Only 55% of non-retired American adults have money in a defined contribution plan such as an IRA or 401(k), according to 2019 data collected by the Federal Reserve. With the coronavirus pandemic upending many aspects of Americans’ lives, saving for retirement may have taken a backseat, even for those individuals who were previously saving. Job losses and unforeseen expenses may lead to the reshuffling of financial priorities – with individuals prioritizing short-term needs over long-term financial goals.

In this study, SmartAsset looked at the extent to which individuals have adjusted their planning and saving for retirement during the coronavirus pandemic. We surveyed roughly 800 individuals who were not retired and had at least one retirement account. We asked the group of non-retirees with at least one retirement account the following three questions:

- Over the past two months, have you made any changes to your retirement contributions?

- Do you think the coronavirus crisis has negatively affected your retirement preparedness?

- How much do you have saved for retirement today?

Below we discuss responses generally and according to both gender and age below. For more information on our survey, its results and how we put the findings together, check out our Data and Methodology section below.

Key Findings

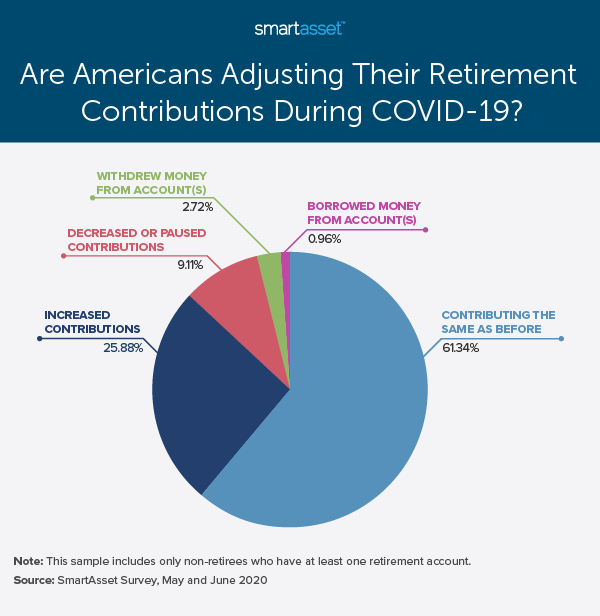

- Most individuals are staying the course. A little less than two-thirds (61.34%) of non-retirees with at least one retirement account reported not having made changes to their contributions during the coronavirus pandemic. A similar percentage of respondents, 60.53%, do not believe COVID-19 has negatively affected their retirement preparedness.

- Low reported uptake of CARES Act retirement relief measures. Along with providing stimulus checks to individuals and loans to small businesses, the Coronavirus Aid, Relief and Economic Security (CARES) Act provides relief to non-retirees by easing the rules for accessing money in retirement accounts. Specifically, it waives the early withdrawal tax penalty on IRAs and 401(k)s, and increases the loan limits for 401(k)s that have increased loan limits. Despite these changes, our survey results show that less than 4% of non-retirees with at least one retirement account have withdrawn or borrowed money from their account.

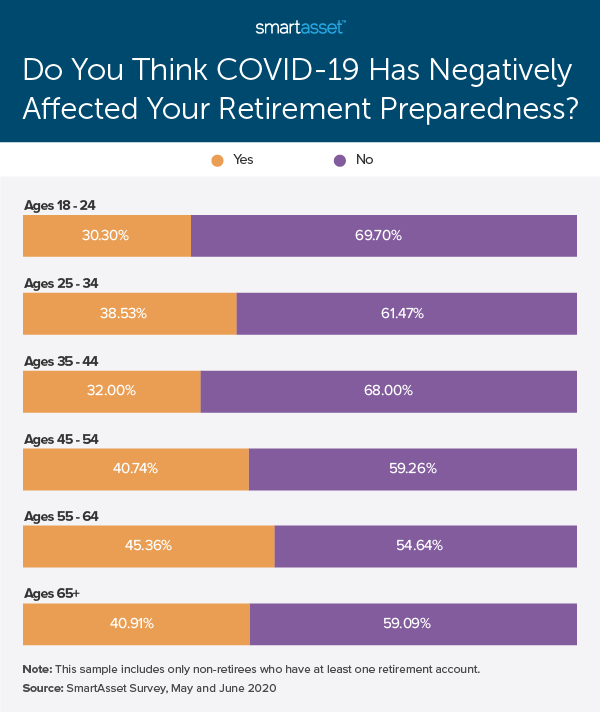

- Women and older non-retirees see the biggest hit to their retirement preparedness. Though less than four in 10 of our survey respondents believe the coronavirus pandemic has negatively impacted their retirement preparedness, women and older non-retirees expressed slightly more concern. Roughly 44% of women and 45% of non-retirees between the ages of 55 and 64 said that COVID-19 had negatively affected their retirement planning.

