Merrill Edge is an online brokerage platform that offers everything from self-directed and automated investing services to financial advisor guidance. The brokerage firm falls under the ownership umbrella of Bank of America. Therefore, Merrill Edge is an especially may be a natural fit for anyone who maintains accounts at BoA. But with an excellent desktop platform, high-quality customer service and plenty of investment insights, Merrill Edge is best suited for those who invest at their computer and who may need access to extra support.

Merrill Edge Overview

| Merrill Edge Overview | |

|---|---|

| Pros | – Free stock, ETF and option trades – Strong desktop platform and research tools – Great customer service |

| Cons | – No fractional shares – No cryptocurrencies |

| Best For | – Desktop investors – Bank of America account holders – Those who need customer service |

| Drawbacks | – May not appeal to active traders |

Fees Under Merrill Edge

Like much of the brokerage landscape, Merrill Edge has an extremely low-cost trading fee schedule. In fact, stocks, ETFs and options are available for $0 per trade. There is no minimum deposit necessary to join Merrill Edge, and the firm does not charge annual account fees.

Merrill Edge’s complete fee schedule is below:

| Merrill Edge Fees | |

|---|---|

| Fee Type | Rates |

| Stock and ETF Commissions | – Online trades: $0 – Representative-assisted: $29.95 |

| Options Commissions | – Online: $0 + $0.65 per contract – Representative-assisted: $29.95 + $0.65 per contract – Exercised/assigned: $0 |

| Mutual Fund Commissions | – No-load NTF: $0 ($39.95 if fund held less than 90 days) – Load-waived funds: $0 – Online no-load TF: $19.95 – Representative-assisted no-load TF: $29.95 |

| Fixed-Income/Bond Commissions | – New issues: $0 – Online Treasurys: $0 – Representative-assisted treasuries: $29.95 – Online corporate, municipal and government agency bonds: $1 – Representative-assisted corporate, municipal and government agency bonds: $1 + $29.95 service fee |

| Account | – Annual fee: $0 – Full account transfer: $49.95 – Partial account transfer: $0 – Domestic/International wire transfer: $24.95 – Closeout fee: $0 (non-retirement account) or $49.95 (retirement account) |

The U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) require their own regulatory fees. These are much less significant than typical commissions and other fees, so you likely don’t need to worry unless you’re trading large amounts of money.

Merrill Edge Services & Features

| Merrill Edge Services & Features | |

|---|---|

| Feature/Service | Details |

| Merrill Edge MarketPro® | – Interactive charts, research and market analysis with current data – Adjustable dashboard to fit your needs |

| Self-Directed Trading | – Independent investment portfolios – Proprietary investment research |

| Merrill Guided Investing | – Automated investing platform that blends technology with the insights of Merrill’s Chief Investment Office – Low fees – $1,000 minimum investment |

| Merrill Edge Financial Advisors | – Work directly with a financial advisor – Manageable fees – $20,000 minimum investment for growth strategies; $50,000 for income strategies |

| Available investment products | – Stocks, bonds, options, ETFs & mutual funds |

The firm’s core brokerage service is its Merrill Edge Self-Directed Trading. This service essentially offers all the benefits of the firm’s research, wide range of investment choices and more in an easy-to-use package that’s great for individual investors. Merrill Edge simplifies much of the market data within this platform so that even those who have just begun investing can do successfully.

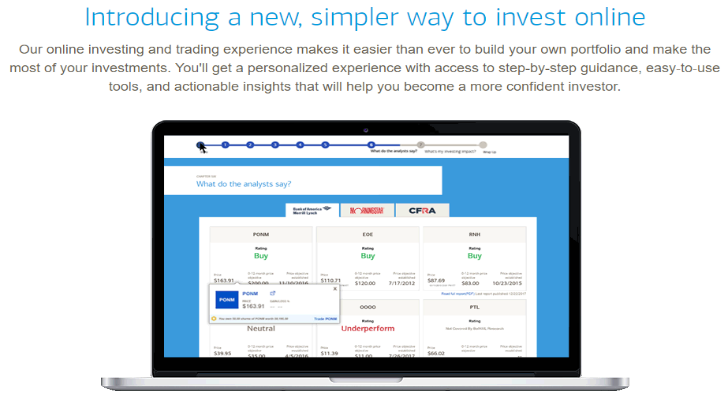

Merrill Edge MarketPro® is an investment research tool developed by Merrill Edge to give you ultimate insight into the market. This desktop-centric platform, which is available to customers with Merrill Edge Self-Directed Trading accounts, features a flexible dashboard that allows you to include the information that’s most important to you. You can take advantage of price alerts, interactive investment charts and data, financial and investment news and more. When you feel informed enough to pull the trigger on a stock, option, mutual fund or ETF trade, you can make the move right within MarketPro®.

It can be scary to jump right into investing without any experience. Financial advisors offer the chance to work directly with an investment professional to develop a portfolio that incorporates long-term financial planning. Merrill Lynch Financial Advisors is the advisory service associated with Merrill Edge. The firm requires a $20,000 minimum investment for growth strategies or $50,000 for income strategies, and charges a 0.85% annual management fee (1.75% for advisor-assisted programs).

Merrill Edge Guided Investing is an in-between offering from Merrill Edge that combines the perks of a financial advisor and personal investment portfolio into one. Clients can monitor their portfolio’s performance and select a risk-adjusted investment strategy, all while a team of advisors at Merrill monitors your account and rebalances as necessary. The annual fee for this is a minimal 0.45%, with a required investment of $1,000.

