In 2017, the U.S. spent $3.50 trillion – more than $10,000 per person – on healthcare, according to the Organization for Economic Cooperation and Development (OECD). As a percentage of U.S. GDP, healthcare made up 17.10%. This is greater on a per capita basis and as a percentage of GDP than any other country.

Though healthcare spending in the U.S. is high, it lags in terms of availability, affordability and health outcomes as compared to many countries that spend less, according to a recent International Federation of Health Plans (iFHP) Comparative Price Report. Many Americans, particularly low-income individuals, do not have access to affordable care, making healthcare reform a popular topic among policymakers and politicians.

In part, the discrepancy between spending and health outcomes in the U.S. as compared to other countries is a result of the fact that healthcare is much more heterogeneous in the U.S. than it is in other countries, according to the iFHP report. That is, healthcare access and availability along with cost and quality of care differ significantly across income-levels and geographic locations, resulting in varying abilities to save for expenses that healthcare may not cover.

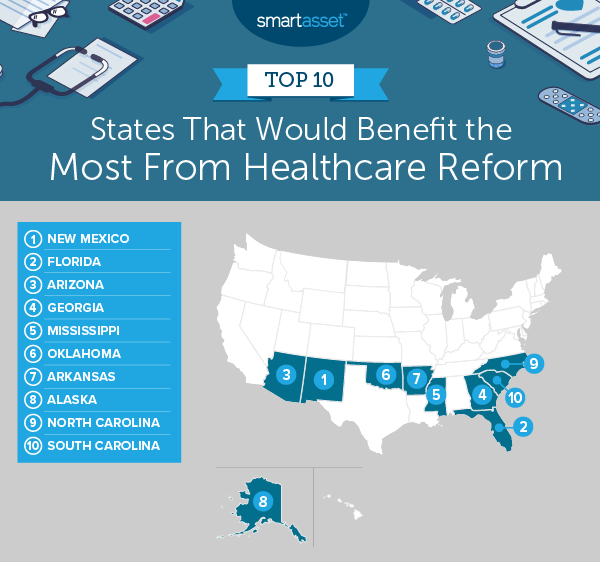

In this study, SmartAsset looked at states that would benefit the most from healthcare reform according to nine metrics that span a range of healthcare indicators, including availability, affordability and outcomes. For more information on our data sources and how we put all the information together to create our final rankings, check out our Data and Methodology section below.

Key Findings

- Southern states populate the top 10. Seven of our top 10 states that would benefit the most from healthcare reform are located in the South, per Census Bureau regional divisions. They are Florida, Georgia, Mississippi, Oklahoma, Arkansas, North Carolina and South Carolina. In 2017, more than 10% of the population in six of those seven states did not have health insurance and more than 15% of the population in all seven reported that they did not see a physician due to cost at some point over the previous 12 months.

- High uninsured rates in Texas. Texas does not rank in our top 10, because average annual health insurance premiums are a smaller percentage of median household income relative to other states. Additionally, a relatively large percentage of private firms offer health coverage to their employees. However, the state has the highest rates of people without health insurance across all three subsets of the population that we looked at – total population, children and the low-income population – compared to any other state. Moreover, 19.6% of the population reported that they did not see a physician in the last 12 months due to cost, which is the highest rate for this metric for any state.

- There are improvements to be made in all states. Even in states that ranked well in terms of healthcare access and affordability according to the metrics we considered, there is room for improvement. For instance, Iowa has the lowest percentage of the population reporting that they did not see a physician due to cost, but that percentage is still sizable at 7.9% for something as important as health. Similarly, even though the District of Columbia has the lowest percentage of residents reporting a poor or fair health status, it’s still 10.8% for this metric.

1. New Mexico

New Mexico ranks in the bottom half of all states across all nine metrics that we considered. In fact, for seven of the nine metrics, it ranks in the bottom third of states and performs the worst with respect to cost-related metrics.

