IRS Form 6251, titled Alternative Minimum Tax—Individuals, determines how much alternative minimum tax (AMT) you could owe. In order for wealthy individuals to pay their fair share of income tax, Congress mandated an AMT in 1969. You have to pay the AMT if you report taxable income greater than certain income threshold exclusions. If this applies to you, then your taxes are run through both the AMT and the traditional tax system, leaving you to pay whichever is higher.

A financial advisor can assist you in creating a tax strategy to minimize your taxes.

Understanding Form 6251 and the Alternative Minimum Tax (AMT)

To try to ensure all taxpayers pay their fair share in income taxes, the U.S. has an AMT in place for taxpayers who earn above a certain income threshold. The AMT sets a floor on the percentage of taxes that a tax filer pays to the federal government regardless of the dollar amount of their exclusions, deductions or tax credits.

The AMT is calculated on IRS Form 6251 with your federal tax return. It uses a separate set of rules from the normal way of calculating taxable income. There are tax preference items that the AMT adds back into your taxable income to arrive at your alternative minimum taxable income (AMTI). So essentially, the AMT limits some deductions, credits and exclusions that aid taxpayers in the traditional tax system. The result is a higher adjusted gross income (AGI) that accounts for types of income that normally slip through untaxed.

The AMT tax rates are 26% and 28%. If you are liable for the AMT, you pay it instead of your regular income tax. You calculate your income tax twice, once under regular tax rules and then again under AMT rules. You pay the higher amount of the two.

The AMT was established by Congress in 1969 when they realized that some wealthy taxpayers were paying little or no income tax due to tax breaks. As the years passed, they realized that bracket creep was causing upper-middle-class taxpayers to pay the AMT instead of just wealthy taxpayers due to tax cuts and inflation. In 2015, Congress passed another law indexing the AMT exemption amount, or income level, to inflation.

Tax Preference Items

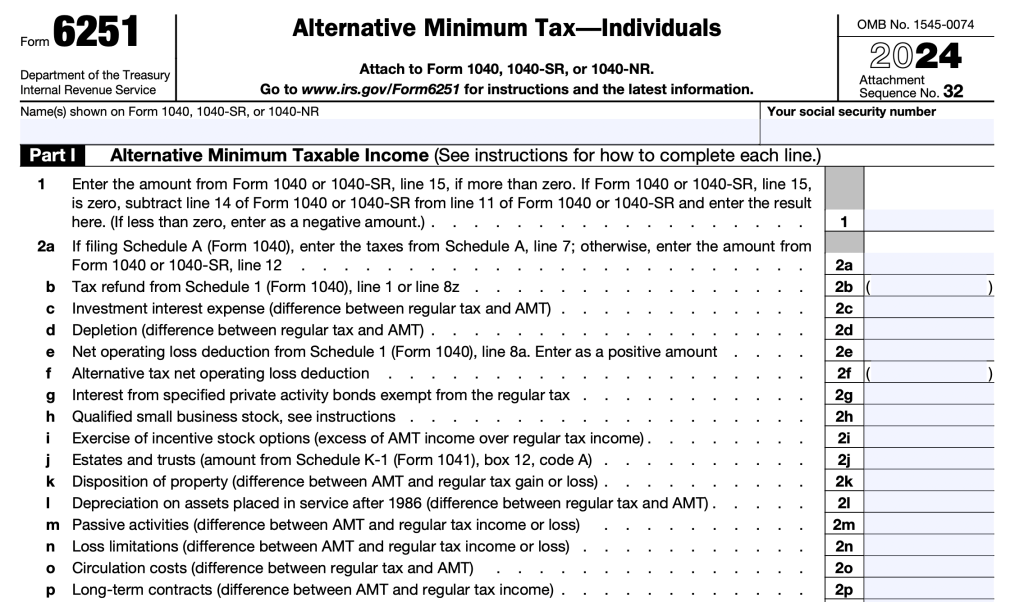

Tax preference items are the deductions, credits and tax exclusions that are added back to your taxable income when you trigger the AMT by going over the income exclusion. They are listed on IRS Form 6251. The top three tax preference items are:

- Interest on private activity municipal bonds

- Excess intangible drilling costs for oil and gas

- Qualifying exclusions for small business stock

Other tax preference items that you have to add back to the AMTI if you trigger the AMT are:

- Tax refund

- Exercise of incentive stock options

- Estates and trusts

- Accelerated depreciation

- Income from exercising incentive stock options

This is not a complete list. A complete list is found on IRS Form 6251.

