Medicaid can help to cover the costs of long-term care for eligible seniors who meet requirements for income and financial assets. It may be necessary to spend down or give away assets to qualify for Medicaid and long-term care benefits. The Medicaid look-back period determines when those transfers need to take place in order to avoid a penalty. The look-back period is a window of time prior to applying for Medicaid in which your financial transactions may be subject to review. The purpose of Medicaid look-backs is to ensure that people meet the financial eligibility requirements.

Medicaid can help to cover the costs of long-term care for eligible seniors who meet requirements for income and financial assets. It may be necessary to spend down or give away assets to qualify for Medicaid and long-term care benefits. The Medicaid look-back period determines when those transfers need to take place in order to avoid a penalty. The look-back period is a window of time prior to applying for Medicaid in which your financial transactions may be subject to review. The purpose of Medicaid look-backs is to ensure that people meet the financial eligibility requirements.

Check in with a financial advisor about whether long-term care Medcaid is the right choice for you or if there are better alternatives.

Medicaid Eligibility Explained

Medicaid is a government program that’s administered by the states. This program provides medical care to qualifying individuals and families, including assistance with long-term care costs. Whether you qualify for Medicaid for long-term-care is based on:

- Age

- Disability status

- Monthly income

- Assets

Generally, someone is eligible to qualify for long-term care Medicaid if they’re 65 or older, permanently disabled or blind and their income and assets are within certain levels. Income and asset thresholds are determined by each state but they’re typically based on federal poverty guidelines.

So in New York, for example, a single person may qualify for nursing care Medicaid if their income doesn’t exceed $884 per month and they have no more than $15,900 in assets. In North Carolina, on the other hand, the income limit for a single person is set at an amount that’s less than what Medicaid pays for nursing home care, which is estimated at $5,470 – $7,775 per month. The total asset limit is $2,000. The limits increase for married couples.

For Medicaid purposes, income includes wages, alimony payments, Social Security benefits, pension payments, IRA withdrawals and dividend payments. Assets include cash, stocks, bonds, investments, IRAs, bank accounts and real estate that isn’t used as a primary residence. Medicaid allows exemptions for things like personal belongings, household furnishings and vehicles. A home can also be exempt if the person applying for Medicaid lives in it or has intent to return to it, their equity is within certain limits or they’re married and a non-applicant spouse lives in it.

How the Medicaid Look-Back Period Works

If you want to apply for long-term care Medicaid but your assets exceed the allowed limit for your state, you may have to spend them down to qualify. This can include using up those assets, i.e. spending down the money in your checking or savings account. But it can also include transferring assets so they’re excluded from your estate.

This is where the Medicaid look-back period comes in. The look-back period defines how much time must pass between the transfer of assets and your initial application for Medicaid-covered nursing care. In most states, this is 60 months or five years. The Medicaid look-back period begins from the date your application is submitted and counts backward.

The purpose of the look-back period is to keep people from qualifying for Medicaid to pay for long-term care unfairly. There’s no limit on the number of transfers you can make prior to the beginning of the look-back period. But any transfers made within that window may trigger a penalty. Specifically, you can be disqualified from receiving Medicaid benefits to pay for nursing care for a certain number of months.

The number of months that you can be denied benefits can be based on the amount of financial gifts made within the look-back period and the average amount that Medicaid pays toward long-term care in your state. Triggering a penalty because of Medicaid look-back period violations can be costly, as it can leave you or your loved ones financially responsible for your costs of long-term care during any months in which you’re not covered.

Medicaid Look-Back vs. Estate Recovery

While the Medicaid look-back period can prevent you from receiving full benefits to pay for nursing care during your lifetime, Medicaid estate recovery can pursue your assets after you pass away. Medicaid estate recovery allows your state’s Medicaid program to attempt to recover money from your estate after your death as reimbursement for costs paid toward long-term care.

While the Medicaid look-back period can prevent you from receiving full benefits to pay for nursing care during your lifetime, Medicaid estate recovery can pursue your assets after you pass away. Medicaid estate recovery allows your state’s Medicaid program to attempt to recover money from your estate after your death as reimbursement for costs paid toward long-term care.

