Robinhood is a brokerage firm whose services are centered around its mobile and online trading platforms. One of Robinhood’s principal attractions is a complete lack of commission fees for all purchases and sales of U.S. listed stocks, options, exchange-traded funds (ETFs) and cryptocurrencies. On the other, it does not offer human advisement and provides limited customer service, limiting its appeal to beginning or novice investors.

Former Stanford roommates Vlad Tenev and Baiju Bhatt founded Robinhood in 2014 after building their own finance companies. As it stands today, the firm is independently owned, with Tenev as CEO, Bhatt as chief creative officer, Dan Gallagher as chief legal compliance and Jason Warnick as chief financial officer. If you have questions about investing or any other financial topics, consider speaking with a financial advisor.

Robinhood Overview

| Pros | – Highly rated mobile app – No minimum balance – Free stock, option, ETF and cryptocurrency trading |

| Cons | – No human advisors – Weak customer support |

| Best For | – Mobile and online traders – Self-sufficient investors |

| Drawbacks | – Lacks human interaction |

Fees Under Robinhood

Robinhood advertises free commissions for all U.S.-listed and OTC securities, including stocks, options, ETFs and cryptocurrencies. This policy does not extend beyond the borders of America, though, as foreign-listed securities call for a $50 fee per trade. Also, if you make a trade via an over-the-phone broker, you’ll be charged a per-trade rate of $10.

It does not charge you for inactivity, nor does it charge fees for adding or withdrawing money to or from your account. (It is able to afford this because the company’s business model generates revenue from third-party brokers each time you make a trade, profiting off of what’s known as the bid/ask spread to the tune of $0.01 or less per share traded.) It offers margin trading for users who sign up for Robinhood Gold. This service costs $5 per month. Robinhood Gold customers get 5.75% margin rate, while non-Gold customers get 9%.

There is no minimum amount of investable assets necessary to become a customer of Robinhood, nor is there a certain account size you need to maintain to retain your eligibility. Initially, funding your account is also free. Because it is a web-based firm, Robinhood does not charge for electronic statements.

Despite the claim of a free-trade policy, fees have been an issue for Robinhood. In December 2020 the Securities and Exchange Commission said one of “Robinhood’s selling points to customers [between 2015 and late 2018] was that trading was “commission free,” but due in large part to its unusually high payment for order flow rates, Robinhood customers’ orders were executed at prices that were inferior to other brokers’ prices.” Robinhood agreed, without admitting or denying the SEC findings, to a cease-and-desist order and to a $65 million civil penalty.

Check out a full listing of each of Robinhood’s fees below:

Robinhood Fees

| Fee Type | Rates |

| Commissions | – U.S. listed and over-the-counter (OTC) securities: $0 – Foreign transaction: $0 per trade – Euroclear: $35 per trade – Canadian: $35 per trade – Foreign Security Cancel/Trade Adjustment: $15 per adjustment – Broker-assisted phone trades: $10 per trade |

| Money Transfer | – Incoming and outgoing bank transfers: $0 – Domestic wire transfer: $0 – International wire transfer: $0 – Domestic overnight check delivery: $20 – Returned check/recall/stop payments: $0 |

| Account Transfer | – Incoming: $0 – Outgoing: 1.5% |

| Maintenance | – Electronic statements: $0 – Paper statements: $2/monthly – Paper confirmations: $2 – Domestic overnight mail: $20 – International overnight mail: $50 |

| Miscellaneous | – Restricted accounts: $0 – Worthless securities processing: $0 (possible additional fees) – Voluntary corporate action/election: $0 |

| Regulatory | – SEC fees: $13 per $1 million of principal – Trading activity fee: no more than of $7.27 per share |

Regardless of Robinhood’s fee schedule, the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) charge their own fees for stock transactions. The SEC charges $13 for every $1 million of principal (rounded to the nearest penny). FINRA charges $0.000119 per share (rounded to the nearest penny) with a max of $5.95.

Robinhood Services and Features

Robinhood Services and Features

| Feature/Service | Details |

| Robinhood Gold | – Margin account – Instant fund access – Increased buying power |

| Robinhood Crypto | – Commission-free – Instant fund access – Available in all states and District of Columbia, except Hawaii and Nevada |

| Educational Resources | – Online help center – Set of articles, tips and other information |

Robinhood Gold is Robinhood’s premium service that’s available for an extra fee, though your first 30 days are free. This opens a multitude of benefits to customers, such as increased buying power by borrowing from Robinhood, extended trading hours, larger instant deposits and instant access to funds following the sale of stocks. For customers who borrow under $50,000, there’s just a single monthly fee. If you borrow more than $50,000, you will incur a sizable 5% APR.

