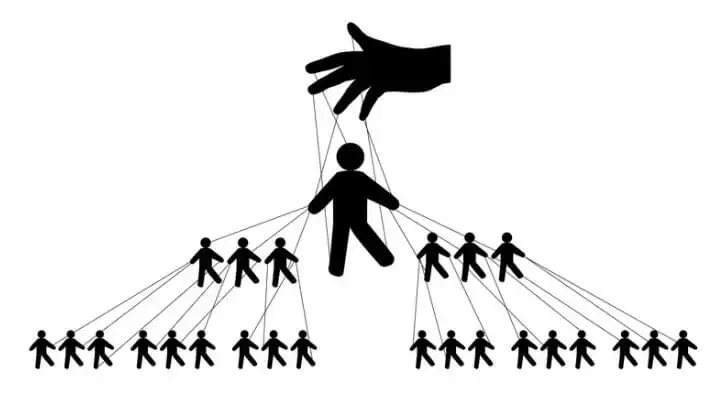

A pyramid scheme is an investment scam. Often they are business opportunity scams that solicit people to pay to distribute products or services. They, in turn, recruit additional distributors. Many people think of supplement sales when they think of a pyramid scheme. Here’s how one works.

A financial advisor can help you determine whether an investment is legitimate.

Pyramid Scheme Legality

Pyramid schemes are illegal in many countries, including the United States. The Federal Trade Commission regularly prosecutes people and companies that promote pyramid schemes. As a result, may companies refund sizable amounts to defrauded investors.

Sometimes companies successfully prosecuted as pyramid schemes close down or change the way they do business. Meanwhile, some pyramid scheme operators face prison times. However, that outcome occurs less often.

How a Pyramid Scheme Works

The pyramid promoter first recruits. Then, investors pay money for rights to sell a product or service. If the scheme involves selling a physical product, the investors usually purchase an inventory of the products.

The pyramid promoter first recruits. Then, investors pay money for rights to sell a product or service. If the scheme involves selling a physical product, the investors usually purchase an inventory of the products.

Investors can now recruit other investors. As a result, initial investors receive rewards based on the income from later investors. Also, they obtain rewards based on how investors recruited even later perform.

As later investors recruit more investors, the number of total investors can grow very rapidly. And as more and more investors join, the revenues from entry fees and product sales can mount quickly. As this happens, financial returns to the promoter and sometimes the earlier investors can also mount very rapidly.

The speed with the number of investors grows is what must bring every pyramid scheme down, however. For instance, say the initial promoter recruits 10 investors. These 10 each recruit 10 investors, and so on. After eight repetitions, a ninth requires 1 billion investors, or more than three times the population of the United States.

First Level: 1 x 10 = 10.

Second Level: 10 x 10 = 100.

Third Level: 10 x 100 = 1,000.

Fourth Level: 10 x 1,000 = 10,000.

Fifth Level: 10 x 10,000 = 100,000.

Sixth Level: 10 x 100,000 = 1,000,000.

Seventh Level: 10 x 1,000,000 = 10,000,000.

Eighth Level: 10 x 10,000,000 = 100,000,000.

Ninth level: 10 x 100,000,000 = 1,000,000,000.

Pyramid Scheme Clues

If you’re thinking that a pyramid scheme sounds a lot like multilevel marketing, you are not the only one. In fact, regulators have attempted to prove that many well-known multi-level marketing companies are pyramid schemes.

In 1979, multilevel marketer Amway prevailed over the FTC in a legal case by showing that it did not fit the definition of a pyramid scheme. Other companies have fared worse. In 2019, multilevel supplement marketer Advocare paid $150 million and changed to single-level distribution after the FTC took it to court.

Pyramid schemes typically contain three characteristics:

- The promoter of the scheme promises investors a high return in a short time.

- Participants never sell a real product or service.

- It focuses on recruiting new participants, who usually must pay large upfront fees.

Once classic pyramid scheme is TelexFree. The Massachusetts company defrauded more than $3 billion from hundreds of thousands of investors around the world. TelexFree claimed to sell telecommunications services. It was actually totally dependent on fees from new distributors and went bankrupt when the flow of new investors dried up. In 2017, the former president was sentenced to six years in prison.

Pyramid Scheme Issues

Some pyramid-type schemes are clearly fraudulent once their inner workings are revealed. For instance, Bernie Madoff operated a type of pyramid scheme called a Ponzi scheme. Instead of misrepresenting new distributors’ signup fees as product sales revenues, Ponzi schemes misrepresent new investors’ initial deposits as investment returns.

It’s not always clear whether multilevel marketing operations are technically pyramid schemes. Even experts may disagree. To protect yourself, the FTC advises erring on the side of caution if any of the pyramid scheme signs are present.

To do due diligence, investors can check with groups like the Direct Selling Association or Better Business Bureau. State attorneys general or consumer protection divisions may also have information. Speaking with other people who have been recruited as distributors or investors is another recommended part of due diligence.

Bottom Line

Some of the oldest and most commonly encountered scams include pyramid schemes. They continue to crop up on a regular basis. Investors and opportunity-seekers should be careful about giving money to any promoter who seems to promise too much, too fast. That’s especially true if the emphasis is on recruiting new investors or distributors.

Investment Tips

- If you aren’t sure about an investment’s legitimacy, consider consulting a financial advisor. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- It can take time and effort to check out a company to make sure it’s not a pyramid scheme. However, it’s a lot easier to avoid giving money to a scam than to get it back later on. It may pay to do your homework.

Photo credit: ©iStock.com/fizkes, ©iStock.com/Nosyrevy, ©iStock.com/Ngampol Thongsai