Tax filers with higher adjusted gross incomes (AGIs) tend to move less than filers with lower AGIs. This may be due to various reasons, including that taxpayers in higher income brackets often skew older or are more established in their careers. Regardless of the cause, IRS migration data shows that roughly 3% of filers with AGIs between $10,000 and $50,000 moved to a different state from 2018 to 2019. By comparison, 2.26% of tax filers with AGIs between $100,000 and $200,000 moved across state lines during the same years. Though higher earners may be less likely to move states overall, some states have still seen relatively large influxes of this demographic.

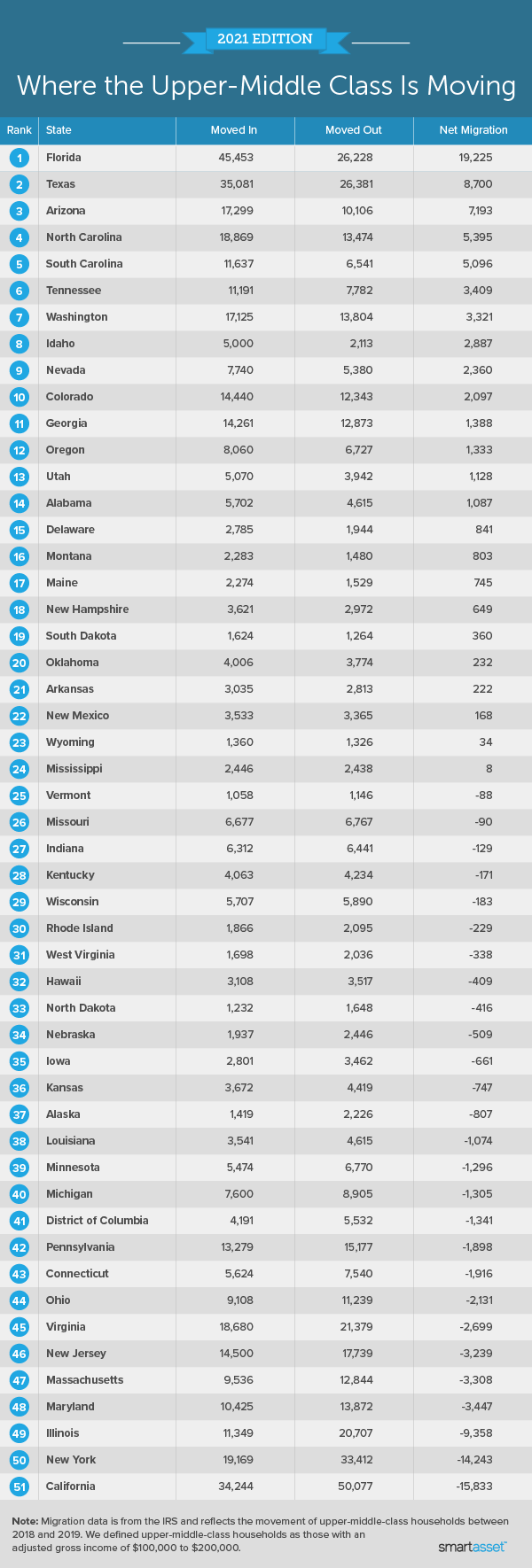

In this study, SmartAsset took a closer look at where upper-middle-class people with AGIs between $100,000 and $200,000 are moving. Using IRS migration data from 2018 to 2019, we compared the inflows and outflows of upper-middle-class people for each state and Washington, D.C. We ranked places according to the net migration of upper-middle-class earners. To learn more about our approach, read the Data and Methodology section below.

This is our third annual study on the states where upper-middle class people are moving. Check out our 2020 edition here.

Key Findings

- The top six states hold steady. In last year’s study (which looked at 2017-2018 IRS migration data), the top six states where upper-middle class people moved to were Florida, Texas, Arizona, North Carolina, South Carolina and Tennessee. Those top six states rank in that same order this year, with Florida having the highest net migration of upper-middle-class people by far.

