TD Ameritrade is a comprehensive brokerage firm with a long-standing presence in the investment industry. Its origins date back to 1975 when its predecessor, First Omaha Securities, Inc., was founded. The firm provides a well-rounded trading experience through its user-friendly online and mobile platforms, catering to both beginner and seasoned investors. Additionally, TD Ameritrade offers a robo-advisory service for automated investing. As one of the 10 largest banks in the U.S., the firm enables commission-free trading of stocks, exchange-traded funds (ETFs), and options. If you’re looking for guidance on investing or other financial matters, consulting a financial advisor may be beneficial.

TD Ameritrade: Overview

TD Ameritrade Overview

| Pros | – No-fee equity, ETF & option online trades – Online/mobile trading platforms for newbies and veterans alike – Robo-advisor service available |

| Cons | – Many disclosures on its record |

| Best For | – Online traders – Customers who value support |

Charles Schwab bought TD Ameritrade in 2020, with integration mostly complete by 2023. Until then the two organizations operated separate broker-dealers, and clients of Schwab and TD Ameritrade continued to do business with their respective firms as usual.

TD Ameritrade attempts to meet the needs of both inexperienced and experienced investors. The dual versions of its online and mobile trading platforms are suitably presented with either a focus of education/guidance or personalization for each group of prospective clients.

TD Ameritrade offers its services in most states and Washington, D.C., as well as the U.S. Virgin Islands and Puerto Rico. The firm is based in Omaha, Nebraska, and it has more than 250 branches around the world.

TD Ameritrade: Brokerage Fees

In October 2019, TD Ameritrade revised its fee schedule to eliminate charges for online trades involving equities, ETFs and options. This makes it a cost-effective choice for investors who are comfortable managing their trades independently through the online platform.

Beyond this, TD Ameritrade’s overall fee structure remains fairly standard. There are no significant hidden costs, but investors can save the most by trading online rather than using phone-assisted services or working with a broker. Since online trades require minimal intervention from the firm, the associated fees remain low.

TD Ameritrade Fees

| Fee Type | Rates |

| Stock Commissions | – Online: $0 – Over the phone: $5 – Broker-assisted: $25 |

| ETF Commissions | – Online: $0 – Over the phone: $5 – Broker-assisted: $25 |

| Mutual Fund Commissions | – NTF funds: $0 – Load: $0 – No-load: $49.99 |

| Options Commissions | – Online: $0 + $0.65 per contract – Exercises and assignments: $0 – Over the phone: $5 + $0.65 per contract – Broker-assisted: $25 + $0.65 per contract |

| Bond Commissions | – Per bond transaction fee: $1 – Treasuries at auction: Available commission free – All other bonds: On a net yield basis |

| CD Commissions | – On a net yield basis |

| Futures Commissions | – $2.25 per contract |

| Exceptions | – Alternative investment transaction fee: $100 – Foreign security: $15 – Commission-free ETF short-term trading: $13.90 – Return check/electronic funding: $25 |

| Regulatory | – Section 31 fee: $0.0000229 per $1 of transaction proceeds – Options fee: $0.009866 per options contract – Trading activity fees: $0.000145 per equity share; $0.00244 per options contract; $0.00092 per bond |

The U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) require their own regulatory fees. These are much less significant than typical commissions and other fees, so you likely don’t need to worry unless you’re trading large amounts of money.

TD Ameritrade: Services and Features

TD Ameritrade Services & Features

| Feature/Service | Details |

| Investment Research Tools | – Market Edge®: current market and technical analysis – ETF Market Center: premier compilation of ETFs – Stocks Charts: analysis of stocks similar to the ones in your portfolio – Screeners: shows stocks, ETFs, options and mutual funds that adhere to your personal specifications – Premier List: list of the top mutual funds – Bond Wizard: projects clients’ returns on bonds and CDs |

| TD Ameritrade Essential Portfolios | – Robo-advisor service – Fully automated with automatic rebalances – $500 minimum investment |

| TD Private Client Wealth | – Full advisor-client relationship – Investment management with financial planning |

| Educational Resources | – Videos, articles and a learning curriculum for becoming a knowledgeable investor |

| Available Investment Products | – Stocks, options, ETFs, mutual funds, futures, forex, annuities, bonds & CDs |

Additional Research Tools

TD Ameritrade offers a comprehensive suite of research tools designed to help investors, regardless of experience level, navigate investment analysis with confidence. These tools are primarily tailored to specific investment types and risk profiles, ensuring a straightforward and user-friendly approach.

While these resources provide valuable insights, developing a deeper understanding of investing can enhance your decision-making process. To support this, TD Ameritrade offers an extensive collection of online educational content, including in-depth articles, instructional videos and a structured investment curriculum, empowering investors to expand their financial knowledge.

