If you ever need ton resolve an issue with the IRS, whether or not it’s related to your federal income taxes, you will need to contact the IRS. That can be intimidating. You may not feel like you know enough about the U.S. tax code to file a complaint or challenge a penalty. Luckily, if you feel this way, there’s something you can do about it. If you’d rather have a lawyer or a tax preparer talk to the IRS, you can complete Form 2848. Here’s our guide to understanding that form.

What Is Form 2848?

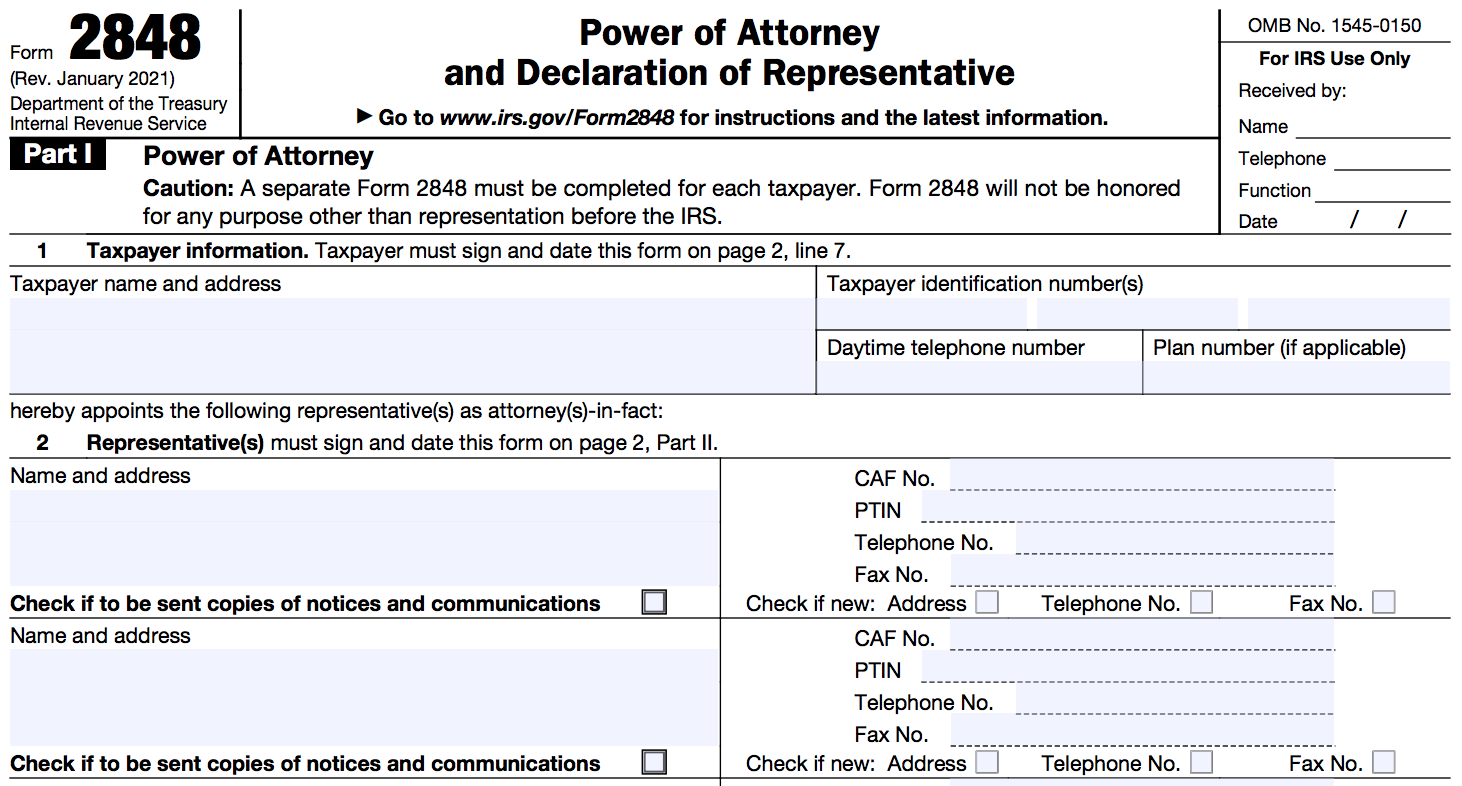

IRS Form 2848 is the Power of Attorney and Declaration of Representative form. If you need someone to represent you and discuss your tax problems with the IRS, you can complete Form 2848. Since tax information is considered private information, you’ll need to formally give another person permission to address your personal tax issues.

There are a number of people who can face the IRS on your behalf. You can enlist the help of an attorney or tax accountant. You can also ask a family member or a student who works for a tax clinic program or a low-income taxpayer clinic to act as your representative.

When to Use IRS Form 2848

Having someone else represent you could be a good idea if a disease or medical condition prevents you from being able to communicate with the IRS directly. You may also need a power of attorney if you plan on being out of the country during tax season.

Businesses including partnerships, associations and corporations can file Form 2848 as well if they need a third party to represent them during conversations with the IRS. Trustees and heirs may also need to use Form 2848 if they need help addressing tax issues related to their trusts and their family members’ estates.

What Form 2848 Allows an Agent to Do

