenses. This means $632 saved per month, or $7,579 in a year.

Data and Methodology

In order to find the cities where a roommate saves you the most, SmartAsset examined data on 50 of the largest U.S. cities. We compared them across the following two metrics:

- Average rent for a one-bedroom apartment. Data comes from Zumper and covers weekly rent prices from April 2019 to April 2020.

- Average rent for a two-bedroom apartment. Data comes from Zumper and covers weekly rent prices from April 2019 to April 2020.

We measured how much a person could save in each city by moving from a one-bedroom apartment to a two-bedroom apartment. To do this, we compared the cost of a one-bedroom to half the cost of a two-bedroom for each city, to account for living with a roommate. We ranked the cities according to where the savings were the largest.

Tips for Managing Your Savings

- Reassess your budget if possible. If you’re wondering how to rethink your budget in light of recent events, or wondering how to make most of any stimulus check you may have received, our budget calculator can help.

- To rent or to buy? Sometimes it’s not worth it to jump right into homeownership. Understand whether continuing to rent is the right choice for you using SmartAsset’s Rent vs. Buy calculator. No matter what your homeownership status, it might be useful to learn about the ways that the recent Coronavirus Aid, Relief and Economic Stablility (CARES) Act passed by the government directly and indirectly protects homeowners and renters.

- Consulting an expert could save you time and money in the long run. If you’re looking for guidance and are able to do so, it might be useful to seek the advice of an expert advisor. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/bernardbodo