TD Ameritrade Essential Portfolios is the robo-advisor arm of TD Ameritrade. A robo-advisor is an automated investment service that builds your portfolio according to your pre-stated risk tolerance, tax situation and overall investment needs. Essential Portfolios will cost you a 0.30% annual fee and a minimum initial investment of $500. You can create a number of accounts through this, such as IRAs, individual and joint accounts and more.

If you are unsure of how to begin investing, a financial advisor can get you on the right track. TD Ameritrade’s internal financial advisor firm is TD Private Client Wealth, which has just under $12.3 billion in assets under management (AUM) and a fee-based fee schedule. The firm’s services include wealth planning, retirement planning, investment management, legacy planning, business succession planning, real estate financing and more. For more options, you can use SmartAsset’s free advisor matching service to find a financial advisor in your area who meets your needs.

TD Ameritrade: Online Experience

A significant part of TD Ameritrade’s brokerage business revolves around its online trading platforms, which are split into two primary offerings: the standard web platform and the advanced thinkorswim platform.

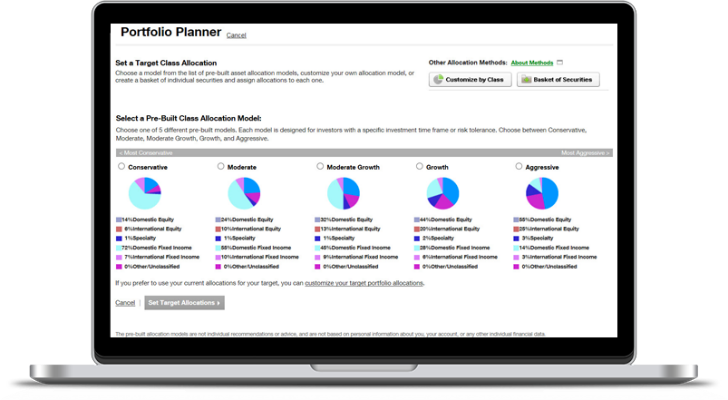

For those new to investing or looking for some level of guidance, the standard platform provides an intuitive starting point. Users have access to a wealth of educational resources designed to help them navigate the complexities of building a well-rounded investment portfolio. Once comfortable, investors can leverage TD Ameritrade’s Portfolio Planner tool, seamlessly integrated with the Retirement Planner, to align investment decisions with long-term financial goals.

The platform also offers pre-built asset allocation models tailored to different risk tolerances, along with real-time market analysis and alerts to keep investors informed about price movements. Additionally, the GainsKeeper® feature automatically tracks gains and losses, simplifying capital gains tax calculations.

For more experienced investors seeking greater control and customization, the thinkorswim platform delivers a robust suite of tools and market data. Users can access extensive national and international market insights, along with in-depth statistical analysis. One standout feature is TD Ameritrade’s paperMoney®, which allows investors to test strategies in a simulated brokerage and IRA — each funded with $100,000 in virtual cash.

thinkorswim also fosters a strong investment community, offering online chat rooms where users can engage with fellow traders to discuss market trends. The platform further enhances the trading experience with powerful tools like Stock Hacker and Market Monitor for tracking prices and data, as well as livestreamed financial news for real-time market insights.

Investors interested in exploring thinkorswim can visit TD Ameritrade’s website to schedule a platform demo and experience its capabilities firsthand.

TD Ameritrade: Mobile Experience

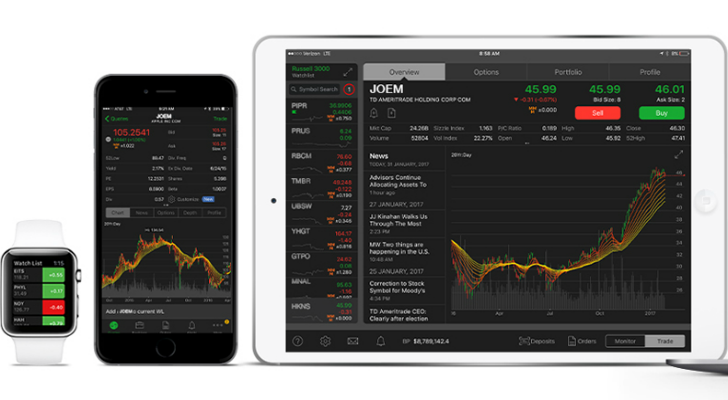

TD Ameritrade has an equally robust mobile investing experience. StockBrokers.com also voted TD Ameritrade the best for mobile trading and for platform/tools. Similar to its desktop services, TD Ameritrade provides two mobile apps – the TD Ameritrade Mobile app and the TD Ameritrade Trader app – that offer features that fall in line with the standard and thinkorswim web platforms, respectively.

As a credit to TD Ameritrade, the firm has managed to squeeze many of its desktop perks into its mobile apps, and this is especially evident with the base TD Ameritrade Mobile app. You can not only monitor your current investments and overall investment portfolio, but you can complete trades, as well. The app even lets you view investment charts, quotes, news and research.

