Rising rents present a major challenge for non-homeowning city dwellers nationwide. Since 1983, the cost of housing for urban renters has risen more than 324%, according to the Bureau of Labor Statistics’ Consumer Price Index. In the meantime, average workers in the largest cities have struggled to keep up as they fill their savings accounts with their earnings, only to see that money go to their landlords. Below, we track this phenomenon by measuring the hours of work needed to pay rent in the largest 25 cities.

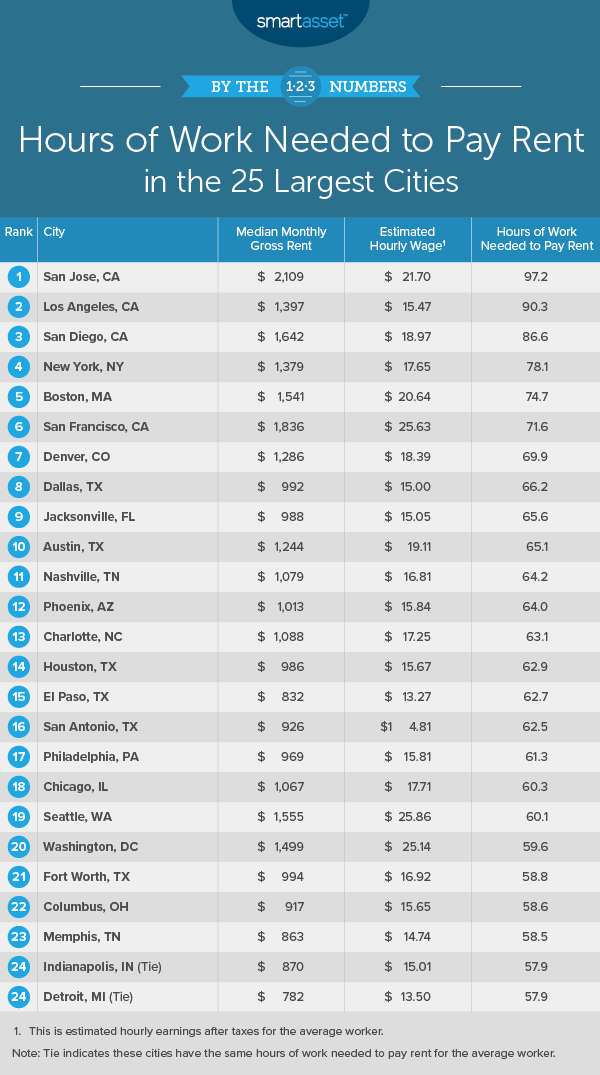

In order to rank the places where it takes the most hours of work to pay for rent, we examined three factors. Specifically, we looked at median after-tax earnings, average annual hours worked and median monthly rent. Check out our data and methodology below to see where we got our numbers and how we put them together to create our final rankings.

This is the 2019 version of this study. Check out the 2018 version here.

Key Findings

- Higher rent is not always a bad deal for workers – While it is true that more expensive cities tend to populate the top of this study, you can also find some expensive cities toward the bottom. In Seattle and Washington, D.C., for example, rents cost at least $1,500 a month on average. In those cities, the average worker needs to put in about 60 hours of work to cover rent. Meanwhile, two cities with sub-$1,000 monthly rents – Jacksonville, Florida, and Dallas, Texas – appear in the top 10.

- It is difficult to avoid being housing-cost-burdened – Across all the cities analyzed, even the ones requiring the least amount of work to pay rent, rents typically eat up at least 30% of income. Workers who are trying to save money should certainly look to shack up with roommates or look to creative budgeting solutions to make sure they can hit their financial goals.

1. San Jose, California

Median rent in San Jose costs $2,109 per month, or slightly more than $25,300 per year. While jobs are high-paying in this city, so are the taxes. The median worker earns $47,500, which is $38,356 after taxes. Per hour, that equals $21.70. So to make rent, the average worker in San Jose needs to put in 97 hours of work per month.

2. Los Angeles, California

Earnings in Los Angeles are low by California standards. The median worker here takes home a net pay of just under $27,000. We estimate the average worker here needs to put in more than 90 hours at the workplace to cover his or her monthly rent. In total, rent is equal to more than 50% of earnings for the average worker.