Merrill Edge Online Experience

Merrill Edge’s services are centered around its online trading platform that allows users to take advantage of self‑directed investing accounts. This affords customers the ability to customize their portfolio to exactly their personal preferences. Merrill Edge provides extensive analysis, research and charts highlighting stocks, the companies they are paired with and their overall performance histories.

If you need help selecting investments to flesh out and diversify your portfolio with, Merrill Edge offers educational resources online. As you build your portfolio, the firm’s asset allocation charts will display how your funds are spread out across the market. Once your investments are complete, tracking their performance is done through virtual charts that compare your returns to that of various indices.

Merrill Edge Mobile Experience

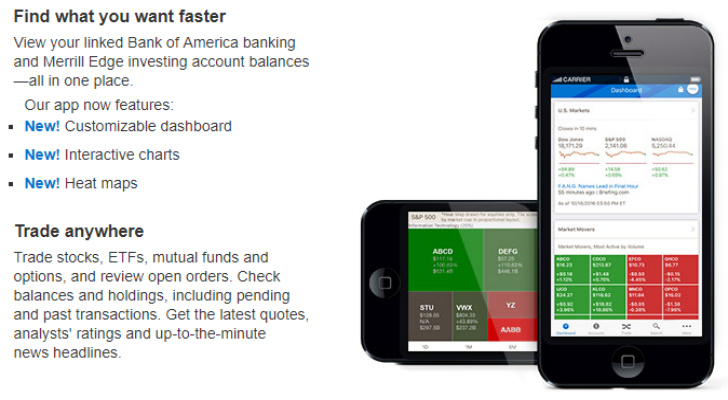

The success of Merrill Edge’s solid desktop trading platform has subsequently transferred to its mobile app. More specifically, the app’s appearance in the Apple store has a strong 4.6-star rating and a middling 3.2-star rating for Android.

All the basics of a brokerage app exist with Merrill Edge. You can view your entire portfolio, see how your investments are progressing, make new investments and deposit money. Recently, though, Merrill has added in some new features. The most important upgrade is the ability for customers to create their own mobile dashboard that puts all of their top priorities in a single place. Furthermore, you can access interactive charts and heat maps that give insight into securities.

Merrill Edge Customer Support

Merrill Edge has four different routes that customers can utilize to access support services. Your options include calling (888) 637-3343, emailing ContactME@ml.com, visiting the firm’s website for online chat or setting up a meeting with a representative, either in person or via callback. Because Merrill Edge is ultimately affiliated with Bank of America, there are a number of financial centers around the country you can stop by if necessary.

Who Is Merrill Edge For?

What Merrill Edge lacks in mobile trading prowess it more than makes up for with its online trading platform. That makes this brokerage a great choice for anyone who likes investing from a desktop or laptop computer. Merrill Edge offers some great customer service in addition to these offerings. So if you prefer to have help available 24/7, the platform should look all the more appealing.

Merrill Edge, and in turn Merrill Lynch, is under the ownership of Bank of America. This gives it a massive physical presence across the country, operating in all 50 states, along with the U.S. Virgin Islands.

How Does Merrill Edge Compare?

Investors who are unsure of what kind of investment account they want will find Merrill Edge to be a diverse brokerage firm. Its services allow you to see everything from a completed self-run investment account all the way up to a standard financial advisory relationship. Also, because of its relationship with Bank of America, BoA customers should look to Merrill Edge as their possible first choice.

Online trading and customer service are major strengths of Merrill Edge, but the same cannot be said for its mobile home on Apple and Android devices. So if mobile trading is your preference, Merrill may not be the best fit for you. On the other hand, more traditional investors will likely be satisfied.

E-Trade has a similar set of services, with highly-rated customer support and a powerful online trading platform. There are brokers, like Robinhood, that are focused more on a strong mobile experience.

| Brokerage Comparison | |||

|---|---|---|---|

| Brokerage Firm | Fees | Minimum | Best For |

| Merrill Edge | $0 | $0 | – Desktop traders – Bank of America Preferred Rewards members – Customer service junkies |

| E-Trade | $0 | $500 | – Those who trade often – Anyone who prefers strong customer service |

| Robinhood | $0 | $0 | – Mobile/online traders – Self-sufficient investors |

Disclosures

Merrill Lynch, which provides Merrill Edge’s services, currently has more than 300 disclosures in its disciplinary past. Although this isn’t terribly alarming considering the firm’s enormous customer and trading base, some of its fines are quite high.

The company paid a $25 million file in January 2025 after the SEC alleged that it “failed to adopt and implement reasonably designed written policies and procedures to consider the best interests of clients when evaluating and selecting cash sweep program options,” according to SEC records.

Bottom Line

Merrill, under the ownership of Bank of America, offers several online investing options for investors looking for low fees and convenience. Merrill Edge, the company’s self-directed platform, may apply to DIY investors who want access to stocks, ETFs, mutual funds, bonds and options. Its Guided Investing and Guided Investing with an Advisor options provide more expert guidance for those who prefer a more hands-off approach. Meanwhile, the firm’s fees are right in line with the market of low-cost online brokers.

How Financial Planning Can Help Your Investments

- In theory, financial planning may seem like a simple task, but there are many nuances to doing it successfully. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- A succinct financial plan is a responsible way to ensure that every investment you make has a specific purpose behind it. For most people, this will likely include some form of planning for their retirement or retirement income. But regardless of the financial goals you choose for your investments, be sure to have a well-built plan in place.

Photo credit: MerrillEdge.com, ©iStock.com/demaerre