There are restrictions, including an exclusion for the estates of Medicaid recipients who are survived by a spouse, a child under age 21 or a blind or disabled child of any age. Medicaid estate recovery can also be blocked if it’s determined that it would cause an undue financial hardship for your surviving family members. And a Medicaid asset protection trust can help to shield assets from estate recovery.

How to Avoid Medicaid Look-Back Period Penalties

Proper planning is key to avoid being penalized under Medicaid look-back rules. When you apply for Medicaid for nursing care you’re required to disclose any and all financial transactions involving the transfer of assets for your state’s look-back period. This can include financial gifts or transfers both large and small as well as loans to friends and family.

It’s up to you to prove that any transfers made during the look-back period were not done simply for the purpose of qualifying for Medicaid. There are some exemptions, however, that can help you avoid look-back penalties. For example, transfers may be exempt if they’re made on behalf of:

- Your spouse

- A blind or disabled child

- A disabled person under age 65

You can also transfer your home without penalty if the transfer is made to a qualifying person. That can include a child under age 21, a child who’s blind or disabled, a sibling who lives in the home and has an equity interest in it or a caretaker child who lived with you at least two years before you entered a nursing home and took care of you during that time.

Talking to a Medicaid planning expert or estate planning attorney may be helpful if you’re worried about triggering Medicaid look-back period penalties. You can also talk to a financial advisor about the best ways to transfer assets and when to set those transfers in motion to ensure that you’re Medicaid-eligible.

Alternatively, you may want to consider purchasing long-term care insurance, which can eliminate worries about the Medicaid look-back period. If you’re worried about paying premiums for insurance coverage you may not use, you could also consider a hybrid policy. Hybrid policies include both life insurance coverage and long-term care insurance. If you don’t use the long-term care portion of the policy your beneficiaries can still receive a death benefit when you pass away.

The Bottom Line

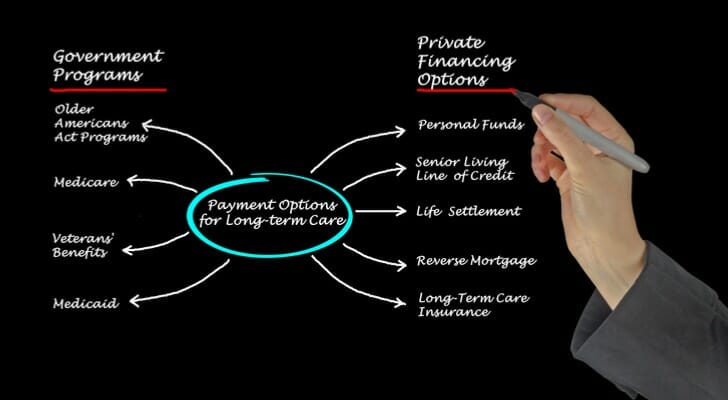

The Medicaid look-back period can play an important part in determining your eligibility to receive help with long-term care. Understanding when this period begins in your state can help you plan ahead to ensure that you’re able to qualify for nursing care Medicaid, should the need for it arise. There are also alternatives to Medicaid for long-term care that you should be aware of.

Tips for Estate Planning

- Consider talking to a financial advisor about what steps you should be taking to prepare for long-term care costs and how to avoid Medicaid look-back period penalties. If you don’t have a financial advisor yet, finding one doesn’t have to be complicated. SmartAsset’s financial advisor matching tool makes it easy to connect with professional advisors in your local area. It takes just a few minutes to get your personalized advisor recommendations online. If you’re ready, get started now.

- Want to take a look at what your portfolio will look like in a decade? SmartAsset’s investment calculator can help you do just that. Enter how much you have invested, how much you’re contributing and what rate of return you expect. We’ll then show you your investment growth five, 10 or even 30 years into the future.

Photo credit: ©iStock.com/kazuma seki, ©iStock.com/vaeenma, ©iStock.com/FatCamera