Once you submit Form 2848, the person you want to represent you has the power to review your tax returns and help you resolve specific problems you list on Form 2848. Your representative can sign your tax return as well under certain circumstances.

Form 2848 does not give representatives free rein to do whatever they want, however. They can’t do anything you haven’t given them the authority to do. They are also prohibited from trying to persuade the government to give you a tax refund check.

How to Complete Form 2848: Part I

Form 2848 is a two-page document with two sections. In Part I, line 1 asks for your name, address and phone number. You must also write in your individual taxpayer identification number, your Social Security number and/or your employer number.

Line 2 asks you to enter the name, phone number, fax number and address associated with the person (or people) who will represent you. You can list up to four representatives on a single form. If there are others acting on your behalf, you can make a note of that beside line 2 and attach a second form with their names.

If you want the person or people representing you to see all the letters that the IRS sends you, there’s a box below line 2 that you can check. Just keep in mind that only up to two people can receive copies of the mail you receive from the federal government.

You’ll also need to list each representative’s CAF (Centralized Authorization File) number and PTIN (preparer tax identification number). The former is a nine-digit number that distinguishes a representative from someone else. If your representative is acting on someone’s behalf for the first time, he or she won’t have a CAF number. The PTIN number is a specific ID number used by certain representatives, including lawyers, paid tax preparers and CPAs.