Health insurance premiums in New Mexico are extremely high compared to the median household income. Using data from the Census Bureau and Kaiser Family Foundation, we found that average annual employee premiums and premiums under the ACA made up 3.33% and 6.37%, respectively, of the median household income in the state in 2017. In gross terms, the Kaiser Family Foundation estimates that the average annual premium for an enrolled employee in an employer-based health insurance plan was $1,558 in 2017. The average annual premium for a silver plan under the ACA, after receiving any premium tax credits, was $2,976.

2. Florida

Uninsured rates in Florida are high. In 2017, 12.9% of the total population, 7.3% of children and 21.3% of the low-income population did not have health insurance. In comparison, only 2.8% of the total population, 1.5% of children and 4.6% of the low-income population did not have health insurance for the same year in Massachusetts, one of the top-ranking states according to those three metrics.

Additionally, percentage of need met in Florida ranks fourth-lowest across all states and the District of Columbia. The Kaiser Family Foundation calculates percentage of need met by dividing the number of physicians available to serve the population by the number of physicians that would be necessary to eliminate primary care health professional shortage areas (HPSAs). HPSAs for primary care are defined as areas in which the ratio of primary care physicians falls below one per 3,500 people. As of the end of 2018, there were 275 HPSA designations in Florida, and the percentage of need met was only 22.1%.

3. Arizona

Health insurance premiums in Arizona are higher than those in almost every other state. The average annual premium after tax credits for a silver plan under the ACA is $3,936, or 6.96% of the median household income in Arizona in 2017, which was $56,581. Additionally, in 2017, the average annual premium for an enrolled employee in an employer-based health insurance plan was $1,554, or 2.75% of the median household income.

Overall health insurance rates along with health insurance rates specifically for children are also low in Arizona. According to Census Bureau estimates, in 2017, 10.1% of the total population and 7.7% of children did not have health insurance.

4. Georgia

With 24.4% of the population uninsured, Georgia has the highest rate of low-income individuals without health insurance of any state in our top 10 and the second-highest rate for this metric across all states. Additionally, like in Arizona, many children in Georgia do not have health coverage. The Census Bureau estimates that in 2017, approximately 7.5% of residents under the age of 19 did not have health insurance.

In general, residents covered by the ACA in Georgia do not allocate as large a percentage to annual premiums from their annual incomes as residents in other states. At 3.63%, the average annual premium under the ACA as a percentage of median household income in Georgia ranks 14th-lowest across all states in our study.

5. Mississippi

Compared to all states, Mississippi had the second-highest percentage of residents reporting that they did not see a physician due to cost in 2017. At 18.2%, it followed only Texas, where 19.6% of residents reported being cost-prohibited.

The average annual premiums for an individual under the ACA and for an enrolled employee under an employer-based health insurance plan are relatively comparable in Mississippi. According to data from the Kaiser Family Foundation, the average annual premiums for an individual under the ACA and for an employee under an employer-based health insurance plans are $1,440 and $1,365, respectively.

6. Oklahoma

Some 14.2% of the population in Oklahoma did not have health insurance in 2017. This is the second-highest rate for this metric of any state in our study, following only Texas. Additionally, Oklahoma ranks in the bottom five of all states for the percentage of children and percentage of low-income residents without health insurance. In 2017, 8.1% of children and 24.1% of low-income residents did not have health coverage.

Despite this, the Kaiser Family Foundation reports that 57.1% of medical need is met in Oklahoma. This is the 12th-highest rate of any state.

7. Arkansas

Almost 25% of the population in Arkansas self-reported a fair or poor health status in 2017. Though uninsured rates are average, with Arkansas ranking in the middle of all states for the percentage of the total population without health insurance as well as the percentage of residents with income below 138% of the poverty threshold without health insurance, many people seem to be cost-prohibited when it comes to seeking professional medical advice or treatment. In 2017, 16.4% of adults reported not seeing a doctor in the past 12 months because of cost. This is greater than both the total population’s uninsured rate, 7.9%, and the percentage of the low-income population without health insurance, 11.3%.

