Posts by Tiffany Patterson

Ways to Protect Your Retirement Savings in a Divorce

Protecting your retirement savings during a divorce may not be at the top of your mind when you are going through the process of splitting up with your spouse. The emotional toll on you and your family, after all, likely… read more…

6 Questions to Ask Before Refinancing

A year after the housing bubble burst, I decided to make a career change and go back to school for my MBA. During one of my first finance courses, my professor discussed her reasons for refinancing her home mortgage at… read more…

6 Ways to Protect Your Bank Accounts

Recently a younger family member mentioned that he had just gotten a new debit card for his checking account because someone had gotten into his account. He said he wasn’t sure how it happened, but someone got access to his checking… read more…

5 Ways to Deal With a Financially Irresponsible Spouse

We’ve all heard the statistic that says an increasingly prevalent cause of divorce is financial issues. It takes more than love to keep a marriage intact, and unfortunately, many people don’t realize that until it’s too late. Marriage requires communication and honesty,… read more…

Pros and Cons of Lending Money to Family Members

Mixing money and family can quickly become very tricky. The reality, though, is that many of us will go through tough financial times—whether we’re just starting out on our own, we recently lost a job or we had some other… read more…

Top 5 Risks to Your Retirement Fund

Saving for retirement can be confusing and arduous. This is especially true if you’re in your twenties or thirties and have decades ahead before you can even seriously consider retiring. However, thinking about and saving for retirement is a major burden that we all have to deal with. To that end, there are constant threats… read more…

5 Steps to Help Care for Elderly Parents

One of the toughest things you will do as an adult is watch as your parents deteriorate with age. Emotionally, it is taxing to watch the very people or person who cared for you as a child slowly become more and more dependent on you for support. The emotional strain can be difficult enough, but… read more…

What Is a Life Insurance Beneficiary?

Although it can be disheartening to dwell on what happens after we die, it’s important for all of us to get our end-of-life financial checklist in order while we’re alive. That way, those who love and depend on us are taken care of after we’ve gone. Arguably the most important part of the estate planning… read more…

What Is Return of Premium (ROP) Life Insurance?

Life insurance is just that, insurance on your life. You pay your policy usually for 10 to 30 years. If you die during this period, your beneficiaries receive a payment from the insurance company. With a traditional term life policy, you do not receive any payout if you outlive your policy. For many, this can… read more…

When is the Right Time to Purchase Life Insurance

When it comes to life insurance, one of the main questions that consumers contend with is when is the right time to purchase? In order to answer this question, it is important to first understand what life insurance is. Related:… read more…

Top 5 Frequent Credit Card Mistakes

Most people’s first venture into establishing credit is opening a credit card. Unfortunately, many of those people are young, on their own for the first time and still figuring out how to handle their money. This can lead to a number of problems, often eventually leading to poor credit. However, opening a credit card does… read more…

The Pros and Cons of Raising the Minimum Wage

For some time now, there’s been a national debate that’s centered around whether or not to raise the federal minimum wage. The current federal minimum wage is $7.25 an hour, while some states are raising that to $15. On the other hand, former President Barack Obama advocated for gradually raising the minimum wage to about… read more…

5 Popular Countries to Consider for Retirement

When it comes to retirement there are a number of things that need to be considered. One of the most important is where you are planning to live during your golden years. For many North Americans, retiring abroad is becoming… read more…

5 Reasons to Return to Graduate School

Now is the time of year for graduate school application deadlines. There can be many benefits to returning to school. Obtaining your graduate degree can help open doors for you in your current career or help if you are considering… read more…

Why You Shouldn’t Count on Your Home Equity for Retirement

Many of us have been taught to look at the purchase of a home as a good investment. When we purchase a home, we are investing in a neighborhood, a school system, and hopefully a safe community to raise our families and spend a large portion of our lives. Buying a home is also a… read more…

5 Signs It’s Time to Start Looking for a New Job

We are living in an age in which professionals, typically, do not spend their entire career with one company. The loyalty between employer and employee there for previous generations is no longer here, on both side of the employer-employee scale. Today’s… read more…

Pros and Cons of Store Credit Cards

Different retailers often try and talk their customers into signing up for store-branded credit cards. Many of them promise to reward account holders with exclusive discounts and perks. And applying for them can be tempting, especially when the holiday season… read more…

How Prepared Are You For Retirement?

When you are first starting out in your career, you tend to think of retirement as something far off. In the days of our grandparents, and even some of our parents, retirement savings wasn’t even an issue – many employers took care of that with company pension plans. Find out now: How much do I… read more…

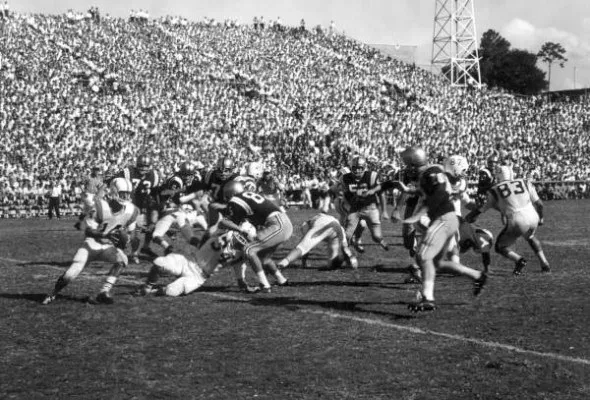

How College Athletes Are Paid in 2026

Elite professional athletes regularly draw salaries reaching into the millions. The minimum annual salary for players in the four major sports leagues is well into the six-figure range, and it’s not uncommon for star players to receive multi-year contracts worth… read more…

Fast Food Advertising, Obesity and the Cost to Everyone

In the U.S., there is growing national concern over the obesity epidemic. According to public health workers, anyone with a body mass index (BMI) over 30 is considered obese. Nearly, one-third of Americans are obese today, and it is estimated… read more…

How Accurate Are Car Dealership Reviews?

Today, more than ever, consumers are relying heavily on online reviews when making purchase. This is particularly true in the automobile industry. Online reviews are supposed to be a simple way for customers to give their informed opinion and experience… read more…

Choosing the Best Financial Advisor for Your Personal Finances

When it comes to money, it often takes a team to help you manage it correctly, particularly once you start working full-time, saving for retirement and starting a family. Financial planning can be difficult to navigate and is often time… read more…

Building Credit Without Debt

When it comes to building credit, many of us are confused as to how to actually build good credit, and the major details that make up a credit card contract or a credit report. This information is extremely important to be aware of, especially when starting out or trying to rebuild your credit after a… read more…