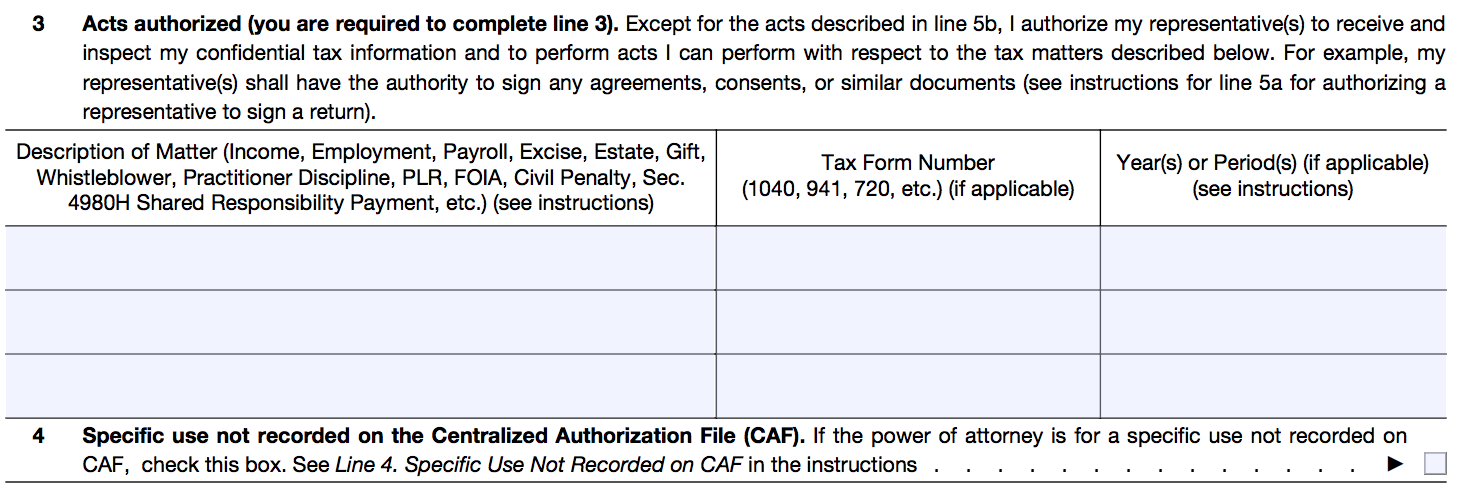

Line 3 asks you to list the tax matters that you authorize your representative(s) to address. You’ll need to describe each issue, the tax form that it appears on and the appropriate year or period of time. Unless you say otherwise, your representative can talk to the IRS about anything related to interest, income tax payments and penalty charges.

The IRS uses a computer system known as CAF to keep track of people serving as representatives for designated taxpayers. Some issues – such as applications for employer identification numbers – don’t appear on the system at all. You can check the instructions for Form 2848 for a list of instances that don’t show up on the CAF. If your concern is similar to the ones listed, you can check the box beside line 4.

Line 5a lets you identify any additional powers that you want your representative to have, including the ability to substitute or add another representative, sign your tax return and/or pass on your tax information to someone else. Your representative won’t be able to take on these tasks (or any others) unless you specifically say that they can in line 5a.