3. San Diego, California

In San Diego, the average resident needs to work nearly 87 hours to cover monthly rent expenses. Those long hours to cover rent are necessary despite the relatively healthy earnings the average San Diego worker takes home. In San Diego, the average worker earns nearly $19 per hour.

4. New York, New York

On average, workers in New York can expect to pay about 40% of their income on rent. Residents here pay $1,379 per month in rent and earn $17.65 per hour on average. But there’s good news for New York workers: The total time they need to work a month to pay rent is down about an hour from last year.

5. Boston, Massachusetts

The average worker in Boston earns $35,083 after taxes, or about $20.64 per hour, and the average rental here costs $1,541 per month. Our numbers show the average worker needs to put in about 74.65 hours of work a month to pay rent.

6. San Francisco, California

San Francisco comes in sixth, despite having the second-highest average rent in the study. The average rental in San Francisco costs a whopping $1,836 per month. But the average San Francisco worker earns just under $26 per hour. So to pay for rent, the average San Francisco worker needs to work slightly more than 71 hours a month. Of course, to afford the other necessities in life and sock money away in an emergency fund or a high-yield savings account, the average worker will need to work more than that.

7. Denver, Colorado

The average rental in Denver is fairly expensive, but thankfully for locals, pay is pretty good as well. The average worker in The Mile High City takes home about $18.39 per hour, while the average rental costs $1,286 per month. To pay for the average rental, the average resident needs to work just under 70 hours per month.

8. Dallas, Texas

On its face, rent is not that expensive in Dallas. The average rental costs less than $1,000 per month. But the problem for renters in Dallas is the relatively low pay. The average worker in Dallas takes home just under $15 per hour. We estimate the average Dallas worker needs to work 66 hours per month to have enough to pay for the average rental.

9. Jacksonville, Florida

To afford the average rental in Jacksonville, residents would need to work just under 66 hours on average. Like in Dallas, the main culprit requiring more hours of work to pay rent is not the price of rent but rather the low pay. The average worker here earns $15.05 per hour.

10. Austin, Texas

The average rental in Austin costs about 35% of the average worker’s income. According to the latest Census Bureau data, the average rental in Austin costs $1,244 per month, and the average worker earns more than $19 per hour, which is high by Texas standards. But because rents are lofty, the average resident needs to work 65 hours a month to pay rent.

Data and Methodology

In order to find out how many hours of work are needed to pay rent in the country’s 25 largest cities, we looked at data on the following three metrics:

- Average annual take-home pay. This is the average worker’s earnings after accounting for income taxes. To find how much each worker would pay in income taxes, we ran the average worker’s earnings data through our income tax calculator. We assumed the average worker would contribute nothing to an IRA or 401(k), take the standard deduction and file as a single filer. Data for average earnings comes from the U.S. Census Bureau’s 2017 1-year American Community Survey.

- Average hours worked per year. This is the number of weeks worked per year multiplied by the number of hours worked per week. Data comes from the U.S. Census Bureau’s 2017 1-year American Community Survey.

- Median rent. Data comes from the U.S. Census Bureau’s 2017 1-year American Community Survey.

In order to find out how many hours of work the average resident needs to pay rent in each city, we first found the average hourly wage for each worker. To do this, we divided average annual take-home pay by average hours worked per year. We then divided the monthly median rent by the average hourly wage. This gave us the average hours of work needed to pay rent. We then ordered the cities from highest to lowest based on the average number of hours needed to pay rent.

Tips for Saving Money

- Try a high-yield savings account – If you are still banking with traditional brick-and-mortar retailers, you are missing out on some serious savings. Online-only banks like Ally and Synchrony offer annual percentage yields (APYs) hundreds of times higher than the traditional banks.

- Get expert advice – Planning for the future can be difficult. When it comes to your finances, any mistake can be costly. To make sure you’re on the right track, why not seek out the advice of a trusted financial advisor? If you are not sure where to find a financial advisor, check out SmartAsset’s financial advisor matching tool. It will match you with up to three local financial advisors who fit your specific needs.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/kate_sept2004