Professional football players lead enviable lives. The pro athletes on an NFL roster make a minimum of $435,000 per year, approximately 10 times the U.S. median income. The top earners get paid over $20 million per year. While that income guarantees a certain level of financial security and material comfort, there’s at least one day of the year that NFL players don’t get to enjoy: tax day.

Curious about how you can take advantage of your own tax breaks? Consider working with a financial advisor.

Understanding NFL Player Taxation

As high earners, NFL players face top tax rates at the federal and local level. In some places, these marginal rates exceed 50%.

But it doesn’t end there. In addition to paying taxes to the IRS and their home team’s state, many professional football players have to pay taxes to every single state in which they play a game, the so-called “jock tax.” That can mean filing as many as 10 different tax returns and coughing up as much as 50% of their salary and bonuses in taxes.

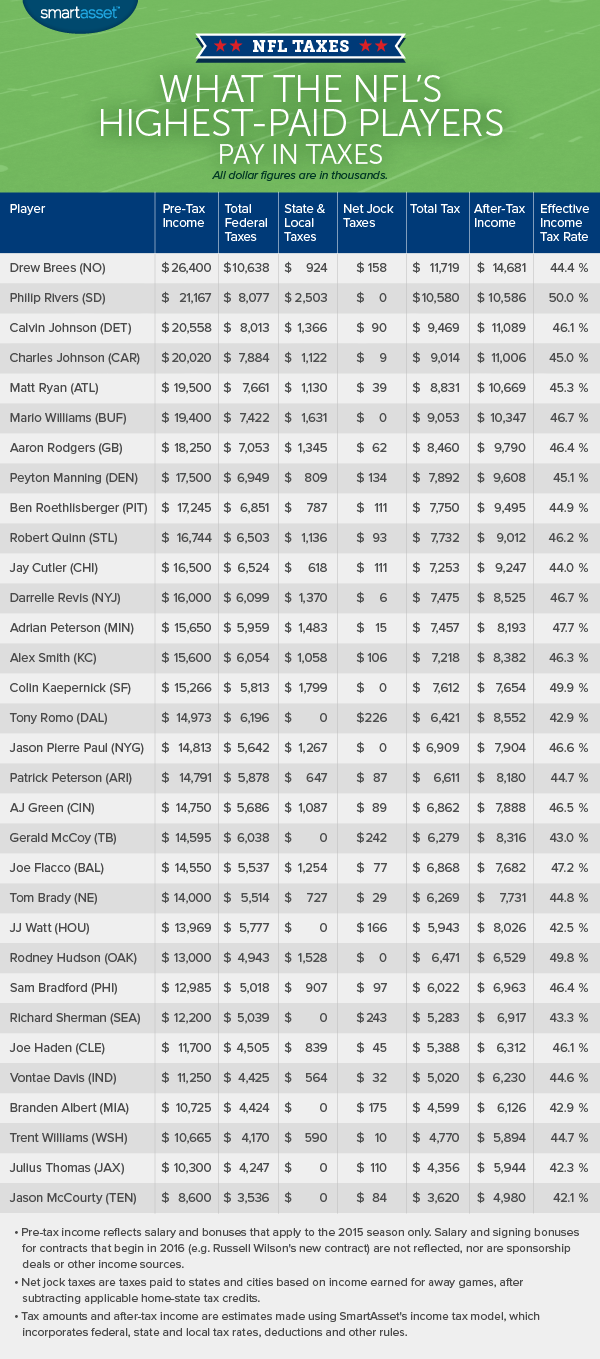

To estimate the tax bills for the top-earning NFL players, SmartAsset ran salary and bonus data from overthecap.com (accurate as of time of writing) through the income tax model that drives our federal, state and local income tax calculator.

We calculated the federal, state and local taxes for the two highest-paid players on every NFL team. Our analysis also incorporated taxes paid to the states and cities of away-game opponents, as well as applicable deductions, credits and exemptions. (Read more about our methodology below.)

