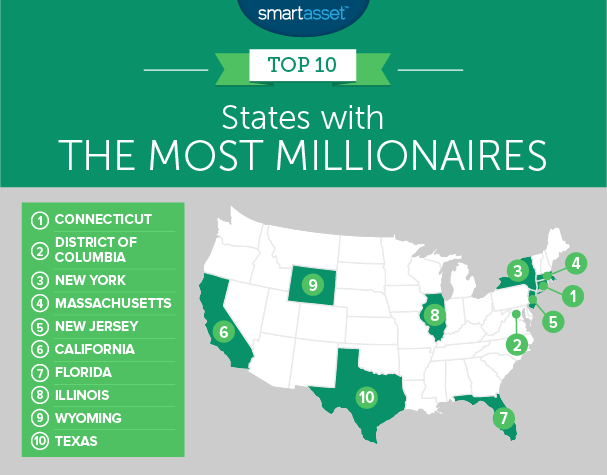

Hollywood and New York City probably come to mind when you think about the places with the most million-dollar earners. While location plays a part in how much money you earn, there are other factors that can help you reach millionaire status. Plenty of patient saving is most likely required. Many people seek professional advice from a financial advisor to help them make the best decisions about their finances. Below, we looked at the unique economic profiles of each state through IRS data to find the states with the most million-dollar earners.

Specifically, we looked at the total number of tax returns and compared that to the total number of tax returns which had an adjusted gross income of at least $1 million. That means we considered both single filers and married couples filing jointly for this analysis. Check out our data and methodology below to see where we got our data and how we put it together.

Key Findings

- U.S. millionaires abroad. Just under 1% of American taxpayers filing from abroad had an adjusted gross income of at least $1 million, according to our analysis. If we had ranked Americans abroad as a separate region for this study, it would have ranked first. In fact a taxpayer filing from abroad is about 50% more likely to be a millionaire than a taxpayer from first-ranked Connecticut.

- High-tax states. In general the states that top this list have high income tax rates. Six of the top 10 states feature higher-than-average tax rates.

- The importance of the cost of living. Many of the states which rank high in this study have high costs of living. Take for example someone who earns $1 million a year and lives in San Francisco. She receives a job offer to move to Minneapolis and earn $900,000. Should she take the job? Going by just cost of living, the answer is yes. The cost of living in San Francisco is roughly 18% higher than it is in Minneapolis. That means someone earning $847,457 in Minneapolis has the equivalent purchasing power of someone earning $1 million in San Francisco.

1. Connecticut

The Constitution State takes the top spot. There were just under 11,500 tax returns filed by taxpayers in Connecticut with a gross income at or above $1 million. That means around 0.65% of all tax returns filed were filed by people with an adjusted gross income above $1 million.

In Connecticut, millionaires lose quite a bit of their earnings to income taxes. According to our data, a married couple earning a combined $1 million would pay $62,982 in Connecticut income taxes.

2. Washington, D.C.

The nation’s capital comes in just behind Connecticut in second place. This area had the second-lowest total number of millionaire taxpayers in our top 10. However due to a low overall population, it had a high concentration of millionaires.

Overall about 0.59% of tax returns in this state were filed by people with an adjusted gross income above $1 million.

3. New York

The Empire State comes in third. Connecticut’s neighbor to the west has the second-most millionaires overall. In total there were 50,080 tax returns filed by people with a gross adjusted income of at least $1 million. Only sixth-ranked California had more. In total 9,614,610 tax returns were filed in New York, according to IRS data, meaning 0.52% were filed by millionaires.

A couple with a combined income of $1 million in the state of New York pays an effective state income tax rate of 6.57%. If they live in New York City, they have to deal with a further effective tax rate of 3.67%. In total, we estimate a couple taking home $1 million could expect to pay $439,191 in income taxes.

4. Massachusetts

Another high-tax Northeastern state takes fourth. There were around 16,000 tax returns filed in Massachusetts by taxpayers with an adjusted gross income above $1 million. That is equal to about 0.47% of all tax filers.

Massachusetts has a flat income tax rate, a good sign for millionaires. However, it is the second-highest flat state income tax in the country, at 5.1%. For millionaires who bought a home in Massachusetts, the state has an average effective property tax rate of 1.15%.

5. New Jersey

The Garden State comes in fifth. Like Connecticut, this state likely benefits from its proximity to New York City. Residents who live in New Jersey pay steep state taxes. Married filers taking home $1 million can expect to pay $72,134 in taxes to the New Jersey state government.

In total, 19,580 New Jersey tax filers took home an income of at least $1 million, equal to about 0.45% of all tax filers.

6. California

No state has more millionaires than California, which perhaps makes sense given that it’s the most populated state. There are just under 72,500 tax filers in California with an adjusted gross income above $1 million. Like residents in some other states in the top 10, such as Connecticut and New York, California residents face high income tax rates.

A couple taking home exactly $1 million in California would pay $94,731 to the California state government.

7. Florida

Florida is the first low-income-tax state to crack this top 10. This state would be a great place for a millionaire to retire. It has no state income tax. A couple filing jointly with an income of $1 million would pay only $364,089 in income taxes. In total around 0.34% out of the 9,627,280 tax filers in Florida took home at least $1 million.

8. Illinois

Illinois just edges out Wyoming and Texas for eighth. These three states’ scores are separated by just over 0.01%. Around 19,800 of the total 6,161,970 tax filers in Illinois took home an income of at least $1 million. That is equivalent to roughly 0.32%.

Like Massachusetts, Illinois has a flat income tax. The good news for Illinois residents, especially the millionaires, is that it is relatively low. A couple taking home $1 million could expect to pay $49,280 in state income tax.

9. Wyoming

The Cowboy State contains the ninth-highest concentration of millionaires in our study. According to IRS data, about 0.32% of all taxpayers in Wyoming took home $1 million or more. In raw numbers that is only 880 residents.

Wyoming might be the best state to live in for people who want to lower their tax burden. This state has no state income tax, the lowest sales tax of any state with a sales tax and the ninth-lowest average effective property tax rate in the country.

10. Texas

Our list ends in another low-income tax state. There are over 37,000 tax filers in Texas with an adjusted gross income of at least $1 million. That means roughly 0.31% of filers took home at least $1 million in adjusted gross income. While Texas residents don’t have to pay state income tax, they do have to contend with some taxes, like a sales tax between 6.25% – 8.25% and property taxes that are among the highest in the nation.

Data and Methodology

For this study, we defined millionaire as an individual or couple who earned at least $1 million in adjusted gross annual income. In order to find the states with the most million-dollar earners, we looked at data for all 50 states and Washington D.C. Specifically we looked at the following two metrics:

- Total number of tax returns with an adjusted gross income of at least $1 million.

- Total number of tax returns.

Data for both metrics comes from the IRS and is for 2015.

We divided the number of tax returns filed by taxpayers with an adjusted gross income of at least $1 million and divided it by the total number of tax returns filed. Using this method we found the the percent of tax filers in each state who are million-dollar earners. We then ranked the states from highest to lowest using this number.

Tips for Saving More Money so You Can Increase Your Net Worth

- A financial advisor can help optimize your tax strategy for your financial goals. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors who can help you achieve your financial goals, get started now.

- According to our investment calculator if you started today with $15,000 in an investment fund and contributed an additional $11,600 each year, you would end up with $1,003,227 after 30 years, assuming an average return of 6%. That means even if you are 35, with only $15,000 saved, you can become a millionaire before you retire.

- Saving can be hard. It’s important to have a budget that you can stick to. By having a budget you can see where your money is going and get an idea of where you could be cutting back your spending.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/Eva-Katalin