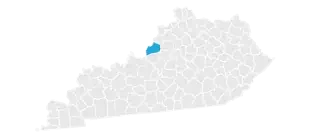

Overview of Jefferson County, KY Taxes

More than 790,000 residents call Jefferson County, Kentucky home. Property taxes in Jefferson County are slightly higher than the statewide effective rate of 0.71%. Properties in Jefferson County are subject to an effective property tax rate of 0.86%.

| Enter Your Location Dismiss | Assessed Home Value Dismiss |

| Average County Tax Rate 0.0% | Property Taxes $0 (Annual) |

| of Assessed Home Value | |

| of Assessed Home Value | |

| National | of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county's effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county's effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

Jefferson County Property Tax Rates

Home to the city of Louisville, Jefferson County is without a doubt the most highly populated in the state with more than twice the number of residents as Fayette County, which ranks second.

Jefferson County’s median home value is $257,100, which is slightly higher than the median home value for the state of Kentucky at $226,000. Though both of these are lower than the national median of $360,600.

Overall, Jefferson County residents pay a median annual property tax bill of $2,223. The median real estate taxes for the state of Kentucky are $1,611.

A financial advisor can help you understand how homeownership fits into your overall financial goals. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Paying Your Jefferson County Property Taxes

Each year, the Property Valuation Administrator’s Office mails all real estate property tax bills to the owner they have on record as of January 1. Current property owners are responsible for making sure all property taxes are paid each year. It’s important that taxpayers pay the amount designated in the “If Paid By: Balance Due” section of their tax bill rather than submitting payments for each of these subtotals separately.

Throughout the summer, Kentucky uses market values in calculating local tax rates. Tax bills are then mailed to owners by the beginning of October. When it’s possible, taxpayers can enjoy a 2% discount on their total tax bill if they pay all taxes due by November 1, though the official last day they can pay is December 31. Otherwise, increasing penalties begin accruing going forward.

If your notice designates that your mortgage company will be responsible for the bill, it’s safe to assume that they’ll use the money you have in escrow to pay any taxes due. Residents can also call the Property Valuation Administrator’s Office for any questions or concerns about whether or not the tax will be paid from escrow.

If you're delinquent on your property taxes, a lien is filed with the Jefferson County Clerk’s Office and placed against your property. The lien will remain until all delinquent taxes are paid in full. It’s worth noting that a third party could purchase your tax bill in situations where there’s still an unpaid balance on your tax account. A potential third party who purchases your tax bill may or may not offer an installment plan for paying your taxes owed.

If you have questions about how property taxes can affect your overall financial plans, a financial advisor in Louisville can help you out.

How Your Jefferson County Property Tax Works

As is common with many parts of the country, Kentucky real estate taxes follow a consistent pattern each year. The state first begins the process in January and looks at area property sales, home construction and property sizes and ages, among other factors to decide on an appropriate market value for each property.

How is your property tax bill calculated? The amount you see on your tax bill comes from a calculation that combines several factors, including your property’s assessed value, tax rates at the state, local and school district levels and the subtotals of each of these taxes before any added penalties or discounts that might apply.

What happens if you sold property in the last year? Sellers typically pay a pro-rated portion of the tax owed for the amount of the year that they owned the property. This amount usually goes to the buyer at closing. The buyer is then responsible for paying all taxes due at the end of the year.

In situations where you’ll be paying your property tax bill yourself instead of your mortgage company handling it, you have several options for paying on your own. Taxpayers can pay in person at the Jefferson County Sheriff’s Office. If you prefer not to pay in person, you have the option of mailing a check or money order to the Sheriff’s Office or paying online via credit card.

Places Receiving the Most Value for Their Property Taxes

SmartAsset’s interactive map highlights the places across the country where property tax dollars are being spent most effectively. Zoom between states and the national map to see the counties getting the biggest bang for their property tax buck.

Methodology

Our study aims to find the places in the United States where people are getting the most value for their property tax dollars. To do this, we looked at property taxes paid, school rankings and the change in property values over a five-year period.

First, we used the number of households, median home value and average property tax rate to calculate a per capita property tax collected for each county.

As a way to measure the quality of schools, we analyzed the math and reading/language arts proficiencies for every school district in the country. We created an average score for each district by looking at the scores for every school in that district, weighting it to account for the number of students in each school. Within each state, we assigned every county a score between 1 and 10 (with 10 being the best) based on the average scores of the districts in each county.

Then, we calculated the change in property tax value in each county over a five-year period. Places where property values rose by the greatest amount indicated where consumers were motivated to buy homes, and a positive return on investment for homeowners in the community.

Finally, we calculated a property tax index, based on the criteria above. Counties with the highest scores were those where property tax dollars are going the furthest.

Sources: US Census Bureau 2018 American Community Survey, Department of Education