The cost of raising a family continues to rise. The United States Department of Agriculture (USDA) estimates that raising a child born in 2015 costs $233,610, from birth to age 17. After accounting for inflation, that’s $31,000 more than it cost in 1960. The USDA does offer some reprieve in that same analysis, however. The data shows that raising a child in the urban Midwest costs about $40,000 less than raising a child in the urban Northeast.

Does that mean families in the Northeast should move to the Midwest? Not necessarily, after all there are many factors to consider when deciding where to raise a family: the cost of a mortgage and child care needs to be weighed next to concerns like the quality of local schools and the area’s crime rates.

We looked at data on eight metrics to find the best cities to raise a family in 2018. We looked at data on housing cost as a percent of income, child care costs, percent of residents under the age of 19, school quality, graduation rate, poverty rate, unemployment rate and crime rate. Check out our data and methodology below to see where we got our data and how we put it together.

This is our second annual study on the best places to raise a family. Check out the 2017 version here.

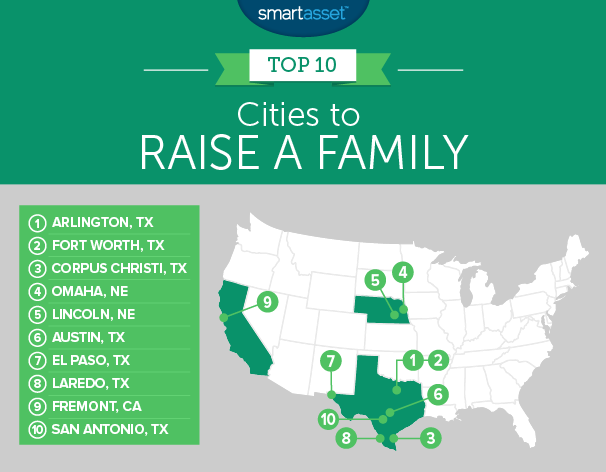

Key Findings

- Texas dominates – The Lone Star State combines good schools with low costs of living to make great cities for raising families. In total, Texas cities took seven of the 10 best cities to raise a family.

- No Northeast – The Northeast has no representatives in the top 25. Typically the biggest cities in the Northeast are plagued by high costs of living, including child care costs and housing costs. Boston for example ranks 66th overall despite the high quality of its schools. A big reason for that is the $20,000 per year average cost to keep their infant in full-time center-based care.

1. Arlington, Texas

Arlington takes the top spot on the back of some impressive scores in education. Over 91% of students here graduate high school, the second-highest rate in our study. The schools in the area also do a good job preparing students for more than just graduation. The average proficiency rate in math and reading in Arlington is 75%.

Another reason to raise a family here is the relatively low cost of living. According to our data, the average home costs only 22.5% of the average household’s income. That figure is well below the affordability line.

2. Fort Worth, Texas

Another city in the Dallas metro area takes second. Like in Arlington, the schools in Fort Worth score well. This city has top 10 scores for its graduation rates and the average proficiency in math and reading.

The reason you might choose Fort Worth over Arlington is that Fort Worth is a slightly younger city. Over 31% of residents in Fort Worth are under the age of 19. That means plenty of socializing and friend-making opportunities for young families in the area.

3. Corpus Christi, Texas

Corpus Christi takes the third spot. This city is one of the most affordable in our top 10. The average home in this city costs only 21% of the average household’s income, a top 10 rate. With less money going to housing, parents can hopefully save for retirement and contribute to their children’s college fund.

Jobs in the area are also fairly plentiful. According to our data the unemployment rate in the area is 5.9%.

4. Omaha, Nebraska

Omaha is the first non-Texas city to make the list. Schools in Omaha are some of the best in the country, according to our data. Omaha schools score a 76% for average proficiency in math and reading. Finding work in this city also shouldn’t be too difficult. Omaha has an unemployment rate of 5.4%, a top 10 rate, according to Census Bureau data.

The jobs here also pay well, at least by local cost-of-living standards. Paying for the average home in Omaha costs 22% of the average household’s income.

5. Lincoln, Nebraska

Nebraska’s capital takes the fifth spot. Lincoln students have an average proficiency in math and reading of 80.8%, the highest in the study. However, the city’s graduation rate is on the low side and hurts its overall score. Only 82% of students in this city graduate, according to the Department of Education data, that’s the lowest score in the top 10.

On the plus side, this is a safe city to call home. According to our data, it has the 24th-lowest crime rate in the country, at 3,400 crimes per 100,000 residents.

6. Austin, Texas

Austin is another Texas cities with competitive schools. The schools around Austin rank sixth in the study for average proficiency in math and reading and first for graduation rate. But that’s not the only reason to raise a family in Austin. The economic situation is positive as well, providing jobs and relatively affordable housing. Austin has an unemployment rate of 5% and average housing costs account for just under 24% of the average household’s income.