Key Findings

- California hits hard. Athletes who play for one of the NFL’s three California teams pay a marginal tax rate of 13.3%, the highest state-level tax in the country. For that reason, players on those teams give up more of their income in taxes than players anywhere else in the country. Phillip Rivers, QB for the San Diego Chargers, has the highest effective tax rate of any NFL player, according to our analysis.

- AFC South is the most tax-friendly NFL division. While on-field results for the four teams in the AFC South have been mixed this season, they are clear winners of the tax bracket. Three of the four teams play in states with no tax on regular income (Texas, Florida and Tennessee), which means no jock taxes on away games. Tax bills for players on Houston, Jacksonville and Tennessee are among the lowest in the league.

- AFC West is worst for taxes. With two teams in California and another in Kansas City (where there are both state and local taxes), the AFC West is the worst division for away-game jock taxes.

NFC East

New York Giants

New York City has some of the highest taxes in the country, with marginal rates reaching 12.7% when including both the state income tax and city income tax. The good news for players on the Giants: they don’t actually play (or practice) in New York. The Giants’ stadium and practice facility are located in New Jersey.

Instead of paying New York taxes, Giants players face the moderately lower tax burden of the Garden State. That means that Jason Pierre Paul and Eli Manning (the top two earners on the Giants for 2015) pay a “mere” 46.6% of their NFL income in taxes, instead of the over 50% rate they would pay in NYC. (Note: Our analysis was done before JPP’s newest and smaller contract.)

Dallas Cowboys

America’s Team is a dream destination for any football player. The ‘Boys have the largest stadium, the biggest fan base and a brand with international appeal. They also pay some of the lowest taxes. That’s because Texas has no state or local income taxes.

Washington

Washington doesn’t actually play in Washington, D.C., which means that players on the team avoid the city’s 8.95% top tax rate. Furthermore, while their home games occur in Maryland (where the total state and local tax rate is also 8.95%), they practice in Virginia, which has a top rate of 5.75%. Thanks to a reciprocal agreement between Virginia and Maryland, the team’s players likely do not have to pay any Maryland taxes whatsoever.

Philadelphia Eagles

Among states with an income tax, Pennsylvania’s flat 3.07% rate is one of the lowest. Unfortunately for Eagles players, they also have to pay a 3.92% tax to the city of Philadelphia. That’s in addition to the jock taxes paid to other states.

Jock taxes in Atlanta, Massachusetts, Detroit and North Carolina also tack on an additional $97,000 to quarterback Sam Bradford’s taxes and $61,000 to offensive tackle Jason Peters’s taxes, according to the SmartAsset tax model. In sum, that leads to effective rates of just over 46%.

NFC North

Green Bay Packers

The division-leading Packers have one of the highest-paid players in the league in Aaron Rodgers. Rodgers will earn about $18.2 million in salary and bonuses for the 2015 season but after paying federal and state taxes equaling 46.4% of his income, he’ll have “only” $10 million left, according to our tax model. (Note: that does not include income earned for his State Farm commercials, data on which is not publicly available.)

Minnesota Vikings

After California, Minnesota is the highest-tax venue for NFL players. The state’s top marginal rate is 9.85%. For someone like Adrian Peterson, who earns over $15 million per year, that means more than $1 million annually in state taxes alone.

Chicago Bears

Chicago is the country’s third largest city, but it ranks nowhere near the top when it comes to income taxes (property taxes are another story). The state income tax rate in Illinois is 3.75% and the city has no local income tax. Nonetheless, thanks to high federal taxes, Jay Cutler and Matt Forte pay an estimated 44% and 43.5% of their income in taxes respectively.

Detroit Lions

Calvin Johnson is the NFL’s highest-paid receiver, earning more than $20 million per year. He’s known for out-muscling DBs to snare tough catches, but not even Megatron can beat the Tax Man. SmartAsset estimates that nearly half his playing income – 46.1% to be exact – goes to taxes.