According to our research, insurance premiums in Arkansas are average, but significant as compared to the 2017 median household income. Specifically, the average annual premium for an enrolled employee in an employer-based health insurance plan was $1,375 and 3.00% as a percentage of median household income.

8. Alaska

According to Census estimates, 13.7% of the total population and 9.6% of children were uninsured in 2017. The low health insurance rates in Alaska may be partially the result of private firms not offering coverage. The Kaiser Family Foundation reports that only 38.1% of private firms in Alaska offer health coverage, the fifth-lowest rate of any state in our study.

Though only a small percentage of firms in Alaska offer health coverage, annual premiums for residents who have that coverage are much lower than in other states. In 2018, the average annual premium for an enrolled employee in an employer-based health insurance plan was only $1,154, or 1.58% as a percentage of the median household income in Alaska – the third-lowest rate overall.

9. North Carolina

In North Carolina, 10.7% of the total population and 4.8% of children did not have health insurance in 2017. Additionally, 20.0% of the population who fell below 138% of the poverty threshold did not have health insurance.

10. South Carolina

In 2017, only 79.8% of low-income individuals in South Carolina had health insurance. In comparison, more than 95% of low-income individuals in Vermont, Massachusetts and the District of Columbia had health insurance coverage that year.

The percentage of individuals reporting fair or poor health in South Carolina ranks within the 20 highest percentages for this metric in our study overall. In 2017, 19.3% of adults reported fair or poor health status. This is the 14th-highest rate in our study overall.

Data and Methodology

In order to find the states that would benefit the most from healthcare reform, SmartAsset looked at data for all 50 states along with the District of Columbia. Specifically, we compared them across the following nine metrics:

- Percentage of the population without health insurance. This is the percentage of a state’s total population without health insurance. Data is from the U.S. Census Bureau’s 2017 1-year American Community Survey.

- Percentage of children without health insurance. This is the percentage of a state’s population younger than age 19 without health insurance. Data is from the U.S. Census Bureau’s 2017 1-year American Community Survey.

- Percentage of low-income residents without health insurance. This is the percentage of people whose income is less than 138% of the federal poverty line who do not have health insurance. Data is from the U.S. Census Bureau’s 2017 1-year American Community Survey.

- Average annual premium under the ACA as a percentage of median household income. This is the average annual premium for a silver plan under the ACA for current marketplace enrollees, after receiving any premium tax credit, divided by the median household income in the state. Data is from the Kaiser Family Foundation and the U.S. Census Bureau’s 2017 1-year American Community Survey.

- Average annual premium under an employer-based health plan as a percentage of median household income. This is the average annual single premium per enrolled employee for employer-based health insurance divided by the median household income in the state. Data is from the Kaiser Family Foundation for 2018 and the Census Bureau’s 2017 1-year American Community Survey.

- Percentage of firms offering coverage. This is the percentage of private sector establishments that offer health insurance to employees. Data is from the Kaiser Family Foundation and is for 2018.

- Percentage of adults reporting fair or poor health status. Data is from the Kaiser Family Foundation and is for 2017.

- Percentage of need met. This is the number of physicians available to serve the population divided by the number of physicians that would be necessary to eliminate primary care health professional shortage areas (HPSAs). HPSAs for primary care are defined as areas in which the ratio of primary care physicians falls below one per 3,500 people. Data is from the Kaiser Family Foundation and is for 2018.

- Percentage of population reporting that they did not see a physician due to cost. Data is from the Kaiser Family Foundation and is for 2017.

To create our final score, we ranked each state in each metric. Then we found each state’s average ranking giving equal weighting to all metrics except percentage of children without health insurance and percentage of low-income residents without health insurance, which we half weighted. We used this average ranking to create our final score. The state with the best average ranking received a 100. The state with the worst average ranking received a 0.

Tips for Avoiding Financial Stress

- Commit to a budget. Committing to a detailed and strict budget can help you avoid spending more than you are able and avoid future stressful financial situations.

- Get financial help. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/bymuratdeniz