Financial advisors are moving their talent south. A new report by the Investment Adviser Association (IAA) and National Regulatory Services (NRS) shows that financial advisors have moved away from traditional financial centers like New York to Southern states such as Florida and Texas. In fact, between 2019 and 2021, the number of advisors in Florida grew by more than twice as much as in California and over three times as much as in Connecticut. New York, on the other hand, shrunk by 62 advisors during those years. Let’s break down what this trend could mean for the industry.

Whether you are looking for retirement or investment advice, a financial advisor could help you create a financial plan for your needs and goals.

Financial Advisor Growth in the South Outpaces East and West

The study from the IAA and NRS shows that, between 2019 and 2021, growth in nontraditional financial centers in Florida and Texas outpaced growth in the East and West.

Overall, the investment advisor industry grew by 16.7% in 2021, with almost 15,000 Securities and Exchange Commission (SEC)-registered investment advisors managing $128.4 trillion in assets for 64.7 million clients.

A specific geographic breakdown, however, shows that this growth was uneven. Growth in the South outpaced growth in the West (13.7% vs. 7.2%) in 2021. The East shrank by 1.9% in the same year.

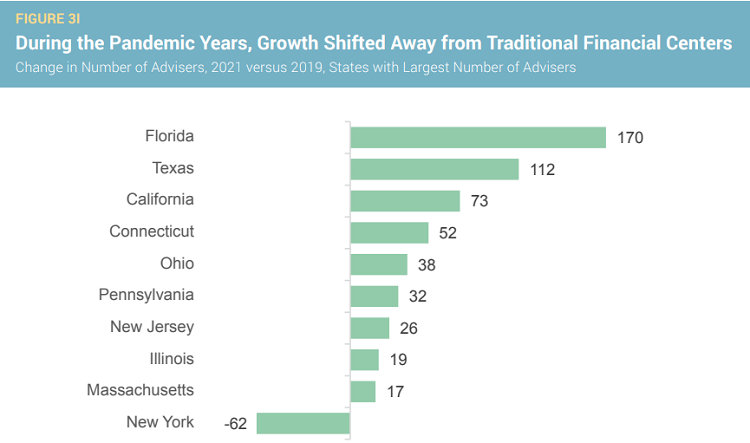

Florida grew the most during the early pandemic years, with 170 new financial advisors from 2019 to 2021. Texas followed second with 112, California was third with 73 and Connecticut ranked fourth with 52. The chart from the IAA report below shows the pandemic shift in growth for the 10 states with the largest number of advisors:

Despite losing 62 advisors during the pandemic, New York, which is widely considered the financial capital of the world, is still home to the largest number in 2021 (2,450). California ranks second with 1,703. Texas is third with 879, and Florida is fourth with 737.

Why Are Advisors Leaving New York?

According to SmartAsset’s 2021 study, a major reason for the move away from New York in the investment advisor industry is likely due to the COVID-19 pandemic. Restrictions in 2020 and 2021 presented an opportunity for advisors to relocate to new areas with lower office costs, sunnier weather and more remote work opportunities.

This was the case with many registered investment advisor (RIA) firms. About 20% of firms moving their headquarters were making the exodus from New York City in 2021, according to SmartAsset.

At the state level, Florida saw the largest uptick in RIA SEC registrations between 2020 and 2021, as the number of RIAs with headquarters in Florida increased by 25.

One notable example is the investment management firm Ark Invest, which recently moved its headquarters to St. Petersburg, Florida after closing its New York office permanently in October 2021.

The pandemic, combined with higher office space costs in New York, and no income taxes in Florida and Texas, likely created relocation opportunities that many firms in the industry found attractive.

What Advisors Can Learn From This Trend

SmartAsset’s 2022 study, which asked 230 financial advisors about their client communication frequency and methods, shows that while in-person meetings are still the most important method to connect with clients, exclusive virtual advisor-client relationships have become popular.

Remote communication has also made connecting with clients more flexible. Digital platforms such as Zoom, Google Meet, GoTo Meeting and Microsoft Teams, could allow advisors to reach more clients in a growing trend.

As financial advising moves into the digital sphere, advisors may be able to video call clients from the sunny beaches of Florida instead of scheduling in-person meetings in New York’s financial district.

And the IAA study also supports this.

“The rapid transition to a work-from-home environment during the pandemic clearly facilitated the shift away from traditional financial centers,” the report says. “At this point, it is unclear whether the shift is largely a function of the pandemic or whether the pandemic merely accelerated an existing trend.”

Bottom Line

The COVID-19 pandemic shifted the way many advisors and firms do business, moving away from traditional financial centers and making services more accessible through digital platforms. Remote accessibility is also changing the way advisors connect with clients, creating new opportunities to deliver qualified financial advice to different locations.

Tips for Growing Your Financial Advisory Business

- Let us be your organic growth partner. One way financial advisors can earn more is by expanding their client base. Our research shows that many new investors are looking for financial advisors; between March and August of 2020, online searches for the term “financial advisor” jumped by nearly 20%. If you are looking to capitalize on increased demand for financial advice, take a look at SmartAsset’s SmartAdvisor platform. We match certified financial advisors with validated, high-intent clients throughout the U.S.

- Expand your radius. SmartAsset’s recent survey shows that many advisors expect to continue meeting with clients remotely following COVID-19. Consider broadening your search and working with investors who are more comfortable with holding virtual meetings and/or spacing out in-person meetings.

Photo credit: ©iStock/Tashi-Delek, Investment Adviser Association, ©iStock/, franckreporter