Posts by Caroline Hwang, CEPF®

Why Retiring Early Is a Bad Idea Now

If you are near retirement and recently unemployed, you may have more company than you think. The tech sector has seen major layoffs over the past several months and many fear a recession is coming. While retiring early by itself… read more…

New House Coronavirus Relief Bill Includes More Stimulus Checks

Coming in at 1,815 pages, the new coronavirus relief bill proposed and approved by the House is a giant wishlist. Named the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act, it includes: $540 billion for states, territories and tribal governments; $100 billion for a public health and social services emergency fund; $100 billion for… read more…

Oregon Coronavirus Relief Programs

Though Oregon’s first case of coronavirus was even before epicenter New York’s, the western state has kept its caseload relatively low. Its population is not as dense, of course. But state-issued social distancing measures have also played a key role… read more…

Vermont Coronavirus Relief Programs

As of April 20, some Vermonters are returning to work amid the COVID-19 pandemic. The phased restart of business allows for outdoor businesses (such as landscaping and utilities) and construction operations to resume work with a maximum two employees per site (indoor construction workers can be in empty buildings only). Also sole proprietors that offer… read more…

The New Small Business Stimulus: PPP Funding and More

Small business owners who missed out on the first round of PPP loans and EIDL grants will have another shot. Congress has approved what’s officially called the Paycheck Protection Program and Health Care Enhancement Act – and informally dubbed Stimulus 3.5. (The third stimulus bill is the $2 trillion CARES Act). The bill was signed… read more…

Kentucky Coronavirus Relief Programs

Compared to neighboring states Ohio and Tennessee, Kentucky has had far fewer coronavirus cases so far. Some counties have yet to tally even one case, though epidemiological modeling forecasts that the state is still a month away from its caseload… read more…

Louisiana Coronavirus Relief Guide

Louisiana was the fourth state in the U.S. to be declared a major disaster – and the fourth state to tally 1,000 coronavirus deaths. A large portion of infections and deaths are located in tourist destination New Orleans and its surrounding area. This year, more than one million visitors from around the country and world… read more…

PPP Loans: Lender List and Requirements

The Paycheck Protection Program (PPP) is closed again. This is the third time since its inception. The first time was when it ran out of its $349 allocation; an interim stimulus bill gave it another $310 billion (with $30 billion set aside for small lenders and… read more…

Coronavirus Stimulus Package: What You Need to Know

In an effort to help curb the economic effects of the coronavirus pandemic, President Donald Trump signed a coronavirus stimulus package called the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act is the biggest rescue package in U.S. history with a staggering price tag of $2 trillion. The legislation seeks to provide… read more…

Coronavirus Stimulus and Relief Program Guide

As the coronavirus pandemic intensifies, Americans are facing not only a public health crisis but an economic one as well. To help you navigate this uncertain period and protect your financial well-being, SmartAsset has gathered a list of resources to help you answer the difficult money questions you may have. We’re updating this page daily,… read more…

8 Things You Can Do to Navigate a Recession

Navigating a recession requires an intelligent, fleet-footed strategy to safeguard your money and protect your financial future amid the downturn and uncertainty. Truth be told, no one, including the experts, knows how any economic slowdown will turn out in the… read more…

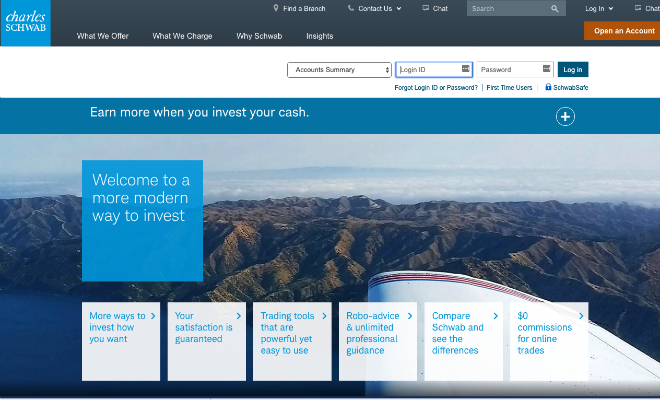

Charles Schwab Review

Long before investing disruptors E-Trade and Betterment came on the scene, there was Charles Schwab & Co., Inc. A maverick since its inception in 1973, Charles Schwab brokerage cut its fees by half when the Securities and Exchange Commission (SEC)… read more…

How to Switch Financial Advisors

For many people, switching financial advisors can be very difficult and they end up avoiding the topic and putting it off, indefinitely. However, replacing your advisor doesn’t have to be a big hassle or come with high costs, if you… read more…

How to Create a Living Trust in Vermont

Contrary to public perception, trusts aren’t only for the wealthy. Indeed, anyone who owns property in Vermont and whose estate is worth more than $10,000 may want to set up a living trust to avoid probate. The court process can… read more…

How to Create a Living Trust in Idaho

After working so hard to build and manage your wealth, you’re not about to let it just scatter to your heirs without a plan. You want to steer it to them intact, which may include creating a living trust to… read more…

How to Create a Living Trust in Kentucky

After the years you put into building your wealth, you want to pass it on to your heirs intact and ideally without the delay of the courts. For Kentuckians, setting up a living trust makes a lot of sense since… read more…

How to Create a Living Trust in Tennessee

It’s not only natural to be thinking about what will happen to your property after you die. It’s also smart. For Tennesseans who want to spare their heirs the time and expense of going through probate, transferring assets to a… read more…

How to Invest $1 Million

There are more ways to invest $1 million than you might think. It’s smart to have a plan in place and to assess your goals for growth and risk tolerance. Of course, you’ll also want to factor in how much… read more…

Public Investing App Review

Public, formerly known as Matador, is a stock-trading app designed for beginner investors, launched in March 2019. While it shares similarities with other beginner-friendly investing platforms like Robinhood, Public stands out with its unique social networking features. The app allows users to follow friends and popular investors, gaining insight into what others are buying and… read more…

Market Correction: Definition, Duration and Everything Else You Need to Know

When people talk about a market correction, it sounds like a euphemism for falling stock prices. But it’s actually a technical term for a 10% or bigger drop in the price of an index (or individual security) from the last… read more…

How Much Do I Need for an Interest-Only Retirement?

For an interest-only retirement, you’ll need to have a large nest egg. How big a nest egg depends on your target income and the interest rate. For example, an annual income of $48,000 would require a nest egg of $1.6… read more…

11 Safe Investments to Protect Your Money

There’s always some risk involved with being an investor. However, there are strategies investors can use to be safer with their money, while also garnering some returns. For instance, you can keep your money liquid by investing in various types of… read more…

6 Disadvantages of Saving With a 401(k) Plan

For most, the advantages of 401(k) plans outweigh the disadvantages. But there are some people who would benefit from steering their retirement savings to other investment vehicles. Could you be one of them? This roundup of 401(k) disadvantages will help… read more…