The largest recipient is the IRS, but the state of Michigan and the city of Detroit also tax residents at rates of 4.25% and 2.4% respectively. (QB Matt Stafford earns slightly less than his top wideout but still pays an effective tax rate of 46%.)

NFC South

Atlanta Falcons

The Falcons are one of the surprise teams of 2015. Matt Ryan to Julio Jones has been the league’s most lethal QB-receiver combo. They are also one of the highest paid pairings, earning $31.9 million together this season.

Thanks to a fairly moderate income tax in Georgia (the top rate is 6%) they get to keep more of that income than many other top NFL players. Overall, however, they are still paying an estimated $14.4 million combined in income taxes on their NFL earnings alone.

Carolina Panthers

Over the past several years, North Carolina’s income tax shifted from a progressive tax with rates as high as 7.75% to a flat tax with rates at 5.75%. That shift has likely meant hundreds of thousands of dollars in tax savings for players on the Carolina Panthers.

Charles Johnson and Cam Newton will pay an estimated $9 million and $5.8 million, respectively, in total taxes on their 2015 income. Cam will be seeing his tax bill rise next season when he enters the first year of a new contract (as will linebacker Luke Kuechly).

Tampa Bay Buccaneers

It’s looking like another disappointing season for the Bucs but the players can take solace in the fact that they pay some of the NFL’s lowest taxes. The Buc’s highest-paid players give up about 43% of their income in taxes.

That number would be lower if not for an away schedule that features seven states which collect an income tax of their own. For example, SmartAsset estimates that Gerald McCoy will pay over $240,000 in income taxes to the home states and cities of his away-game opponents.

New Orleans Saints

This is the last season in which Drew Brees qualifies as the top-earning NFL player (Aaron Rodgers looks to claim that title next year). Despite moderate tax rates in Louisiana (the top rate is 6%), he also has the largest overall tax bill in SmartAsset’s analysis. We estimate that Mr. Brees will pay $11.7 million in state and federal taxes.

NFC West

Arizona Cardinals

Income taxes in Arizona are fairly low, topping out at just 4.54%. That’s good news for Patrick Peterson, one of the league’s best and most well remunerated defensive backs. He will pay an estimated effective tax rate of 44.7% on his 2015 income, below average for top NFL players.

Saint Louis Rams

Tax cuts in Missouri will reduce the state’s top income tax rate from 6% to 5.5% in coming years. That means big savings for Rams players. For example, defensive lineman Robert Quinn will pay an estimated $969,000 in state taxes on his $16.74 million in 2015 income. At a top rate of 5.5%, he would pay closer to $885,000. That’s $84,000 in savings, enough for a new Lexus!

Seattle Seahawks

The Hawks have been one of the NFL’s hottest teams in recent years. Two consecutive Super Bowl appearances have helped them draw top free agent talent like Percy Harvin (in 2014) and Jimmy Graham. Another reason free agents love Seattle? The taxes. Washington State has no personal income tax.

The flipside of that is that when the Seahawks leave the confines of vaunted CenturyLink Field, they have to cough up big dollars to their away-game hosts thanks to the jock tax. Richard Sherman, for example, will pay an estimated $241,000 in additional income taxes to other states in 2015, highest of any player in the NFL.

San Francisco 49ers

It’s been a rough season for the 49ers, who are breaking in a new stadium with one of their worst seasons in years. The one bit of good news (for players, not fans)? The location of that new stadium means they’ll all pay lower taxes this season.

Thinking about a move to San Francisco? Find out what your taxes will be with SmartAsset’s California tax calculator.

The city of San Francisco levies a city income tax of 1.5% against people who live or work within city limits. Since the team’s new park is not in San Fran but in Santa Clara, most players will no longer have to pay that tax. That has likely saved Colin Kaepernick, who earns over $15 million per year, more than $200,000 in taxes.

AFC East

New England Patriots

The dynastic Patriots show no signs of slowing down this season, with Tom Brady & Co. steamrolling most of their opponents to date. One adversary against which they don’t stand a chance, however, is the IRS. SmartAsset estimates that Brady will pay $6.27 million in taxes on his football income alone this year. Nearly 90% of that will go to the federal government.