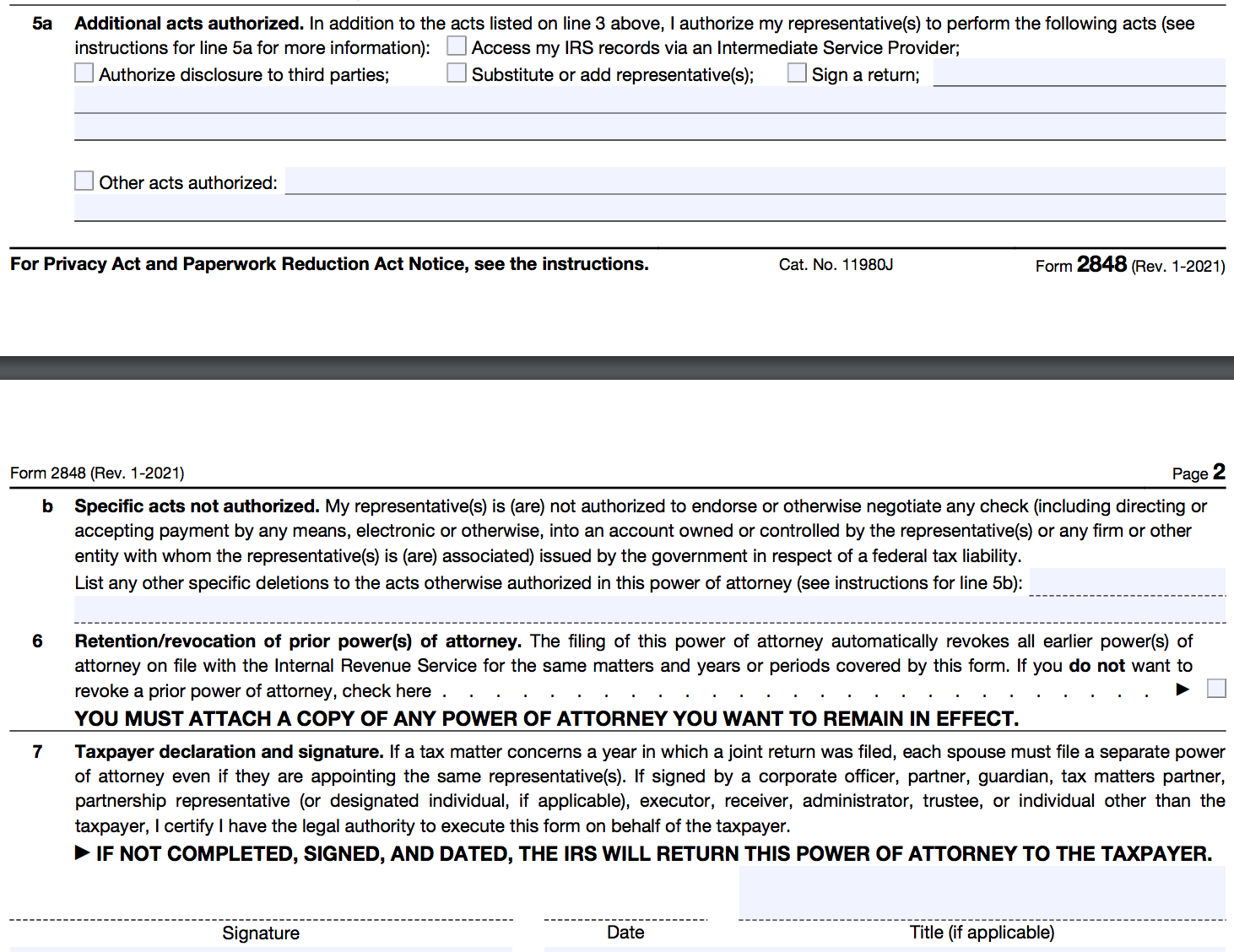

Line 5b lets you list the powers that you don’t want your representative to have. By submitting Form 2848, you automatically take back any authority that you previously gave a representative. If you want someone who once represented you to act on your behalf in the future, you can check the box beside line 6 and include a copy of their power(s) of attorney with the form.

The final part of Part I is line 7, which requires you to print your print your name and title (if applicable) and sign and date the form.