The one metric which may give families pause is the age of residents in this city. Around 24% of residents are under the age of 19, a relatively low score for this study.

7. El Paso, Texas

El Paso is a very safe city according to our data. This city has about 2,100 crimes for every 100,000 residents, a top 10 score. El Paso also has a young population, with plenty of children and teenagers. Over 30% of residents here are under the age of 19. Parents will also be happy to learn that its average child care costs are among the lowest in this study. Putting an infant in full-time centered-based care costs $8,500 per year. That’s a top 15 score.

Schools in El Paso do leave something to be desired, however. The city ranks below-average for both graduation rate and average proficiency in math and reading.

8. Laredo, Texas

Laredo has the youngest population in this study. That means plenty of kids in the area and all the socializing opportunities those kids bring. Schools around Laredo are also above-average. This city ranks 16th for average proficiency in math and reading and fifth for graduation rate.

One area of concern for families in the area is the economic climate in Laredo. This city ranks 89th for poverty rate and 53rd for average housing costs as a percent of income.

9. Fremont, California

Fremont is the only California city to crack our top 10. Despite being plagued by high housing costs – the median home costs $2,070 per month – households in this city do fairly well. Housing costs eat up only 22% of median household income, according to Census Bureau data. Fremont also has the lowest poverty rate in our study.

Furthermore, the city is one of the safest in the country. According to data from the FBI, Fremont has a combined violent and property crime rate of 2,176 per 100,000 residents. That’s the sixth-lowest rate in our study.

10. San Antonio, Texas

Our top 10 ends in San Antonio. San Antonio had strong scores in schooling and cost-of-living metrics. This city ranked in the top 20 for both housing costs as a percent of income and average annual child care costs. The city’s best score came in its graduation rate. Over 90% of students graduate from high school according to our data. For that metric, San Antonio ranks sixth in the study.

If San Antonio wants to climb any higher in this ranking, the city will need to improve its crime rate. San Antonio ranked 72nd in crime rate per 100,000 residents.

Data and Methodology

In order to rank the best cities to raise a family, we looked at data on 91 of the largest 100 cities in the country. We compared them across the following eight metrics:

- Housing cost as a percent of income. This is the median housing cost as a percent of the median household income. Data comes from the Census Bureau’s 5-Year American Community Survey.

- Annual cost of full-time center-based child care for infants. Data comes from Child Care Aware and is from 2017.

- Percent of residents under the age of 19. Data comes from the Census Bureau’s 5-Year American Community Survey.

- Average proficiency in math and reading. This is the average percent of students across schools who are proficient in math combined with the average percent who are proficient in reading. Data comes from the U.S. Department of Education EDFacts for the 2015-2016 School Year and is measured by metro area.

- High school graduation rate. This is the average percentage of students across schools who graduate. Data comes from the U.S. Department of Education EDFacts for the 2015-2016 School Year and is measured by metro area.

- Poverty rate. Data comes from the Census Bureau’s 5-Year American Community Survey.

- Unemployment rate. Data comes from the Census Bureau’s 5-Year American Community Survey.

- Crime rate per 100,000 residents. This is the combined property and violent crime rates per 100,000 residents. Data comes from the FBI’s 2016 Uniform Crime Reporting Program.

We ranked each city in each metric. Next, we found each city’s average ranking, giving equal weight to each metric. Using this average ranking we created our final score. The city with the best average ranking received a score of 100. The city with the worst average ranking received a 0.

Tips for Affording a Family Home

With child care costs and housing costs rising it is more important than ever that families find affordable housing for themselves.

- Before you start searching for a home, you should figure out how much home you can afford. This means taking a close look at your income, amount of outstanding debt and how much you’ve already saved for a down payment. You might also consider consulting a financial advisor to figure out how buying a home will impact your budget and your long-term financial goals. The SmartAdvisor matching tool can help you find a person to work with to meet your needs. After you answer a series of questions about your situation and goals the program will narrow down your options to three fiduciaries who suit your needs. You can then read their profiles to learn more about them, interview them on the phone or in person and choose who to work with in the future. This allows you to find a good fit while the program does much of the hard work for you.

- Once you have chosen a home you are interested in, it is a fairly straightforward process to estimate how much your monthly mortgage payments will be. But owning a home comes with more costs than just the mortgage. You need to estimate how much you will be spending on property taxes and homeowners insurance. And don’t forget appreciation, when the value of your home increases so does how much you pay in property taxes. If you are moving from renting to owning in a state like Texas or New Jersey, you may be surprised at just how much of your housing costs are taken up by property taxes.

- If you are a young family and planning on growing, it makes sense to buy a home for tomorrow rather than today. This means buying a home with enough space to house future family members. You can actually save money down the road this way, as you’ll avoid having to pay closing costs and broker’s fees by not having to shop for another home. But even if you are buying a bigger home than you need at this current moment, make sure it’s still a home you can actually afford.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/eugeniomarongiu