The middle class may be feeling the squeeze, but the upper-middle class certainly isn’t. The former cohort has shrunk from 61% of households in 1971 to just 52% now, according to the Pew Research Center. The upper-middle class, by contrast, has seen an uptick to 12% of households compared to just 10% almost 40 years ago. This growing, high-earning demographic, which SmartAsset defined as those with incomes between $100,000 and $200,000, is also on the move, migrating across state lines potentially for job opportunities, attractive housing markets or lower tax liabilities.

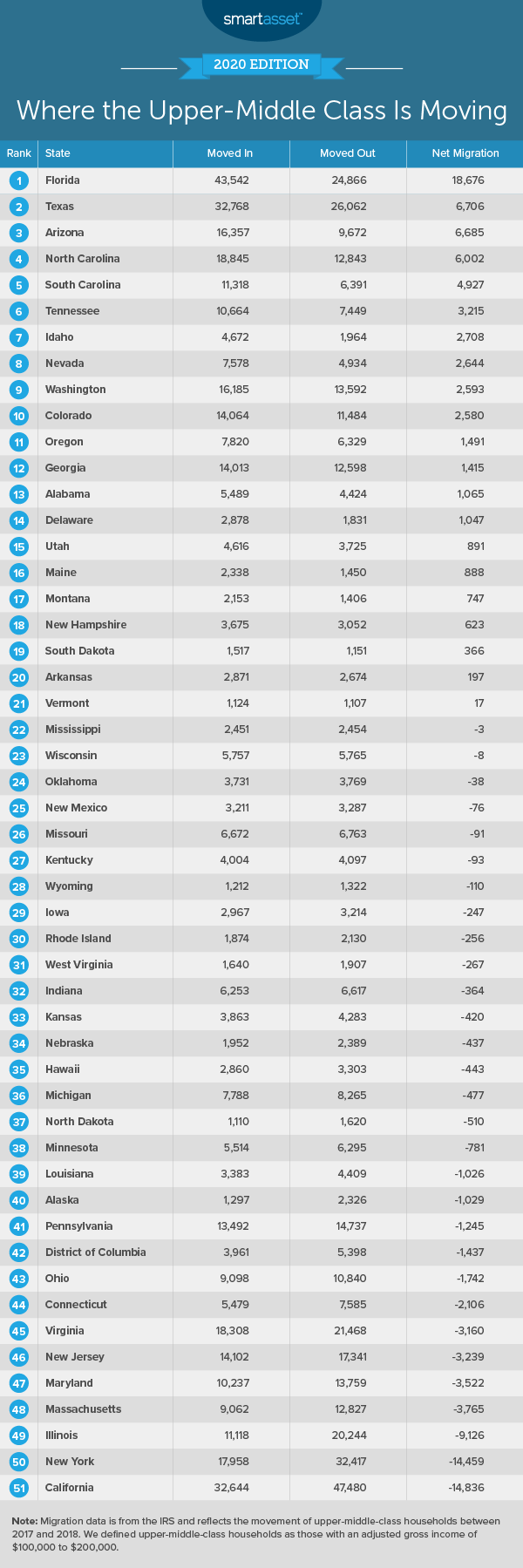

To find where upper-middle-class people are moving, SmartAsset analyzed inflows and outflows of people in this income range in every state as well as Washington, D.C. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s second study on where upper-middle-class people are moving. Read the 2019 version here.

Key Findings

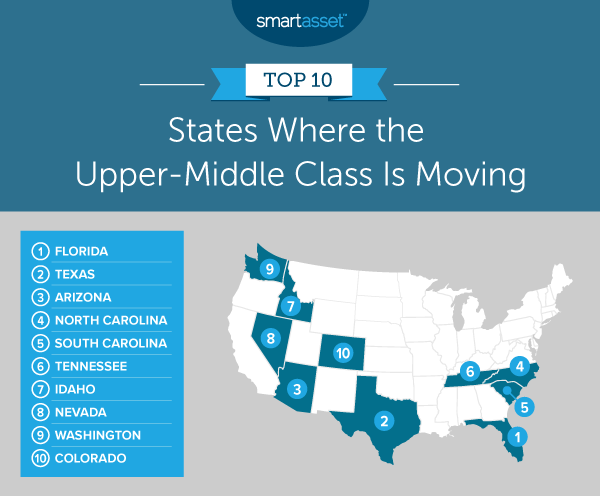

- The South and West dominate the top of the list. According to Census regional divisions, half of our top 10 states are in the American South (Florida, Texas, North Carolina, South Carolina and Tennessee), and the other half are in the West (Arizona, Idaho, Nevada, Washington State and Colorado).