Filling out Form 2848: Part II

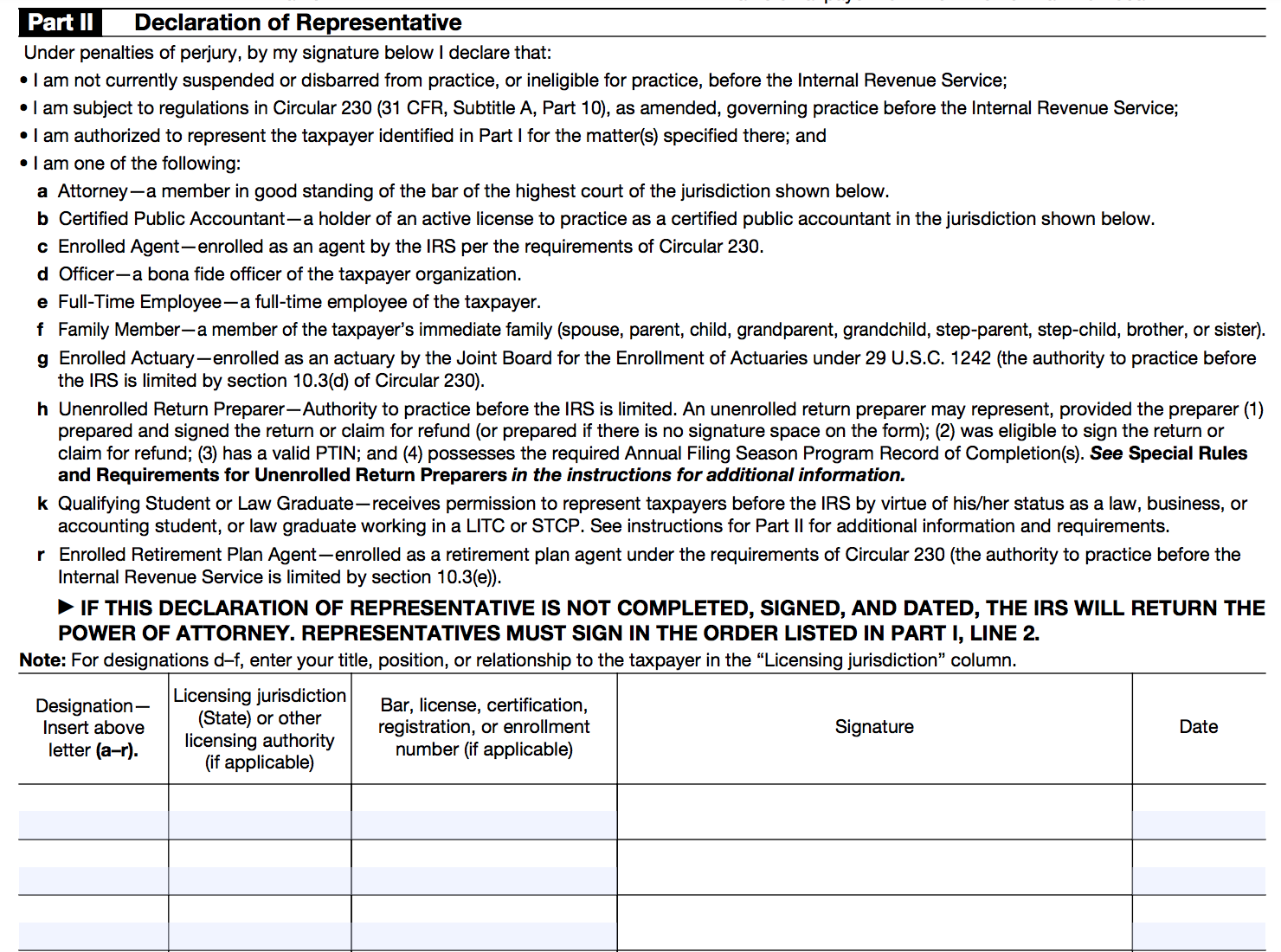

The person who has agreed to represent you will fill out Part II of the form. He or she will need to choose the letter (from a list) that corresponds to their relationship to you. For example, they will need to put a “b” if they are a certified public accountant and an “f” if they are a member of your family. They will also need to provide additional details about their licensing jurisdiction and license/certification number. The final requirement requirement is their signature.

When you’re ready to submit Form 2848, you can fax or mail it to one of the addresses listed on the form’s instructions.

Bottom Line

By filing Form 2848, you’re essentially giving a third party the authority to act as the liaison between you and the federal government. Enlisting the help of a lawyer or a CPA could be a good idea, especially if you’re not comfortable interacting with the IRS.

As you’re completing the tax form, it’s important to be as thorough as possible so that your representative clearly understands what he or she can and can’t do. If you’re filing a joint tax return with your spouse and you need representation, both of you must submit separate copies of Form 2848.

Tax Planning Tips

- A financial advisor can help optimize your tax strategy for your financial goals. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors who can help you achieve your financial goals, get started now.

- Plan ahead for tax season by calculating how much you’ll owe. SmartAsset offers several tax calculators, including a federal income tax calculator and a property tax calculator.

- Our annual roundup of the best tax filing software can help you get through this tax season as painlessly as possible.

Photo credit: ©iStock.com/andresr, All images of Form 2848 are from IRS.gov, ©iStock.com/South_agency