- Maryland and Alaska have the highest percentage of upper-middle class filers, but high earners are leaving both states. More than one in five tax filers in Maryland and Alaska earn between $100,000 and $200,000. However, filers with AGIs in that range are leaving both states. From 2018 to 2019, there were net migrations of 3,447 and 807 upper-middle-class tax filers out of Maryland and Alaska, respectively.

1. Florida

Between 2018 and 2019, there was a net migration of roughly 19,200 upper-middle-class tax filers to Florida. As a result, about 1.1 million upper-middle-class people filed taxes in 2019, making up 12.85% of all Florida filers.

2. Texas

With no state income tax, Texas has been a hotspot for upper-middle-class people over the past several years. Most recently, there was a net migration of 8,700 upper-middle-class people to the state from 2018 to 2019.

3. Arizona

About 17,300 upper-middle-class people moved to Arizona between 2018 and 2019, while roughly 10,100 left. In total, the net migration of upper-middle-class people was almost 7,200.

If you recently moved to Arizona and are looking for some financial help, check out our list of the top financial advisors in the state.

4. North Carolina

Between 2018 and 2019, the net migration of high-earning tax filers to North Carolina was 5,395. As a result, upper-middle-class filers made up 14.28% of all North Carolina tax filers in 2019.

5. South Carolina

South Carolina follows closely behind North Carolina as a state where upper-middle-class people are moving. From 2018 to 2019, more than 11,600 filers with AGIs between $100,000 and $200,000 moved to the state, while roughly 6,500 left. In total, the net migration was 5,096.

6. Tennessee

Like two of the other states in our top five – Florida and Texas – Tennessee does not tax wages and earnings, meaning that upper-middle-class earners may be able to increase their savings rate. About 11,200 upper-middle-class people moved to Tennessee between 2018 and 2019, while less than 7,800 left. In total, the net migration of upper-middle-class people was 3,409.

7. Washington

With a net migration of 3,321 upper-middle-class people, the state of Washington has the highest percentage out of all the top 10 states in our list of where upper-middle-class people are moving. According to 2019 IRS data, 19.70% of filers earn between $100,000 and $200,000 annually.

8. Idaho

Idaho fell one spot in this year’s study, after ranking No. 7 in our 2020 study. However, despite placing behind Washington this year, IRS migration data shows that the net migration of upper-middle-class people actually increased between 2017-2018 and 2018-2019. From 2017 to 2018, there was a net migration of 2,708 upper-middle-class people, relative to a net migration of 2,887 people from 2018 to 2019.

9. Nevada

According to 2018-2019 IRS migration data, about 7,700 upper-middle-class people moved to Nevada while less than 5,400 left. In total, the net migration of the upper-middle class to Nevada was 2,360, the ninth-highest in our study.

10. Colorado

Colorado rounds out our list of top 10 states where upper-middle class people are moving. More than 14,400 upper-middle class people moved to the state between 2018 and 2019, while less than 12,400 left. In 2019, more than 18% of tax filers earned between $100,000 and $200,000, the 12th-highest rate across all 50 states and D.C.

Data and Methodology

Data for this study comes from 2018-2019 IRS migration data. To find where upper-middle-class people are moving, we found the inflows and outflows for people earning between $100,000 and $200,000 for each state and Washington, D.C. We then calculated a net migration figure for upper-middle-class filers and ranked all 50 states and Washington, D.C. accordingly.

Tips For Maximizing Your Savings

- Make your savings work to make you more income. To take full advantage of compound interest, it is important to start early. Take a look at our investment calculator to see how your investment in a savings account can grow over time.

- Contribute to a 401(k). A 401(k) is an employer-sponsored defined contribution plan in which you divert pre-tax portions of your monthly paycheck into a retirement account. Some employers will also match your 401(k) contributions up to a certain percentage of your salary, meaning that if you chose not to contribute, you are essentially leaving money on the table. Our 401(k) calculator can help you determine what you saved for retirement so far and how much more you may need.

- Consider professional financial support. A financial advisor can help you make smarter financial decisions to be in better control of your money. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/Pgiam