Pew Research Center found that in 2017 more U.S. households were headed by renters than at any point since 1965. Considering the fact that rent is a major expense for many people – more than half of household income in some of the country’s largest cities – workers might find themselves clocking extra hours to pay their landlords and build their savings. Of course, it can take more work hours to cover rental costs in some cities compared to others.

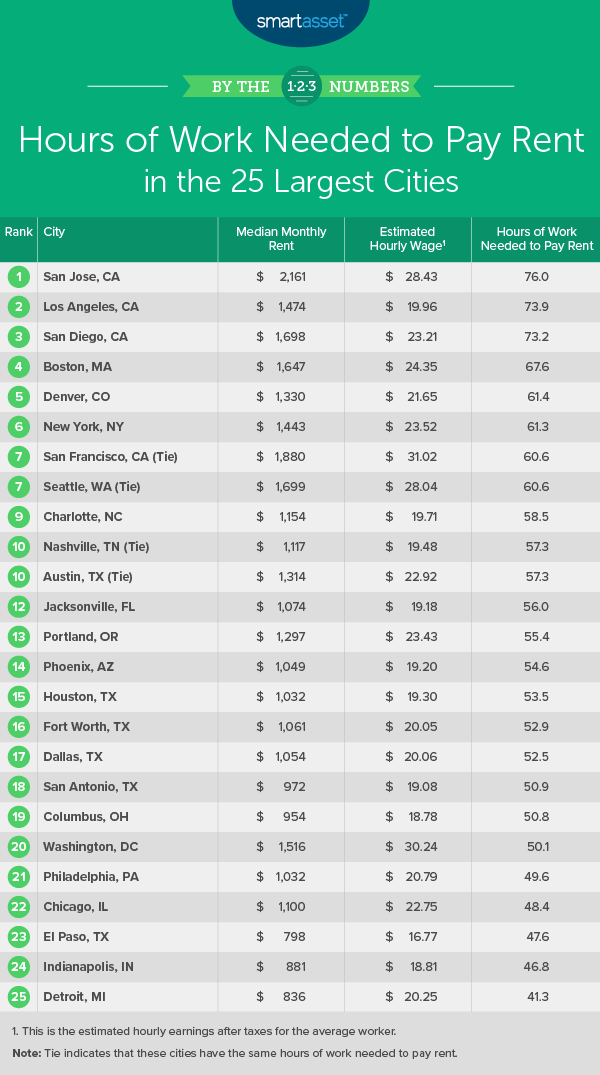

In this study, SmartAsset uncovered the hours of work needed to pay monthly rent in the 25 largest American cities, considering data on the following metrics: average annual take-home pay, average hours worked per year and median rent. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is the 2020 version of this study. Check out the 2019 version here.

Key Findings

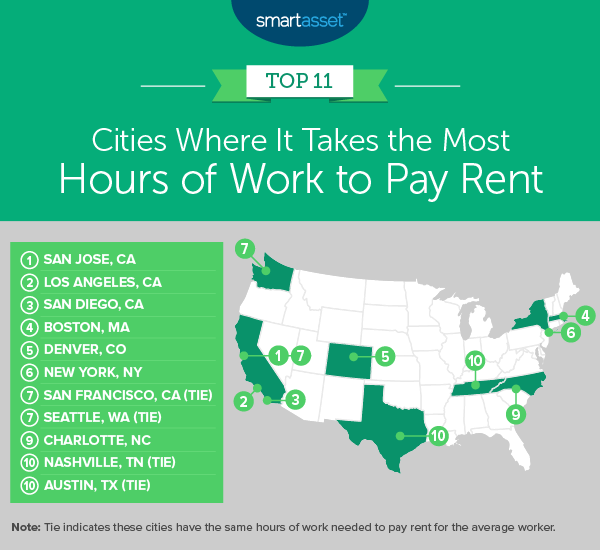

- Several cities in Western states require more work to cover rent. Of the 10 cities in the country where the highest number of hours is needed to pay rent, six are in Western states: California, Colorado and Washington State. Four of those six are in California, with an average monthly rent across them of $1,803.

- Housing costs are high across all large U.S. cities. Annual rent comprises more than 30% of average earnings in all 25 cities in our study, suggesting that many residents may be housing-cost burdened. In fact, in three California cities in our study – San Jose, Los Angeles and San Diego – housing costs comprise more than 50% of average earnings for workers.

1. San Jose, CA

It takes more than 76 hours of work in San Diego, California to pay median monthly rent, which is $2,161 or almost $26,000 per year. The median worker earns $40,596 after taxes, and the estimated hourly wage is about $28. San Jose also ranks as the No. 1 city where homeowners spend most on housing in the U.S.

2. Los Angeles, CA

The average annual take-home pay in Los Angeles, California is $26,740, or an hourly wage of $19.96. By our estimates, the average worker in this city would need to work almost 74 hours to be able to pay the median monthly rent, $1,474.