Changes to Retirement Contributions During COVID-19

Most non-retirees with at least one retirement account have not made changes to their contributions during COVID-19. More than six in 10 respondents are continuing to contribute to their account(s) the same as before. The chart below shows how non-retirees with at least one retirement account responded to the question: Over the past two months, have you made any changes to your retirement contributions?

More than a quarter of survey respondents (25.88%) recently increased their retirement contributions. This may be in response to the fact that some employers reduced or suspended their 401(k) matching. That is, individuals themselves may be making up for a loss in total monthly contributions to their account(s), since respondents who have not changed their individual contributions could still be experiencing a decrease in total contributions if their employer’s match has changed.

Beyond a potential decrease in overall contributions due to match suspensions, other individuals have chosen themselves to decrease or pause their individual contributions. About 9% of survey respondents reported decreasing or pausing contributions to their plan(s) over the past two months. Additionally, 2.72% of non-retirees withdrew money from their account(s) while less than 1% borrowed money from their account(s).

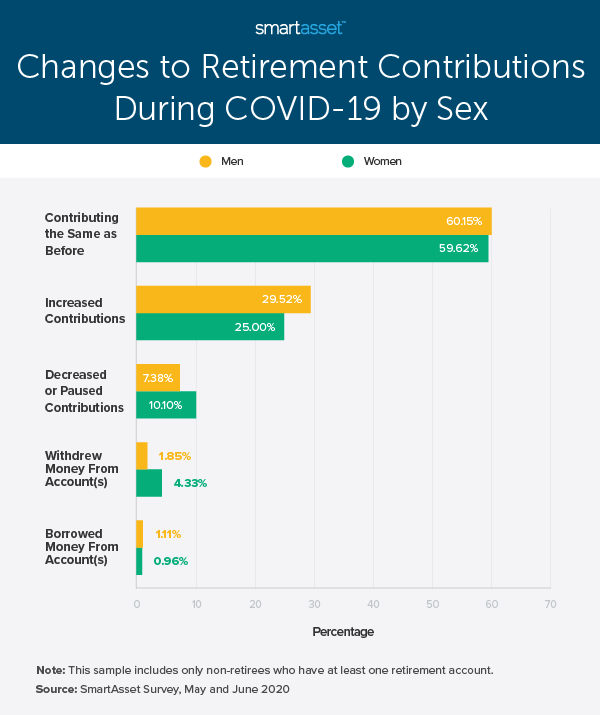

Recently, women have been slightly more likely than men to access money from their retirement accounts, according to our findings. More than 5% of women reported withdrawing or borrowing money from their account(s) while less than 3% of men reported taking or borrowing money from their account(s). Similarly, more than 10% of women decreased or paused their contributions, while only about 7% of men did the same.

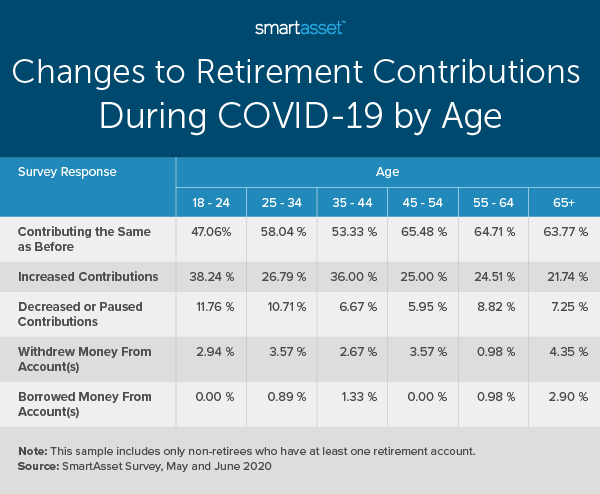

With respect to age, younger non-retirees have been more likely to decrease or pause their contributions while older non-retirees reported accessing money in their accounts at a higher rate. Close to 12% of non-retirees between the ages of 18 and 24 reported decreasing or pausing their retirement contributions in the past two months, while only about 7% of non-retirees 65 years and older reported the same. Meanwhile, less than 3% of young non-retirees said they withdrew or borrowed money from their account(s), but more than 7% of senior non-retirees reported taking advantage of CARES Act retirement relief measures.