Based on his NFL income, Brady will “only” have to file tax returns in five different states this year (Massachusetts, New York, Indiana, New Jersy and Colorado). He benefits from a schedule that features two away games in tax-free Texas and another in Florida.

New York Jets

The Jets, like the Giants, save their players a fairly substantial sum of tax dollars by playing in New Jersey rather than the city of New York. If, for example, the Jets played in Queens, they would face a top state and city tax rate totaling 12.7%.

Buffalo Bills

In New York State, only those who earn over $1,000,000 pay the state’s top tax rate of 8.82%. While that excludes the vast majority of the population and even many professional athletes, Bills players like Mario Williams and Marcell Dareus fall squarely into that top bracket. That means they pay some of the highest taxes in the league.

Miami Dolphins

The Dolphins made a splash this off-season when they signed former Detroit Lion Ndamukong Suh out of free agency. Many speculated that Suh chose the Dolphins over his former team because his taxes would be significantly lower in Florida.

There may be something to that. The top-earning Dolphins pay effective rates of 42.9% of their income in taxes. That’s 3% lower than the taxes on Detroit players, representing hundreds of thousands of tax savings for players like Suh, who earn over $10 million per year.

AFC North

Cincinnati Bengals

The state of Ohio’s tax rates top out at 5.33% but Cincinnati collects its own city income tax of 2.1%. That costs players like the Bengals’ AJ Green hundreds of thousands per year in additional taxes. Overall, Green, who is one of the NFL’s top receivers, will pay an estimated $6.8 million in taxes on his 2015 income.

Pittsburgh Steelers

Professional athletes are subject to the “jock tax,” which means they may have to pay income taxes in every state in which they play a game. Reciprocal agreements not to tax one another’s residents between Pennsylvania and several other states may shield players on the Steelers from paying such taxes in states including Ohio (where they play two games this year) and Maryland. That could mean tens or hundreds of thousands in tax savings for players like Ben Roethlisberger.

Cleveland Browns

Combined state and local tax rates in Cleveland can be as high as 7.33%. While that pales in comparison to places like California or Hawaii (which, alas, has no NFL team), it still takes a chunk out of the income of top pro players.

Not that anyone feels sorry for them. Even after giving up an estimated 46.1% of his income in taxes, Cleveland’s Joe Haden is taking home $6.3 million annually.

Baltimore Ravens

After California’s three teams and Minnesota, Baltimore is the highest-tax team an NFL player can sign with. Indeed, Joe Flacco’s estimated effective tax rate of 47.2% ranks as the ninth highest in the league.

AFC South

Indianapolis Colts

While Colts players may not publically declare that they love their division foes, they probably love where they play. Tennessee, Texas and Florida do not collect state income taxes on regular income, which means Colts players avoid the hated “jock tax” for at least those three games every year. That saves them tens if not hundreds of thousands of dollars in additional taxes every year.

Tennessee Titans

The state of Tennessee does not collect a personal income tax (though it does tax personal income from interest and investment dividends). It briefly flirted with a tax specifically targeted at professional athletes but that tax excluded the NFL and was repealed in 2014. The upshot is that Titans players like Jason McCourty pay some of the lowest taxes in the league.

Houston Texans

While JJ Watt doesn’t have to pay any state or local taxes in Texas, he does have to cough up some of his income when the Texans go on the road. The league’s top defensive lineman can expect to file at least five tax returns in opponent territory, paying an estimated total of $165,513 in jock taxes.

Jacksonville Jaguars

The past few years have been rough on the Jags, who haven’t had a winning season since 2007. It isn’t all bad news, however. Florida has no income tax, which means Jaguars players enjoy some of the league’s lowest taxes. Julius Thomas, for example, will pay an estimated 42.3% of his income in taxes this year – high for the average American, but low for an NFL star.