3. San Diego, CA

In the third of four California cities on this list, San Diego, the average worker needs to clock a little more than 73 hours to cover monthly rent, which is $1,698. Given that the average worker in San Diego works 39 hours per week, it would take this person almost two weeks to work enough to cover that monthly rent. The average worker in San Diego earns $39,500 before taxes, which means the take-home pay is about $32,400, or a little more than $23 per hour.

4. Boston, MA

In Boston, Massachusetts, the average worker earns close to $33,000 after taxes, or about $24 an hour. The median monthly rent in Boston is $1,647, which means residents there will have to work more than 67 hours to pay for a month’s rent. Given that the average worker in Boston works about 38 hours per week, it would take about 12 to 13 days for a worker to cover this amount.

5. Denver, CO

The median monthly rent in Denver, Colorado is $1,330, the third-lowest rent amount across all 10 cities on this list. The average worker in Denver earns $42,409, which means take-home pay is $34,335 after taxes, or $21.65 an hour. In order to cover the costs of the average monthly rent in the city, a person would need to work about 61.4 hours. Of course, getting a roommate can help mitigate the expense of rent.

6. New York, NY

New York City has the sixth-highest number of hours needed to pay rent across the 25 largest cities in the country. The average worker in New York earns $40,932 and takes home $31,627 after taxes, or $23.52 per hour. With a median monthly rent of $1,443 for an individual share of rent across all five boroughs, the average worker in New York City would have to work over 61 hours to cover rent..

7. San Francisco, CA (Tie)

In San Francisco, California, the median monthly rent is $1,880, the second-highest monthly rent amount across all 25 cities in our study. However, the average worker in the city makes $31.02 per hour, or $50,002 after taxes. This means that a person would have to work 60.6 hours in order to cover rent costs. At an average of 40.5 hours worked per week in San Francisco, it would take this worker about a week and a half to pay for rent.

7. Seattle, WA (Tie)

Seattle, Washington ties with San Francisco for seventh place, with workers needing to put in roughly 60.6 hours to pay the median monthly rental cost of $1,699. The average worker in Seattle earns $52,385 and takes home $43,678 after taxes, or $28.04 per hour. While renters may be frustrated to spend so much time working just to cover their housing costs, living in the city may be worth it as Seattle ranks among the top boomtowns in America with low unemployment and healthy income growth.

9. Charlotte, NC

Average earnings for a worker in Charlotte, North Carolina are $36,340. After taxes, the average worker would take home $29,474, or $19.71 an hour. Charlotte has the second-lowest median monthly rent across the top 10 cities, at $1,154. This means annual rent costs in the city total $13,848. To be able to pay for a month’s rent in Charlotte, the average worker would have to work almost 59 hours.

10. Nashville, TN (Tie)

The median monthly rent in Nashville is $1,117 or $13,404 per year. With the average worker there earning $29,971 after taxes, or $19.48 per hour, it would take the person approximately 57 hours of work to cover the cost of rent each month. Still, Nashville may be particularly appealing to younger members of the workforce given that it ranks among the best cities for new college grads.

10. Austin, TX (Tie)

Austin, Texas ties with Nashville, with the 10th-highest number of hours of work needed to pay rent of the 25 largest cities in the U.S. The average worker in Austin makes about $23 per hour, and median monthly rent in the city is $1,314. As a result, the typical worker will need to put in an estimated 57.3 hours of work to cover rent alone.

Data and Methodology

To find out how many hours of work are needed to pay rent in the 25 largest cities in the U.S., we looked at data on the following three metrics:

- Average annual take-home pay. This is the average worker’s earnings after accounting for income taxes. To find out how much each worker would pay in income taxes, we ran the average worker’s earnings data through our income tax calculator. We assumed the average worker would contribute nothing to an IRA or 401(k), take the standard deduction and file as a single filer. Data for average earnings comes from the U.S. Census Bureau’s 2018 1-year American Community Survey.

- Average hours worked per year. This is the number of weeks worked per year multiplied by the number of hours worked per week. Data comes from the U.S. Census Bureau’s 2018 1-year American Community Survey.

- Median monthly rent. Data comes from the U.S. Census Bureau’s 2018 1-year American Community Survey.

First, we found the average hourly wage for each worker by dividing average annual take-home pay by average hours worked per year. Then we divided the monthly median rent by the average hourly wage. This resulted in the average hours of work needed to pay rent. Finally, we ordered the cities from highest to lowest based on the average number of hours needed to pay rent.

Tips for Managing Your Savings

- How much are you really taking home? When budgeting how much to allocate to needs, wants and savings, it’s important to know how much you’re actually starting with. Use SmartAsset’s paycheck calculator to find out.

- 401(k) matching. Though we assumed in the study that a worker didn’t contribute to an IRA or 401(k), doing so can be a great way to grow your savings. In particular, taking advantage of a 401(k) employer match program is an ideal way to build your retirement savings faster and not leave money on the table. When considering a new job always review the retirement plan offerings to be sure that it’s the right one for your needs.

- Expert financial advice. You already work hard to make ends meet, so why put in more hours than you need to in order to get expert help with your assets? Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/Drazen Zigic