- Upper-middle-class Americans are gravitating toward tax havens. Four states in our top 10 – Florida, Texas, Nevada and Washington – have no income tax. Two other states – North Carolina and Colorado – have a flat rate income tax. Furthermore, Tennessee does not have a personal income tax but does tax some dividends and interest.

1. Florida

Florida’s warm weather and lack of a state income tax may be why so many upper-middle-class people want to move there. The net migration of upper-middle-class people to Florida between 2017 and 2018 was 18,876, nearly three times as many as the next closest state.

New or prospective Florida residents may wish to consult SmartAsset’s list of the state’s top financial advisor firms.

2. Texas

Texas saw a net gain of 6,706 upper-middle-class people from 2017 to 2018. Again, the lack of income tax in the Lone Star State may account, in part, for this influx.

3. Arizona

Arizona does have income tax, but it’s among the lower rates in the nation, topping off at 4.50% for incomes higher than $159,000. The net migration of upper-middle-class people to the state from 2017 to 2018 was 6,685.

4. North Carolina

North Carolina saw a net gain of 6,002 upper-middle-class people over the time period we considered for this study. North Carolina has several big cities, access to many beaches and a flat income tax rate of 5.25%, all of which could be attractive to people with incomes from $100,000 to $200,000.

5. South Carolina

South Carolina has among the lowest property tax rates in the nation, so high-income earners can buy their dream house without worrying about being overwhelmed by taxes. The Palmetto State saw an increase of 4,927 upper-middle-class people from 2017 to 2018.

6. Tennessee

Tennessee is another state that does not tax salaries or wages (but there are taxes on interest and dividend income). The Volunteer State gained 3,215 upper-middle-class people from 2017 to 2018.

7. Idaho

Though Idaho has fairly high income taxes, it has low property taxes and is actually one of the best states for homeowners. That may explain, in part, the appeal of the state, which saw a net migration of 2,708 upper-middle-class people between 2017 and 2018.

8. Nevada

Nevada is another state offering no income tax, which is a strong incentive for people making higher incomes. The Silver State gained 2,644 upper-middle-class citizens from 2017 to 2018.

9. Washington

Washington State is another state with no income tax. This factor could be one contributor to the increase in upper-middle-class residents by 2,593 from 2017 to 2018. Those in Washington seeking a financial advisor firm to work with may wish to consult SmartAsset’s list here.

10. Colorado

Colorado gained 2,580 upper-middle-class residents between 2017 and 2018. Those interested in moving there might wish to note that the Rocky Mountain State has a flat income tax of 4.63% and relatively low property taxes.

Data and Methodology

To find out where upper-middle-class people are moving, SmartAsset compared data from tax returns between 2017 and 2018 for every state and Washington, D.C. We found the inflows and outflows for people earning between $100,000 and $200,000 and subtracted the outflows from the inflows to calculate the net migration. Then, we ranked all 50 states, along with Washington, D.C., by this net figure. All data is from the IRS.

Tips for Managing Your Money in the Upper-Middle Class

- Seek professional financial advice. If you are an upper-middle-class income earner, a financial advisor can help you make the most of your funds. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool connects you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now.

- Considering moving to a new state? Even if you’re in the upper-middle class with a substantial income, you don’t want to blow your budget on housing. Find out how much house you can afford so that you can narrow down your search.

- Did you factor in taxes? Taxes are important when considering where to move. See your tax burden with SmartAsset’s income tax calculator.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/akurtz