Posts by Mark Henricks

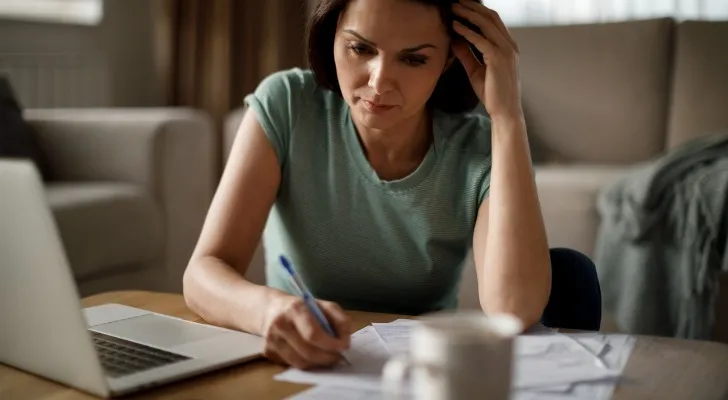

My Mother Has $260k in an IRA. Is a Nursing Home Able to Take It?

A nursing home cannot directly seize funds held in an individual retirement account (IRA). However, retirement accounts in many states are generally treated as countable assets for Medicaid eligibility, which means their value can affect whether you qualify for Medicaid coverage of long-term care. In many cases, this requires a “spend-down,” where IRA funds are… read more…

What’s a Realistic Retirement Budget? I’m 60 With $740k Saved on an $85k Salary.

For most of your working career, the focus of your retirement planning is on accumulating savings and investing that money wisely. As you approach retirement, more attention will go to estimating your income after you stop working, and the kind of lifestyle that this will support. The way to do that is through building a… read more…

What’s a Realistic Retirement Budget? I’m 66 With $1.1k in a 401(k), Another $80k in Savings and I’ll Have $2,800 in Social Security

A retirement budget compares expected income with planned expenses to see whether spending fits within available income. This process begins by listing income sources and savings and estimating how much they can provide each year. To show how a retirement budget works, let’s break down an example of a retirement profile with a $1.1 million… read more…

How to Move Money From a Roth IRA into Stocks

If you have money in a Roth IRA, you may be wondering how to move some of it into stocks to maximize your investment potential. This is an important consideration. Choosing to save in a Roth IRA provides significant tax advantages. However, the way you allocate the funds within the account may have a larger… read more…

How Much Money Do I Need to Start Day Trading?

Day trading has captured the interest of many aspiring investors, drawn by the promise of quick profits and the excitement of fast-paced market action. But before diving in, one of the most important questions to consider is: how much money do I need to start day trading? The answer isn’t one-size-fits-all, as it depends on… read more…

Guide to Cross-Border Financial Planning and Services

Cross-border financial planning and services have become increasingly important in our globalized world, where people frequently live, work and invest in multiple countries. If you’re an expatriate, business owner with international operations or someone planning to retire abroad, it is important to understand how different tax systems interact and how to optimize your financial strategy… read more…

Guide to Cross-Border Investment Banking and Financing

Cross-border investment banking and financing represent one of the most complex yet potentially rewarding areas of finance. When companies seek to expand internationally, access foreign capital markets or engage in multinational mergers and acquisitions, they enter a landscape filled with unique challenges and opportunities. From understanding regulatory differences and currency exchange risks to structuring deals… read more…

What Tax Bracket Does It Make Sense to Start Converting Traditional IRA to a Roth?

Your current tax bracket is an important consideration when evaluating whether to convert a tax-deferred retirement account to a Roth account. However, it’s just one of several elements to keep in mind. For example, your tax bracket in retirement is just as important as the one you’re in now. If you’re in a lower tax… read more…

Bond Mutual Funds vs. Stock Mutual Funds

Bond mutual funds pool investors’ money to purchase various debt securities issued by governments, municipalities or corporations. They typically offer stable and regular income through interest payments, making them attractive for conservative investors or those nearing retirement. On the other hand, stock mutual funds invest in shares that provide ownership of individual companies. This approach… read more…

Stocks vs. Options vs. Futures: What Are the Differences?

Stocks, options and futures represent three distinct ways to participate in financial markets, each offering different structures, risks and strategies. Stocks give investors ownership in a company, while options grant the right—but not the obligation—to buy or sell an asset at a specific price. Futures, on the other hand, are binding contracts to buy or… read more…

How to Withdraw From Your 401(k) After Age 60

Reaching age 60 is a major financial milestone, particularly when it comes to your 401(k) retirement savings. While you can access your 401(k) without penalties after age 59 ½, there are important rules, strategies and tax implications to keep in mind. As you near or enter retirement, you’ll likely begin to consider how and when… read more…

Can 401(k) Participants Also Make SEP IRA Contributions?

