Saving for a home can take years, which sometimes makes the idea of switching from renting to buying a daunting one even if you have some help. But if you’re on your own, buying a home can be even more challenging. Not only do you need to have enough money to make a down payment by yourself, but you need to make enough each month to afford mortgage payments as well. That doesn’t mean you need to set aside this dream. With some thoughtful planning and detailed information, residents in many cities are successfully making the leap. Below, we look at the latest data to find the cities with the highest single homeownership rate.

To find the places where singles have the highest homeownership rates, we analyzed Census data on the number of one-person households that own their homes in an area and compared that to the overall number of one-person households. Read more about our data and how we put it together in the Data and Methodology section below.

This is SmartAsset’s second annual study of the cities with the highest single homeownership rates. You can read the 2018 version here.

Key Findings

- Higher incomes at the top. Perhaps unsurprisingly, median incomes are much higher in the top 10 cities than in the bottom 10. Incomes in the top 10 cities average about $75,800, while incomes in the bottom 10 average about $57,300.

- High housing costs and high homeownership rates. The figure for average monthly housing costs across the top 10 cities ($1,397) is higher than the figure for average monthly housing costs across the bottom 10 cities ($1,290).

- Arizona, a top state for single homeownership, has a lot of retired homeowners as well. Arizona has three cities in the top 10 and a fourth in the top 15 of this study. All four of those Arizona cities also rank among the top 15 cities where retirees are moving. Overall in Arizona, 31.4% of people aged 65 and over own their homes.

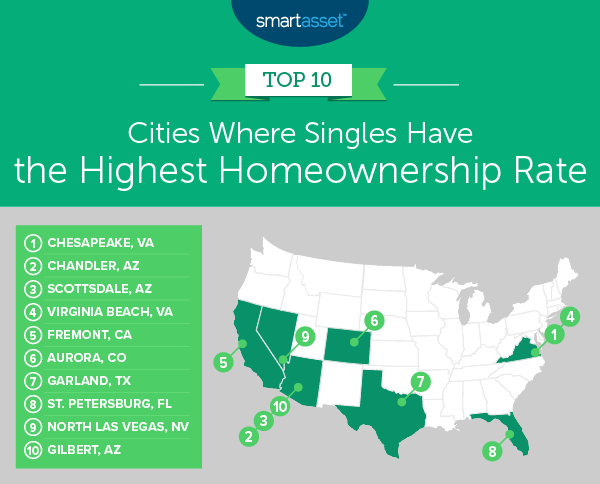

1. Chesapeake, VA

One-person owner-occupied homes: 11,323

Total one-person households: 17,062

Single homeownership rate: 66.36%

2. Chandler, AZ

One-person owner-occupied homes: 13,344

Total one-person households: 23,202

Single homeownership rate: 57.51%

3. Scottsdale, AZ

One-person owner-occupied homes: 21,376

Total one-person households: 37,243

Single homeownership rate: 57.40%

4. Virginia Beach, VA

One-person owner-occupied homes: 22,666

Total one-person households: 40,385

Single homeownership rate: 56.12%

5. Fremont, CA

One-person owner-occupied homes: 5,363

Total one-person households: 9,723

Single homeownership rate: 55.16%

6. Aurora, CO

One-person owner-occupied homes: 17,578

Total one-person households: 32,557

Single homeownership rate: 53.99%

7. Garland, TX

One-person owner-occupied homes: 9,467

Total one-person households: 17,583

Single homeownership rate: 53.84%

8. St. Petersburg, FL

One-person owner-occupied homes: 22,675

Total one-person households: 42,328

Single homeownership rate: 53.57%

9. North Las Vegas, NV

One-person owner-occupied homes: 7,680

Total one-person households: 14,361

Single homeownership rate: 53.48%

10. Gilbert, AZ

One-person owner-occupied homes: 8,757

Total one-person households: 16,413

Single homeownership rate: 53.35%

Data and Methodology

Using data on the largest 100 cities, SmartAsset created this ranking of the cities where singles have the highest homeownership rates. We considered two factors:

- Total number of one-person households. This is the number of one-person households.

- Owner-occupied one-person households. This is the number of one-person households that own their home.

Data comes from the Census Bureau’s 2017 1-year American Community Survey.

To create our rankings, we divided the number of owner-occupied one-person households by the total number of one-person households. The result was the homeownership rate for singles in that city. Then we ranked cities from highest to lowest.

Tips for Finding the Perfect Home

- Improve your credit before your buy. Your credit score and history play a big part in the mortgage rates that lenders will offer you. You can help yourself save in the long term by raising your credit score as much as possible before buying a home.

- Don’t overspend. When choosing your home, it’s important to know how much home you can afford. And once you’ve determined how much you’re comfortable spending, don’t spend more than that. Even if you think you’ve found the perfect home, overspending now may make things more difficult for you in the future.

- Get an expert’s opinion. A financial advisor is an expert who can look over your entire financial situation to help you determine whether buying a home is the right choice. An advisor can also provide more perspective on your ability to buy by helping you see where you stand with other financial goals like saving for retirement. This free matching tool will help you find a financial advisor in your area.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/BartekSzewczyk, ©iStock.com/PeopleImages, ©iStock.com/FG Trade, ©iStock.com/Brothers91, ©iStock.com/Rawpixel, ©iStock.com/Squaredpixels, ©iStock.com/svetikd, ©iStock.com/Kerkez, ©iStock.com/Stígur Már Karlsson Heimsmyndir, ©iStock.com/monkeybusinessimages, ©iStock.com/kali9