Taxes and rent are unavoidable expenses for those who don’t own their home, and though there are other necessities like food, that category and others allow for more flexibility in how consumers budget. For renters, the yearly fixed cost of taxes and rent can greatly affect how much money they have left over to spend and save, especially for those looking to put money down on a mortgage.

With all this in mind, SmartAsset analyzed data to find the cities where renters have increasingly more money left over after covering taxes and rent. For details on our data sources and how we put the information together to create our final rankings, see the Data and Methodology section below.

Key Findings

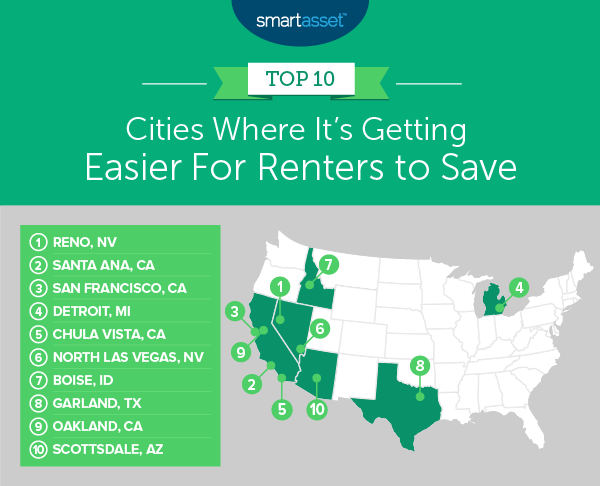

- Head West. Of the top 10 cities in this study, eight are in the Pacific or Mountain time zones, including four in California. The Western region of the country clearly dominates the top portion of this list of cities where it’s getting easier for renters to save.

- Overall growth. Of the 100 cities for which we analyzed data, 86 have seen at least some growth in income after taxes and rent payments between 2013 and 2017, with only 14 seeing a decrease in income after taxes and rent payments.

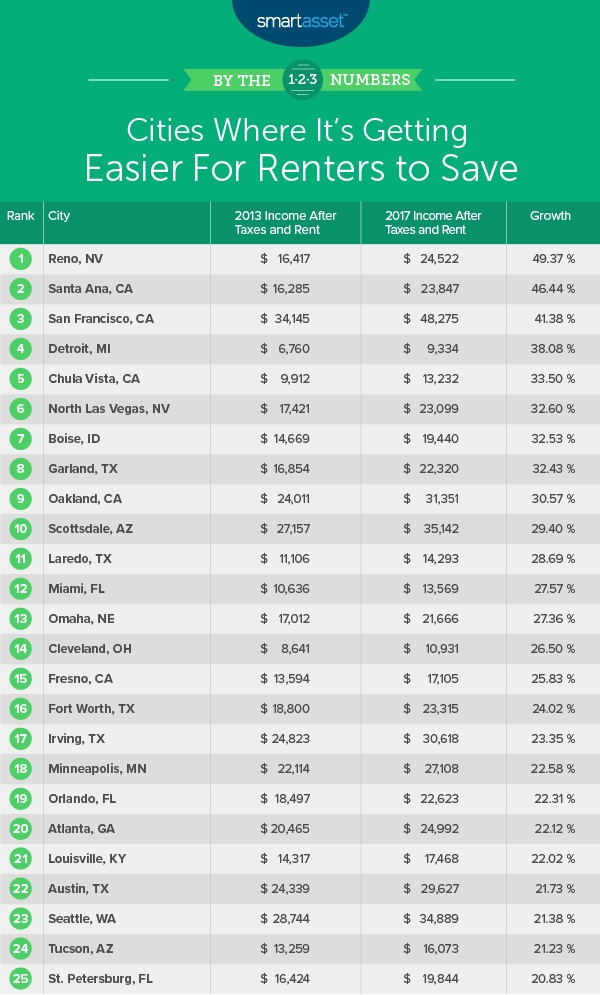

1. Reno, NV

The Biggest Little City in the World, Reno, Nevada, saw income after taxes and rent payments increase from $16,417 in 2013 to $24,522 in 2017. That’s a total increase of $8,105 or 49.37% over that time period. The median total income saw a particularly robust increase, from $29,286 in 2013 to $41,140 in 2017, which helped offset rent increases and secure Reno’s status as the city where it’s getting easier for renters to save.