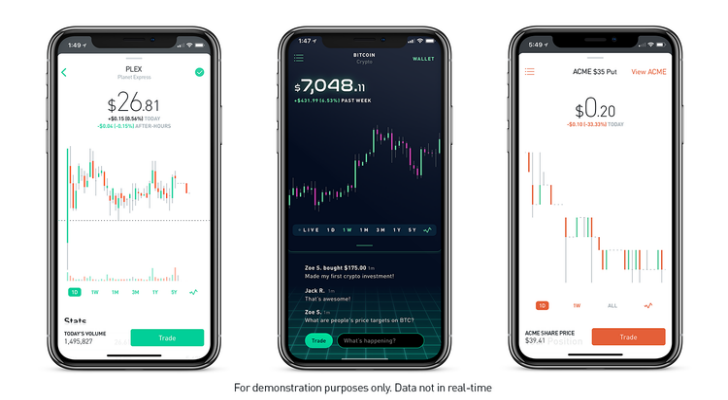

In an effort to keep up with modern investing trends, Robinhood has created a cryptocurrency service called Robinhood Crypto. This provides a convenient way for customers to invest in digital currencies like Bitcoin. Similar to the rest of its products, this service holds steady on $0 commissions and instant access to your money.

Successful investors keep investing, which gives Robinhood an incentive to educate their customer base. Robinhood’s website features a robust set of articles and other content that can help to make you more knowledgeable about its services, specific investment types, investing strategies and more. Of course, you can also consult a financial advisor for investment advice.

Robinhood Online Experience

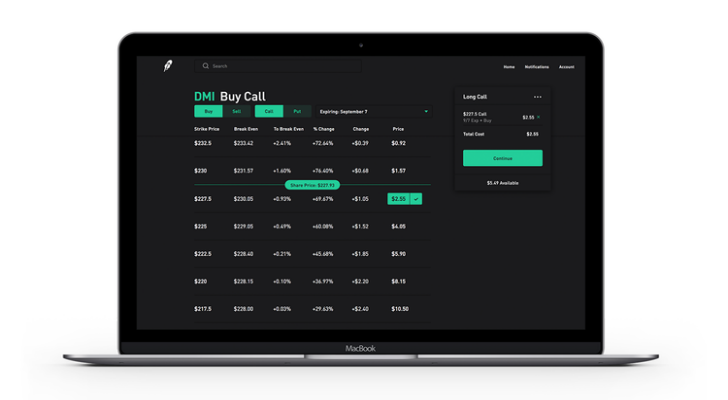

Robinhood has its roots in the mobile investing sphere, but the firm quickly realized that it would need an online platform as well. In 2017, the firm released this service in an effort to mimic its already successful mobile apps, creating another way that customers could look at their account and buy investments. Your online account includes a number of perks that are aimed to make the purchase process simpler and more data-based.

For example, you can view series of stocks that Robinhood aptly calls “collections.” These are organized into some unique categories — those helmed by female CEOS, for example, or those in the entertainment sphere. In an effort to assist you in ironing out your investments further, Robinhood provides the average price that other customers bought a stock at, along with a related purchase list. Prior to investing, you can view Wall Street and Morningstar analyses of an investment, along with a particular company’s earnings reports for the preceding two years and any news related to it.

Robinhood Mobile Experience

Robinhood originated as a mobile service, so it should come as no surprise that this is the strongest part of its business. Current and former Robinhood customers apparently feel the same way, as the app has received 4.8-star and 4.7-star ratings on the Apple and Android app stores, respectively. As a matter of fact, Apple awarded Robinhood the prestigious Design Award in 2015, making it the first finance app to receive this distinction.

The app allows you to purchase stocks and other investments. It also maintains the ability to access in-depth investment information, like past performance charts, news, average prices and the aforementioned “collections.”

Robinhood Customer Support

Unfortunately, Robinhood doesn’t offer much in terms of customer service. In fact, it doesn’t operate a phone support line and has no physical locations. This severely limits the response speed of the firm. The nearest offering for direct support is Robinhood’s ticket service, which you can find in its online help center. This is meant to be a last resort, though, as the firm provides content and troubleshooting strategies to help you figure out things on your own.

Who Is Robinhood For?