Many people who contribute to a 401(k) wonder if they can also make SEP IRA contributions. The answer depends on factors like employment status, income sources and how the SEP IRA is structured. Business owners and self-employed individuals often have more flexibility, while traditional employees generally cannot contribute directly to a SEP IRA unless they… read more…

Stock and Bond Allocations by Age

Building a portfolio often involves adjusting stock and bond allocations by age to reflect changing financial goals and risk tolerance. While age is only one of several factors that drive asset allocation decisions, investors of a similar age frequently have portfolios that resemble each other in important ways. Younger investors typically hold a higher percentage… read more…

How to Become a Millionaire By Age 40: Steps and Examples

Most people never achieve a net worth of $1 million, but it’s possible to reach that wealth goal at the relatively early age of 40 even from humble beginnings. Many who become millionaires by 40 start investing while still quite young, are willing to take calculated financial risks and prioritize acquiring assets that can grow… read more…

How Much Should I Have in My 403(b) to Retire?

Wondering how much you should have in your 403(b) to retire comfortably? It’s a common question for educators, healthcare workers and employees of non-profit organizations who rely on these tax-advantaged retirement plans. The answer varies based on your desired retirement lifestyle, expected expenses, other income sources and retirement age. While financial advisors often suggest aiming… read more…

Should You Invest $100k in Stocks or Real Estate?

Deciding whether to invest $100,000 in stocks or real estate depends on your financial goals and personal preferences. Stocks offer greater liquidity, making it easier to access your money quickly, and have historically delivered average annual returns of about 10.5%, although they can be volatile. Real estate, on the other hand, provides a physical asset… read more…

What to Invest $100k in for a Diversified Portfolio

Wondering how to build a diversified portfolio with $100,000? With this amount of capital, you have many options to spread your investments across different asset classes. A balanced approach might include a mix of stocks through index funds or ETFs, bonds for stability, real estate investment trusts (REITs) for property exposure and perhaps alternative investments… read more…

What Are the Pros and Cons of a Defined Benefit Plan?

Defined benefit plans, often referred to as traditional pensions, offer a reliable stream of income in retirement. These plans can provide peace of mind with guaranteed income, but they also tend to be less flexible than defined contribution plans like 401(k)s. They are also not available to most private-sector workers. Whether you’re evaluating a job… read more…

How to Invest $10k in Real Estate: Strategies and Examples

Even $10,000 can be enough to start investing in real estate, a historically stable asset class that also offers appealing income and appreciation potential. Whether you’re looking to generate passive income, diversify your investment portfolio or participate in real estate appreciation without direct ownership responsibility, there are strategies suited to your needs. From fractional ownership… read more…

How to Invest $500k for Monthly Income

Investing $500k for monthly income involves choosing a mix of assets that can provide steady cash flow while managing risk, liquidity and taxes. Common strategies include putting portfolio funds into dividend-paying stocks, bond ladders, real estate investment trusts (REITs) and annuities. No single approach is optimal for all income investors. The goal is to balance… read more…

What Are Inverse/Short Gold ETFs?

Inverse or short gold ETFs are investment vehicles designed to profit when the price of gold declines. Unlike traditional gold ETFs, which track the price of gold and increase in value when gold prices rise, inverse gold ETFs move in the opposite direction. These funds are popular among traders and investors who want to hedge… read more…

Gold ETFs vs. Physical Gold: Pros and Cons of Each

Gold has long been viewed as a safe haven in uncertain times, but today’s investors have more ways than ever to add it to their portfolios. Instead of buying and storing physical gold, many now turn to gold exchange-traded funds (ETFs), which make it easier to gain exposure to the metal without the hassle of… read more…

Tangible Assets: Definition, Classifications and Examples

Tangible assets are physical items with concrete worth that can be touched, seen and quantified on a balance sheet. Unlike their intangible counterparts, such as patents or goodwill, tangible assets have material substance and typically play key roles in a company’s day-to-day operations. From the buildings that house businesses to the equipment that powers production,… read more…

Types of Long-Term Care Insurance: Traditional vs. Hybrid

Long-term care insurance helps cover costs associated with extended medical care that aren’t typically covered by health insurance, Medicare or Medicaid. As healthcare costs continue to rise, these policies have become increasingly important components of comprehensive retirement planning. Each type has distinct advantages and potential drawbacks depending on your financial situation, health status and long-term… read more…

How Much Do You Need to Retire by 2060?

The year 2060 is a long time off, but now is not too early to start planning for retirement when it rolls around. With evolving economic landscapes, fluctuating inflation rates and changing life expectancy, determining the right amount to save can seem daunting. However, understanding the fundamentals of retirement planning can help demystify this process.… read more…