2. Santa Ana, CA

The first of four California cities on this list, Santa Ana saw average income after taxes and rent payments go from $16,285 to $23,847. That $7,562 increase represents a 46.44% jump. While you can pocket some of that extra cash for necessary household expenses, you can also choose to invest some of it in a variety of ways.

3. San Francisco, CA

San Francisco, California’s income after taxes and rent payments jumped $14,129 from 2013 to 2017. A relatively high income to start means that increase was third overall in terms of percentage points, at 41.38%, but it is the largest total increase overall in terms of raw dollars.

4. Detroit, MI

Detroit, Michigan ranks fourth on our list of the cities where it’s getting easier for renters to save. The Motor City saw median income after average taxes and rent increase from $6,760 in 2013 to $9,334 in 2017, an increase of 38.08%. As Michigan is tax-friendly toward retirees, it wouldn’t be a bad idea to consider putting some of that extra money in a retirement account.

5. Chula Vista, CA

Another California location, Chula Vista, ranks fifth. Chula Vista’s median income after taxes and rent payments went up by $3,320 – from $9,912 in 2013 to $13,232 in 2017. That’s a jump of 33.50%. Chula Vista is actually also one of the top 25 undervalued cities in America in 2019.

6. North Las Vegas, NV

North Las Vegas, Nevada had a median income after taxes and rent payments of $17,421 in 2013. That increased to $23,099 in 2017. That means that over the course of that time period, the amount of money that average renters had to spend after subtracting rent and taxes from their income increased by $5,679, or 32.60%.

7. Boise, ID

Next up in our top 10 is Boise, Idaho. The median income after taxes and rent payments here went from $14,669 in 2013 to $19,440 in 2017, an increase of $4,772 or 32.53%. That’s quite a few extra dollars that you could budget for your needs as well as for putting into a high-yield savings account to save for a rainy day.

8. Garland, TX

The median income after taxes and rent payments in Garland, Texas was $16,854 in 2013. That number jumped by $5,466 in 2017 to $22,320, an increase of 32.43%. Millennial renters here might find it worth it to reconsider how they budget their income after paying rent and taxes, as Garland is one of 2019’s top 10 cities where millennials are buying homes.

9. Oakland, CA

Oakland is the ninth-ranking city overall, and the final California city in our top 10. The median income after taxes and rent payments for residents of this Bay Area city was $24,011 in 2013 and had increased to $31,351 in 2017. That is an increase of $7,339, or 30.57%. Oakland is also one of the top 10 cities of 2019 where renting with a roommate saves the most, so renters who are roommates here could potentially have even more savings to use for their needs and investments.

10. Scottsdale, AZ

Scottsdale, Arizona is the final city in our top 10. The median income after taxes and rent payments in 2013 was $27,157. By 2017 it had increased to $35,142. That’s an increase of $7,985, or 29.40%. After budgeting for other necessities like food and clothing, you’d likely still have enough to be within the current limits for contributing to your IRA.

Data and Methodology

To find the cities where it’s getting easier for renters to save, SmartAsset determined the median income after taxes and rent payments for 100 of the largest cities in the country in both 2013 and 2017, and then calculated the percentage change. To find our results, we took the median income for a city minus estimated taxes on that income and average annual rent. The sources for our data are as follows:

- Total income. Data is from the Census Bureau’s 2013 and 2017 1-year American Community Surveys.

- Average rent. Data is from the Census Bureau’s 2013 and 2017 1-year American Community Surveys.

- Average taxes. Data is from SmartAsset’s Income Tax Calculator. 2017 tax rates are used

Tips on Getting More From Your Money

- Sound planning is indispensable. If you want to get the most out of your money, consider finding someone to help. Finding the right financial advisor that fits your needs doesn’t have to be hard, though. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Budget your income. One way to increase your income after taxes and rent payments is to plan how you spend your money. Use SmartAsset’s free budget tool to figure out a plan that works for you.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/sturti