AFC West

Denver Broncos

Colorado’s flat income tax rate of 4.63% is fairly low as compared with the top rates in most states. On the other hand, Peyton Manning and the rest of the Broncos have to play at least two away games in California every year (against Oakland and San Diego).

Indeed, Manning will pay nearly $400,000 in jock taxes on his 2015 income according to SmartAsset’s analysis, though he can claim Colorado tax credits for about $265,000 of that.

Oakland Raiders

The good news for the Raiders is that halfway through the season they are still in the thick of the playoff race. The bad news is that whatever happens, come tax day they’ll have to pay tax rates that rank among the highest in the league. SmartAsset estimates that Oakland’s Rodney Hudson will give up 49.8% of his 2015 income in taxes, the third highest rate in the league.

San Diego Chargers

Phillip Rivers is completing almost 70% of his passes this season, which places him near the top of the league for that statistic. He leads the league in another, more dubious category. According to SmartAsset’s analysis, Rivers effective income tax on 2015 NFL income will be 50%, the highest rate in the league. He’s the only player who will pay half of his income in taxes.

Kansas City Chiefs

According to Over the Cap, Alex Smith will earn $15.6 million in salary and bonuses over the course of the 2015 season. He’ll pay out an estimated $7.2 million of that in taxes, including $900,000 to the state of Missouri and $156,000 to Kansas City.

He’ll also have to pay a jock tax to eight different away-game states and cities, including California, Minnesota and Maryland. Those will cost him another $105,000.

Methodology

To estimate the taxes paid by NFL players, SmartAsset fed salary and bonus data from overthecap.com into the income tax model that powers our income tax calculator. The model incorporates nearly every single federal, state and local tax rule that goes into a tax return filed anywhere in the U.S. For example, the model automatically applies the additional 0.9% Medicare payroll tax to high earners. (Try it yourself!)

The income figures we used to calculate taxes were for NFL salary and bonus income only. We did not use sponsorship, investment or any other income, which is not often publicly available. Likewise, we used income for the 2015 season only (for contracts that were in existence at the time of this writing).

We allocated signing bonus income evenly over the course of each player’s contract (so a player on a 3-year contract with a $3 million signing bonus would get $1 million of that tacked on for this year). For players like Russell Wilson and Eli Manning, both of whom signed new contracts to begin next year we used only income for this year’s contract.

In order to calculate tax-burdens, we had to make some assumptions with regards to deductions and exemptions. We assumed that every player would take the maximum $18,000 401(k) contribution. We assumed each player deducted agent fees of 3%, NFL Player’s Association fees of $10,000 and home mortgage interest of $45,000 (approximately the maximum amount, though it will vary depending on interest rate).

We also incorporated each player’s marital status. For players who are currently married, we assumed they would file jointly with their spouse. Unmarried players were treated as single filers.

Jock Taxes

SmartAsset’s analysis also incorporates the taxes paid to the states and cities of away-game opponents, also known as jock taxes. These taxes are calculated based on “service days,” that is, the number of days spent working (practicing and then playing) in the state. So, for example, if a player spends 17 days in a state and earns income on 170 days total of work, 10% of his income is taxable in that state.

We assume each away game was equal to 7 service days out of 170 total for the season. That means a player with $10 million in total income would have income of $411,764 in any away-game state. If he played two away games in that state, total income would be double that amount. To calculate the jock tax, we ran those income numbers through the tax model for each of the away-game jurisdictions.

The good news for most players is that their home-states allow taxes paid in other jurisdictions to be credited, so that they don’t pay double taxes on the same income. The credit is equal to the amount that was paid in the other jurisdiction or the amount that would have been paid on that income at home, whichever is lower. For players in high-tax venues such as California, that means these jock taxes add nothing to their total tax bill.

We calculated the total jock tax credit for each player and, lastly the net jock tax. That is the taxes paid in other jurisdictions minus the credits received at home. We combined that with the federal, state and local taxes on total income to arrive at each player’s total tax bill.

Questions about our study? Contact us at blog@smartasset.com.

Photo credit: ©istock.com/EdStock