While Robinhood doesn’t necessarily require you to have ample investment experience prior to joining, it’s extremely helpful if you have the ability to be an independent investor. Outside of some light educational content on its website, the firm does not have advisory representatives to aid you in your investment choices.

Given that Robinhood is a mobile- and internet-centric brokerage firm, prospective investors should be technologically literate. Robinhood does not have physical branches that you can visit. The firm’s app and website are available throughout all 50 states and Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How Does Robinhood Compare?

Of course, it’s nearly impossible to find a fee structure that includes as many $0 appearances as Robinhood. So it will understandably beat out the stock trading costs associated with just about every brokerage firm that you pit against it. This is evident in the table below, as E-Trade and Merrill Edge’s average $6.95 charges stand out compared to Robinhood’s fee-free offerings.

On the other hand, minimum investments are less common. Robinhood is absent of this requirement, but this shouldn’t necessarily be a determining factor as to why you’d choose it over another broker. Instead, look more toward the “Best For” column below to gain more insight into which would work best for you.

Brokerage Comparison

| Brokerage Firm | Fees | Minimum | Best For |

| Robinhood | $0 | $0 | – Mobile/online traders – Self-sufficient investors |

| E-Trade | $6.95 | $500 | – Those who trade often – Anyone who prefers strong customer service |

| Merrill Edge | $6.95 | $0 | – Bank of America account holders – Customer support junkies |

Robinhood: Legal Troubles

Though named Robinhood, a nod to a legendary British archer who battled the rich sheriff of Nottingham on behalf of his impoverished subjects, its reputation as a friend of small investors has taken a beating in the last few years.

Gamestock

In January 2021 Robinhood limited customers – that is, small investors – from purchasing GameStock shares. Those customers’ heavy purchases were driving an unprecedented short squeeze that enabled many Robinhood customers to finally pay off big debts and experience upward mobility for the first time. Their gains, of course, came at the expense of powerful hedge funds whose failed attempt at shorting GameStock shares ended up costing them billions. Robinhood’s decision to limit customers’ GameStock purchases capped the hedge funds’ financial hemorrhage and limited its own customers’ ability to profit from their short squeeze.

To no one’s surprise it also sparked litigation: By mid-February those retail customers had filed more than 90 lawsuits against Robinhood.

Congress responded by summoning Robinhood and Melvin executives to testify on Feb. 18, and both companies were expected to deny they colluded to harm retail investors of GameStock. In addition, Congress brought executives of Citadel and Reddit to testify on the subject. Also making an appearance on Capitol Hill was Keith Gill, known as “Roaring Kitty,” the r/WallStreetBets member who talked up GameStock shares before and during the historic short squeeze.

In the runup to the Congressional testimony many critics attributed Robinhood’s decision to limit trading on its dependence on market makers who handle customers’ buy-and-sell orders. Chief among those market makers is Citadel Securities, which is owned by billionaire Ken Griffin. Citadel Securities accounts for a big chunk of Robinhood’s revenue. Significantly, Griffin also owns hedge fund Citadel LLC, which spent a small fortune bailing out a fellow hedge fund that was one of the main losers in the GameStock short squeeze. In other words, when loyalties were revealed, Robinhood turned out to be working for the sheriff of Nottingham – that is, the Wall Street establishment; to many observers, the suspicion seemed more than plausible.

Other Issues

In April 2023 the firm agreed to pay $10.2 million to settle a multistate probe into allegations that in March 2020 it harmed retail investors, partly from not supervising technology that caused outages and blocked investors from trading. Also, in 2021 FINRA hit Robinhood with $70 million in fines over systems outages. It was the largest fine in FINRA’s history.

Robinhood: Bottom Line

If you want to avoid constantly going through a broker to purchase an investment, the self-sufficient nature of Robinhood is likely attractive. Of course, this doesn’t come without its pitfalls. It can be tough to access customer support should you have any problems or specific questions.

Nothing is promised when you take a chance on investments, but Robinhood undoubtedly puts you in a solid situation that’s angled for success. Between Robinhood’s commission-free stock and options trades and impressive mobile and online presence, customers are afforded more than enough potential for financial upside.

Tips to Get Into Investing

- Robinhood is a great way to invest, if you prefer a DIY approach. But a financial advisor can offer you a more hands-on help. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Having a concise and purposeful plan for your investments is incredibly important. And a significant part of these plans should be your asset allocation. This dictates how your funds will be spread across different investment types. So should you need help figuring this out, check out the free SmartAsset asset allocation calculator.

Photo credit: Robinhood.com, ©iStock.com/ipopba