A vesting period is the time an employee must work for an employer in order to own outright employee stock options, shares of company stock or employer contributions to a tax-advantaged retirement plan. Vesting periods come in a variety of durations. Retirement contributions are limited by government rules, while share and option vesting periods are generally negotiated between employer and employee. If you have questions about your employee stock options or other investments, consider speaking with a financial advisor.

The Basics of Vesting Periods

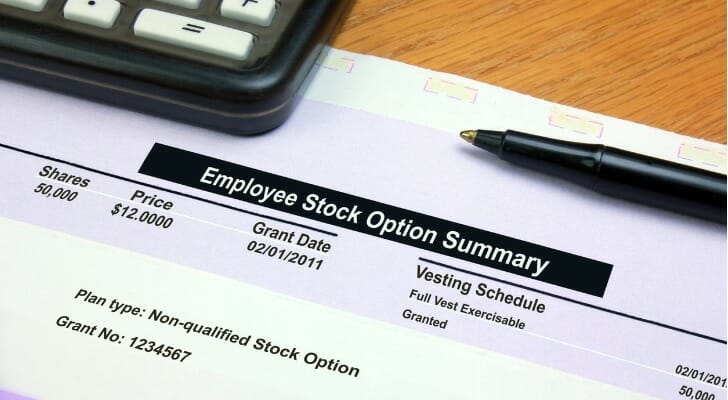

As part of employee compensation, employers sometimes give workers shares of company stock or stock options to buy shares. This is an effort to encourage employees to feel a sense of ownership in the business and to encourage them to remain employed with the company instead of moving on to another job somewhere else. Usually, the employees don’t get full ownership of those shares immediately after starting work. The period of time that has to pass before they get full ownership is the vesting period.

Vesting periods also figure in retirement plans. Employer contributions to these plans may not immediately be owned by the employee. Instead, they’ll become owned over a vesting period. Whether applied to options and grants or employer retirement contributions, if the employee leaves or is terminated before the vesting period, the employee generally loses the chance to own any benefits that have not been vested.

The details of how employee benefits such as stock options and shares become vested are laid out in the employment contract that the employee agreed to when taking the job. Vesting of retirement contributions will be explained in the retirement plan summary available from the plan administrator or human resources department.

Employers have to follow a number of rules on vesting retirement plans. The Tax Reform Act of 1986 and Internal Revenue Service regulations set out specific parameters for how long vesting periods can be. Vesting periods can range from immediate to seven years, depending on the type of plan and the employer.

Types of Vesting Periods

The simplest vesting period is immediate or zero; the employee immediately owns any grants of shares or options or employer contributions to retirement plans. Whether vesting will be immediate is generally at the discretion of the employer within limits. Some sorts of retirement contributions have to be immediately vested. For instance, retirement plan contributions voluntarily withheld from an employee’s paycheck are always 100% vested immediately. Employer contributions to SEP IRA and IRA plans are also immediately vested.

Other kinds of qualified defined contribution retirement plans, such as profit-sharing and 401(k) plans, may have immediate vesting but typically have a vesting period. Whether used for shares and options or retirement contributions, there are two major types of schedules for vesting periods: cliff vesting and graded vesting.

With cliff vesting, the employee has 100% ownership of the benefits after a set period has passed. This period could be as short as a year or could be as long as several years. IRS rules on retirement plans keep employers using cliff vesting from forcing employees to wait more than three years to acquire ownership of the employer contributions to a plan. The rules are different for defined benefit plans such as pension plans. These can use an immediate vesting schedule or extend the vesting period up to seven years. With shares and options not included as part of a retirement benefit, it’s up to the employer and employee to negotiate an acceptable vesting period. This could be as short as a year or as long as several years.

With graded vesting, employees get ownership in stages. For defined contribution retirement plans, IRS requires vesting of 20% of employer contributions after one year, 40% after three years, 60% after four years, 80% after five years and 100% after six years of service. Employers are free to vest benefits sooner, but can’t require employees to wait longer. For graded vesting of shares and options, the periods agreed to by employer and employee are often similar to retirement plan graded vesting schedules.

Other Vesting Considerations

Sometimes the vesting schedule for shares and options describes a trigger event that will give the employee immediate full ownership of the benefits. In the case of a startup, the trigger may be an initial public offering (IPO) or sale to another firm.

Triggers also figure in retirement plans. Plan termination is one trigger. If a retirement plan is terminated, all the retirement plan contributions have to be immediately 100% vested. A plan may be terminated if the company is sold to or merges with another firm, files for bankruptcy or simply elects to switch to another type of plan. Retiring is a trigger that applies to retirement plan contributions. When an employee reaches full retirement age, the employee’s retirement plan contributions become fully vested.

Where Is Vesting Used Besides Retirement Plans?

Vesting is commonly used in various compensation and incentive programs beyond retirement plans. In employee stock options and equity grants, vesting schedules ensure that employees earn ownership of company shares or stock options over time. This encourages retention and aligns employee interests with the company’s long-term goals, as individuals must stay with the company for a specified period before fully owning the granted shares.

Another area where vesting applies is in deferred compensation programs, such as bonuses or profit-sharing. Employers may offer these incentives with vesting periods to ensure employees remain with the organization for a set duration. If an employee leaves early, they may forfeit a portion or all of the unvested amounts, promoting loyalty and long-term commitment.

Vesting can also appear in partnerships and business agreements. For example, founders or key partners may agree to vesting schedules for their ownership stakes, ensuring that they earn their full equity only after contributing to the business for a certain number of years. This structure helps prevent individuals from leaving prematurely with a full stake and ensures accountability and sustained involvement.

Bottom Line

Some employers offer benefits in the form of matching funds to their employees’ retirement plans. Workers then become fully vested, or own employer-provided funds, either immediately or after several years of service. Federal and state laws govern how long a company can require you to work to become fully vested. Generally, the maximum is two to seven years, depending on the kind of plan, vesting schedule and other factors.

Retirement Planning Tips

- Consider working with a financial advisor before taking a job that offers benefits with a vesting period or accessing vested benefits at your current job. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Vesting doesn’t necessarily mean an employee has unfettered access to benefits. For instance, until they reach age 59.5, employees who withdraw from 401(k) plans may owe penalties on withdrawn amounts. And employees may have to wait several months after an initial public offering to sell even fully vested shares and stock options.

Photo credit: ©iStock.com/JohnnyGreig, ©iStock.com/GaryPhoto, ©iStock.com/Artur