According to 2018 Census Bureau data, approximately two of every 10 owner-occupied housing units in the U.S. is a one-person household. That means more than 17 million units fall under this category. These are singles who have chosen to buy a house or apartment instead of renting. Covering initial expenses like closing costs and a down payment – not to mention saving up for future costs like mortgage payments and insurance – can be difficult for a multi-person household, let alone just an individual. But there are some cities in which single homeowners are increasingly choosing to buy. SmartAsset crunched the numbers to find out where.

To uncover the cities where singles are increasingly choosing to buy over rent, we examined data on the 100 largest U.S. cities for two metrics: single homeownership rate in 2014 and single homeownership rate in 2018. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s second version of our study on where singles are choosing to buy over rent. Read the 2019 version here.

Key Findings

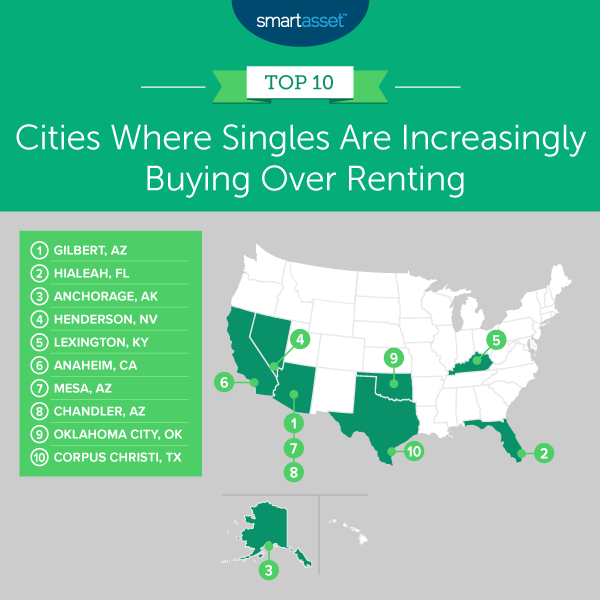

- Arizona cities are a popular choice for individual homeowners. Three of the top 10 cities in the study are in Arizona – Gilbert, Mesa and Chandler. All three had a 2018 single homeownership rates of at least 53%. This means that more than half of individuals living alone own a house or apartment in those cities.

- Southern and Western cities populate the top 10 and 25. The top 10 of our list is represented by only cities in the Southern and Western regions of the country, according to Census regional divisions. Moving to the top 25, we see that only three cities (St. Louis, Missouri and Chicago, Illinois in the Midwest and New York, New York in the Northeast) are not located in either of these regions.

- Though single homeownership rates are increasing in some cities, they are declining in the majority of large U.S. cities. Nationally, the single homeownership rate has remained consistent over the past four years, hovering around 52%. However, Census Bureau data shows that across the 100 largest cities in the U.S., the four-year change in the homeownership rate for singles decreased in 55 of them.

1. Gilbert, AZ

Of the 100 largest cities in the country, Gilbert, Arizona is the top place where singles are increasingly choosing to buy over rent. In 2014, the total number of occupied one-person households was 10,428, and with 6,158 of them owner-occupied, the homeownership rate for singles that year was 59.05%. The 2018 rate was 70.77%, marking an increase of 11.72% – the largest in our study. Current homeowners in Gilbert who are looking to sell might wish to take advantage of this increase, as the city is also one of the best U.S. cities to sell a house.

2. Hialeah, FL

Over the past four years, the homeownership rate for single homeowners in Hialeah, Florida increased by more than 10%. In 2014, there were a total of approximately 14,300 occupied one-person households, with 5,041 of them owner-occupied, resulting in a single homeownership rate of about 35%. In 2018, that rate increased to more than 45%, with more than 6,100 individuals of the total 13,515 one-person households owning their homes.

3. Anchorage, AK

In 2018, the homeownership rate for single occupants in Anchorage, Alaska was 55.82%, as 15,459 of the total 27,694 occupied one-person households were owner-occupied. This marks a 6.56% increase from 2014, the third-largest increase in the study. The 2014 homeownership rate for singles in Anchorage was about 49%.

4. Henderson, NV

In 2018, the homeownership rate for singles in Henderson, Nevada was 53.04%. By comparison, in 2014, the homeownership rate for singles was 46.86%. Henderson’s four-year change for this metric is an increase of 6.18%.

5. Lexington, KY

Individuals have been increasingly choosing to buy instead of rent in Lexington, Kentucky in recent years. The four-year change in the homeownership rate for singles in the city has increased by 5.92%, according to our comparison of Census Bureau data from 2014 and 2018. Specifically, the rate increased from 42.25% in 2014 to 48.17% in 2018.

6. Anaheim, CA

Single residents in Anaheim, California have increasingly chosen to buy instead of rent in 2018 than in 2014. In 2018, there were approximately 18,900 occupied one-person households in the city, about 8,700 of which – or almost 46% – were occupied by their owners. By comparison, there were about 17,000 total occupied one-person households in Anaheim in 2014 and fewer than 6,900 of them – or about 40% – were occupied by their owners.

7. Mesa, AZ

Mesa is one of three Arizona cities in our top 10, as well as the top city where retirees are moving. The homeownership rate for one-person households in the city was 48.02% in 2014 and 53.00% in 2018, marking a four-year increase of close to five percentage points.

8. Chandler, AZ

In 2014, there were a total of 20,554 occupied one-person households in Chandler, Arizona, about half of which were occupied by their owners. According to Census Bureau data, that rate increased by 4.84% over the following four years. In 2018, the homeownership rate for singles was 55.82%.

9. Oklahoma City, OK

Oklahoma City, Oklahoma had a 43.59% homeownership rate for single homeowners in 2014. In 2018, more than 37,300 of its total roughly 79,000 one-person households were owner-occupied, resulting in a homeownership rate of 47.22%.

10. Corpus Christi, TX

In 2014, 43.22% of the total occupied one-person households in Corpus Christi, Texas were occupied by their owners. In 2018, however, owner-occupied one-person households comprised 46.32% of all occupied one-person households, resulting in a four-year increase in this rate of 3.10%.

Data and Methodology

To find the cities where singles are increasingly choosing to buy over rent, we looked at data on the 100 largest U.S. cities across two metrics:

- Percentage of owner-occupied one-person households in 2014. This is the number of owner-occupied households as a percentage of all one-person households in 2014.

- Percentage of owner-occupied one-person households in 2018. This is the number of owner-occupied households as a percentage of all one-person households in 2018.

Data comes from the Census Bureau’s 2014 and 2018 1-year American Community Surveys.

To create our rankings, we calculated the difference between the percentage of owner-occupied one-person households in 2018 and the percentage in 2014. We ranked cities according to those that had the largest difference between those two years.

Tips for New Homebuyers

- Total costs add up. Once you seal the deal on a home, property taxes and home insurance are of course important costs to consider in addition to mortgage. But make sure you’re aware of how costs can add up during the home buying process as well – including closing costs and a down payment. To understand the full costs of the home buying process more fully, check out our comprehensive home buying guide.

- Remember to negotiate. It doesn’t hurt to negotiate on an asking price. Be sure to think carefully about what you send in as an initial offer.

- Expert advice. It may be a good idea to consult a financial advisor to better understand your financial situation regarding a major decision like buying a home. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/andresr