Quicken is well known for its personal finance tools, including budgeting and mortgage management. However, it also offers a solution for estate planning. Quicken WillMaker & Trust allows you to create and customize your own will and trust without the need for a lawyer. The platform also enables you to draft essential legal documents, such as healthcare directives, with ease.

While Quicken WillMaker is a convenient option for drafting a will, a financial advisor can provide more comprehensive estate planning guidance.

Quicken WillMaker & Trust Overview

| Quicken WillMaker & Trust Overview | |

|---|---|

| Pros | – Software and online version vetted by qualified attorneys – Covers a wide range of topics, including wills, trusts and medical directives – Straightforward to use |

| Cons | – Costs $109+ |

| Best For | – Those with a wide range of estate planning needs who don’t want to pay an attorney |

Quicken WillMaker & Trust: Services & Features

Quicken WillMaker & Trust can take care of almost all of your estate planning needs. You can do all of the following in a relatively short amount of time using the software:

- Name a guardian for your child or pet in case of an emergency

- Make final arrangements for your resting place and funeral

- Write a will to determine asset distribution

- Create a trust

- Specify how to handle debts that are owed upon your death

- Name an executor of your will

- Create a healthcare directive, which can be used in the event you become incapacitated

Quicken WillMaker & Trust provides a range of essential estate planning services similar to those offered by its competitors. However, it sets itself apart with its robust trust creation features, allowing users to include specific provisions, designate additional executors and appoint trustees.

That said, there are certain limitations to be aware of. The software does not support estate planning for digital assets, charitable donations or property deed transfers. If your estate planning needs extend beyond its capabilities, consulting a financial advisor can provide the comprehensive guidance necessary to ensure your wishes are fully addressed.

Quicken WillMaker & Trust: Pricing

| Quicken WillMaker & Trust’s Fee Structure | |

|---|---|

| Membership Tiers | – $109 – $219 |

| Extra Features | – Write personalized letters to family and friends who survive you |

Another positive feature of Quicken WillMaker & Trust is that all you’ll need to pay is a flat price of $99. From there, you can install the program on your personal computer and create any documents you wish.

This differs from some other estate planning platforms that charge you based on the features you take advantage of, the membership tier you buy into or how many times you use it. While $99 for any program isn’t cheap, when you consider the range of materials that you’ll have access to, it may well be worth it if you have multiple estate planning documents to create.

Quicken WillMaker & Trust: User Support

Quicken WillMaker & Trust provides customer support up to the end of the edition year that you purchase. For example, if you buy the current edition, Quicken WillMaker & Trust 2026, you’ll have access to customer support through Dec. 31, 2026.

Interestingly, the software doesn’t provide the option to talk to an attorney or an estate planner, even during the current edition year. Nolo, the company that sells the software, does have a resource library to help you resolve common problems and answer basic questions, though.

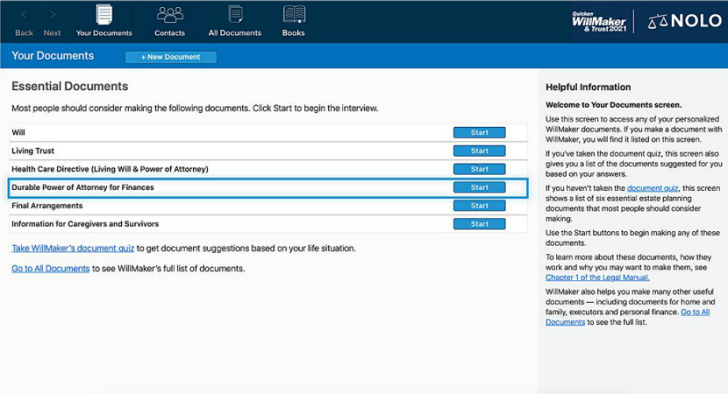

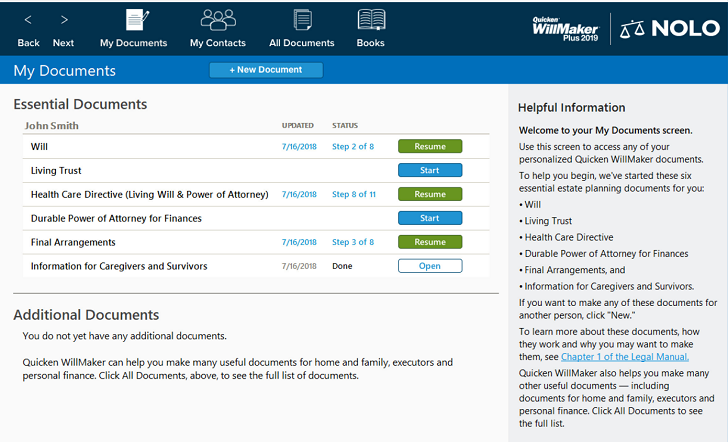

Quicken WillMaker & Trust: Product Experience

The user experience of Quicken WillMaker & Trust has been improved. Whereas you once needed to download software onto your computer, now you have the choice to complete your will on the firm’s secure online platform. However, by saving your documents locally, you’ll ensure they’re accessible regardless of if you have internet or not.

The software is certainly broad and comprehensive. The screenshot above shows just how many features you’ll have access to, but the interface can also feel a little outdated and cluttered with many layers of information packed into a small area. That said, if you read through everything carefully, you should be able to figure out anything you might need to do.

Note that the software of Quicken WillMaker & Trust isn’t very demanding. Just about any relatively young computer should be able to run it without a hitch. It’s also available for both Apple and Windows computers.

How Does Quicken WillMaker & Trust Stack Up?

Quicken WillMaker & Trust provides access to more estate planning options than some other services. Some competitors of Quicken boast features like the ability to talk to an actual estate planning lawyer. This could prove to be helpful if your situation is especially complex.

| Comparing Quicken WillMaker & Trust to Other Services | |||

|---|---|---|---|

| Service | Pricing | Features | Accessibility |

| Quicken WillMaker & Trust | – $109 to $219 | – Final arrangements for your resting place – Wills and trusts – Specify how to handle debts – Name an executor – Healthcare directives | – Software and online |

| Trust & Will | – Trust: $499 ($599 for couples) – Will: $199 ($299 for couples) | – Will membership – Trust membershi | – Web-based program |

| Rocket Lawyer | – $39.99/month for membership ($239.88 per year for Rocket Legal+) – With no membership, services available for a separate cost – Free seven-day trial for will making | – Custom legal forms – Sessions with a lawyer – Online Q&A with lawyers – Document defense – Form an LLC, corporation or non-profit – Registered agent service | – Web-based program |

Bottom Line

Quicken WillMaker & Trust is a solid estate planning option if you’re looking for access to a lot of different estate planning documents. However, you’ll also end up paying $109+ for estate planning. All in all, though, DIY estate planners will likely find this to be a helpful option. The right solution for everyone will vary based on their individual needs.

Tips for Estate Planning

- There are many facets to estate planning, and you don’t have to tackle them on your own. In fact, it can help to work with a financial advisor. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- When it comes to estate planning, it can be tempting to try and go at it alone. Between services like Quicken WillMaker & Trust and independent online research, there’s lots of info to help you. However, there are risks to DIY estate planning. Make sure you know what you’re getting into before you get started.

- A living will or another form of advance directive can help ensure that your doctors and loved ones comply with your choices. You might want to consider creating one for when you cannot communicate decisions on your own.

Photo credit: ©iStock.com/Ridofranz, newegg.com, ©iStock.com/steamdbinfo