What Triggers the AMT?

The AMT is typically triggered by tax filers whose income exceeds the annual AMT exemption for that year. For tax year 2025 (which you file in 2026), the exemption is $88,100 for single individuals and $137,000 for married couples. For tax year 2024 (which you file in 2025), the exemption is $85,700 for singles and $133,300 for married couples.

To calculate how much income you have to pay the AMT on, subtract your exemption from your income calculated under AMT rules and you will find the amount of income on which you will have to pay the ATM, which also means a higher tax rate of 26% or 28%.

The exemption starts phasing out when, for tax year 2025, you reach $626,350 as a single filer and $1,252,700 for a married couple. For 2024, the exemptions are $609,350 and $1,218,700, respectively. Once you reach those income levels, your income exemption starts gradually going away.

Example of an AMT Calculation Using Form 6251

The AMT system is quite complex, as it features a number of different variations from the traditional income tax system in the U.S. Here’s a step-by-step breakdown of how Form 6251 is used to calculate your AMT liability:

- Enter your taxable income on IRS Form 1040 or 1040-SR from line 15 after subtracting lines 12 and 13 from line 11. Enter the result on line 1 of Form 6251.

- Beginning with line 2a to line 3, enter an amount for any that apply to you. Add together all amounts from line 1 to line 3.

- Enter the total on line 4. This is your AMTI.

- Multiply your AMTI by the appropriate tax percentage, either 26% or 28%, depending on where you fall within the instructions on Form 6251.

- Subtract the foreign tax credit from the AMTI if you qualify for it.

- Compare your tax under regular tax rules to the tax on your AMTI and pay the higher amount.

General Tax Planning Tips for AMT

The AMT can lead to a higher tax bill, but careful planning may help reduce its impact. One approach is managing deductions that trigger the AMT, such as state and local taxes or incentive stock options. Spreading out deductions over multiple years can help avoid crossing AMT thresholds in any single year.

If you have incentive stock options, timing the exercise of options can help control AMT exposure. Exercising smaller amounts over several years instead of all at once can prevent a large tax adjustment. If the AMT applies, tracking the AMT credit for future use when selling the stock can help lower regular tax liability.

Contributing to traditional IRAs, 401(k)s and health savings accounts (HSAs) can also help. Since these contributions lower taxable income, they may help keep income below the AMT exemption phase-out levels.

Finally, charitable giving can also be useful. Since donations are still deductible under AMT, donating appreciated stock instead of cash can lower taxable income while avoiding capital gains tax on the stock sale.

Bottom Line

IRS Form 6251 is a complex tax form and a complicated issue. If you are likely to get hit with the AMT, part of the reason may be that the calculation of AMT causes you to lose many of the tax deductions, credits and exclusions that you have available. This will raise your taxable income which will cause your tax rate on your AMTI to be higher. The highest AMT tax rate is 28%.

The point of the AMT is to prevent the wealthy from using excessive tax breaks to substantially lower their tax liability. Due to its complexity, you may want to use a tax accountant or a financial advisor to help you complete it.

Tips on Taxes

- Consider working with a financial advisor to prevent triggering the AMT. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Capital gains are a possible tax preference item when calculating the AMTI. Use SmartAsset’s capital gains calculator to see how your capital gains affect your AMT.

Photo credit: ©iStock.com/SouthWorks, ©iStock.com/designer491, ©Department of the Treasury

Internal Revenue Service