While the services of the thinkorswim platform are laid out better in its desktop incarnation, TD Ameritrade has done an admirable job turning it into a mobile offering with the TD Ameritrade Trader app. The same in-depth investment analysis and data that’s on your computer is available in the palm of your hand. You can set up news, market and update alerts through the app to give yourself the ability to stay on top of your investments at all times.

For Apple users, these apps are also available for the Apple Watch™. Between the Android and Apple app stores, users have rated TD Ameritrade Mobile at 3.6 stars and 4.5 stars, respectively.

TD Ameritrade: Customer Support

As one of the largest investment organizations in the U.S., TD Ameritrade has the resources on-hand to set up an extensive customer support network, and it doesn’t disappoint. First and foremost, customers can trade on their platforms 24 hours a day, five days a week. Should you have questions about any of the firm’s services, or investing in general, you can reach customer service over the phone at (866) 839-1100 or via the chat service on your online and mobile accounts.

How Does TD Ameritrade Compare to Other Brokerages?

Like many of its brokerage counterparts, TD Ameritrade does a solid job of offering services for both novice and veteran investors. Robinhood, by comparison, is a simple and user-friendly platform that’s a good fit for new investors. On the other hand, Merrill Edge and Schwab boast some of the more in-depth benefits that long-time investors expect.

In terms of investor costs, TD Ameritrade’s free online equity, ETF and option trading makes the firm attractive, although other firms like Merrill Edge have also adopted this type of fee schedule. Robinhood takes things a step further, though, as it offers these same perks in addition to free cryptocurrency trading.

Brokerage Comparison

| Brokerage Firm | Features | Offers Financial Advisors? | Offers a Robo Advisor? | Best For |

| TD Ameritrade | – Plethora of investment research tools – Wide selection of investments – thinkorswim desktop tool | ✓ | ✓ | – Online traders – Customers who value support |

| Robinhood | – Built specifically for mobile – Significant cryptocurrency trading capabilities – Smaller set of investments that other brokerages | X | X | – Mobile/online traders – Self-sufficient investors |

| Merrill Edge | – Customizable MarketPro research dashboard – Plenty of branch access – Weak mobile trading app | ✓ | ✓ | – Desktop traders – Bank of America account holders – Customer support junkies |

What’s the Catch?

There are two online/mobile trading platforms available through TD Ameritrade: its standard product and the thinkorswim product. Unfortunately, these two platforms have not been integrated into the same mobile apps or online dashboard. This could become a bit inconvenient, especially for those who want to participate in both sides.

TD Ameritrade does have some disclosures, which you can find more information about below.

TD Ameritrade: Disclosures

According to FINRA, TD Ameritrade has 216 total disclosures on its regulatory record. Brokerage firms typically receive these legal infringements when they violate federal or state laws that dictate how securities must be marketed, offered, bought, sold and generally handled. The fines associated with TD Ameritrade’s offenses range from $500 all the way up to a staggering $2.65 million.

In 2018, the SEC fined TD Ameritrade $500,000 after it found that the firm had not filed suspicious activity reports for 111 of its independent investment advisors that it terminated. According to the SEC, this situation “presented an unacceptable business, credit, operational, reputational or regulatory risk to [TD Ameritrade] or its customers.” Without denying or admitting the allegations, TD Ameritrade agreed to pay the $500,000 fine.

TD Ameritrade’s Acquisition of Scottrade

In late 2017, TD Ameritrade bought out Scottrade, another massive national brokerage that opened its doors in 1981. With the annexation of Scottrade’s accounts and funds, the firm now serves a combined 11 million clients with more than $1 trillion in assets. TD Ameritrade finished its complete integration of Scottrade in 2018.

Bottom Line

Because of the overarching appeal of its services, TD Ameritrade often has a place on every investor’s list of considerations, regardless of their experience level. The thinkorswim web and mobile platform has an impressive array of research benefits that will help you make informed decisions about where to invest. But if you prefer a more straightforward approach, TD Ameritrade’s standard online and mobile package may be more to your liking.

Tips to Help You Improve Your Investments

- Want to get some guidance in your investing strategy rather than going it alone? A financial advisor can build an investing plan for you. Finding the right financial advisor to help you invest doesn’t have to be hard. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Try to avoid becoming so obsessed with the return potential of your portfolio that you forget to take into account the ever present capital gains tax. SmartAsset’s capital gains tax calculator can help you figure out exactly what you can expect Uncle Sam to take.

Advertiser Disclosure: We maintain strict editorial integrity in our writing and assessments. This post contains links from our advertisers, and we may receive compensation when you click these links. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone.

Photo credit: TDAmeritrade.com, ©iStock.com/undefined_undefined