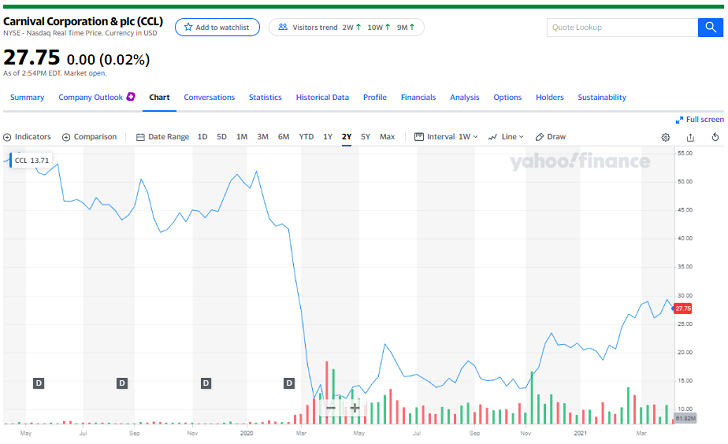

Carnival Corporation (ticker symbol: CCL) is a large British and American cruise operator with its headquarters located in Doral, Florida. Carnival went public on the New York Stock Exchange (NYSE) in 1987 at a price of about $4 per share. Since then, the stock reached a historic high of about $70 in early 2018. However, at the start of the COVID-19 pandemic, it dropped precipitously to about $12. In turn, some investors think that as the travel industry recovers, the stock will go up again. If you’re considering buying stocks, a financial advisor can help you craft a personalized investment plan for your needs.

How to Buy Carnival Stock With a Brokerage Account

Carnival is a publicly traded company, so it’s easy to buy through most types of brokerage accounts. If you’re of age and you don’t yet have a brokerage account, you can open one through a variety of different investment companies and platforms. Before you make a decision on what kind of brokerage account to open, it’s important to weigh your options. Each broker offers different account minimums and trading commissions, so some accounts will fit your financial situation better than others.

In the grand scheme of the market, CCL stock is fairly reasonably priced. But if you’d like to buy a fractional share, you have the option to do so with a brokerage account that supports fractional shares.

Once you’ve made a decision about what kind of brokerage account to open, you should fund your account and figure out how many shares you want to buy. You can then put in an order to buy shares of CCL. You can buy at market price, or place a limit order that lets you dictate the maximum or minimum price at which you’re willing to buy or sell.

Brokerage Comparison

| Brokerage Firm | Stock Trading Fees | Minimum | Best For |

| Robinhood Read Review | $0 | $0 | – Online traders – Autonomous investors |

| Merrill Edge Read Review | $0 online/$29.95 for broker-assisted trades | $0 | – Bank of America account holders – Those who value customer support |

| TD Ameritrade Read Review | $0 online/$25 for broker-assisted trades | $0 | – Online traders |

How to Buy Carnival Stock With a Financial Advisor

If you’re looking for a hands-on alternative to buy stock like CCL without a brokerage account, a financial advisor can provide you with expert guidance on your investment portfolio. You can work with one to determine your investment strategy and structure your portfolio to reach your financial needs and goals.

This is a particularly great option for those who are new to investing. The know-how of a financial advisor can come in handy if you’ve never dabbled in the stock market. In fact, an advisor can help you hedge against losses by diversifying your assets across the market. This is also true if you’re close to retirement, since you’ll have the benefit of having your future under the watchful eye of an advisor.

Overview of Carnival Corporation

Carnival is a large multinational cruise operator made up of a U.S.-based company and a UK-based company. The American arm of Carnival Corporation is listed on the New York Stock Exchange under the ticker symbol CCL. Conversely, Carnival PLC is listed on the London Stock Exchange. The two companies operate as one entity and have over 100 cruise vessels across nearly a dozen different cruise line brands. These include:

- AIDA Cruises

- Carnival Cruise Line

- Costa Cruises

- Carnival CSSC

- Cunard Line

- Holland America Line

- P&O Cruises

- P&O Cruises Australia

- Princess Cruises

- Seabourn Cruise Line

Arnold W. Donald is the CEO and president of Carnival Corporation. In total, the companies above employ over 150,000 people. While Carnival’s business was quite heavily impacted due to the COVID-19 pandemic in 2020, it had revenues of nearly $6 billion over the year.

Carnival’s Financial Profile

Most people have heard of Carnival because of its presence in the global cruise market. Despite its popularity, however, the company’s stock is far from being blue-chip, as it has a volatile price history.

The COVID-19 pandemic took a serious toll on the global travel industry, and the cruise industry was perhaps the hardest hit. Back in March 2020, several of Carnival’s cruise ships had outbreaks on board that prevented them from docking for weeks at a time.

Because of situations like this, countries and principalities across the world banned cruise ships from coming to their shores, which hurt the cruise industry. While Carnival hasn’t declared bankruptcy, there are worries that a bankruptcy could be in the company’s future if things don’t improve.

If you’d like a more holistic view of Carnival, you may want to review its Form 10-K, which is an annual report that all publicly-traded companies must file with the SEC. The form highlights everything from a company’s management, risks, expenses and total revenue.

Should You Buy Carnival Stock?

When deciding if you should purchase Carnival stock, it’s always a good idea to first assess your financial situation and long-term savings goals. Carnival is a widely recognized company in the travel space, but its stock is still susceptible to volatility. What it comes down to is if you can handle the risk that comes along with a stock like Carnival’s.

The oldest adage about investing, simple as it sounds, is that you should buy low and sell high. While Carnival isn’t hitting an all-time low right now, it’s certainly far below its pre-pandemic levels. If you think that things will return to normal for cruise lines in the near future, investing in Carnival might make sense. However, the company is rumored to be nearing bankruptcy, so that’s something to consider as well. That’s especially true if the cruise industry doesn’t rebound in 2021 and beyond.

Investing Tips

- The process around deciding which individual stocks to buy can be tough, but a financial advisor can help you figure things out. SmartAsset’s free matching tool pairs you with up to three financial advisors in your area in just five minutes. If you’re ready to be matched, get started now.

- Before you invest any of your hard-earned money, be sure to have specific goals in mind. If you’re looking for a place to start, check out SmartAsset’s free investment calculator.

Photo credit: ©iStock.com/Joel Carillet, ©iStock.com/wildpixel, ©iStock.com/Yahoo! Finance