To buy or to rent? It’s a tough question. And though buying a home can seem a more feasible undertaking with a partner to help cover the down payment and mortgage, American singles in certain cities are more commonly opting to buy instead of rent. Rather than throw away rent money to a landlord, singles with enough in their savings accounts are embracing homeownership and the benefits of building up their home equity. Below, we rank the most popular cities where singles are choosing to buy over rent.

To find the cities in particular where increasing numbers of single residents are choosing to buy over rent, we analyzed Census Bureau data on the difference in the percentage of singles choosing to buy instead of rent between 2013 and 2017. Read more about our data sources and how we put our findings all together in the Data & Methodology section below.

Key Findings

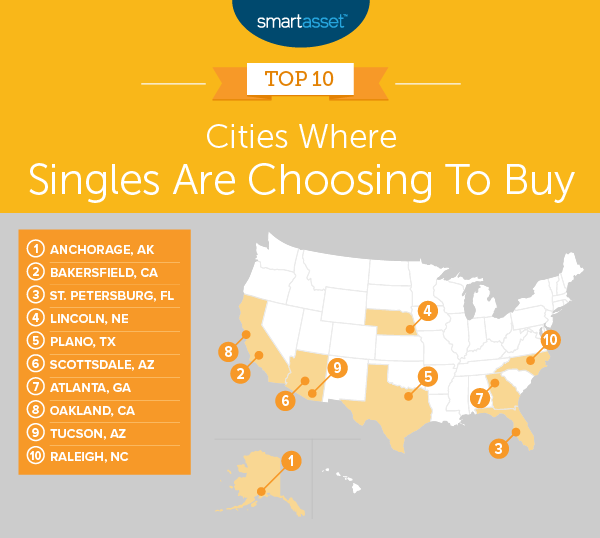

- Geographical diversity reigns. Single homeownership seems to be increasing across various states. The top 10 cities on this list have three entrants from Pacific Western states, two cities from Mountain Western states, one city from the Midwest, and four cities in the South.

- Northeastern states are not top contenders. The only major region not represented in the top 10 is the Northeast. Perhaps in big Eastern Seaboard cities like Boston and New York, the cost is just too high for people living alone to buy their own place.

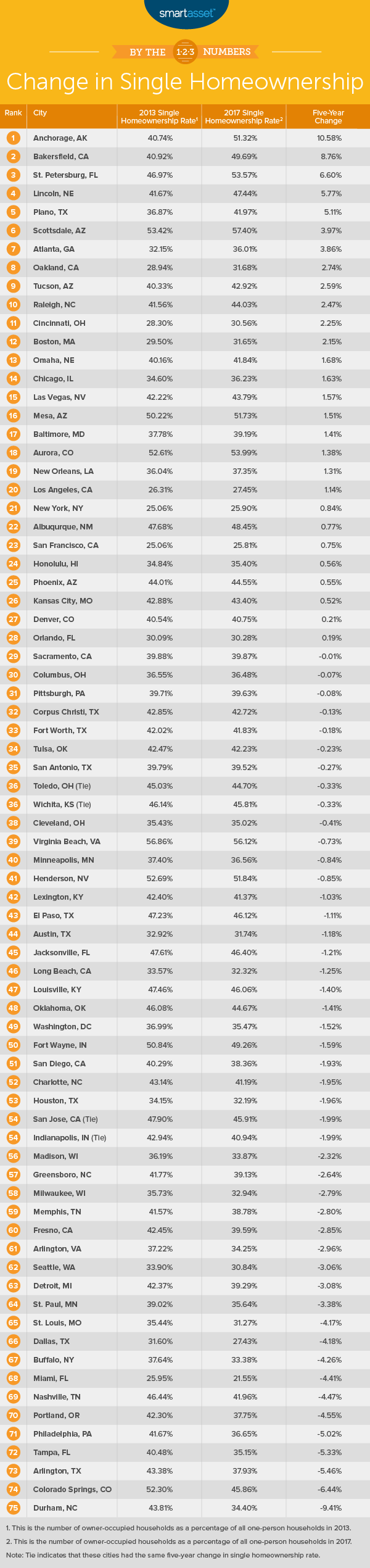

1. Anchorage, AK

2013 Percentage of singles choosing to buy: 40.74%

2017 Percentage of singles choosing to buy: 51.32%

Change in percentage: 10.58%

2. Bakersfield, CA

2013 Percentage of singles choosing to buy: 40.92%

2017 Percentage of singles choosing to buy: 49.69%

Change in percentage: 8.76%

3. St. Petersburg, FL

2013 Percentage of singles choosing to buy: 46.97%

2017 Percentage of singles choosing to buy: 53.57%

Change in percentage: 6.60%

4. Lincoln, NE

2013 Percentage of singles choosing to buy: 41.67%

2017 Percentage of singles choosing to buy: 47.44%

Change in percentage: 5.77%

5. Plano, TX

2013 Percentage of singles choosing to buy: 36.87%

2017 Percentage of singles choosing to buy: 41.97%

Change in percentage: 5.11%

6. Scottsdale, AZ

2013 Percentage of singles choosing to buy: 53.42%

2017 Percentage of singles choosing to buy: 57.40%

Change in percentage: 3.97%

7. Atlanta, GA

2013 Percentage of singles choosing to buy: 32.15%

2017 Percentage of singles choosing to buy: 36.01%

Change in percentage: 3.86%

8. Oakland, CA

2013 Percentage of singles choosing to buy: 28.94%

2017 Percentage of singles choosing to buy: 31.68%

Change in percentage: 2.74%

9. Tucson, AZ

2013 Percentage of singles choosing to buy: 40.33%

2017 Percentage of singles choosing to buy: 42.92%

Change in percentage: 2.59%

10. Raleigh, North Carolina

2013 Percentage of singles choosing to buy: 41.56%

2017 Percentage of singles choosing to buy: 44.03%

Change in percentage: 2.47%

Data and Methodology

Using data on the largest 100 U.S. cities (which eventually yielded 75 cities for this particular study, based on available data), SmartAsset created these rankings of where singles are choosing to buy over rent. We used the following metrics to make our calculations:

- Percentage of owner-occupied one-person households in 2013. This is the number of owner-occupied households as a percentage of all one-person households in 2013.

- Percentage of owner-occupied one-person households in 2017. This is the number of owner-occupied households as a percentage of all one-person households in 2017.

Data comes from the Census Bureau’s 2013 and 2017 1-year American Community Surveys.

To create our rankings, we calculated the difference between the percentage of owner-occupied one-person households in 2017 and the percentage in 2013. We then used that calculation to rank the cities in descending order. We ranked the city with the largest percentage increase first. By contrast, we ranked the city with the smallest percentage increase last.

Homebuying Tips

- The price is right. Once you decide you want to buy a home, you’ll need to figure out your price range. Find out by using SmartAsset’s home affordability calculator.

- Speak to an expert. Whether you live on your own or live with your family, buying a house can be an easier process than you might think, with the right help. A financial advisor is a good person to speak to in order to take a deeper look at how this kind of a purchase would fit into your overall plan. SmartAsset can help you find one with our free financial advisor matching service. You answer a few questions and we match you with up to three advisors. We fully vet our advisors and they are free of disclosures.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/monkeybusinessimages, ©iStock.com/marchmeena29, ©iStock.com/RyanJLane, ©iStock.com/MartinPrescott, ©iStock.com/JohnnyGreig, ©iStock.com/MartinPrescott, ©iStock.com/mphillips007, ©iStock.com/GlobalStock, ©iStock.com/PeopleImages, ©iStock.com/CharlieAJA, ©iStock.com/kali9