Concern Over Retirement Preparedness

We additionally asked respondents if they thought the coronavirus crisis has negatively affected their retirement preparedness and how much they have saved for retirement today. Less than four in 10 respondents (39.47%) were concerned about their retirement preparedness in relation to the coronavirus pandemic, though women and older non-retirees expressed slightly higher levels of concern. The bar graph below shows concern about retirement preparedness by age.

Despite higher levels of concern, more than half of older non-retirees in our survey have more than $250,000 saved for retirement. 62.37% of non-retirees between the ages of 55 and 64 and 54.24% of non-retirees ages 65 and older said that they had retirement savings of $250,000 or more. An additional 16% and 20% of non-retirees in the same age brackets, respectively, have saved between $100,000 and $249,999 for retirement.

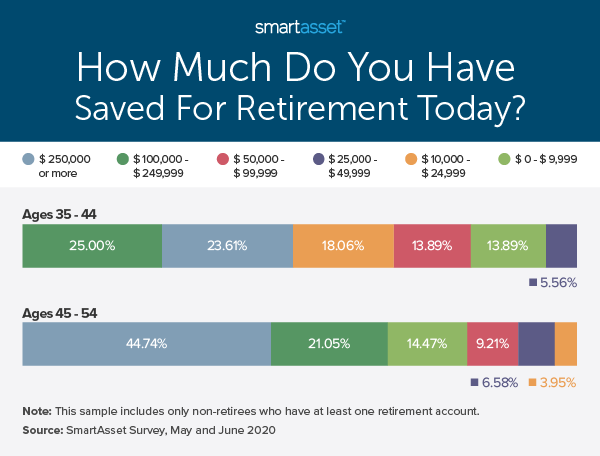

Unsurprisingly, younger non-retirees were the most likely to have the least currently saved for retirement. About 41% and 34% of non-retirees between the ages of 18 and 24 and the ages of 25 and 34, respectively, responded that they had between $1 and $9,999. Responses to our survey question – How much do you have saved for retirement today? – are shown below for non-retirees who are between roughly 10 and 30 years away from the average retirement age.

Data and Methodology

All figures in this report come from an online survey posted on SmartAsset’s site between May 20, 2020 and June 19, 2020. Our first question (Do you currently have at least one retirement account?) identified non-retirees who have at least one retirement account. Of the total 1,823 adults who responded, 801 replied that they had at least one retirement account and are not currently retired. Those 801 respondents were then asked the following three questions:

- Over the past two months, have you made any changes to your retirement contributions?

- Do you think the coronavirus crisis has negatively affected your retirement preparedness?

- How much do you have saved for retirement today?

Of the 801 non-retirees with at least one retirement account, 626 responded to the second survey question, 608 responded to the third survey question and 584 responded to the fourth survey question. We used the largest survey size possible when discussing metrics in each section. Data on gender and age for respondents comes from Google Analytics.

Tips for Protecting Your Retirement Savings During an Economic Downturn

- Know your options. Before you withdraw or borrow money from your retirement account, consider the full costs of taking money out. Despite CARES Act accommodations, there is still the downside that you are taking money away from your own retirement. If you need help on immediate payments, the CARES Act also provides relief for rent and mortgage payments along with enhanced unemployment benefits. Additionally, some states are offering aide beyond programs approved by the federal government. Our full guide on coronavirus relief programs by state can be found here.

- Look into your asset allocation. Volatility in the stock market may cause concern over your retirement account and preparedness. If that is the case, be sure to look into your asset allocation and consider your timeline for retirement. If you still have several decades to go before retirement, you have a longer time for your portfolio to recover from financial losses and may be able maintain your current allocation or investment more heavily in stocks. On the other hand, if you have less than 10 years until retirement or want to take a more conservative stance, a higher allocation to bonds may be more appealing.

- Talk to an expert. Consider talking to a financial advisor about keeping your retirement savings on track. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Jantanee Rungpranomkorn